What Kind Of Deductions Can I Claim As An Independent Contractor Web 5 Dez 2023 nbsp 0183 32 16 amazing tax deductions for independent contractors What can you write off on taxes Let s explore the following categories of independent contractor tax

Web A write off is when you claim tax deductions on the money spent as an independent contractor on eligible expenses For example the truck driver example from earlier can write off expenses related to their truck while Web 15 Juni 2021 nbsp 0183 32 There are a number of business deductions you can take as an independent contractor including health insurance home office deductions mileage and deductions for your phone bill

What Kind Of Deductions Can I Claim As An Independent Contractor

What Kind Of Deductions Can I Claim As An Independent Contractor

https://www.racomi.org/wp-content/uploads/2023/08/overview-of-the-almighty-tax-deduction-for-small-businesses.png

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

Top 10 Tax Deductions Synchrony Bank Synchrony Bank

https://www.synchronybank.com/images/hero-top-10-tax-deductions-you-should-know-about_1140x570.jpg

Web 12 Apr 2023 nbsp 0183 32 19 Tax Deductions for Independent Contractors in 2023 Independent contractors can claim write offs on their self employment income to reduce their tax Web All self employed people can claim business expenses on their taxes That s true if you re a 1099 contractor Freelancer Gig worker Small business owner If you re spending money buying something that helps

Web 20 Dez 2023 nbsp 0183 32 Here are some of the most common self employment tax deductions you can claim as an independent contractor Home office Vehicle use Office supplies Phone and internet Self employment tax Web 12 Dez 2022 nbsp 0183 32 It can be overwhelming to find the right 1099 deductions to claim that will reduce your federal income tax bill If you are a contractor the odds are good that you

Download What Kind Of Deductions Can I Claim As An Independent Contractor

More picture related to What Kind Of Deductions Can I Claim As An Independent Contractor

Lot Of Things Newsletter Image Library

https://d2zqka2on07yqq.cloudfront.net/wp-content/uploads/2022/04/common-small-business-tax-deductions-1.png

Can I Claim My Laptop As An Education Expense Leia Aqui Is A Laptop

https://assets-global.website-files.com/601d611d601043ab3e22931b/63c0f1e767846cf05c7af85e_how-to-write-off-expenses-as-an-independent-contractor.webp

What Is An Independent Contractor In The U S AFP

https://americansforprosperity.org/wp-content/uploads/2021/02/Infographic_v02-01.png

Web As an independent contractor you re self employed meaning your taxes and expenses aren t automatically deducted This could leave you wondering what deductions you re eligible for Luckily we ve put Web As an independent contractor understanding your tax obligations is essential This article explains income tax self employment tax estimated quarterly taxes deductions and

Web 27 Nov 2019 nbsp 0183 32 Independent contractor status usually gives you a lot more autonomy and control over your work You re your own boss set your own hours and make your own Web 9 Jan 2020 nbsp 0183 32 Currently you can claim a deduction of up to 50 of what you paid in self employment taxes Business expense deductions Wondering what you can write off as

10 Things New Business Owners Must Know Rate exchange

https://triplogmileage.com/wp-content/uploads/2018/08/rev02-01-min-33-min.jpg

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

https://www.nextinsurance.com/blog/tax-deductions-for-independent...

Web 5 Dez 2023 nbsp 0183 32 16 amazing tax deductions for independent contractors What can you write off on taxes Let s explore the following categories of independent contractor tax

https://www.decimal.com/blog/write-offs-for-in…

Web A write off is when you claim tax deductions on the money spent as an independent contractor on eligible expenses For example the truck driver example from earlier can write off expenses related to their truck while

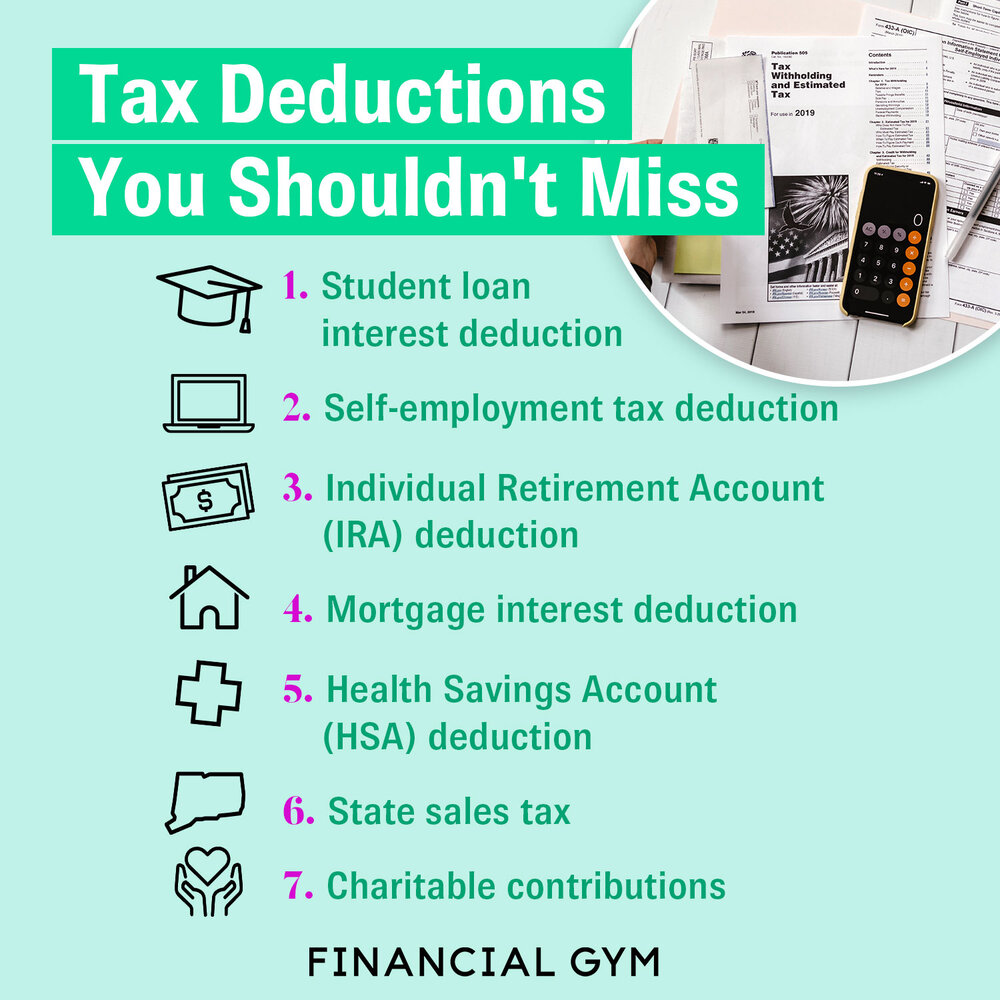

Tax Deductions Write Offs To Save You Money Financial Gym

10 Things New Business Owners Must Know Rate exchange

Understanding Contractor Misclassification Danst

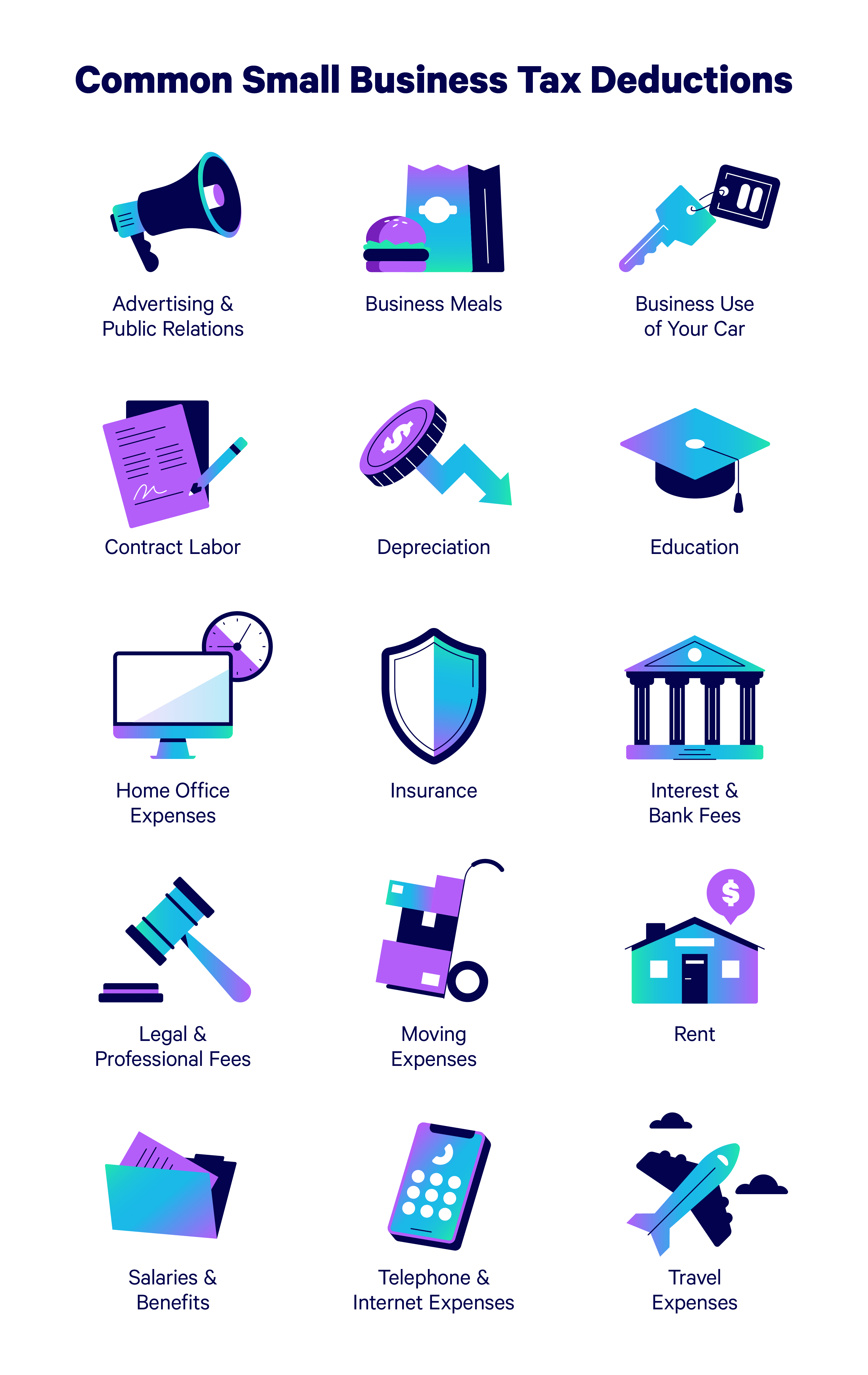

Small Business Expenses Tax Deductions 2023 QuickBooks

Corporation Prepaid Insurance Tax Deduction Financial Report

How To Obtain Small Business Tax Deductions

How To Obtain Small Business Tax Deductions

Teacher Tax Deductions Teacher Organization Teaching

List Of Tax Deductions Here s What You Can Deduct

Can You Deduct Unreimbursed Employee Expenses In 2022

What Kind Of Deductions Can I Claim As An Independent Contractor - Web 12 Apr 2023 nbsp 0183 32 19 Tax Deductions for Independent Contractors in 2023 Independent contractors can claim write offs on their self employment income to reduce their tax