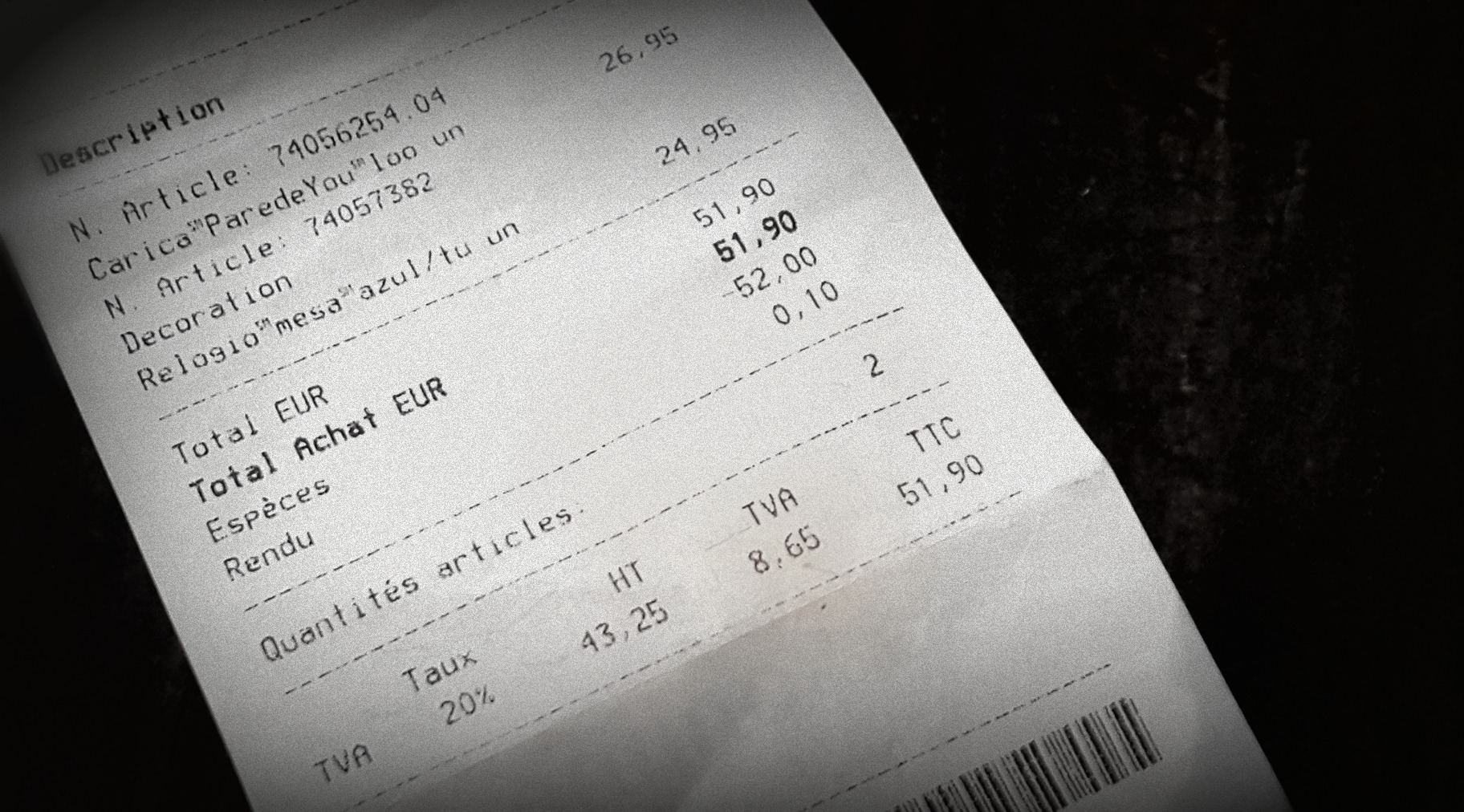

What Is The Vat Tax Refund In France Value added tax VAT is a multi stage sales tax the final burden of which is borne by the private consumer VAT at the appropriate rate will be included in the price you pay for

Here s the best news in August 2021 the minimum amount of your purchase decreased from 175 to 100 While the typical tax is 20 the average refund is 12 It could be As a visitor to France you may be eligible to buy goods tax free and get a refund on the Value Added Tax VAT you paid during your stay This guide will walk you through the

What Is The Vat Tax Refund In France

What Is The Vat Tax Refund In France

https://www.francetraveltips.com/wp-content/uploads/2022/06/Tax-refund-area-at-Charles-de-Gaulle-airport.jpeg

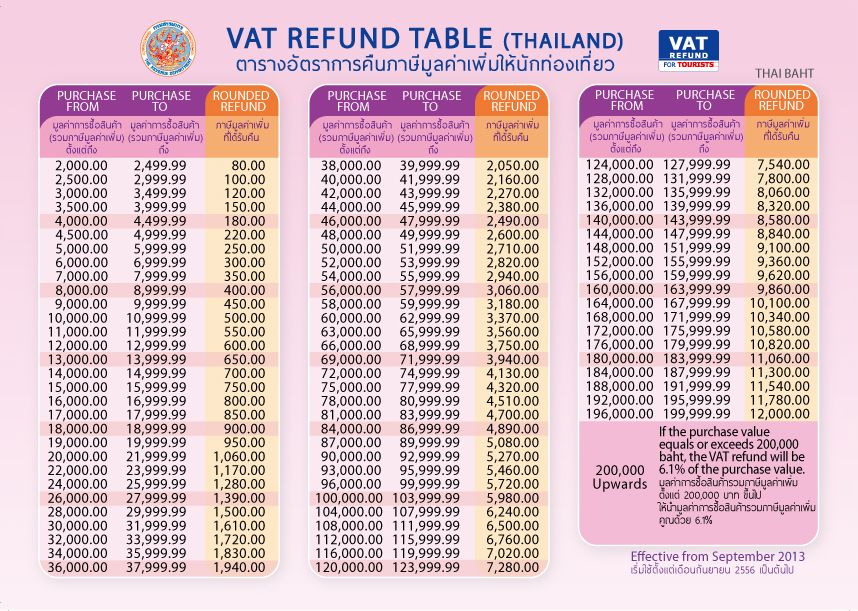

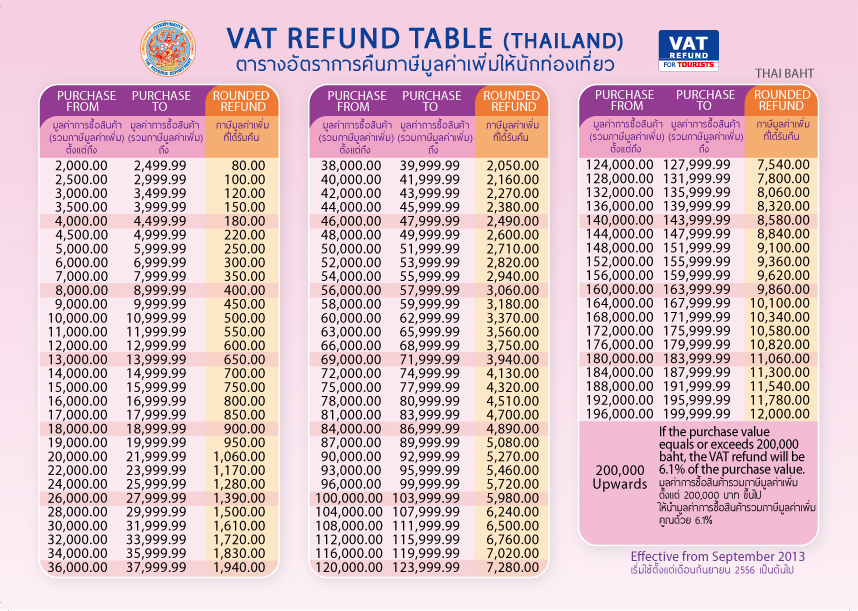

Vat Refund Calculator StormTallulah

https://www.rd.go.th/fileadmin/user_upload/kortor/images/Vat-Refund-Sheet1.jpg

Claim Your Paris VAT Refund Tax In France Before You Leave

http://parisjourney.com/wp-content/uploads/2015/05/recipt-TVA-2.jpg

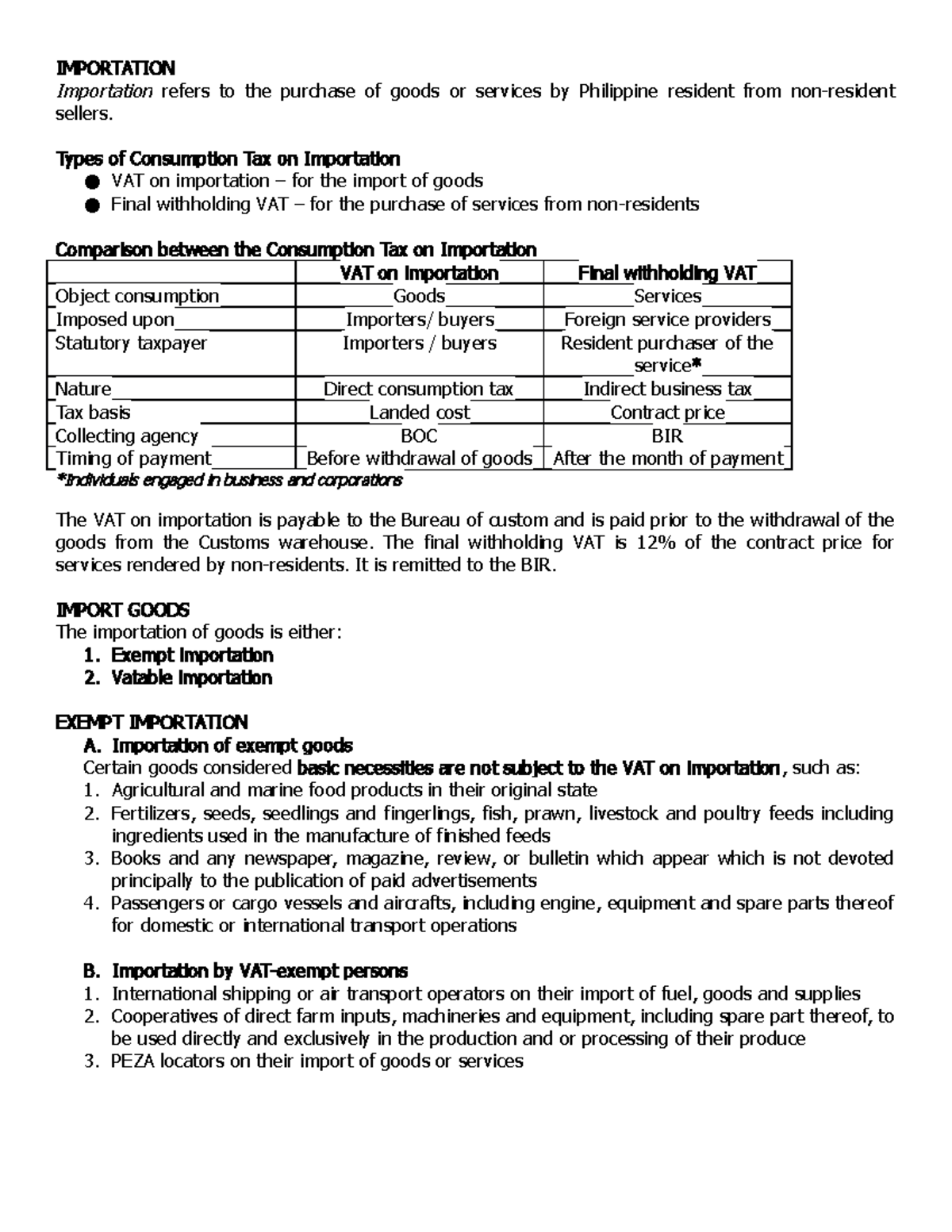

You must claim your VAT refund online via the authorities in the country where your business is based If you are eligible for a refund the authorities will pass VAT refunds If your non French company does not carry out transactions that are liable for VAT in France it may under certain conditions be refunded VAT connected with

France will repay you between 12 and 12 of the money that you spend on items subject to ordinary VAT rates during your vacation The minimum purchasing Under certain conditions you can obtain a refund of the VAT paid on the goods purchased during your stay in France You must meet the following conditions l Purchase the

Download What Is The Vat Tax Refund In France

More picture related to What Is The Vat Tax Refund In France

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

TAX 02 VAT ON Importation IMPORTATION Importation Refers To The

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/bdbc43f0b74e18c8371903962c19004b/thumb_1200_1553.png

:max_bytes(150000):strip_icc()/Value-Added-Tax-bfc9359a52f74ae9a430d4c2d7ce91e2.jpg)

Uwe s Bar Page 2 Ross Tech Forums

https://www.investopedia.com/thmb/wc_UBpTaJ3YvYXA7BUSdIuvJ00g=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Value-Added-Tax-bfc9359a52f74ae9a430d4c2d7ce91e2.jpg

Decline If you re reading this article you re probably aware of VAT refunds or have even experienced the joy of shopping tax free in France before But the way you validate your refund form can differ How to qualify for the VAT Tax Refund in France Wevat application In order to qualify for the VAT TAX refund in France you must Traditional Process Spend 100 01 Euros or more at one given store Wevat Digital

Who can benefit from the tax refund VAT refunds The tax refund can be granted to the buyer who follow those 3 conditions your primary residence is located in a non EU If you want a Value added tax VAT refund you have to Be a citizen of a non EU nation when making the transaction Have not yet spent six months in France Be at least 16

New Digital VAT Tax Refund Process In Paris France With Wevat Petite

https://petiteinparis.com/wp-content/uploads/2021/12/new-digital-vat-tax-refund-in-Paris-1440x1800.jpg

Europe Search Marketing Country Information

https://i.pinimg.com/originals/85/8c/95/858c95812839ed5d9b3b9bd85e734071.jpg

https://taxation-customs.ec.europa.eu/guide-vat-refund-visitors-eu_en

Value added tax VAT is a multi stage sales tax the final burden of which is borne by the private consumer VAT at the appropriate rate will be included in the price you pay for

https://www.francetraveltips.com/eu-vat-refund-in-france

Here s the best news in August 2021 the minimum amount of your purchase decreased from 175 to 100 While the typical tax is 20 the average refund is 12 It could be

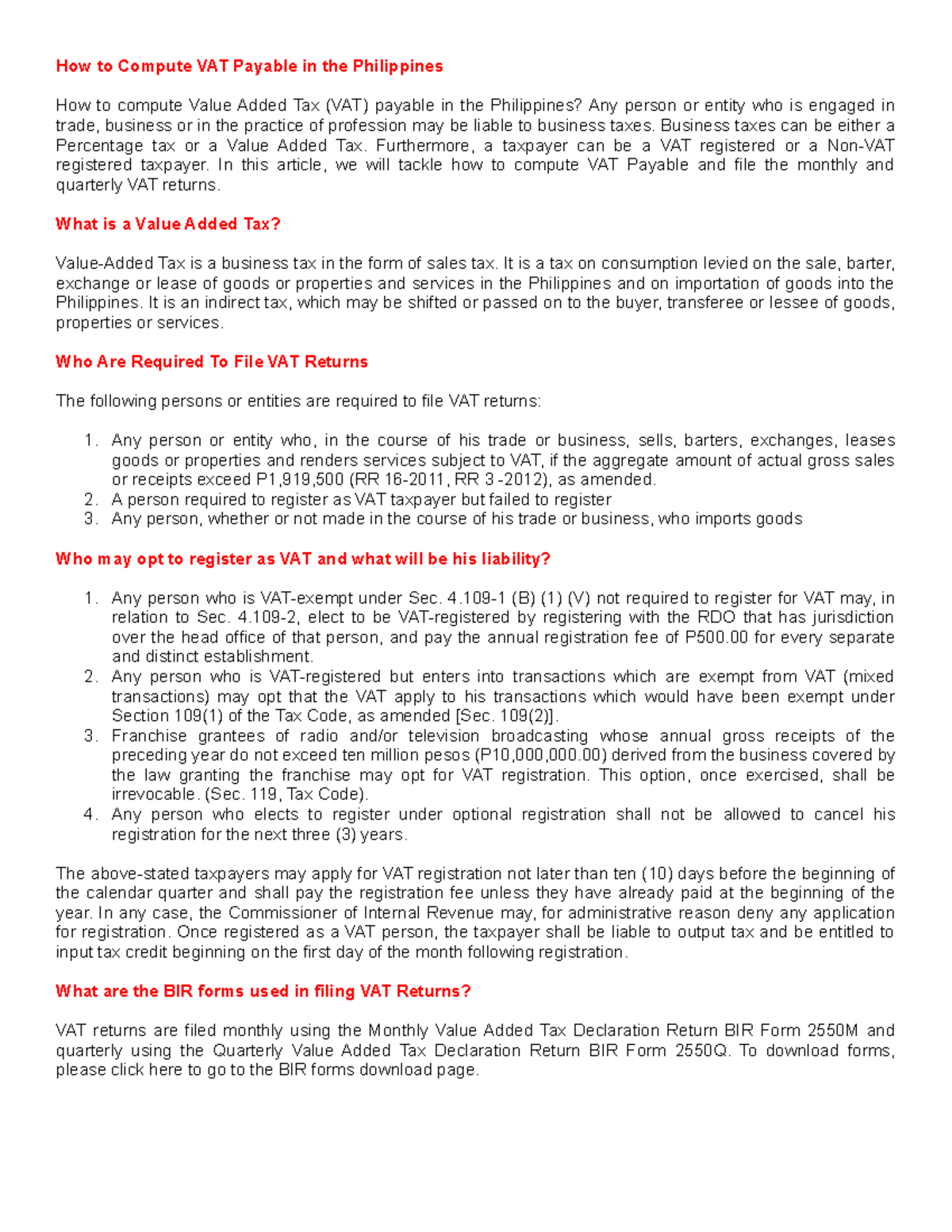

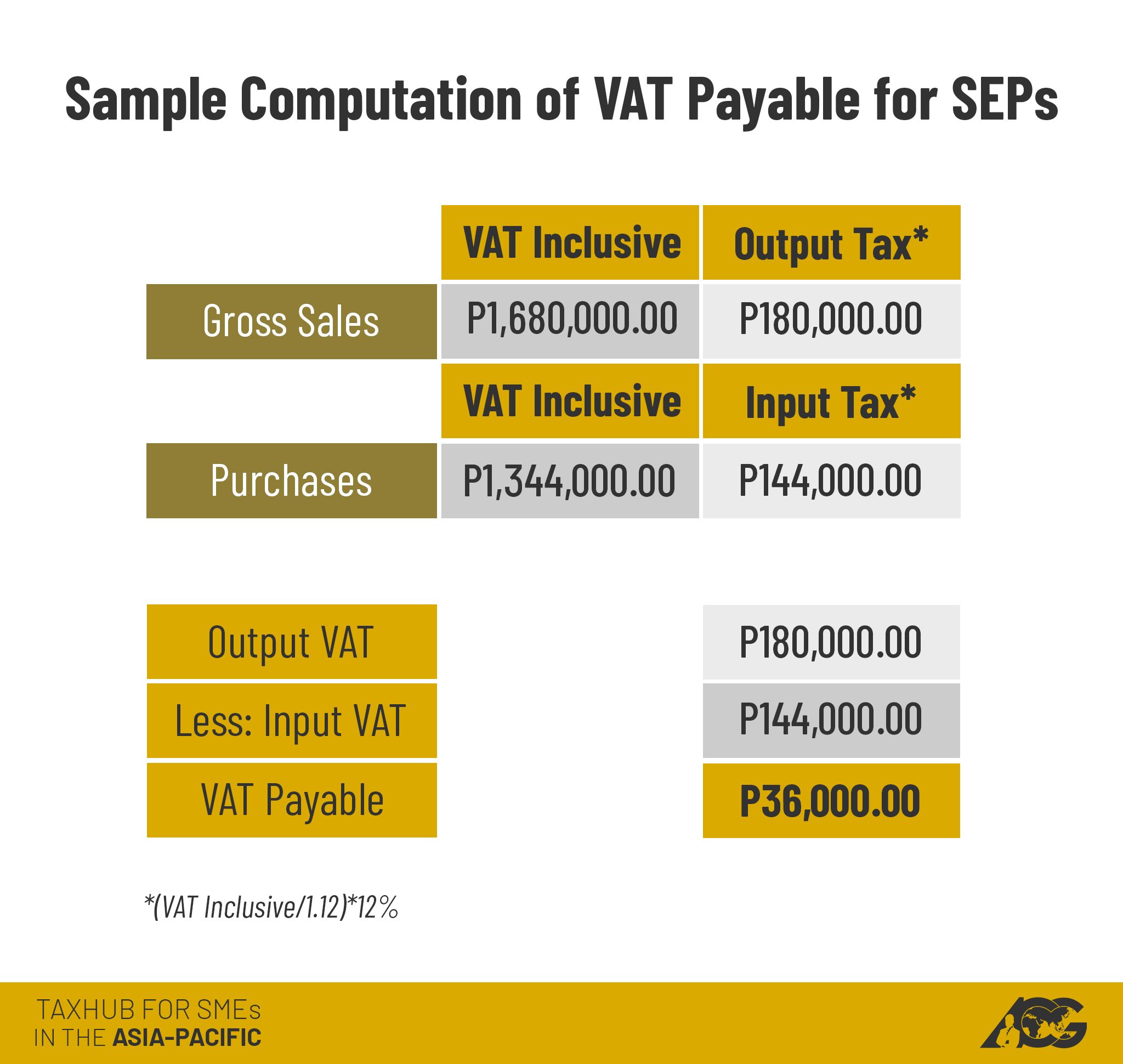

How To Compute VAT Payable Business Taxes Can Be Either A Percentage

New Digital VAT Tax Refund Process In Paris France With Wevat Petite

Can I Receive The VAT Tax Refund In The UK With Brexit Petite In Paris

Tax Refund In France How To Claim VAT Tax Refund In France By

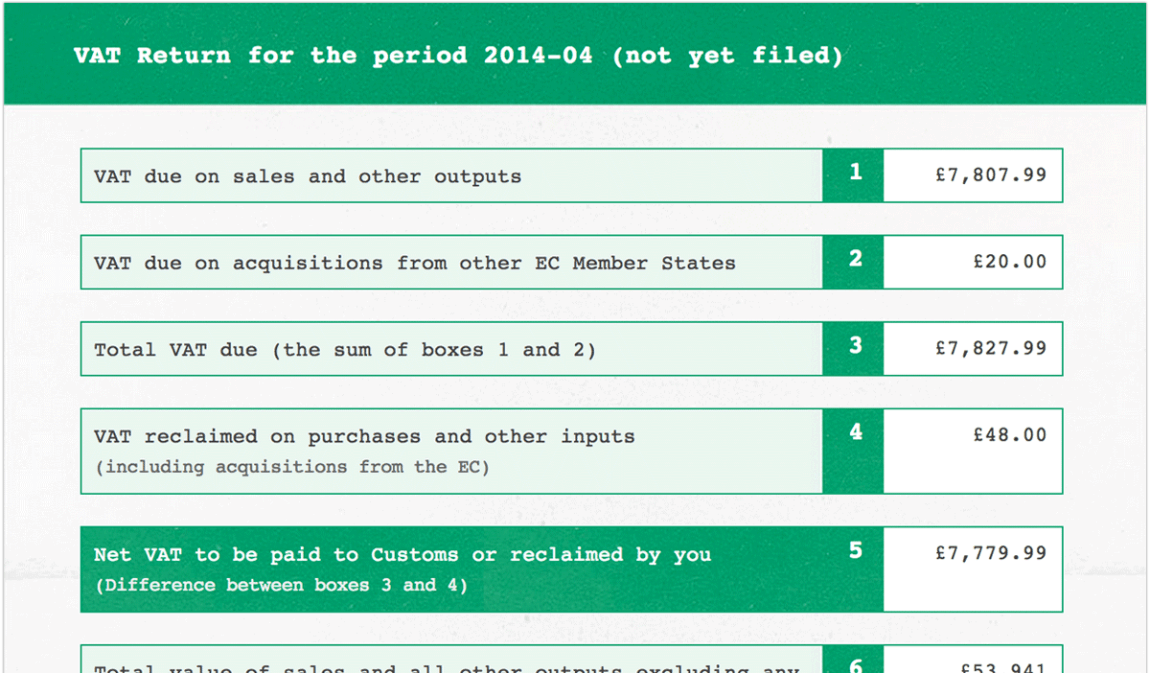

FreeAgent VAT Online Submission 1Stop Accountants

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

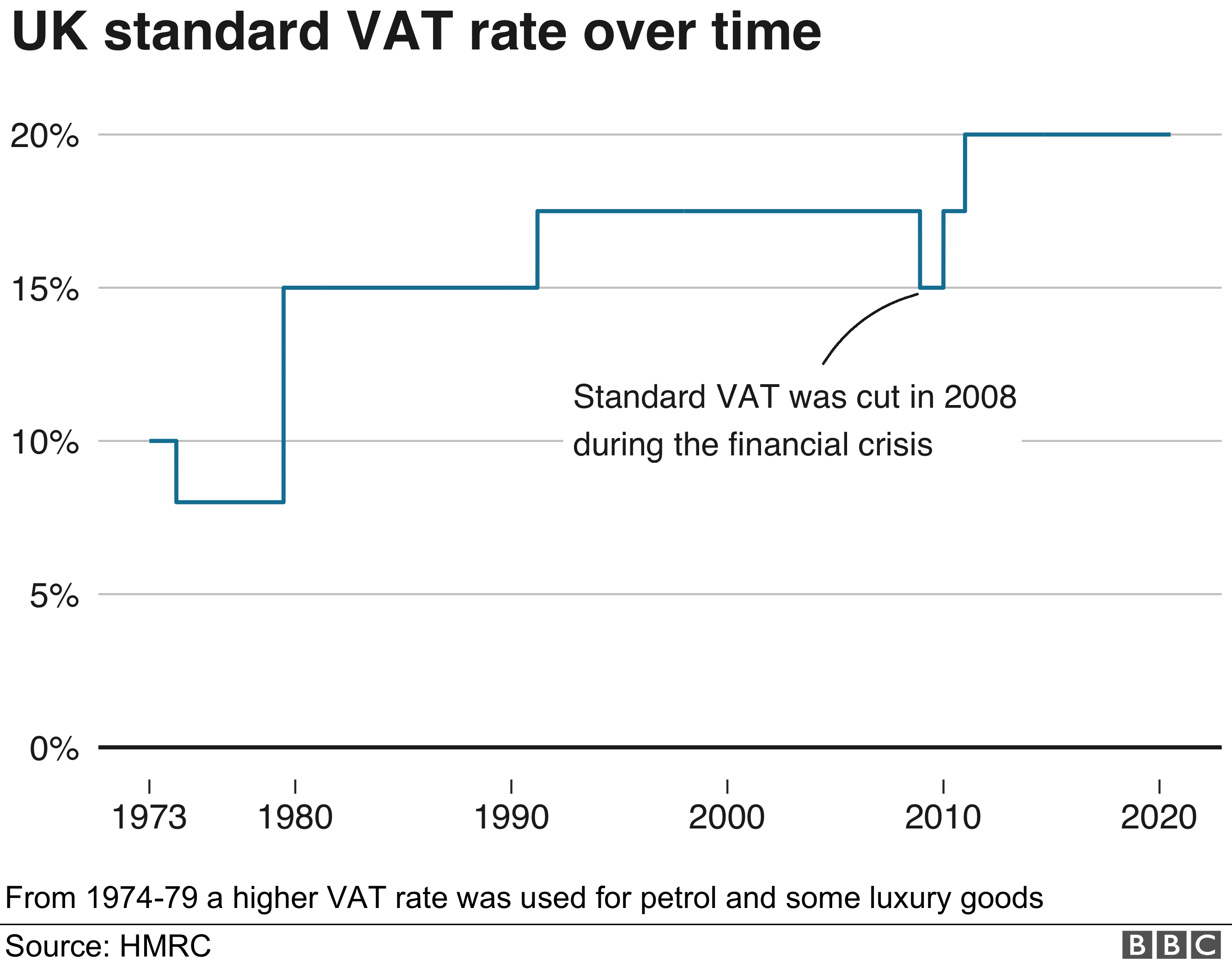

KFC Nando s And Pret Lower Prices After VAT Cut BBC News

AskTheTaxWhiz VAT Or Non VAT Taxpayer

3 Reasons You Shouldn t Receive A Tax Refund Next Year GOBankingRates

What Is The Vat Tax Refund In France - To claim back the VAT You must export the goods with you to the UK within three months of purchase You must get your VAT refund forms stamped by customs