What Is Withholding Tax In Italy Withholding tax Italy Dividends royalties interest rents etc Dividends paid to foreign entities are subject to ordinary withholding tax at the rate of 26 percent

Withholding tax implications Italian companies are subject to IRES at a rate of 24 on interest income Non financial companies are not subject to IRAP on interest income while banks financial institutions insurance Ritenuta d Acconto also known as withholding tax is a mechanism implemented by the Italian government to collect taxes from various sources of income

What Is Withholding Tax In Italy

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg)

What Is Withholding Tax In Italy

https://www.investopedia.com/thmb/hKbxsZX-BiSjEk4A17iSasrOsS4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg

Withholding Tax Meaning Types Step By Step Calculation

https://www.wallstreetmojo.com/wp-content/uploads/2019/11/Withholding-Tax.png

Paying Property Tax In Italy Here s Your Full Guide Wise Formerly

https://wise.com/imaginary/property-tax-in-italy.jpg

The Italian tax system provides the six following categories of income Employment income Business income Self employment income Real estate income How do I pay my taxes in Italy Italian withholding agents employer may withhold Italian income tax at source

Taxation in Italy is levied by the central and regional governments and is collected by the Italian Agency of Revenue Agenzia delle Entrate Total tax revenue in 2018 was Individual is an Italian tax resident in the year of filing of the Mod 730 and in the previous one Individual has a withholding agent in Italy in the period of the filing of

Download What Is Withholding Tax In Italy

More picture related to What Is Withholding Tax In Italy

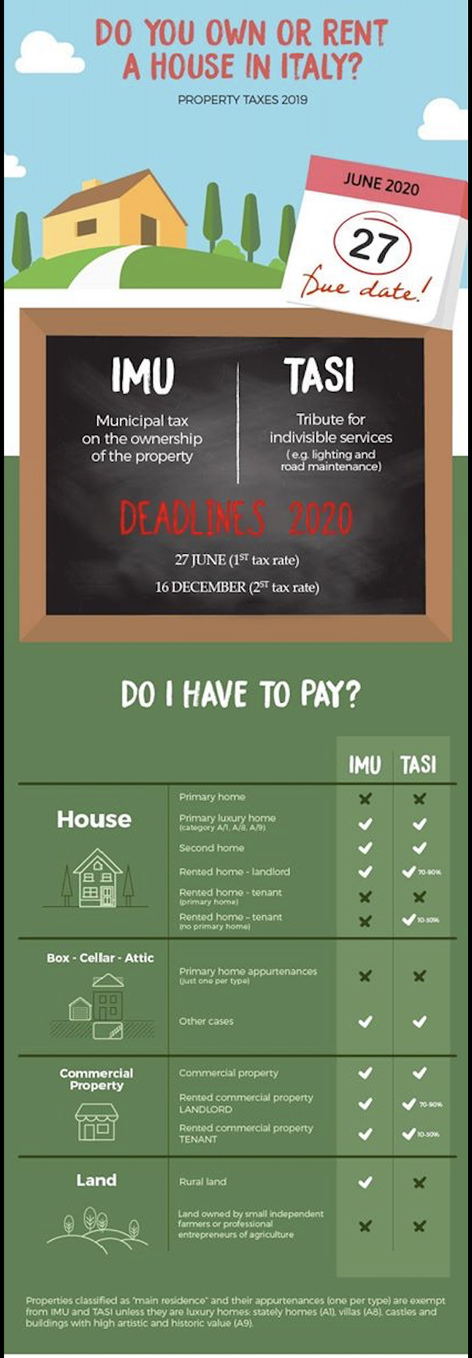

PROPERTY TAX IN ITALY THE ULTIMATE GUIDE FOR 2020 Accounting Bolla

https://accountingbolla.com/wp-content/uploads/2021/03/screen-shot-2020-03-23-at-4-28-29-pm.png

PROPERTY TAX IN ITALY THE ULTIMATE GUIDE FOR 2020 Accounting Bolla

https://accountingbolla.com/wp-content/uploads/2021/03/screen-shot-2020-03-23-at-4-21-45-pm_orig-758x1024.png

INCOME TAX RATE IN ITALY 2020 GUIDE FOR FOREIGNERS Accounting Bolla

https://accountingbolla.com/wp-content/uploads/2021/03/the-management-is-checking-the-accuracy-of-the-com-crw4jbl_orig.jpg

For the non resident most Italian tax liabilities will be satisfied by a way of withholding tax at source thus the payer will deduct from any payment of income from employment or There is a provision for withholding tax reimbursement up to 11 26 provided that such dividends were taxed in the State of residence of the beneficiary The withholding tax can be reduced pursuant to the

Individuals who generate financial income through Italian banks and financial institutions generally do not disclose anything in their tax return as taxes are The law provides for a system based on five taxes the imposta sul reddito income tax the imposta sulle societ corporate tax the imposta sul valore aggiunto VAT or sales

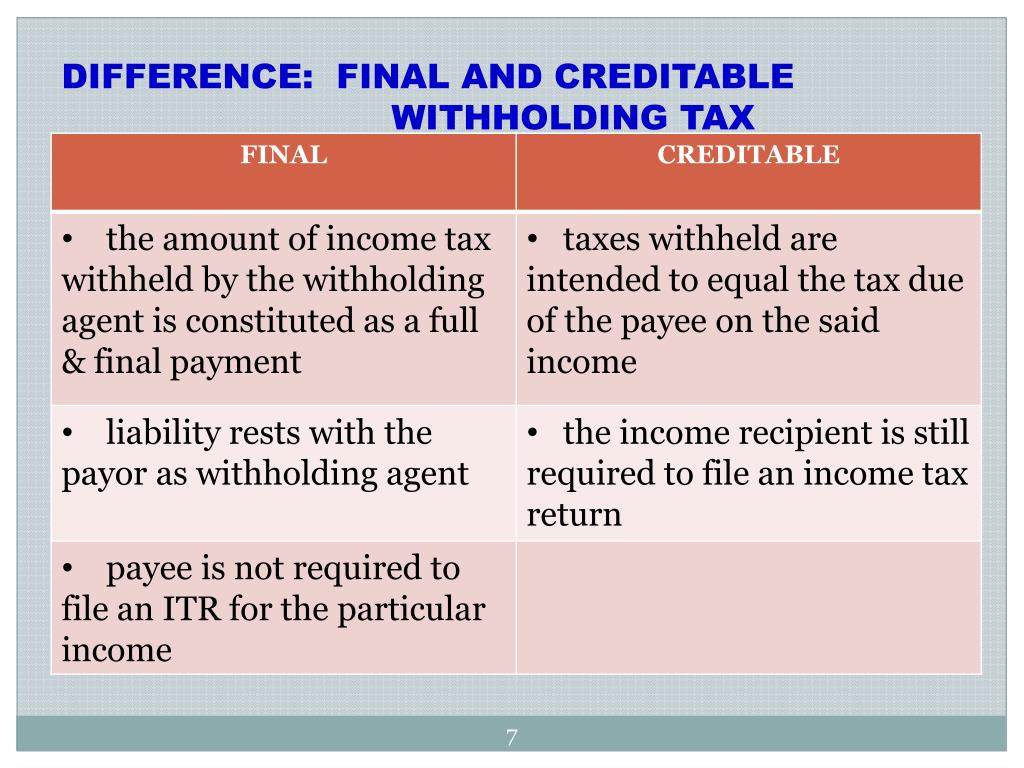

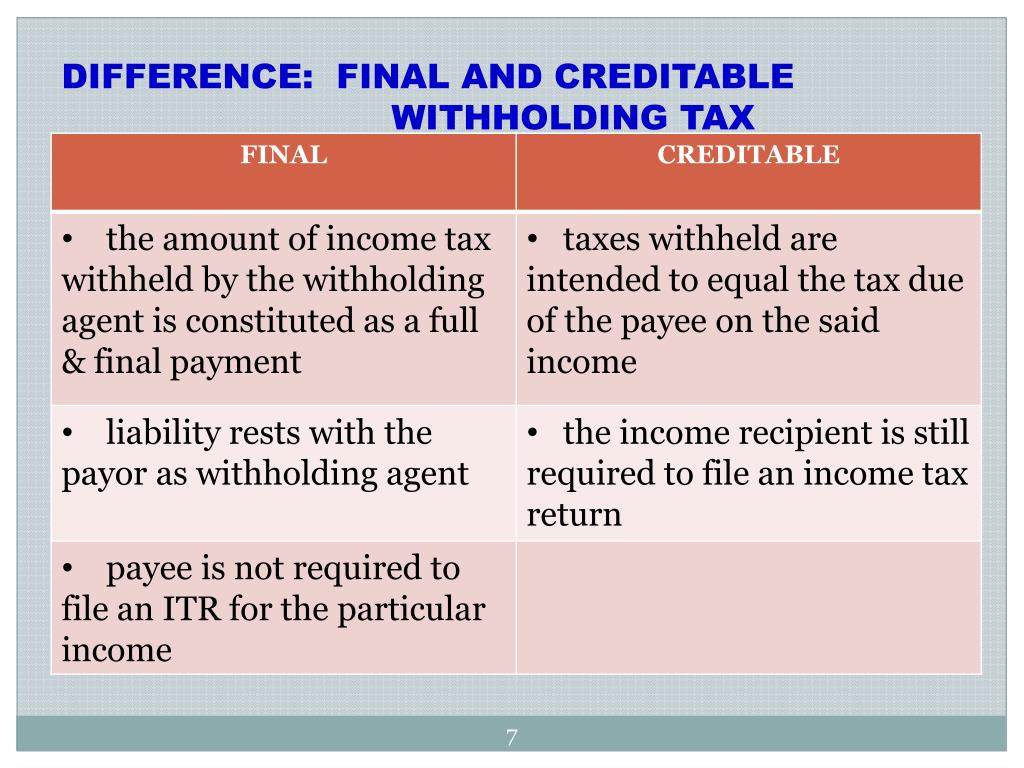

PPT WITHHOLDING TAX AT SOURCE PowerPoint Presentation Free Download

https://image.slideserve.com/1062935/slide7-l.jpg

Understanding Withholding Taxes In Latin America Biz Latin Hub

https://images.bizlatinhub.com/wp-content/uploads/2023/04/54403aac-eng-withholding-tax-biz-latin-hub-infographic-1024x576.png

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg?w=186)

https://www.dlapiperintelligence.com/goingglobal/...

Withholding tax Italy Dividends royalties interest rents etc Dividends paid to foreign entities are subject to ordinary withholding tax at the rate of 26 percent

https://www.dentons.com/.../italy

Withholding tax implications Italian companies are subject to IRES at a rate of 24 on interest income Non financial companies are not subject to IRAP on interest income while banks financial institutions insurance

A Guide To The Basics Of Withholding Tax Expanded ACCOUNTAHOLICSPH

PPT WITHHOLDING TAX AT SOURCE PowerPoint Presentation Free Download

Step By Step Document For Withholding Tax Configuration SAP Blogs

PROPERTY TAX IN ITALY THE ULTIMATE GUIDE FOR 2020 Accounting Bolla

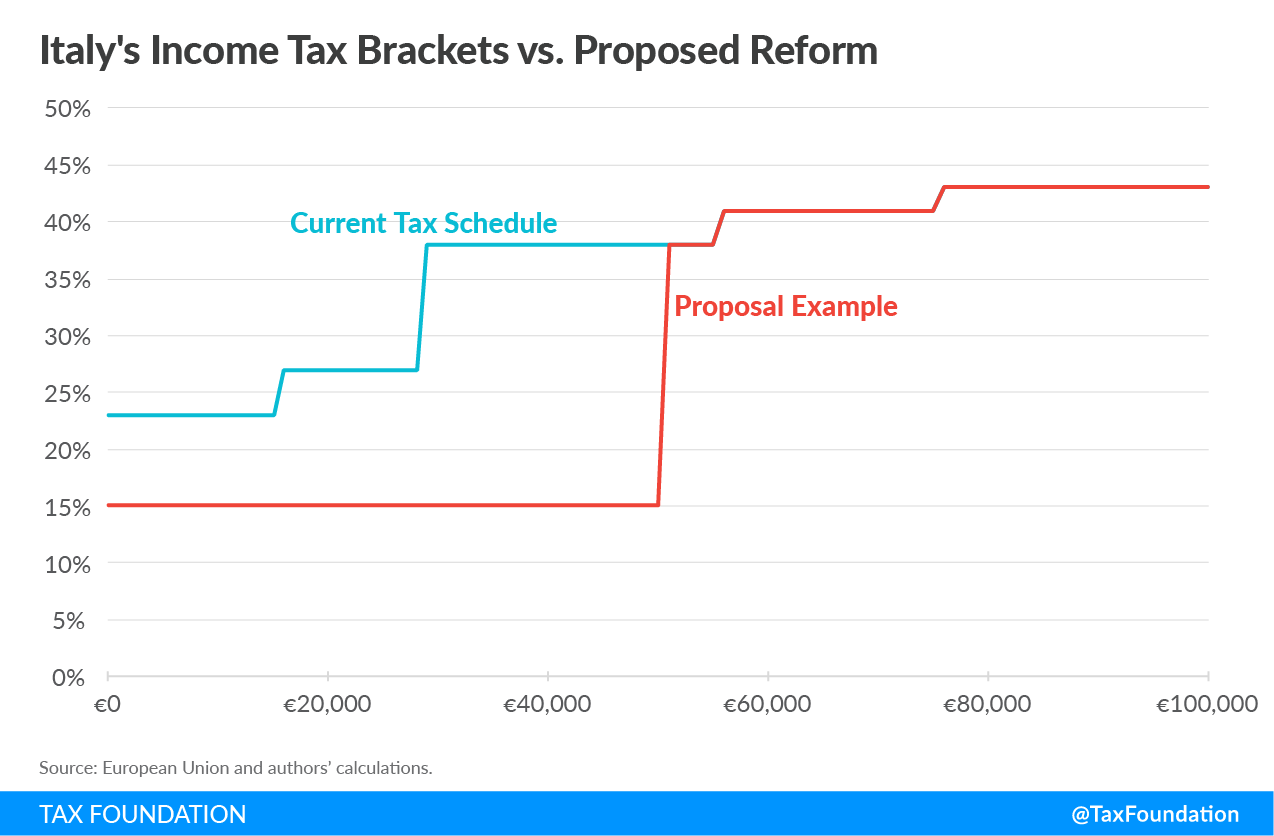

Income Tax Brackets Italy 2022 The Spectrum IFA Group

SIMPLE TAX GUIDE FOR FOREIGNERS IN ITALY Migrants Digest

SIMPLE TAX GUIDE FOR FOREIGNERS IN ITALY Migrants Digest

Italy Income Taxes Italy Can Pay For A Flat Tax Italy Taxes

Withholding Tax WHT AceConsulting

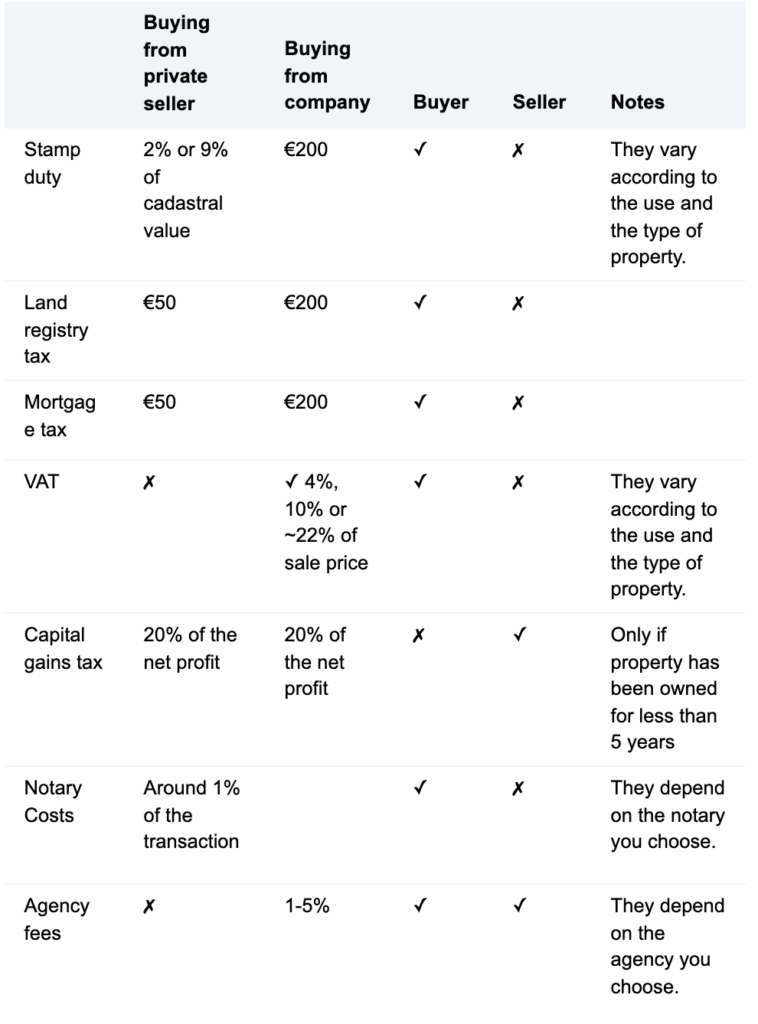

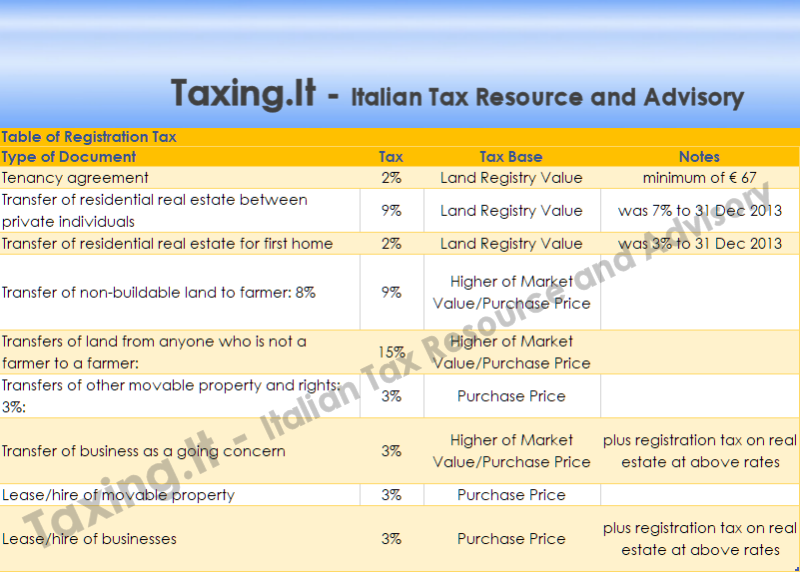

Table Of Main Registration Taxes In Italy Italian Tax

What Is Withholding Tax In Italy - With this in mind it s especially important to understand how Italian taxation works and what you can do to be frugal This guide will give you a complete overview of