What Is The Tax Credit Income Threshold Verkko 27 marrask 2023 nbsp 0183 32 Withdrawal threshold rate 41 41 41 Threshold for those entitled to Child Tax Credit only 163 19 995 163 18 725 163 17 005 Income rise

Verkko 13 hein 228 k 2023 nbsp 0183 32 So if your salary is 163 8 000 a year you ll be earning 163 545 over this threshold For each pound your working tax credit will be reduced by 41p which can be worked out as 545 x 0 41 223 45 Verkko 13 marrask 2023 nbsp 0183 32 To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit

What Is The Tax Credit Income Threshold

What Is The Tax Credit Income Threshold

https://www.bowditch.com/estateandtaxplanningblog/wp-content/uploads/sites/5/2018/11/Doing-taxes-bw.jpg

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

https://udwa.org/wp-content/uploads/TaxCredit.png

Tax Credit Universal Credit Impact Of Announced Changes House Of

https://commonslibrary.parliament.uk/wp-content/uploads/2015/11/IDS.jpg

Verkko 13 jouluk 2023 nbsp 0183 32 Tax Credits despite the name are benefit payments to support people with children or who are in work but on low incomes There are two types Verkko 27 marrask 2023 nbsp 0183 32 Child Benefit Guidance Rates and allowances tax credits Child Benefit and Guardian s Allowance Find out the rates thresholds and allowances for

Verkko 13 hein 228 k 2023 nbsp 0183 32 Child tax credit income thresholds The income threshold for receiving the maximum amount of child tax credit is 163 18 275 For every 163 1 of income over this threshold you earn per Verkko 1 p 228 iv 228 sitten nbsp 0183 32 For tax preparers understanding the intricacies of the tax code is crucial and the foreign tax credit becomes a vital tool in managing the tax implications of

Download What Is The Tax Credit Income Threshold

More picture related to What Is The Tax Credit Income Threshold

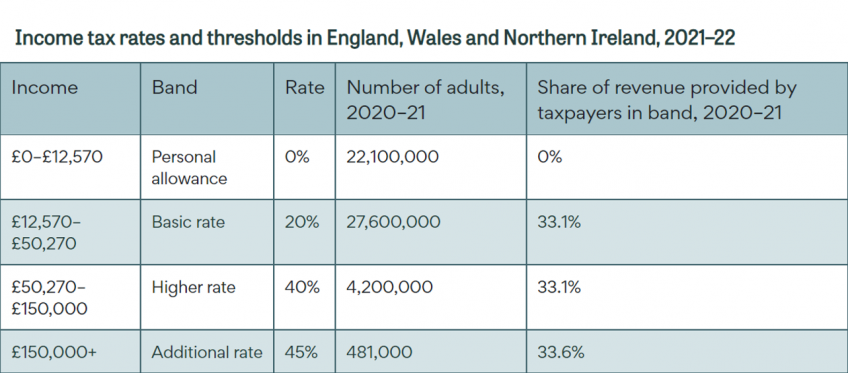

Income Tax Explained IFS Taxlab

https://ifs.org.uk/sites/default/files/styles/wysiwyg_full_width_desktop/public/2021-06/Income tax rates and thresholds in England%2C Wales and Northern Ireland%2C 2021–22_0.png?itok=sAe2JxBC

IRS Here Are The New Income Tax Brackets For 2023 Bodybuilding

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

Verkko Entitlement to tax credits is dependant on income thresholds and tapers The Tax Credits Income Thresholds and Determinations of Rates Regulations 2002 Reg 3 Verkko 3 p 228 iv 228 228 sitten nbsp 0183 32 For the 2023 tax year the child tax credit amounts to 2 000 per qualifying dependent child if the taxpayer s modified adjusted gross income is

Verkko Go to GST HST credit income levels and the GST HST credit payments chart to find out if you are entitled to receive the GST HST credit for the 2022 base year You can also Verkko 1 p 228 iv 228 sitten nbsp 0183 32 The good news for many is that from 2023 24 onwards the self assessment threshold for those getting an income from PAYE earnings only will

Chapter 3 Transfer And Business Taxation Chapter 3 Gross Estate

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/f352c5275ee4b83f75a75ce733e11533/thumb_1200_1553.png

What Is The Earned Income Tax Credit The TurboTax Blog

https://blog.turbotax.intuit.com/wp-content/uploads/2010/11/eitc1.jpg?resize=300

https://www.gov.uk/.../tax-credits-child-benefit-and-guardians-allowance

Verkko 27 marrask 2023 nbsp 0183 32 Withdrawal threshold rate 41 41 41 Threshold for those entitled to Child Tax Credit only 163 19 995 163 18 725 163 17 005 Income rise

https://www.which.co.uk/money/tax/tax-credits-a…

Verkko 13 hein 228 k 2023 nbsp 0183 32 So if your salary is 163 8 000 a year you ll be earning 163 545 over this threshold For each pound your working tax credit will be reduced by 41p which can be worked out as 545 x 0 41 223 45

2023 Tax Brackets The Best Income To Live A Great Life

Chapter 3 Transfer And Business Taxation Chapter 3 Gross Estate

Introduction To The Low Income Housing Tax Credit LIHTC Program

FAQ WA Tax Credit

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)

Astounding Gallery Of Eic Tax Table Concept Turtaras

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

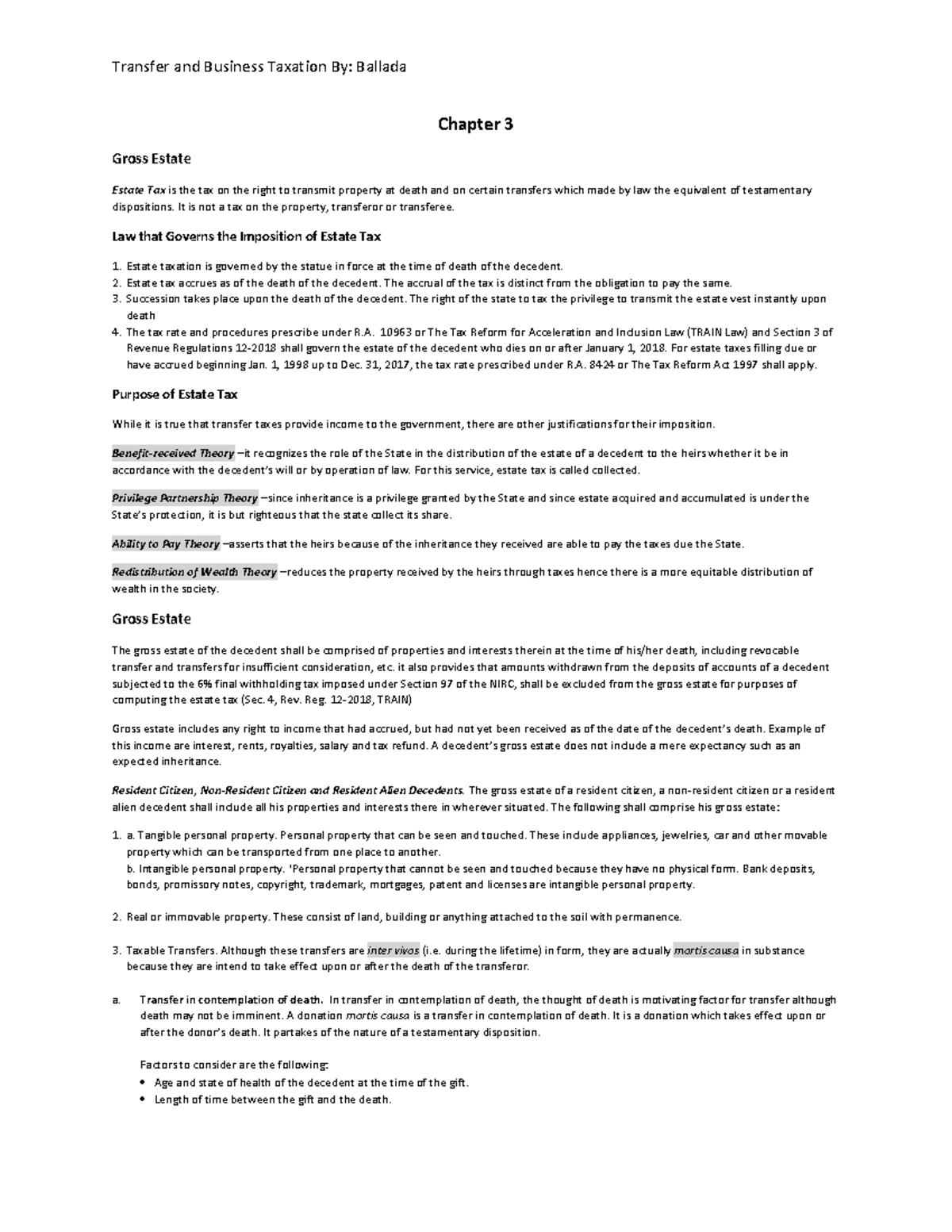

Solar Tax Credit How Do I Get It New England Clean Energy

Accounting For Income Deferred Taxes What Is The Tax Reconciliation

From withholding Tax To adjusted Gross Income Tax Season Terms For

What Is The Tax Credit Income Threshold - Verkko 8 tammik 2024 nbsp 0183 32 Advertiser disclosure Child Tax Credit 2023 2024 What It Is Requirements and How to Claim For 2023 taxpayers may be eligible for a credit of up