What Is The Tax Rate On Dividends In Ireland Irish resident companies must withhold tax on dividend payments and other distributions that they make There are some exceptions to this They must withhold Dividend

The current Dividend Withholding Tax rate in Ireland is 25 This rate applies to dividends paid by Irish resident companies to both residents and non residents Dividend withholding tax is How much tax do I pay on Share Dividends in Ireland Income tax on dividends is taxed the same way as any other income For example A PAYE employee on the highest rate of income tax will pay 40 per cent income tax as

What Is The Tax Rate On Dividends In Ireland

What Is The Tax Rate On Dividends In Ireland

https://m.foolcdn.com/media/dubs/images/original_imageshttpsg.foolcdn.comeditorialimag.width-880_95QcIGr.png

Beginners Guide To Taxes On Stock And Dividends In Ireland Capital

https://i.ytimg.com/vi/-YhVIJVfQlQ/maxresdefault.jpg

How Are Reinvested Dividends Taxed DividendInvestor

https://www.dividendinvestor.com/wp-content/uploads/DivInvest_Tax-Rates-Table-Ordinary-Income-2-1024x361.png

Dividend WHT applies at 25 to dividends and other distributions However an exemption may be available where the recipient of the dividend is either an Irish company or a non Irish A withholding tax at the standard rate of income tax currently 20 applies to dividend payments and other profit distributions including cash and scrip dividends made by an Irish resident

Dividends paid and other distributions relevant distributions made by Irish resident companies are generally liable to a dividend withholding tax DWT at a rate of income tax of 25 This Dividend withholding tax DWT applies to dividends and other distributions made by Irish resident companies at the rate of 25 Exemptions from DWT may apply in the case

Download What Is The Tax Rate On Dividends In Ireland

More picture related to What Is The Tax Rate On Dividends In Ireland

New Dividend Tax Rates From April 2023 MCL

https://mcl.accountants/wp-content/uploads/2022/10/Dividend-tax-rates.jpg

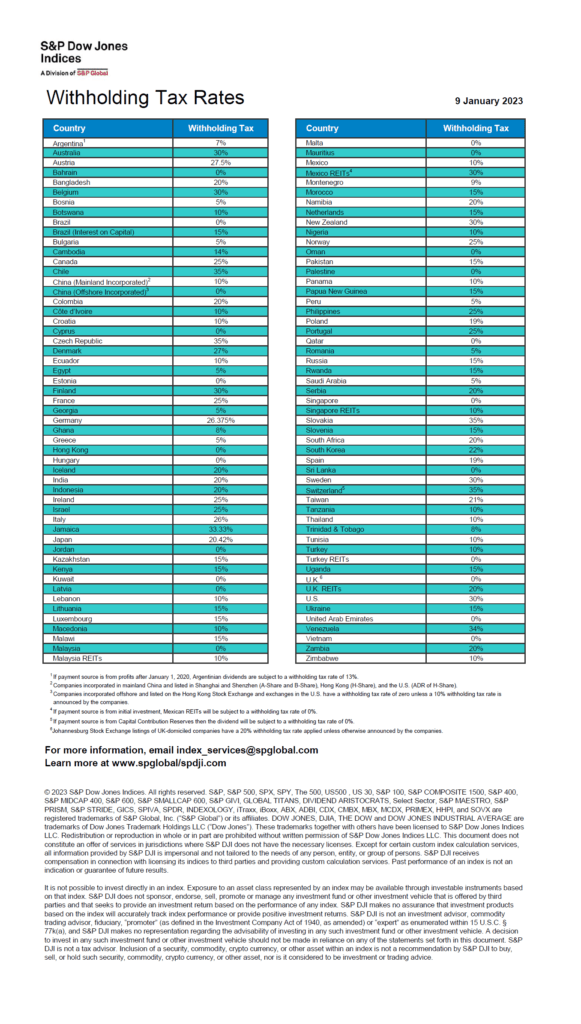

Dividend Withholding Tax Rates By Country For 2023 TopForeignStocks

https://topforeignstocks.com/wp-content/uploads/2023/01/Dividend-withholding-taxes-by-Country-Jan-2023-581x1024.png

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

Dividend payments are typically taxable at the regular level of 12 5 Corporations doing business in Ireland must also be aware that dividend payments from commercial transactions The dividend withholding tax is applied at a standard rate of 20 for dividend payments and other distributions made by companies registered in Ireland Most Irish companies will pay dividends twice a year and the

There is a 20 with holding tax on the dividend income from Irish shares 100 of the dividend is assessable for income tax purposes and the 20 with holding tax is deemed All income including dividends is taxed at either 20 or 40 depending on your standard tax bracket This means that you could effectively pay the same amount of tax on your dividends

What Are Retained Earnings Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/10/09182412/Retained-Earnings-Example-Apple-AAPL.jpg

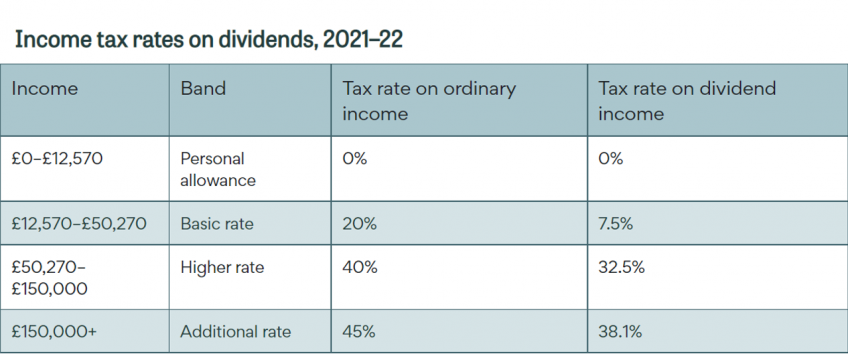

Income Tax Rates On Dividends 2021 22 IFS Taxlab

https://ifs.org.uk/sites/default/files/styles/wysiwyg_full_width_desktop/public/2021-06/Income tax rates on dividends%2C 2021–22.png?itok=lYbDEcrN

https://www.revenue.ie › en › companies-and-charities › ...

Irish resident companies must withhold tax on dividend payments and other distributions that they make There are some exceptions to this They must withhold Dividend

https://www.taxreturnplus.ie › tax-return-guides › ...

The current Dividend Withholding Tax rate in Ireland is 25 This rate applies to dividends paid by Irish resident companies to both residents and non residents Dividend withholding tax is

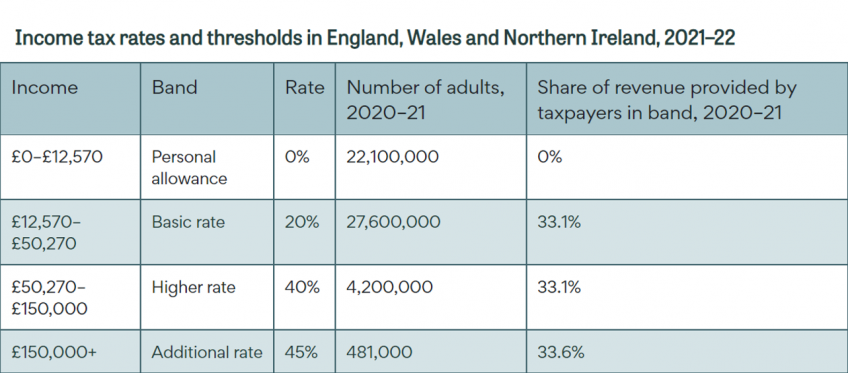

Income Tax Explained IFS Taxlab

What Are Retained Earnings Formula Calculator

Taxes On Dividends Answers To 4 Common Questions Savoteur

Gcash Rates Cash In Cash Out Sign Laminated Signage A4 A3 Size

Tax Rate On Qualified Dividends A Comprehensive Guide TAXGURO

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

First Schedule 2nd Division Of The Income Tax Ordinance 2001

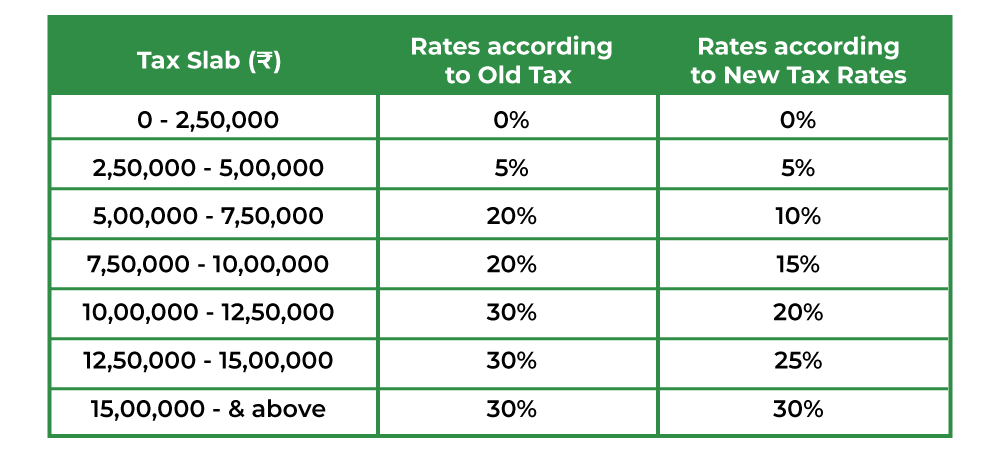

Old Tax Regime Vs New Tax Regime GeeksforGeeks

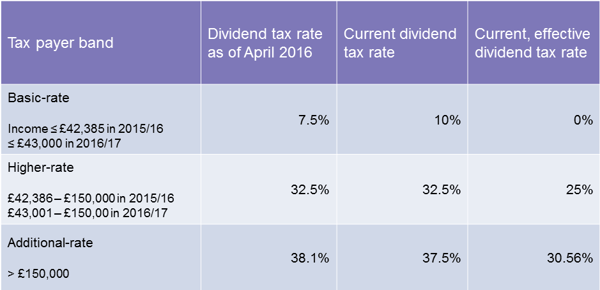

Beware Your Dividend Tax Rate Is Changing Here s What You Need To Know

What Is The Tax Rate On Dividends In Ireland - Many Irish companies pay dividends twice a year and will always deduct 20 tax at source from the gross dividend If you are liable for tax at a higher rate you will pay tax on the