What Medical Bills Can You Claim On Taxes You may be able to claim health insurance premiums on your tax return This depends on how much you spent on medical care how you paid for premiums and if you were self employed But you cannot deduct expenses that were reimbursed by an insurance plan a flexible spending account a health savings account or another tax advantaged savings

Deductible medical expenses may include but aren t limited to the following Amounts paid of fees to doctors dentists surgeons chiropractors psychiatrists psychologists and nontraditional medical practitioners Depending on the cost of your medical expenses and your adjusted gross income AGI the IRS may allow you to claim medical expense deductions You have to claim the itemized deduction to be eligible for a medical expense deduction Learn more about qualified medical costs and how much you can write off

What Medical Bills Can You Claim On Taxes

What Medical Bills Can You Claim On Taxes

https://static.twentyoverten.com/content/featured/6-tips-to-paying-medical-bills-you-cant-afford.jpg

Can I File Bankruptcy On Medical Bills Schmidt Whitten Whitten

https://kmslawoffice.net/wp-content/uploads/2023/05/AdobeStock_118985864.jpg

How Many Kids Can You Claim On Taxes YouTube

https://i.ytimg.com/vi/5ZlHu2_Btog/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYZSBlKGUwDw==&rs=AOn4CLAUVfOUGX38VyHK3nGlEwomCKi1-g

To deduct medical expenses from taxes it s important to understand the eligibility criteria set by the Internal Revenue Service IRS As of the 2024 tax year taxpayers can deduct medical expenses exceeding 7 5 of their adjusted gross income AGI Understanding which medical costs are eligible for tax deductions is crucial for maximizing returns and ensuring compliance with IRS regulations This article examines the specifics of claiming medical expenses on taxes focusing on what qualifies and how to document these costs effectively

The short answer is yes but there are some limitations Can You Claim Medical Expenses on Your Taxes While many out of pocket medical bills are deductible you have two hurdl You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical expenses on your tax return

Download What Medical Bills Can You Claim On Taxes

More picture related to What Medical Bills Can You Claim On Taxes

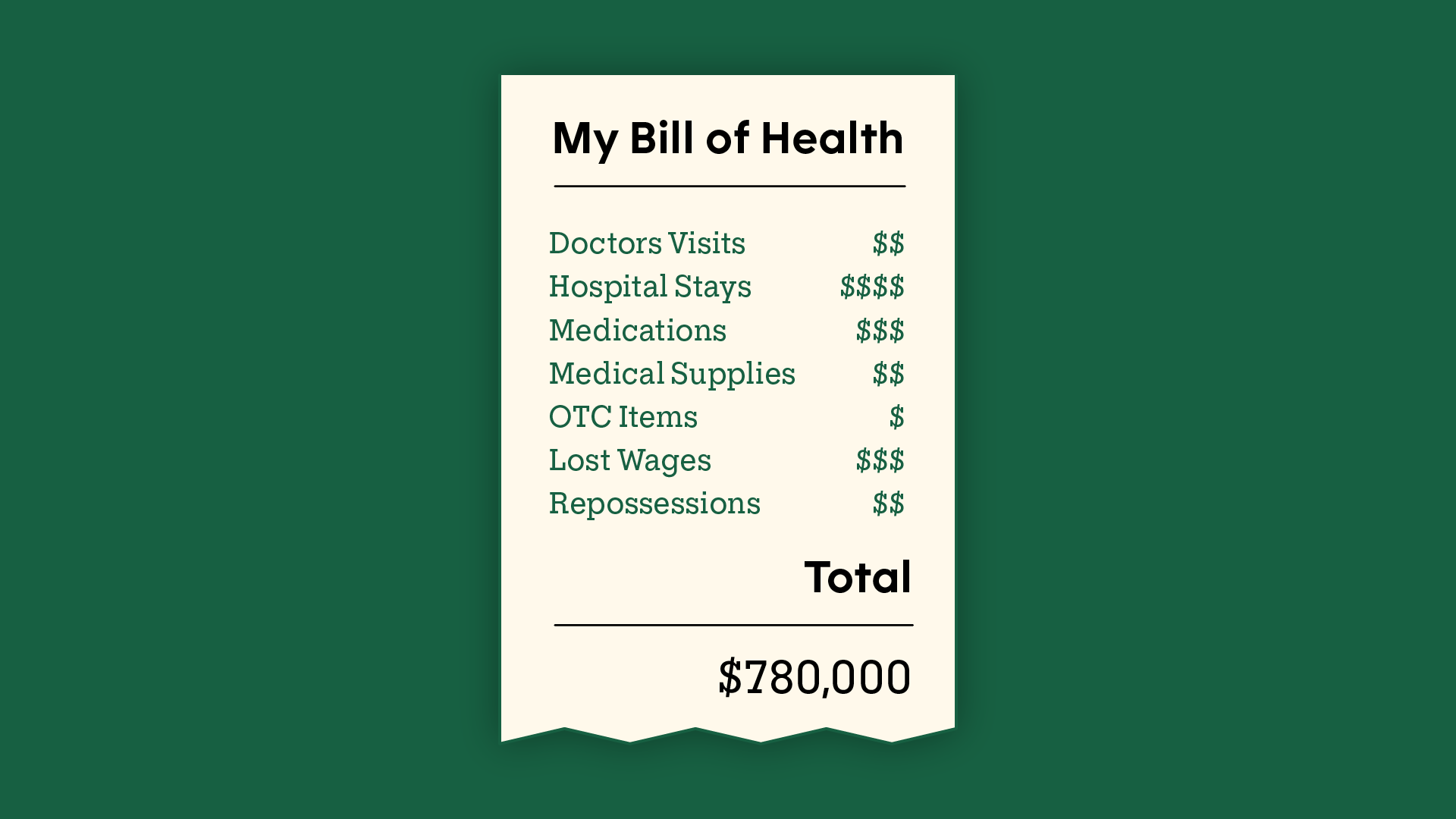

How To Lower Your Hospital Bill Plantforce21

https://images.ctfassets.net/4f3rgqwzdznj/6nkNZ8MEpJ1V3ggiilpgGO/8d442a94cf03c27dc8e8205ba8671161/GRxH_bill_of_health_GFX-01.png

How To Lower Your Hospital Bill Plantforce21

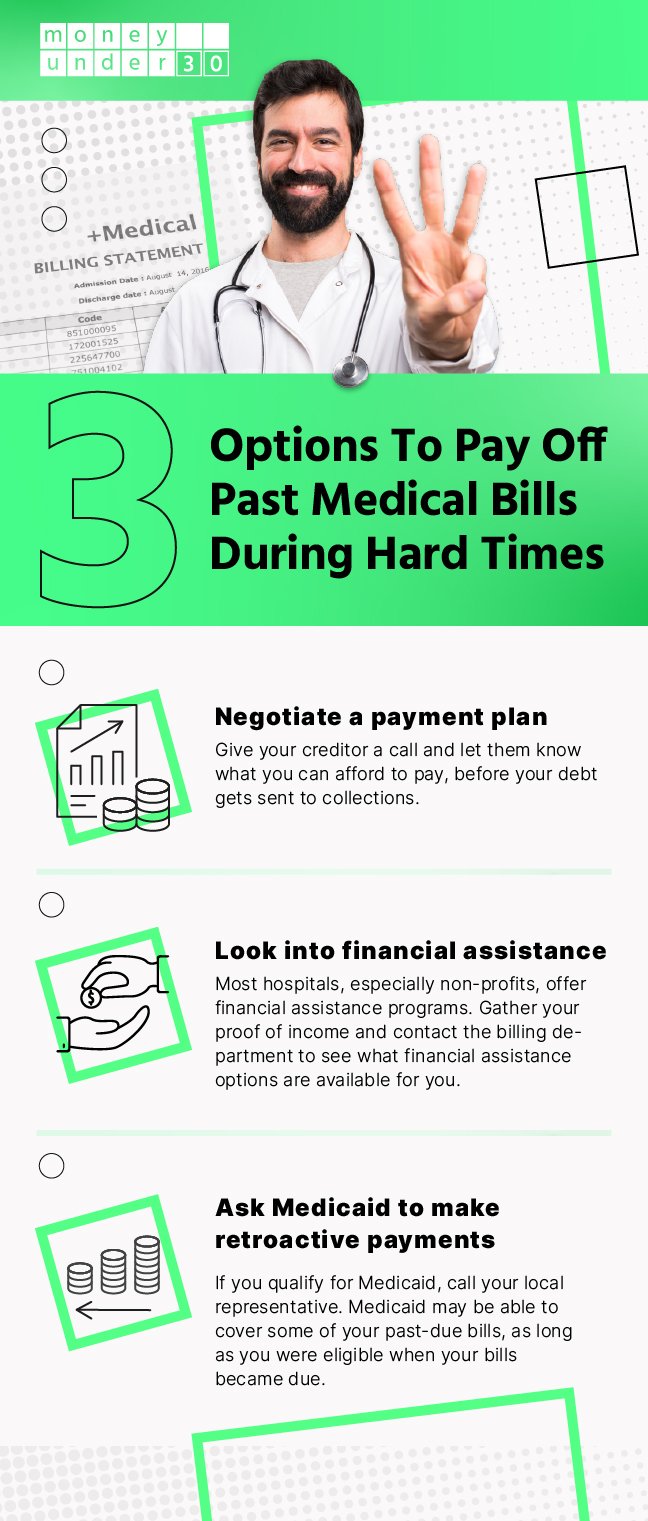

https://www.moneyunder30.com/wp-content/uploads/2018/05/MU30_Medical_Bills.jpg

How Much Medical Expense Can You Claim On Taxes 27F Chilean Way

https://www.27fchileanway.cl/wp-content/uploads/2023/05/how-much-medical-expense-can-you-claim-on-taxes.jpg

If you still owe a bill you can t deduct it until you pay it off You also can t claim medical expenses reimbursed by your insurance company or any other third party You can t deduct any expenses you have reimbursed with a tax free account such as flexible spending or health savings accounts The IRS allows you to deduct certain medical expenses from your taxes this year Here s what you need to know

[desc-10] [desc-11]

Can I Claim Medical Expenses On My Taxes TMD Accounting

http://tmdaccounting.com/wp-content/uploads/2017/08/Can-I-Claim-Medical-Expenses-on-My-Taxes-.png

How Many Kids Can You Claim On Taxes Hanfincal

https://hanfincal.com/wp-content/uploads/2022/01/how-many-kids-can-you-claim-on-taxes-hanfincal.jpg

https://www.goodrx.com › insurance › taxes › deductible...

You may be able to claim health insurance premiums on your tax return This depends on how much you spent on medical care how you paid for premiums and if you were self employed But you cannot deduct expenses that were reimbursed by an insurance plan a flexible spending account a health savings account or another tax advantaged savings

https://www.irs.gov › taxtopics

Deductible medical expenses may include but aren t limited to the following Amounts paid of fees to doctors dentists surgeons chiropractors psychiatrists psychologists and nontraditional medical practitioners

How Many Kids Can You Claim On Taxes Hanfincal

Can I Claim Medical Expenses On My Taxes TMD Accounting

What Can You Claim On Taxes In 2020 Perth Mobile Tax

Can I Write Off Medical Expenses Canada 27F Chilean Way

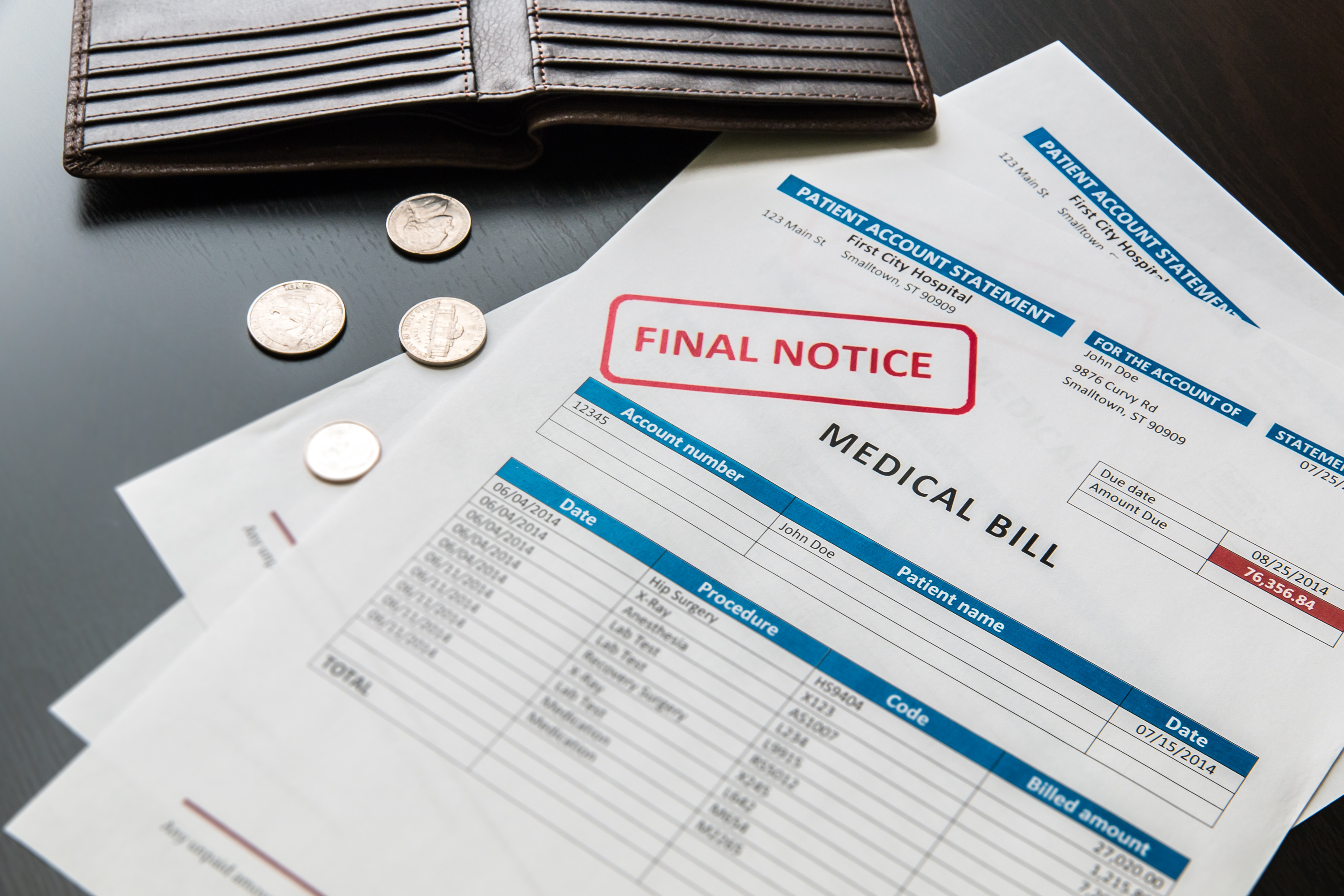

What Happens If You Don t Pay Medical Bills Self Credit Builder

Medical Bills Bankruptcy Acworth GA Law Offices Of Roger Ghai

Medical Bills Bankruptcy Acworth GA Law Offices Of Roger Ghai

Itemized Medical Bill Template

Should You Pay Medical Bills With Credit Cards Credit One Bank

Do You Have A Medical Bill We Should Investigate Share It With Us

What Medical Bills Can You Claim On Taxes - [desc-13]