What Is The Tax Rate In California For Payroll Income tax rates in California vary based on an individual s income and range from 1 to 12 3 with higher rates applying to individuals with higher income levels A tax rate schedule is available from the California Franchise Tax Board

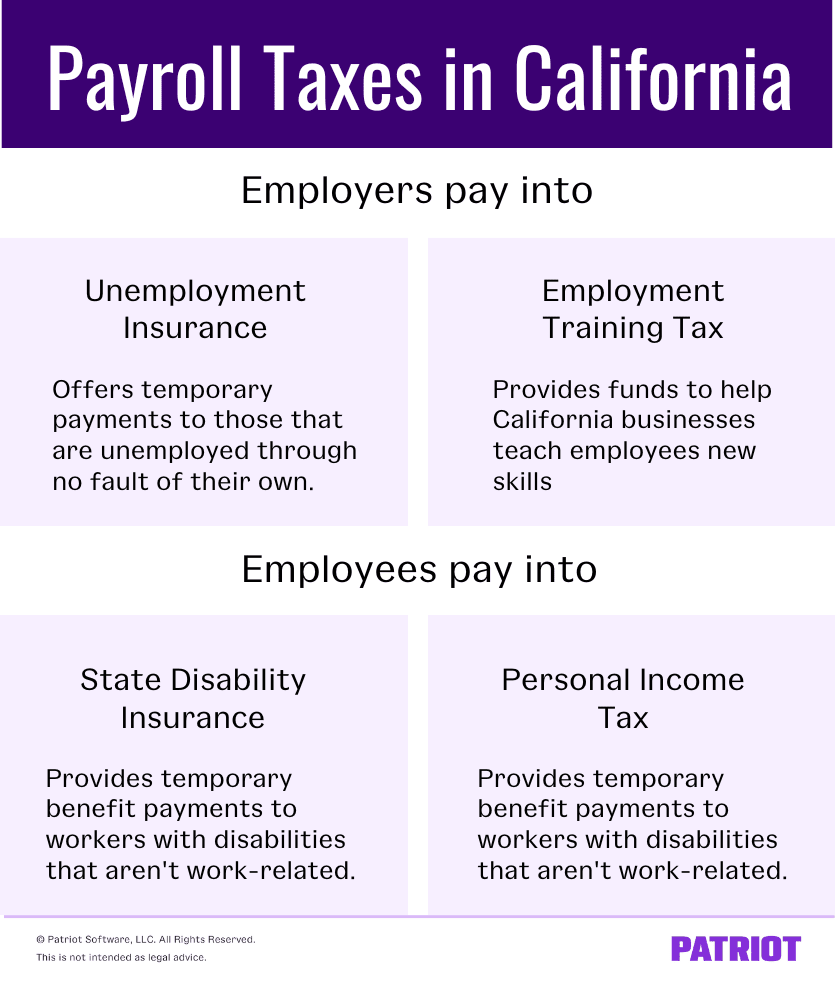

The California payroll tax structure for an employer in this state is based on four distinct taxes commonly referred to as the CA SUI ETT SDI and PIT payroll taxes There are different rates for each of these taxes and the calculation methods are different as Find out how taxable wages are calculated including Unemployment Insurance tax Employment Training Tax and State Disability Insurance tax

What Is The Tax Rate In California For Payroll

What Is The Tax Rate In California For Payroll

https://www.patriotsoftware.com/wp-content/uploads/2022/08/Copy-of-Payroll-Taxes-in-California-835-×-986-px-1.png

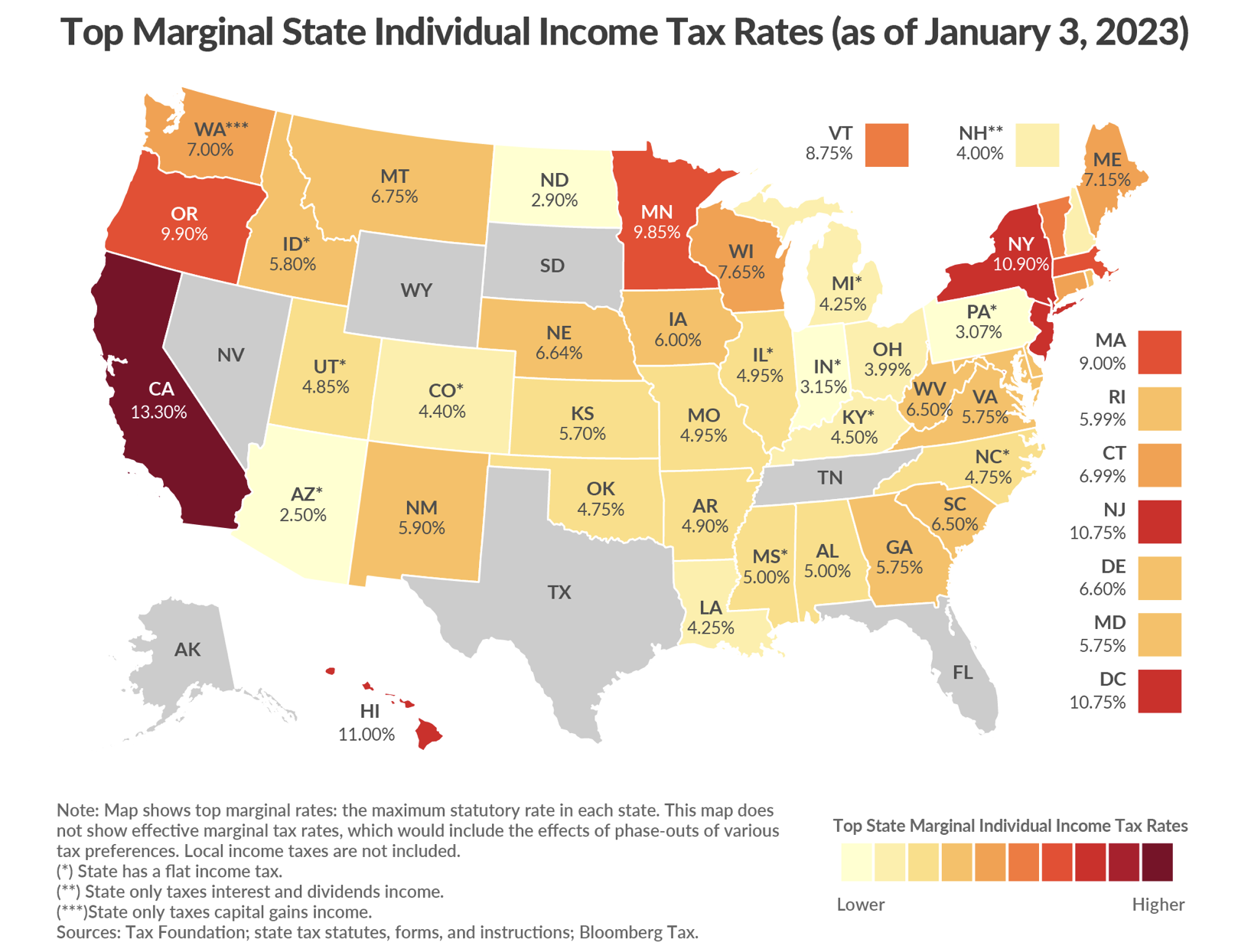

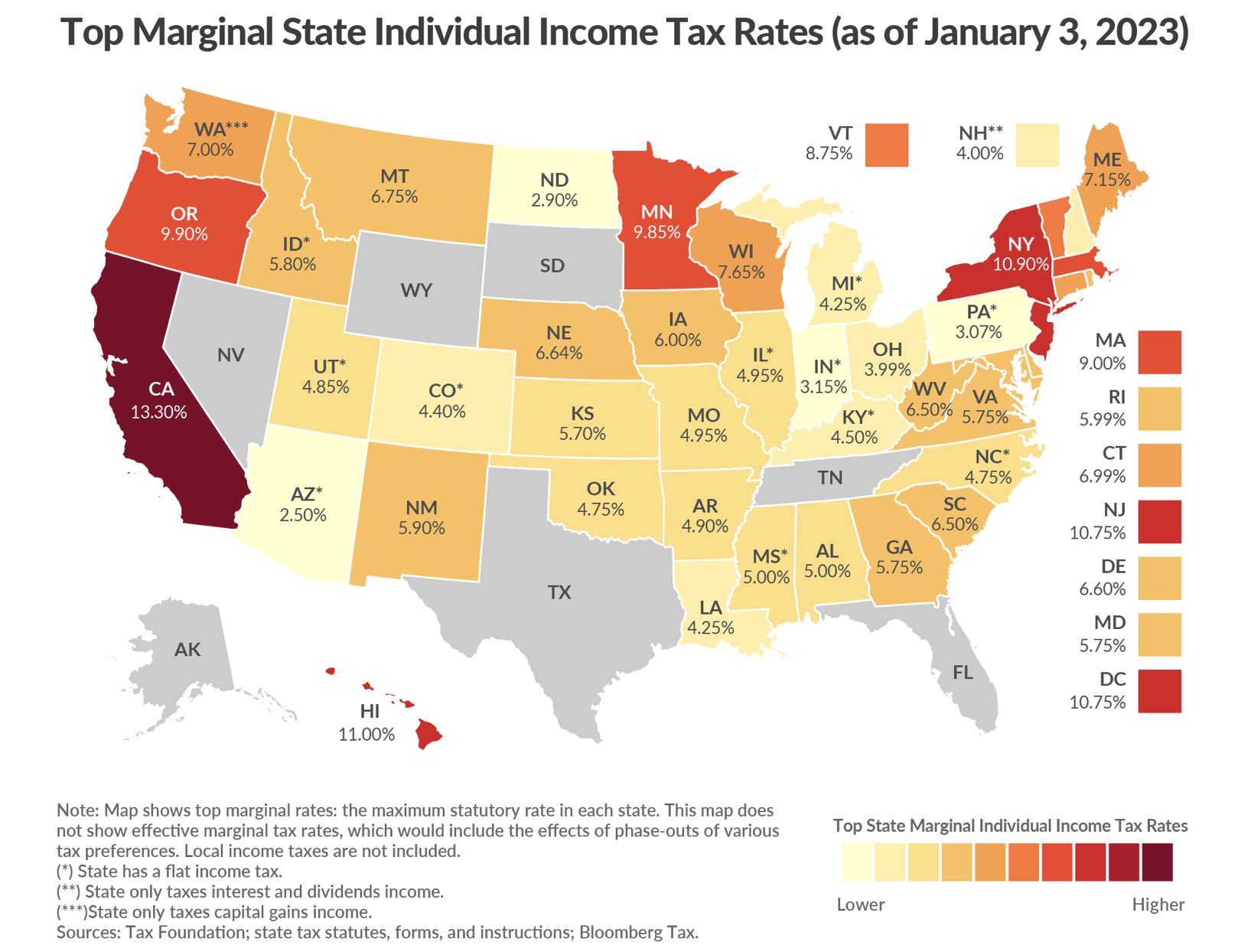

Exposing Gavin s Dishonesty California Tops State Individual Income

https://californiaglobe.com/wp-content/uploads/2023/12/Screenshot-2023-12-18-at-7.15.07-AM.png

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

California Paycheck Quick Facts California income tax rate 1 00 13 30 Median household income in California 91 905 U S Census Bureau Number of cities that have local income taxes 0 Your California paycheck begins with your gross income which is subject to federal income taxes and FICA taxes The Federal Insurance Contributions Act FICA taxes you a combined rate of 7 65 for Social Security and Medicare

The FUTA rate for 2023 is 6 0 but many employers are able to pay less for instance up to 5 4 each year due to tax credits Most employers will pay this tax annually with Form 940 But larger employers with more than 500 in tax due will have to pay quarterly California employers have to pay two of the four state payroll taxes in 2023 They include Unemployment Insurance UI Tax Ranges from 1 5 to 6 2 on the first 7 000 of every employee s annual salary depending on how much you ve paid in unemployment benefits

Download What Is The Tax Rate In California For Payroll

More picture related to What Is The Tax Rate In California For Payroll

What Is The Tax Rate For Selling A Business

https://diversifiedllc.com/wp-content/uploads/2023/07/featured-image-for-blogs-1160x665-2023-07-20T101721.545.jpg

California Tax Rates Rankings California State Taxes CompSuite

https://www.bookstime.com/wp-content/uploads/2022/07/cash-flow-cff-scaled-1.webp

New Dividend Tax Rates From April 2023 MCL

https://mcl.accountants/wp-content/uploads/2022/10/Dividend-tax-rates.jpg

There are nine California state income tax rates ranging from 1 to 12 3 Tax brackets depend on income tax filing status and state residency California income tax rate The income tax rate in California ranges from 1 to 13 3 and is dependent on the employee s income tax bracket and filing status The 10 tax brackets California tax brackets are 1 2 4 6 8 9 3 10 3 11 3 12 3 and 13 3

California payroll tax is a series of 4 types of tax 2 paid by the employer and 2 paid by the employee that must be paid or withheld every pay period The 4 payroll tax types are California State Unemployment Insurance Tax CA SUI paid by the employer California Employee Training Tax CA ETT paid by the employer Your free and reliable California payroll and tax resource Including federal and state tax rates withholding forms and payroll tools

How To Pay Your Vehicle Tax Everything You Need To Know In 2023

https://www.emineakbucak.com/wp-content/uploads/2023/03/gustavo-S-W9vDL5whU-unsplash-scaled.jpg

Income Tax Rules On Mutual Funds Profit Explained Mint

https://www.livemint.com/lm-img/img/2023/05/12/1600x900/Income_tax_rules_on_mutual_funds_profit_explained_1683873793219_1683873793477.jpg

https://onpay.com/payroll/calculator-tax-rates/california

Income tax rates in California vary based on an individual s income and range from 1 to 12 3 with higher rates applying to individuals with higher income levels A tax rate schedule is available from the California Franchise Tax Board

https://www.sambrotman.com/blog/california-payroll...

The California payroll tax structure for an employer in this state is based on four distinct taxes commonly referred to as the CA SUI ETT SDI and PIT payroll taxes There are different rates for each of these taxes and the calculation methods are different as

TaxTips ca Business 2022 Corporate Income Tax Rates

How To Pay Your Vehicle Tax Everything You Need To Know In 2023

The Nuances Of The Colorado Income Tax And Payroll Tax

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

Tax Payment Which States Have No Income Tax Marca

Ultimate California Sales Tax Guide Zamp

Ultimate California Sales Tax Guide Zamp

Data Driven Viewpoints A 99 YEAR HISTORY OF TAX RATES IN AMERICA

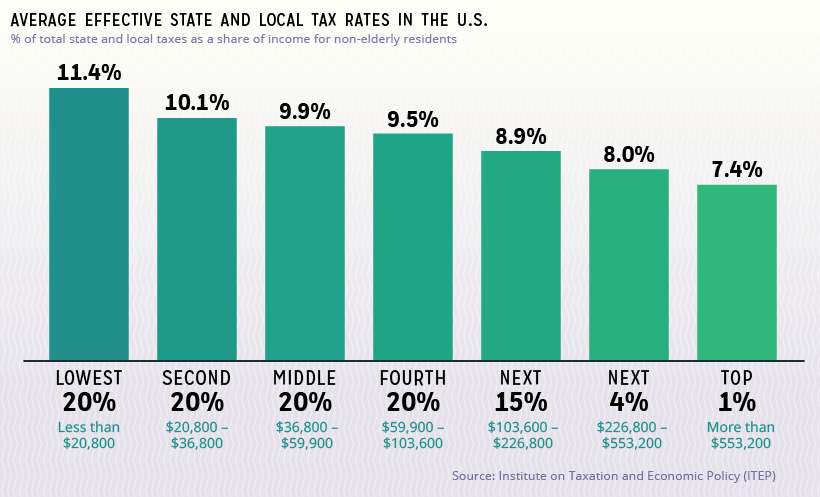

Effective Tax Rates In The United States

Corporate Tax Rates In The G7 Moore Smalley

What Is The Tax Rate In California For Payroll - California Paycheck Quick Facts California income tax rate 1 00 13 30 Median household income in California 91 905 U S Census Bureau Number of cities that have local income taxes 0