What Mileage Rate Can I Claim For A Company Car 5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work journeys for them Only payments specifically for

Tax rates per business mile Your employee travels 12 000 business miles in their car the approved amount for the year would be 5 000 10 000 x 45p plus 2 000 x 25p It does With mileage rates you can get reimbursed for costs related to business trips whether they were made with a personal vehicle or a company car HMRC sets the rates to reflect the tear and wear of the

What Mileage Rate Can I Claim For A Company Car

What Mileage Rate Can I Claim For A Company Car

https://assets.website-files.com/6074c63496470bc95664f07c/639cb30af9a451ddf8ab07bf_new irs rate 2023 cardata mileage-p-1080.png

New IRS Standard Mileage Rates In 2022 MileageWise 2023

https://www.mileagewise.com/wp-content/uploads/2021/12/.irs-standard-mileage-rate-2022.jpeg

IRS Issues Standard Mileage Rates For 2023 Business Use Increases 3

https://www.clevelandgroup.net/wp-content/uploads/2023/01/mileage-rate.jpg

Take our example If you travel 17 000 business miles in your car the mileage deduction for the year would be 6 250 10 000 miles x 45p 7 000 miles x 25p It s worth AMAP rates are nice and simple compared to AFR and AER An employee can claim 45p per mile for business mileage up to the first 10 000 miles in their own car For business mileage above 10 000

When you use your personal vehicle for business purposes many employers will reimburse you per mile with Mileage Allowance Payments MAP HMRC provides If you are paid a car allowance your employer may provide a lower mileage rate or none at all If so you can claim Mileage Allowance Relief MAR from HMRC at

Download What Mileage Rate Can I Claim For A Company Car

More picture related to What Mileage Rate Can I Claim For A Company Car

Federal Mileage Reimbursement IRS Mileage Rate 2021

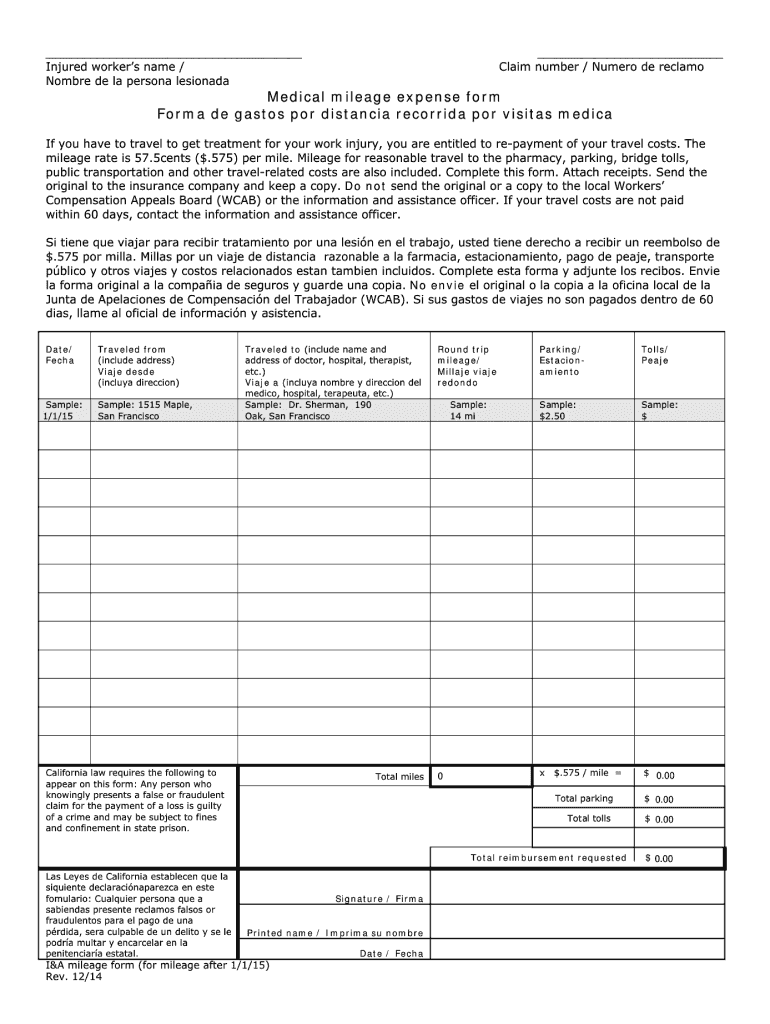

https://irs-mileage-rate.com/wp-content/uploads/2021/08/free-9-sample-mileage-reimbursement-forms-in-pdf-word.jpg

Mileage Claim Rate Everything You Need To Know Moss

https://www.getmoss.com/guide/wp-content/uploads/2022/10/What-Is-a-Mileage-Claim-Rate-768x364.png

What Mileage Does A Car s Value Depreciate Direct Car Buying

https://lirp.cdn-website.com/8864221d/dms3rep/multi/opt/Will+a+Car-s+Mileage+Depreciate+its+Value+-+Easterns+Automotive-1920w.jpeg

You can claim Mileage Allowance Relief MAR at tax time from HMRC if your employer doesn t reimburse you for your business related vehicle expenses or if The current mileage rates are used for both mileage relief for employees and mileage deductions for self employed The rates for 2023 are as follows Cars and vans 45p for the first 10 000 miles 25p for every

What are the mileage rates for company cars and vans An employee driving a company owned vehicle on their own fuel is reimbursed by their employer using advisory fuel rates AFRs Discover if you could claim tax back for company car mileage Here we outline the millage rates and much more to help you determine what you re owed

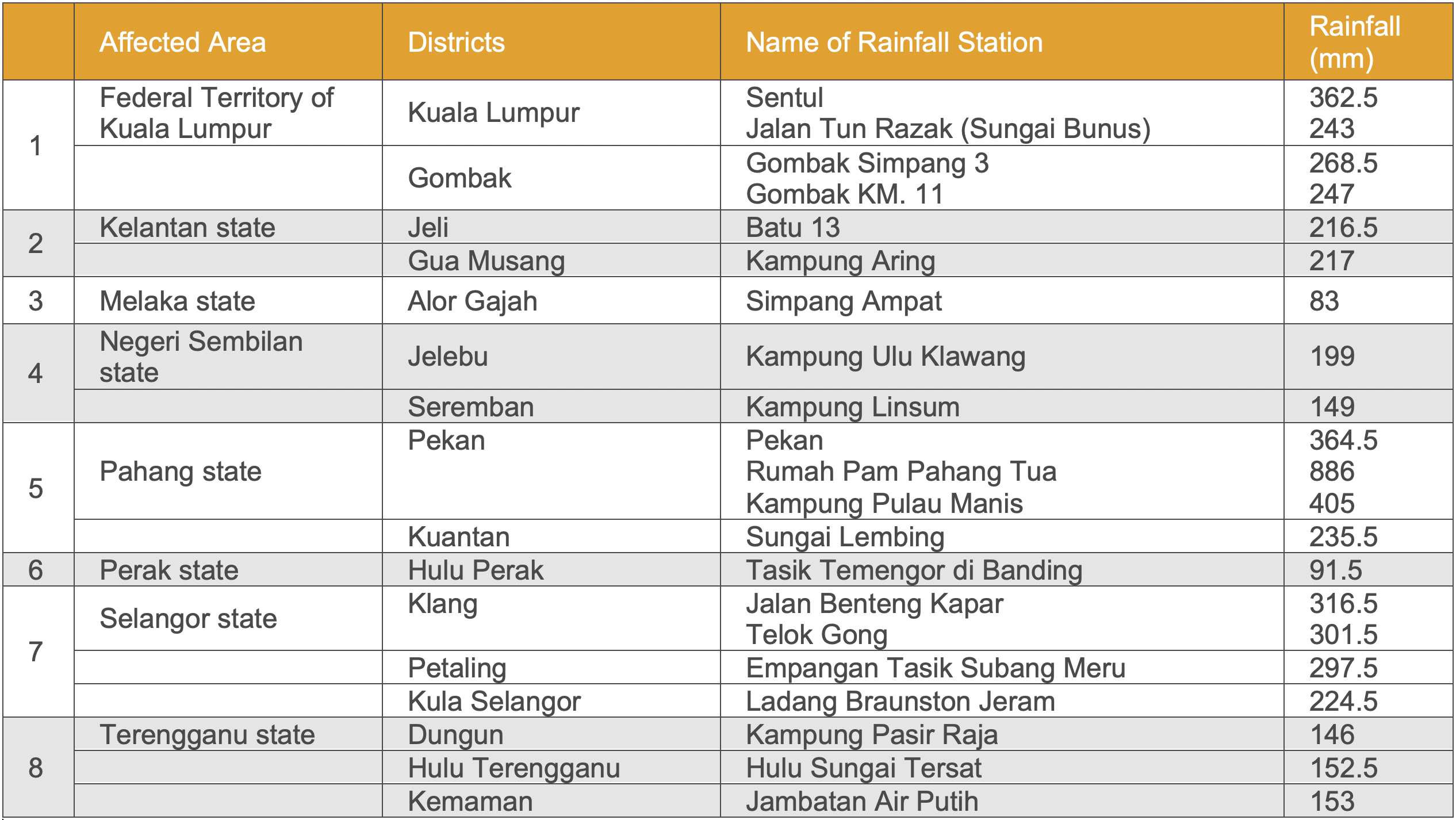

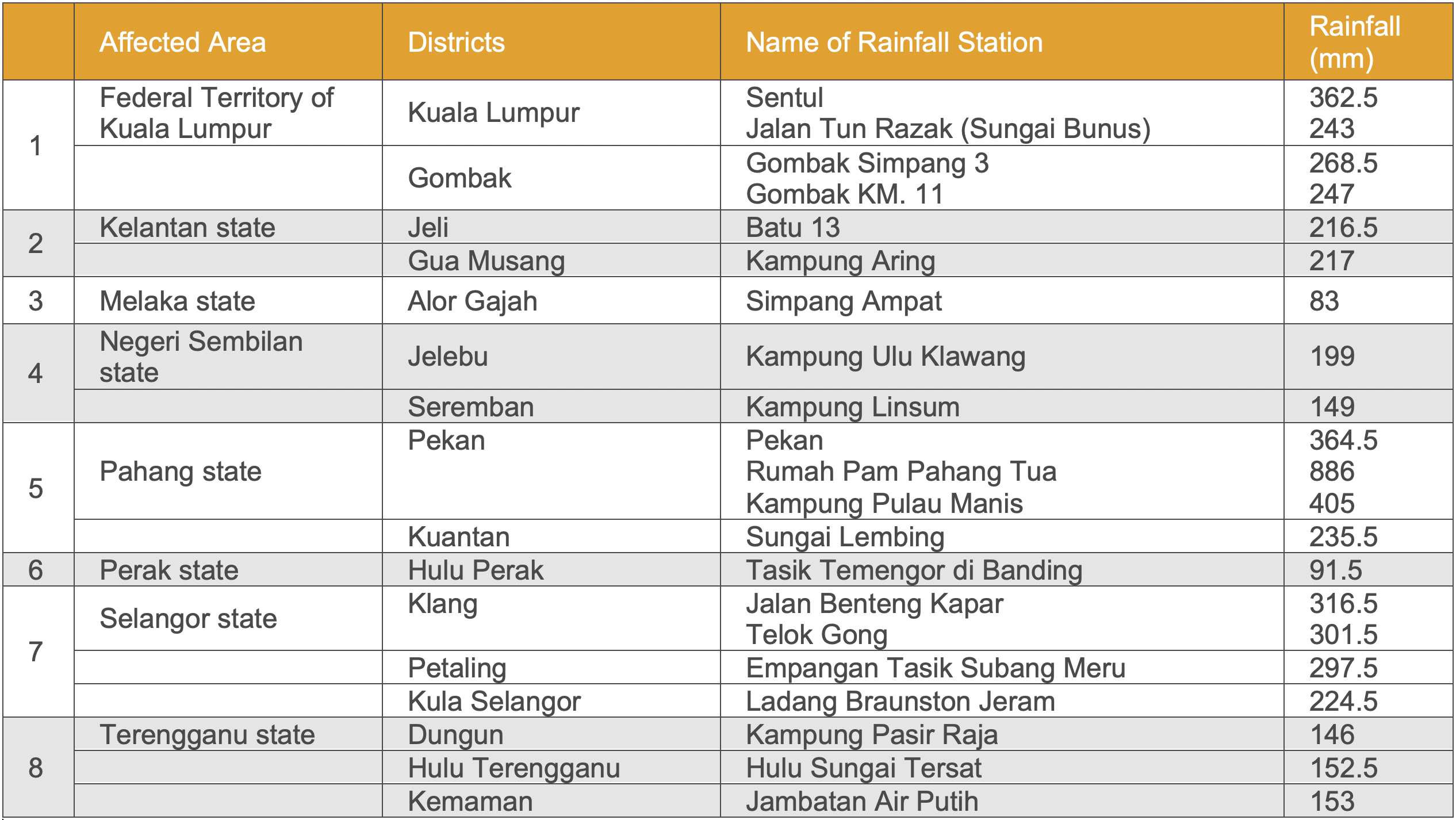

Mileage Claim Rate 2017 Malaysia MaliktaroOsborne

https://www.jbarisk.com/media/2186/table-1.png

Federal Mileage Rate 2023 Know More About IRS

https://sdgln.com/wp-content/uploads/2023/01/Federal-Mileage-Rate-2023-Know-More-About-IRS.jpg

https://www.gov.uk/government/publications/rates...

5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work journeys for them Only payments specifically for

https://www.gov.uk/expenses-and-benefits-business...

Tax rates per business mile Your employee travels 12 000 business miles in their car the approved amount for the year would be 5 000 10 000 x 45p plus 2 000 x 25p It does

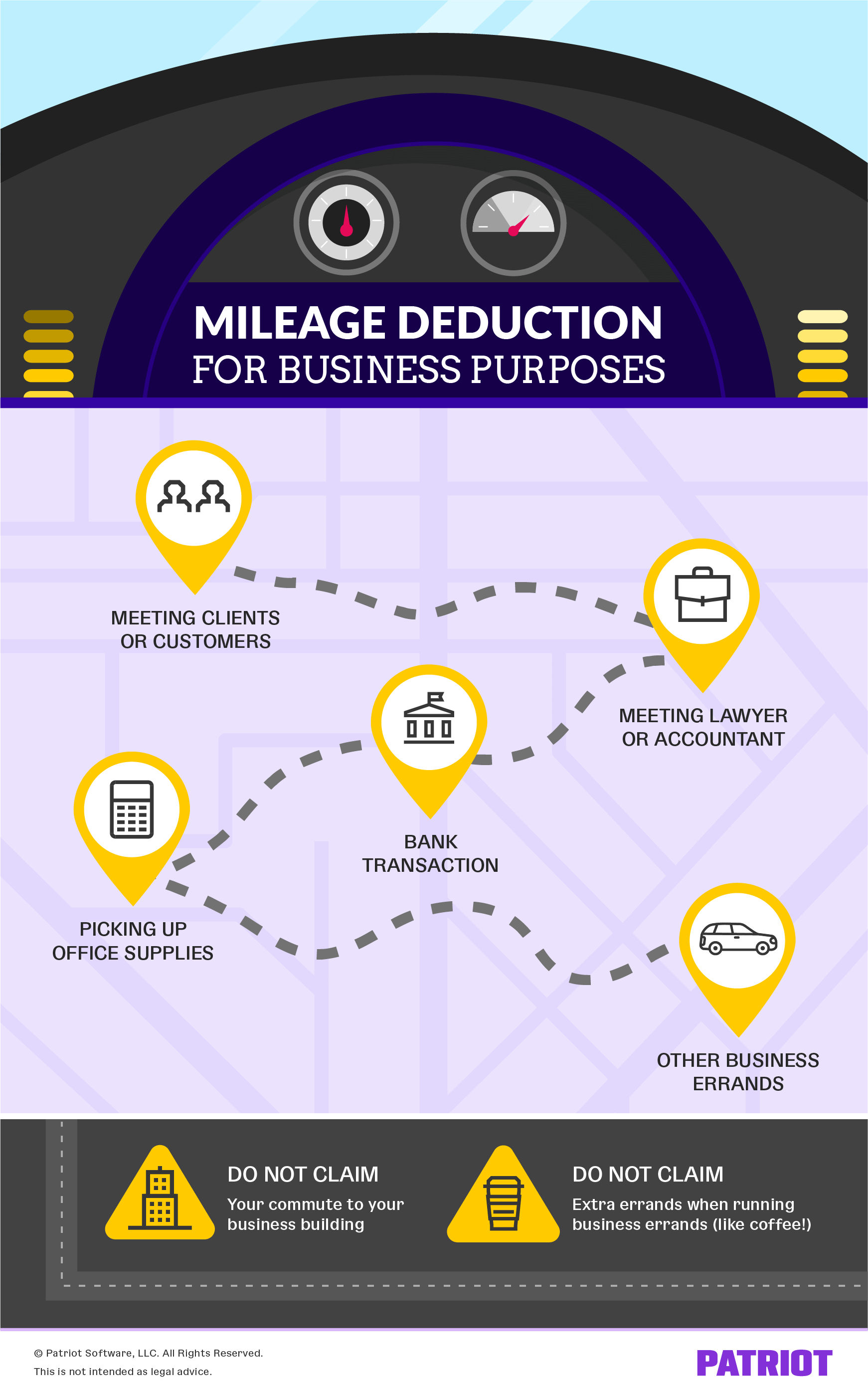

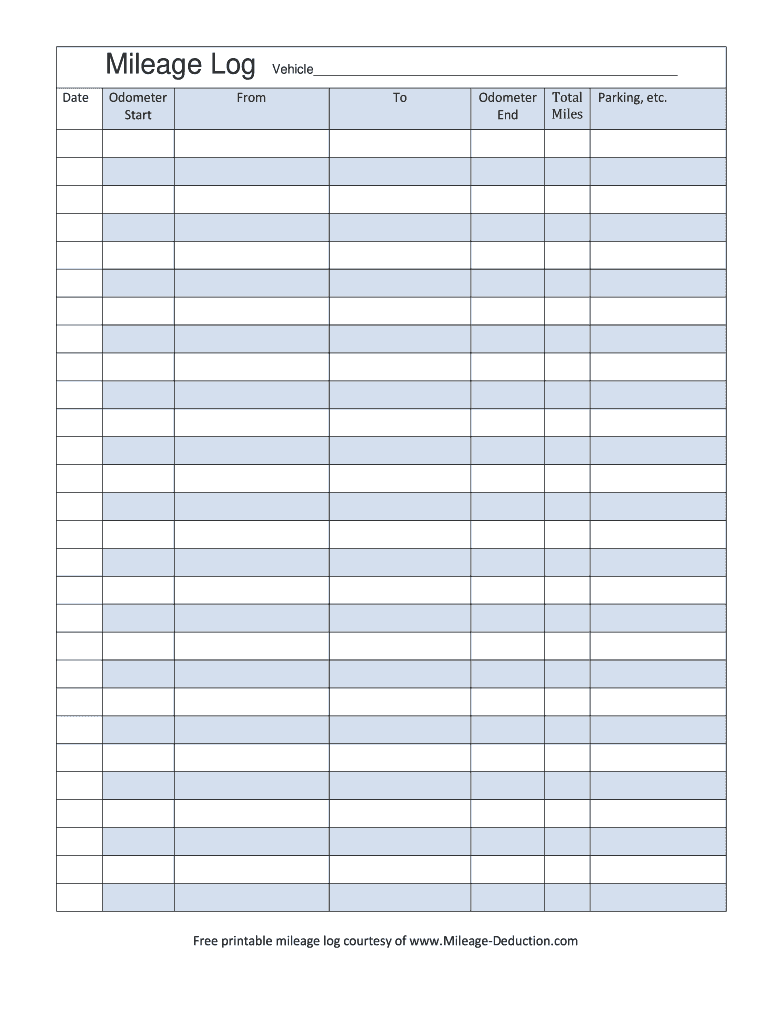

Business Mileage Deduction 101 How To Calculate For Taxes

Mileage Claim Rate 2017 Malaysia MaliktaroOsborne

Ny Form Ud 1 Fillable Pdf Printable Forms Free Online

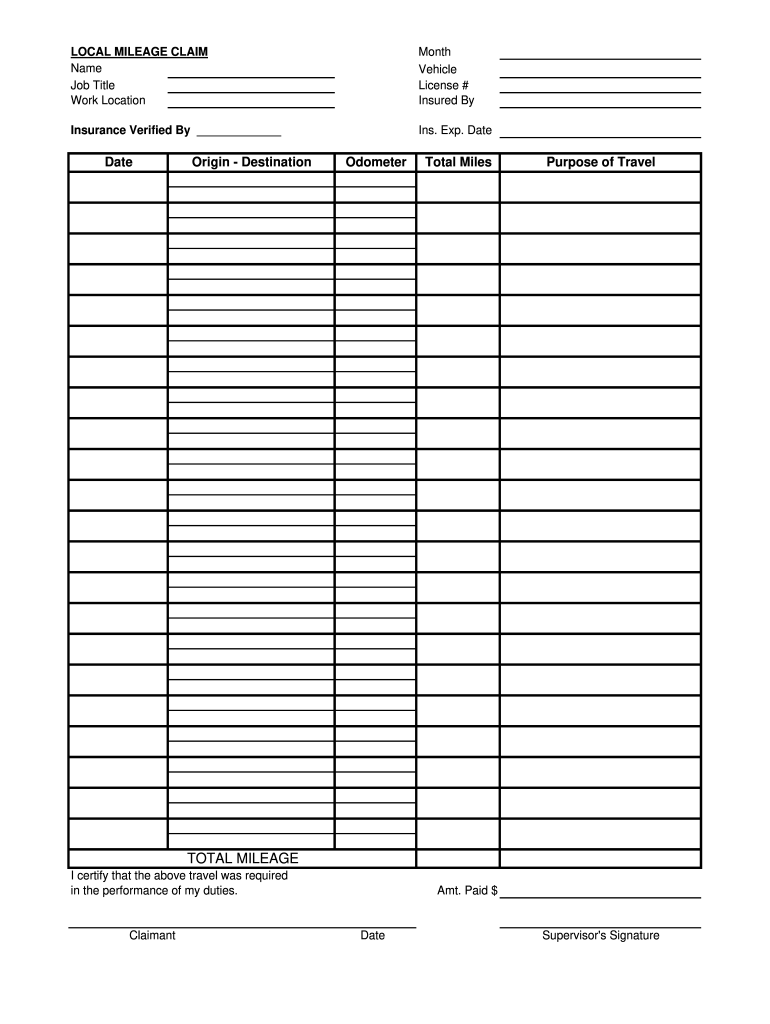

Mileage Form 2021 IRS Mileage Rate 2021

Free PDF Mileage Logs Printable IRS Mileage Rate 2021

Mileage Claim Rate Everything You Need To Know Moss

Mileage Claim Rate Everything You Need To Know Moss

Example Of 25 Printable Irs Mileage Tracking Templates Gofar Mileage

IRS Now Has A Higher Standard Mileage Rate Because Of Rising Gas Prices

Fuel Mileage Trip Calculator KuwatBobaker

What Mileage Rate Can I Claim For A Company Car - The attached document is classified by HMRC as guidance and contains information about rates and allowances for travel including mileage and fuel