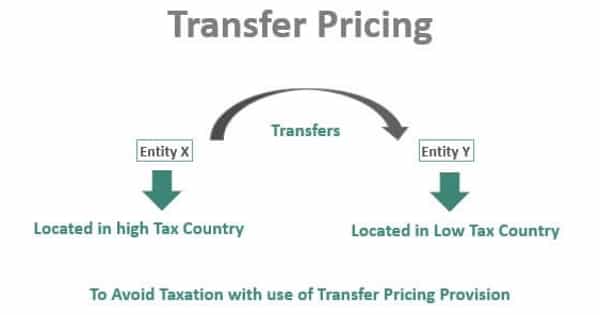

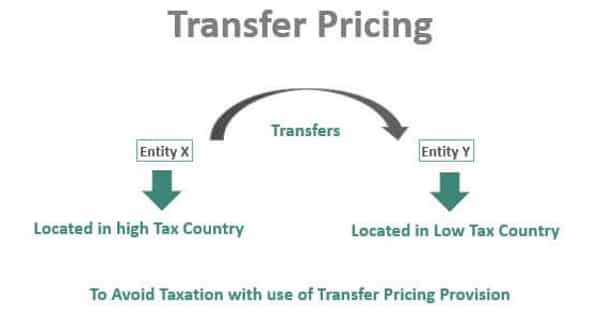

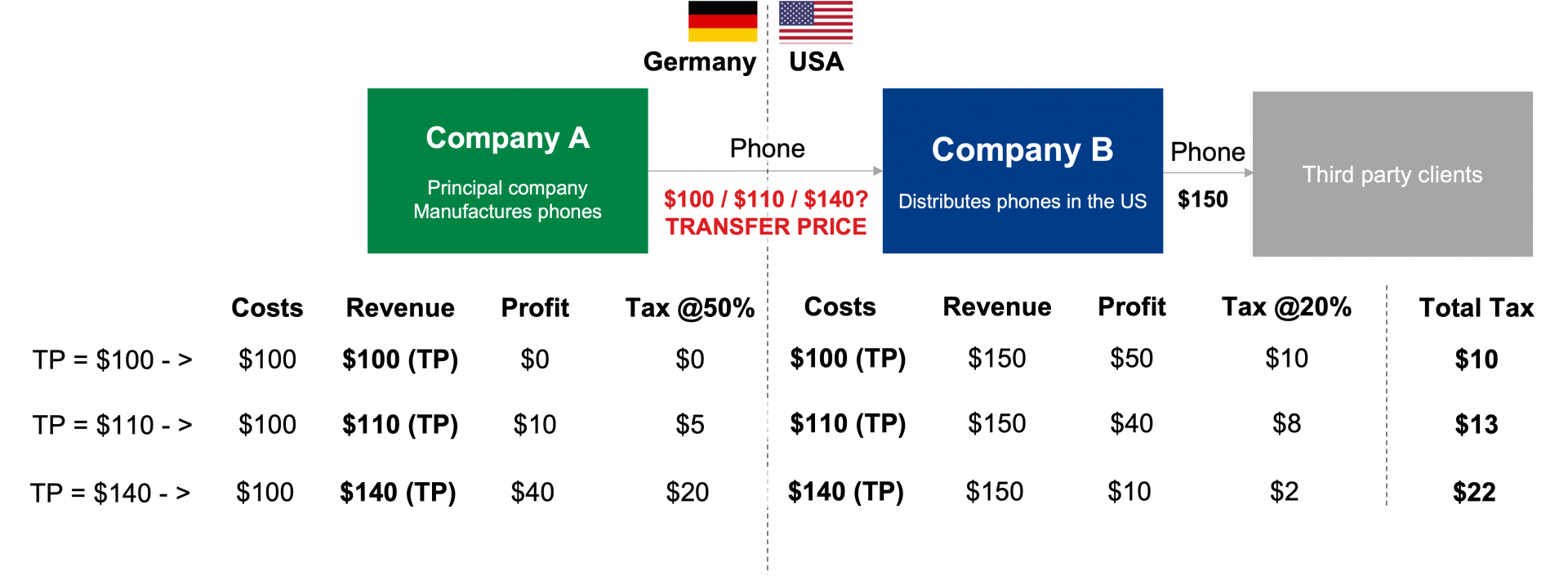

What Is Transfer Pricing In Taxation Key Takeaways Transfer prices that differ from market value will be advantageous for one entity while lowering the profits of the other entity Multinational companies can manipulate

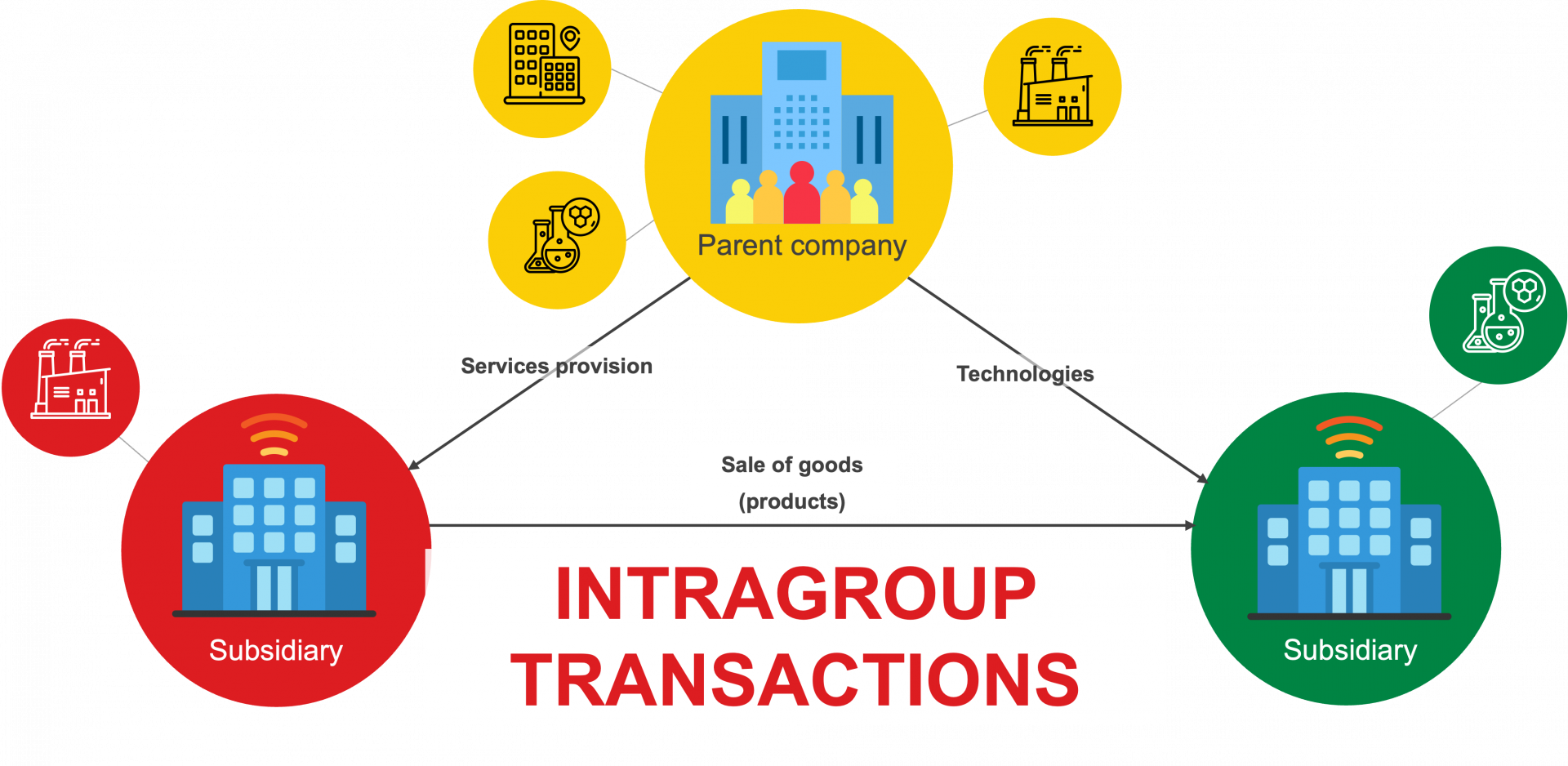

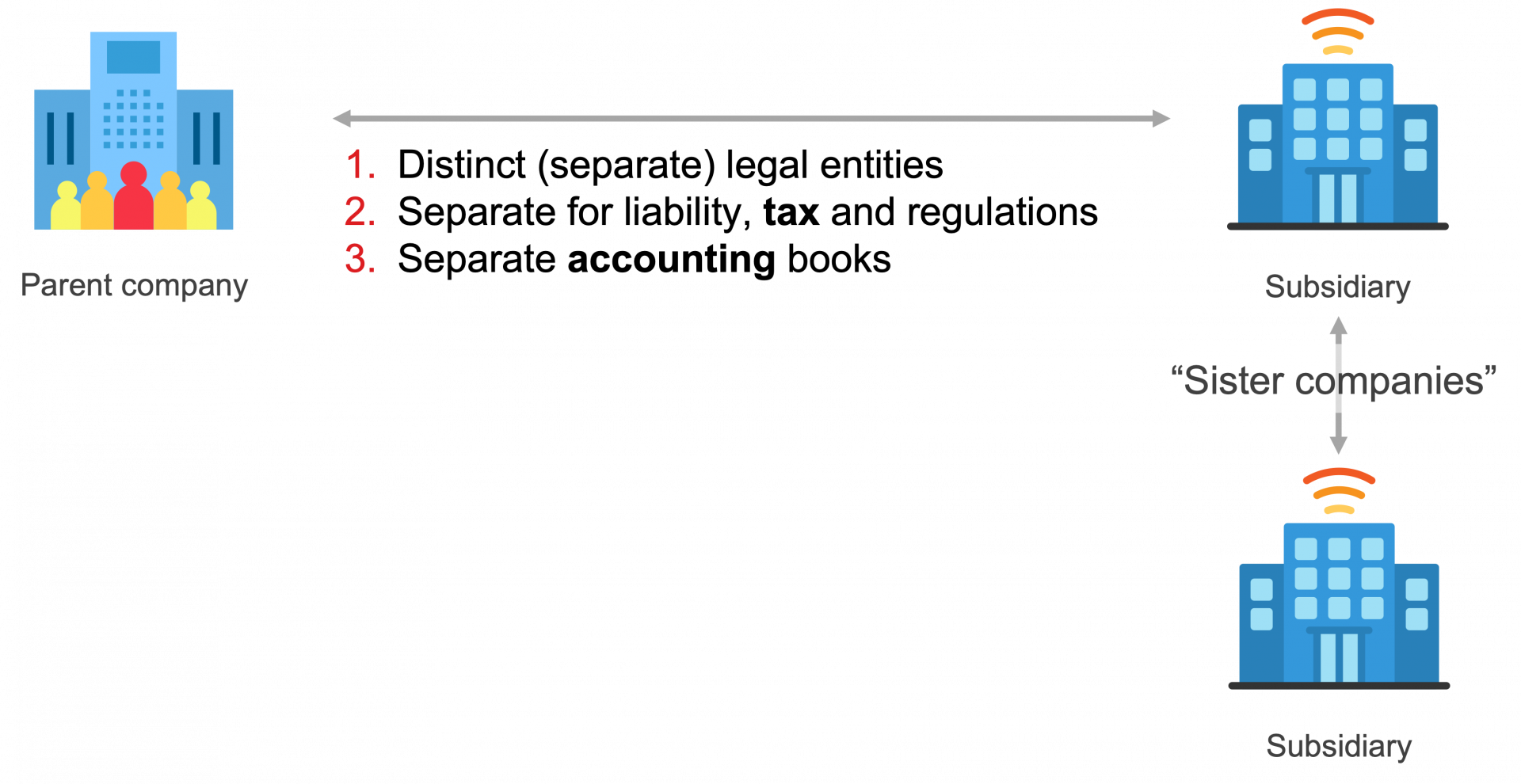

Transfer pricing refers to the prices of goods and services that are exchanged between companies under common control For example if a subsidiary company sells goods or renders services to its holding company or a sister company the price charged is referred to as the transfer price Transfer pricing is the general term for the pricing of cross border intra irm trans actions between related parties Transfer pricing therefore refers to the setting of prices7 for transactions between associated enterprises involving

What Is Transfer Pricing In Taxation

:max_bytes(150000):strip_icc()/transferprice.asp_final-6b9648f512974b73bc464682d58a1dbe.png)

What Is Transfer Pricing In Taxation

https://alphabets.app/735079cd/https/2625bb/www.investopedia.com/thmb/BLOiCorl8MtmT9_QCf1GEERcgLo=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/transferprice.asp_final-6b9648f512974b73bc464682d58a1dbe.png

Transfer Pricing In Terms Of Taxation And Accounting Assignment Point

https://assignmentpoint.com/wp-content/uploads/2021/09/transfer-pricing-1.jpg

The Transactional Net Margin Method Explained With Example

https://transferpricingasia.com/wp-content/uploads/2017/03/transactional-net-margin-method-example.jpg

Transfer pricing is the price determined for the transactions between two or more related entities within a multi company organization This price is also known as the cost of transfer which shows the value of such transfer between the related entities in terms of goods or even transfer of employees or labor across different departments Transfer pricing refers to pricing arrangements between related parties often involving transfers of tangible and intangible property This is an important tax and management issue for enterprises operating in a cross border environment

Transfer prices are the rates levied on goods services or intellectual property traded between different departments or subsidiaries of the same parent company Picture this A subsidiary in Country A produces a component that another subsidiary in Country B requires Podcast overview You may have heard the term or read about it in the newspaper or even worked with a transfer pricing professional on a project But have you ever really stopped to wonder what it actually means Transfer Pricing is a lot of things but it s certainly not boring

Download What Is Transfer Pricing In Taxation

More picture related to What Is Transfer Pricing In Taxation

If Apple s Irish Tax Loophole Is A Fraud The Whole Tech Industry Is

http://images.techhive.com/images/article/2016/08/transfer-pricing-chart-100674778-large.idge.png

What Is Transfer Pricing

https://lwfiles.mycourse.app/startaxed-public/64fa1c7667ce31c4827d4285d4fb66d6.png

Learn About Transfer Pricing Example Benefits Importance Of

https://khatabook-assets.s3.amazonaws.com/media/post/2022-05-09_083142.1302480000.webp

Transfer pricing is a mechanism for determining arm s length pricing in related party transactions often in the context of cross border transactions Transfer pricing audits are increasing in number complexity and expense all around the world as tax authorities look for additional revenue Transfer pricing is an accounting and taxation practice that sets the price that will be charged internally from another division subsidiary or holding company for

[desc-10] [desc-11]

Transfer Pricing

https://taxspeed.co.id/wp-content/uploads/2022/09/10-1.png

What Is Transfer Pricing TPC Group

https://en.tpcgroup-int.com/wp-content/uploads/2022/10/What-is-Transfer-Pricing.jpg

:max_bytes(150000):strip_icc()/transferprice.asp_final-6b9648f512974b73bc464682d58a1dbe.png?w=186)

https://www.investopedia.com/terms/t/transferprice.asp

Key Takeaways Transfer prices that differ from market value will be advantageous for one entity while lowering the profits of the other entity Multinational companies can manipulate

https://corporatefinanceinstitute.com/resources/...

Transfer pricing refers to the prices of goods and services that are exchanged between companies under common control For example if a subsidiary company sells goods or renders services to its holding company or a sister company the price charged is referred to as the transfer price

Law Web Income Tax Department Can Not Recover Penalty From Tax Payer

Transfer Pricing

TRANSFER PRICING Central Africa Tax Guide

Mengenal Transfer Pricing Definisi Peran Penting Hal Yang Harus

What Is Transfer Pricing

Transfer Pricing Regulations In Thailand Mandatory Reporting MPG

Transfer Pricing Regulations In Thailand Mandatory Reporting MPG

Income Taxation And Transfer And Business Taxation By Tabag 2021

:max_bytes(150000):strip_icc()/Term-Definitions_transfer-pricing-49c8de8ae5a649849a48fbd9139dc8c2.png)

What Does Book Transfer Debit Mean Leia Aqui How Does A Book Transfer

What Is Transfer Pricing

What Is Transfer Pricing In Taxation - Podcast overview You may have heard the term or read about it in the newspaper or even worked with a transfer pricing professional on a project But have you ever really stopped to wonder what it actually means Transfer Pricing is a lot of things but it s certainly not boring