What Is The Tax Exemption Limit For Senior Citizens In India Verkko 11 tammik 2023 nbsp 0183 32 Higher income exemption limit Senior citizens are required to pay tax over the income of Rs 3 00 000 while this limit is Rs 5 00 000 for super senior citizens This benefit is not available for the ordinary individuals as the limit is Rs

Verkko 29 kes 228 k 2023 nbsp 0183 32 Very senior citizen A senior citizen is granted a higher exemption limit compared to non senior citizens The exemption limit for the financial year 2022 23 available to a resident Verkko For ordinary individual tax payers the basic exemption limit upto which he is not required to pay any tax is presently fixed at Rs 2 50 lakh for AY 2021 22 However for Senior Citizens the basic exemption limit is fixed at a higher figure of Rs 3 lakh

What Is The Tax Exemption Limit For Senior Citizens In India

What Is The Tax Exemption Limit For Senior Citizens In India

https://www.pdffiller.com/preview/50/825/50825271/large.png

Preventive Check Up 80d Wkcn

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

Senior Citizens Get Special Exemption In Income Tax Know 5 Big

https://indiarag.com/wp-content/uploads/2022/06/Senior-citizens-get-special-exemption-in-income-tax-know-5.jpg

Verkko 14 maalisk 2023 nbsp 0183 32 Senior citizens already enjoy a higher basic exemption limit compared to normal taxpayers The introduction of Section 80TTB further aids tax savings for senior citizens Let us see how with the following example Verkko 2 elok 2023 nbsp 0183 32 For the FY 2021 22 the exemption limit for senior citizens was Rs 240 000 The exemption limit applies to the total income of the senior citizen i e all income heads combined salary house property other sources capital gains and

Verkko 19 hein 228 k 2023 nbsp 0183 32 Under the old tax regime Indian super senior citizens have a higher exemption limit compared to senior citizens and other taxpayers The tax slabs are as follows Income Range Verkko Exemption limit for senior citizens Under the old regime the exemption limit is 3 lakh for seniors and 5 lakh for super seniors 80 years and above In the new regime

Download What Is The Tax Exemption Limit For Senior Citizens In India

More picture related to What Is The Tax Exemption Limit For Senior Citizens In India

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

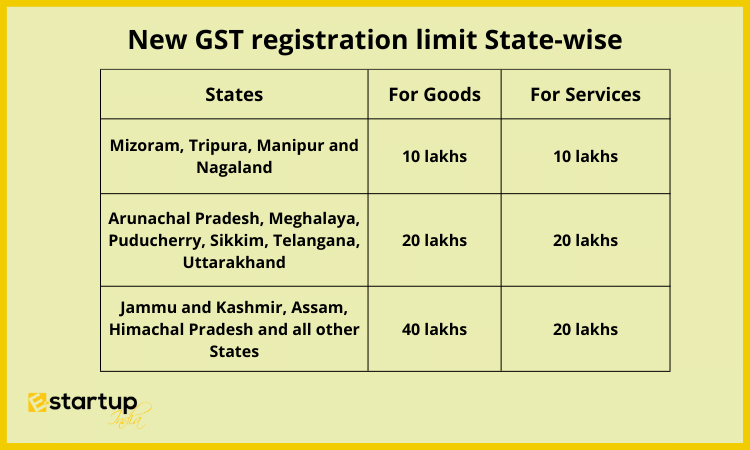

Gst Registration On Limit For Services In FY 2022 23

https://www.e-startupindia.com/learn/wp-content/uploads/2022/08/New-GST-registration-limit-State-wise.png

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

https://i.postimg.cc/bN09RcMs/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg

Verkko 19 jouluk 2023 nbsp 0183 32 The basic exemption limit for senior citizens is Rs 3 lakh compared to Rs 2 50 lakh for an ordinary individual taxpayer For super senior citizens the limit is Rs 5 lakh in a financial year Every individual whose estimated tax liability in a Verkko Let us look at the basic exemption limits for senior citizens along with various other tax benefits that they can enjoy Income tax slab for senior citizen As most of you would know the Income Tax Act further divides senior citizens into two categories senior

Verkko Maximum exemption limit is as follows 1 In case of super senior citizen Rs 5 00 000 2 In case of senior citizen Rs 3 00 000 3 In case of any other person Rs 2 50 000 2 Issue of notice under section 148 to re open assessment within 3 years Verkko Exemption limit refers to the threshold of income up to which an individual is not liable to pay any tax The basic tax exemption for non senior citizens in India is Rs 2 50 000 On the other hand senior citizens enjoy a higher exemption limit of up to Rs 3 00 000

Budget 2021 Income Tax Returns Exemption Senior Citizens Above 75 Years

https://resize.indiatvnews.com/en/resize/newbucket/1200_-/2021/02/eth6sfpu0auony6-1612164111.jpg

Sample Letter Exemption Doc Template PdfFiller

https://www.pdffiller.com/preview/497/332/497332566/large.png

https://cleartax.in/s/income-tax-slab-for-senior-citizen

Verkko 11 tammik 2023 nbsp 0183 32 Higher income exemption limit Senior citizens are required to pay tax over the income of Rs 3 00 000 while this limit is Rs 5 00 000 for super senior citizens This benefit is not available for the ordinary individuals as the limit is Rs

https://taxguru.in/income-tax/what-are-the-ta…

Verkko 29 kes 228 k 2023 nbsp 0183 32 Very senior citizen A senior citizen is granted a higher exemption limit compared to non senior citizens The exemption limit for the financial year 2022 23 available to a resident

Tax Exemption Certificate SACHET Pakistan

Budget 2021 Income Tax Returns Exemption Senior Citizens Above 75 Years

Save Time And Money On Sales Tax Exemption Certificate And Workbooks

Writing Religious Exemption Letters

2022 23 Tax Rates TAX

Income Tax Calculation For FY 2023 24 Examples FinCalC Blog

Income Tax Calculation For FY 2023 24 Examples FinCalC Blog

New Tax Regime Vs Old Tax Regime Which Is Better Yadnya Investment

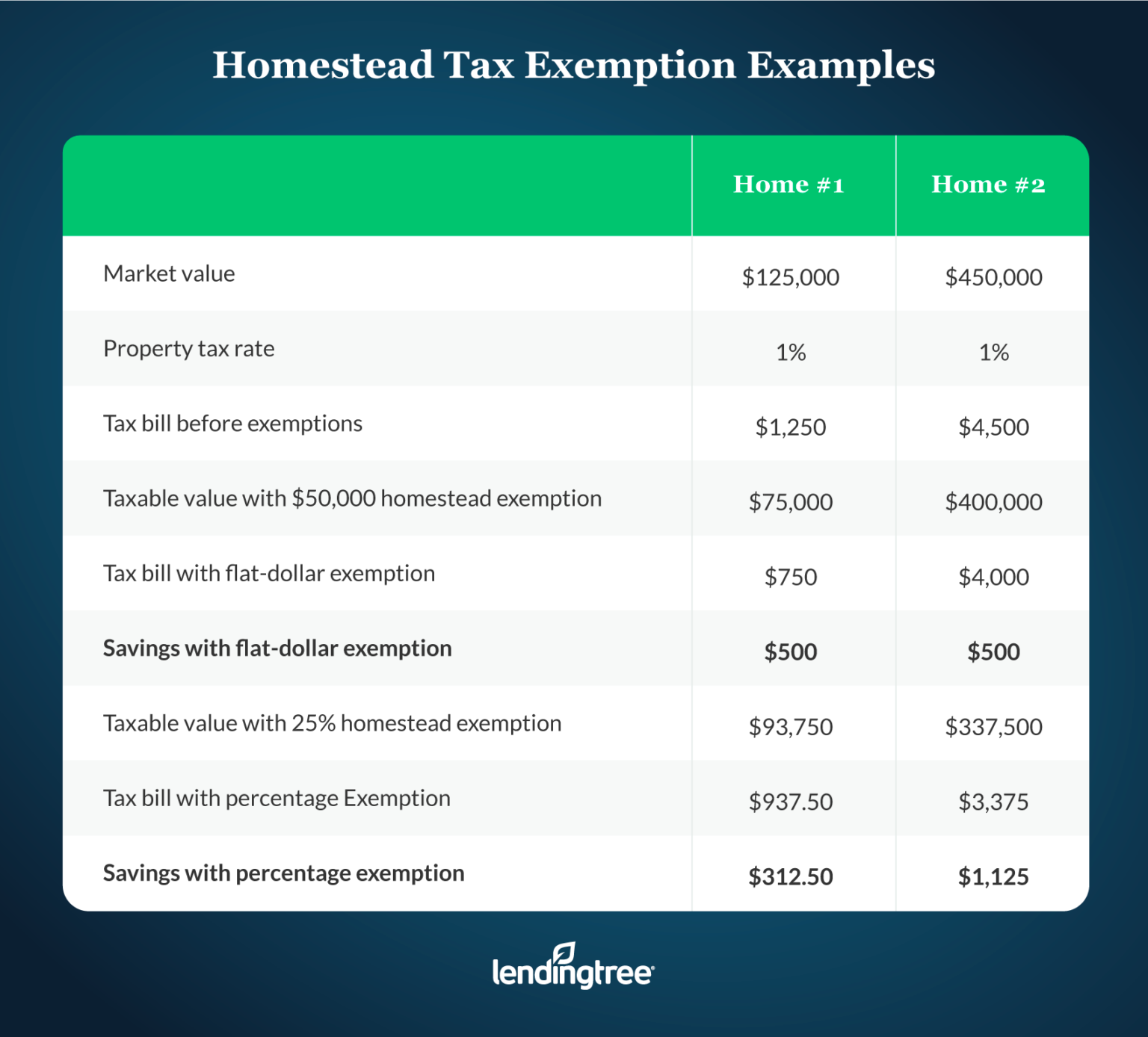

What Is A Homestead Exemption And How Does It Work LendingTree

Method Of Calculating Income Tax For Senior Citizen Pensioners

What Is The Tax Exemption Limit For Senior Citizens In India - Verkko 30 hein 228 k 2022 nbsp 0183 32 Under the income tax law an individual is considered as a senior citizen or super senior citizen provided he she has crossed the specific age in the financial year An individual can be considered as a senior citizen if he she is of age