What Items Are Exempt From Sales Tax In Colorado In Colorado certain items may be exempt from the sales tax to all consumers not just tax exempt purchasers The state exempts groceries prescription drugs and certain medical devices from

For detailed information about state administered local sales tax exemptions please see the Supplemental Instructions for Form DR 0100 and Department publication Colorado FOOD AND RELATED ITEMS NOT EXEMPT FROM COLORADO SALES TAX The Department of Agriculture guidelines prohibit the use of food stamps or WIC vouchers for the purchase of

What Items Are Exempt From Sales Tax In Colorado

What Items Are Exempt From Sales Tax In Colorado

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/virginia-sales-tax-exemption-form-st-11-fill-out-and-sign-printable-6.png

Free Printable Tax Exempt Product Form For Companies Printable Forms

https://www.pdffiller.com/preview/5/506/5506066/large.png

Agriculture Sales Tax Exemption Oklahoma Farm Bureau

https://www.okfarmbureau.org/wp-content/uploads/AgSalesPageHeader.jpg

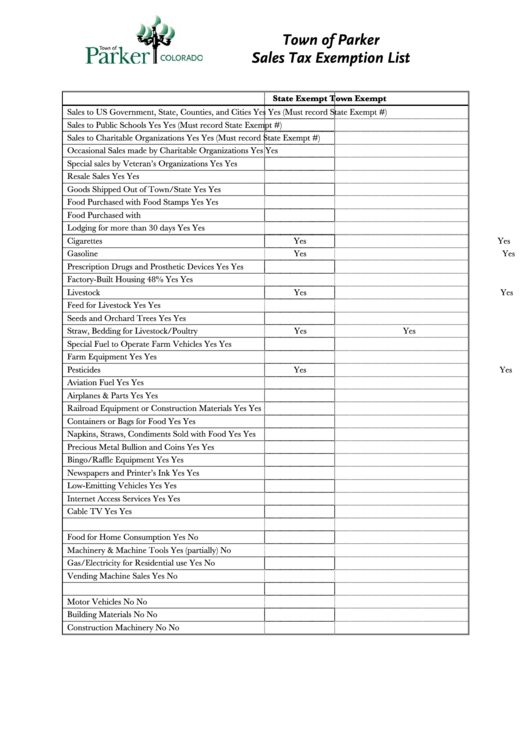

Taxation Exceptions While most items require sales tax certain goods are exempt from the imposition of sales tax These exemptions include Farm equipment Food for home State Sales Tax Vendors do not need to collect state sales tax if the food is purchased from them for the buyer to consume at home The state of Colorado exempts food for home consumption

You may be able to deduct certain sales from sales tax based on either the type of item sold or the identity of the purchaser The information on this webpage will help to explain some of the Here is a list of some tax exempt items in Denver Item Description TIC Number Prescription Drugs Medications 40010 Groceries Unprepared food items 50010 Medical

Download What Items Are Exempt From Sales Tax In Colorado

More picture related to What Items Are Exempt From Sales Tax In Colorado

Ca Sales Tax Exemption Certificate Resale Fill Online Printable

https://www.pdffiller.com/preview/442/869/442869902/large.png

Sales Tax Exemption List Form Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/226/2263/226369/page_1_thumb_big.png

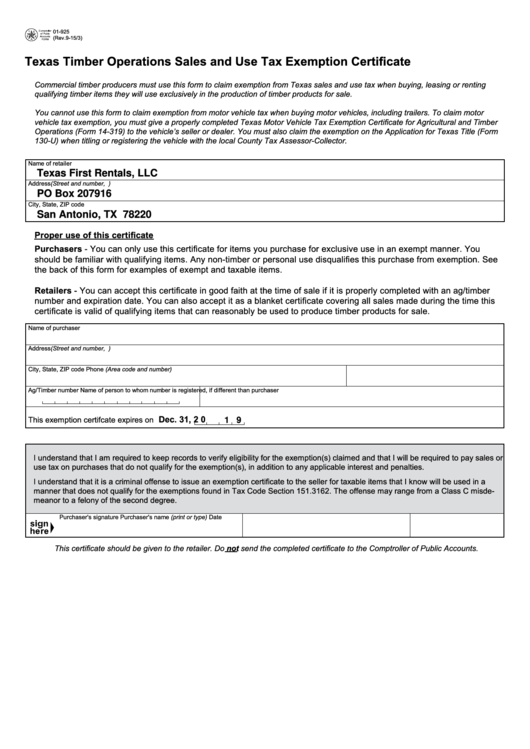

Fillable Texas Timber Operations Sales And Use Tax Exemption

https://data.formsbank.com/pdf_docs_html/135/1359/135919/page_1_thumb_big.png

What products are exempt from Denver sales tax rate Food including food sold through vending machines Residential Energy Usage all gas electricity coal wood and fuel In Colorado certain items may be exempt from the sales tax to all consumers not just tax exempt purchasers The state exempts groceries prescription drugs and certain

The Colorado state sales tax rate is 2 9 and the average CO sales tax after local surtaxes is 7 44 Groceries and prescription drugs are exempt from the Colorado sales tax Counties and cities can charge an additional local sales What transactions are generally subject to sales tax in Colorado Colorado imposes a sales tax on all retail sales of tangible personal property which includes the rental of hotel rooms or

State And Local Sales Tax Rates Midyear 2021 Laura Strashny

https://files.taxfoundation.org/20210707180628/2021-sales-taxes-by-state-2021-sales-tax-rates-by-state-2021-state-and-local-sales-tax-rates-July-2021-1200x1033.png

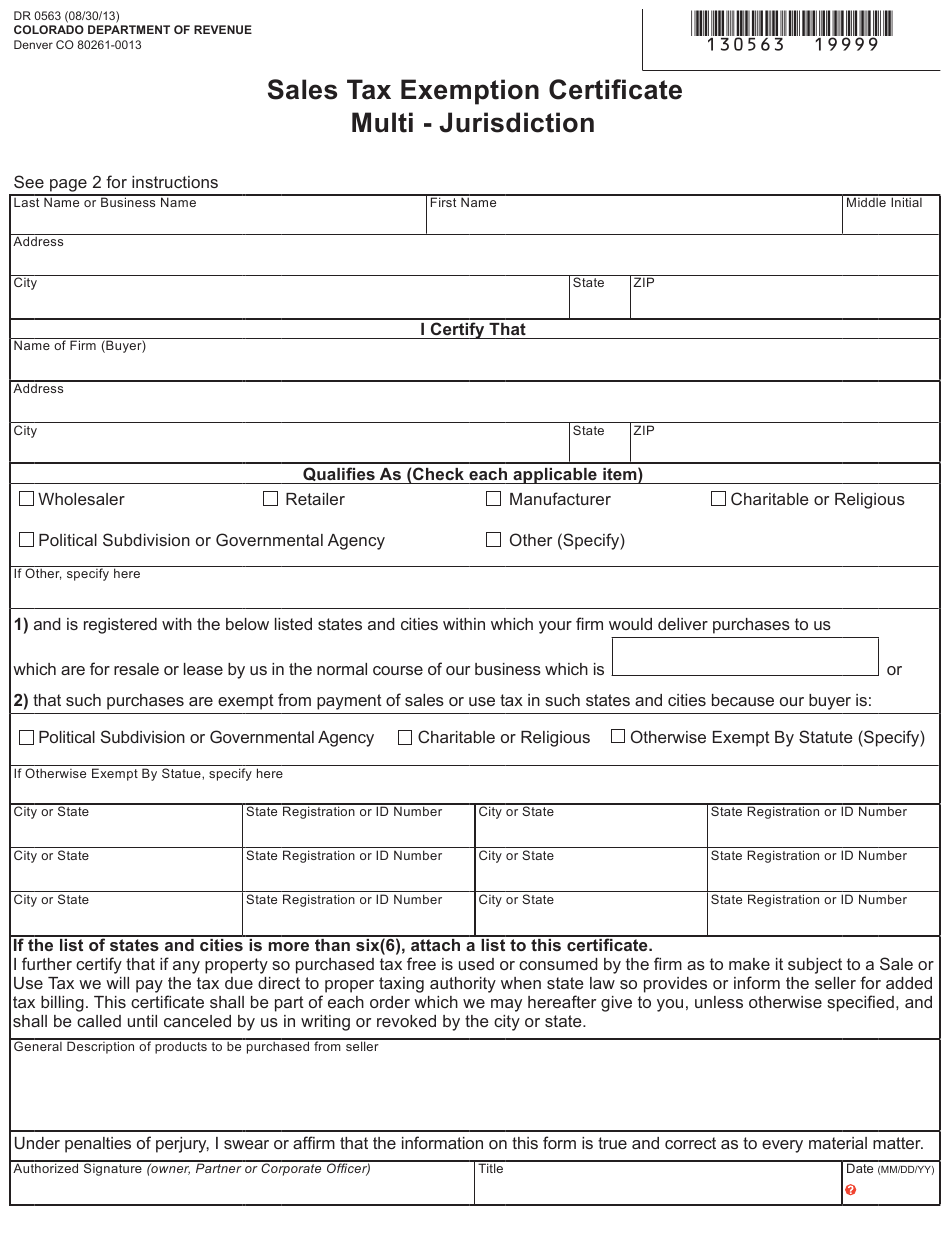

How To Get A Sales Tax Exemption Certificate In Colorado ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/form-dr0563-download-fillable-pdf-or-fill-online-sales-tax-exemption-3.png

https://www.salestaxhandbook.com › colorado › sales-tax-exemptions

In Colorado certain items may be exempt from the sales tax to all consumers not just tax exempt purchasers The state exempts groceries prescription drugs and certain medical devices from

https://tax.colorado.gov › sales-tax-guide

For detailed information about state administered local sales tax exemptions please see the Supplemental Instructions for Form DR 0100 and Department publication Colorado

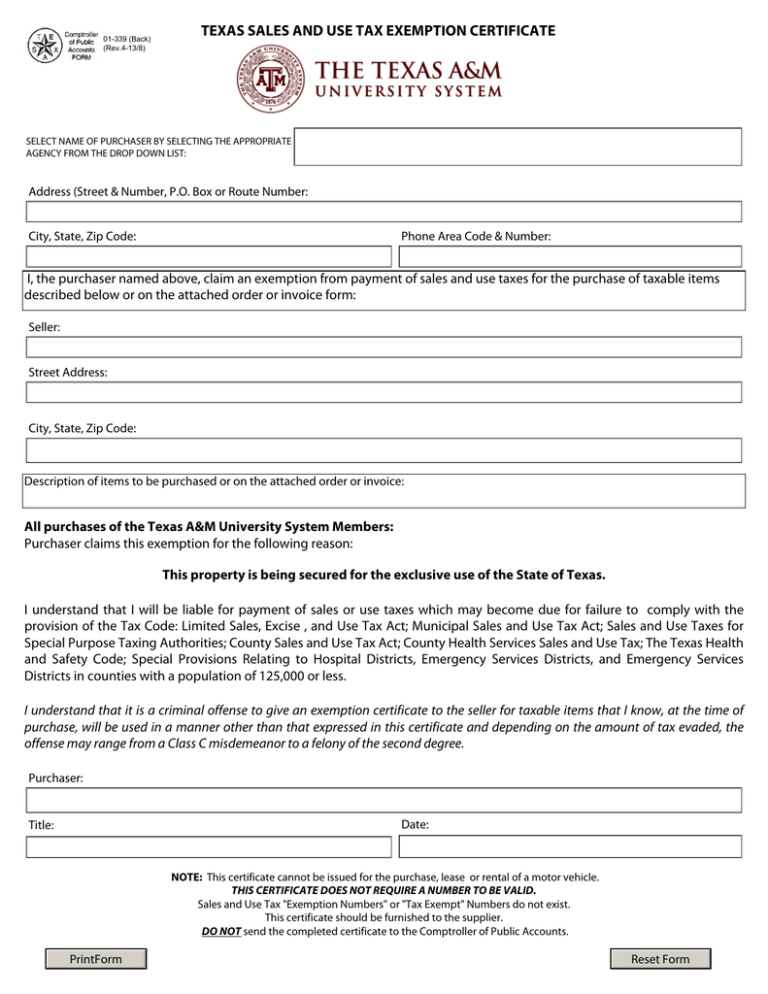

2023 Sales Tax Exemption Form Texas ExemptForm

State And Local Sales Tax Rates Midyear 2021 Laura Strashny

Exempt Supply Invoice Reachaccountant

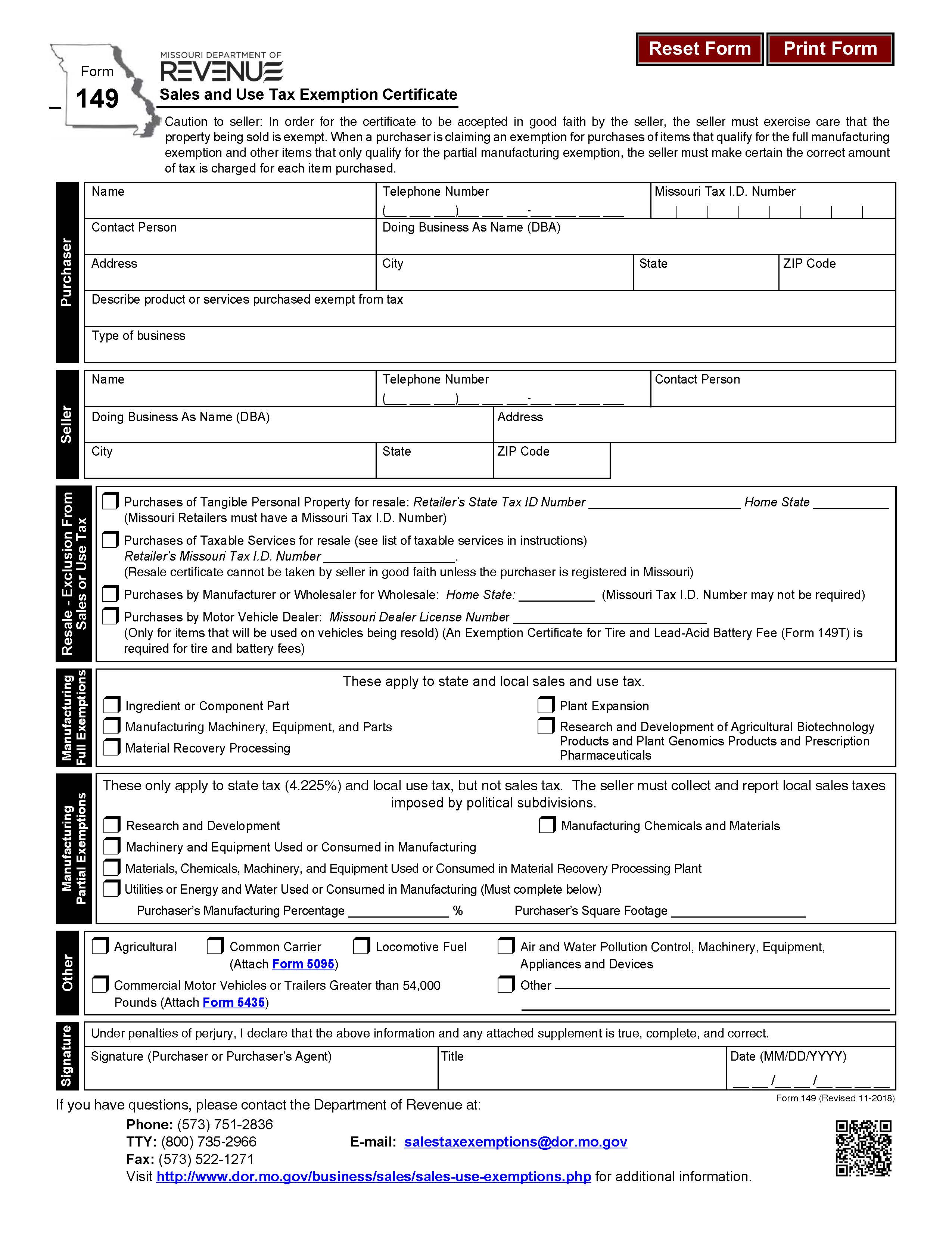

Missouri 149 Sales And Use Tax Exemption Certificate

Certificate Of TAX Exemption PAFPI

Sales Exemption Certificate TUTORE ORG Master Of Documents

Sales Exemption Certificate TUTORE ORG Master Of Documents

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales

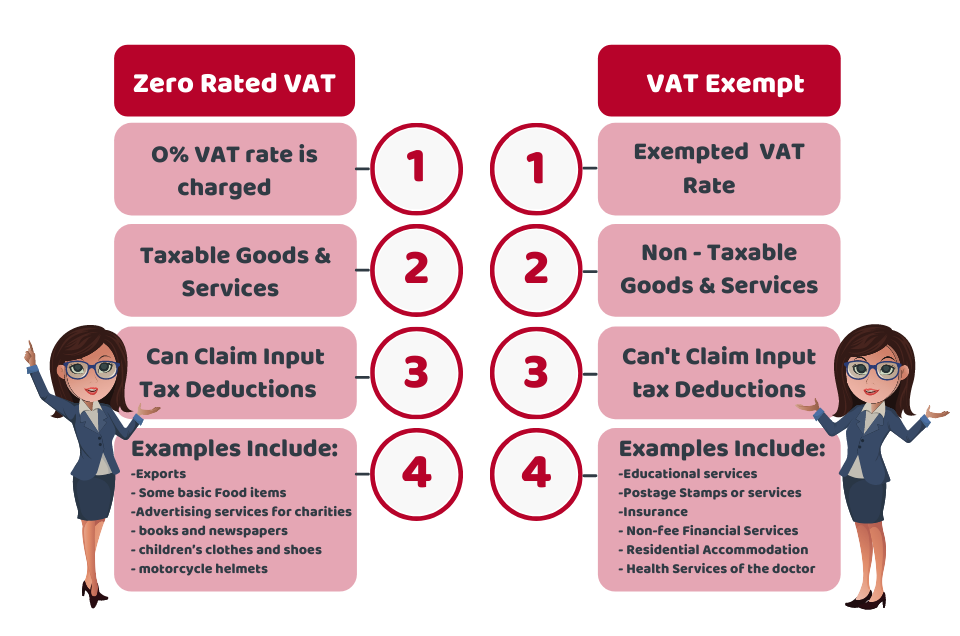

Whats The Difference Between Exempt Items And Zero Rated Vat Items

Sales Use Tax Exempt Form 2023 North Carolina ExemptForm

What Items Are Exempt From Sales Tax In Colorado - State Sales Tax Vendors do not need to collect state sales tax if the food is purchased from them for the buyer to consume at home The state of Colorado exempts food for home consumption