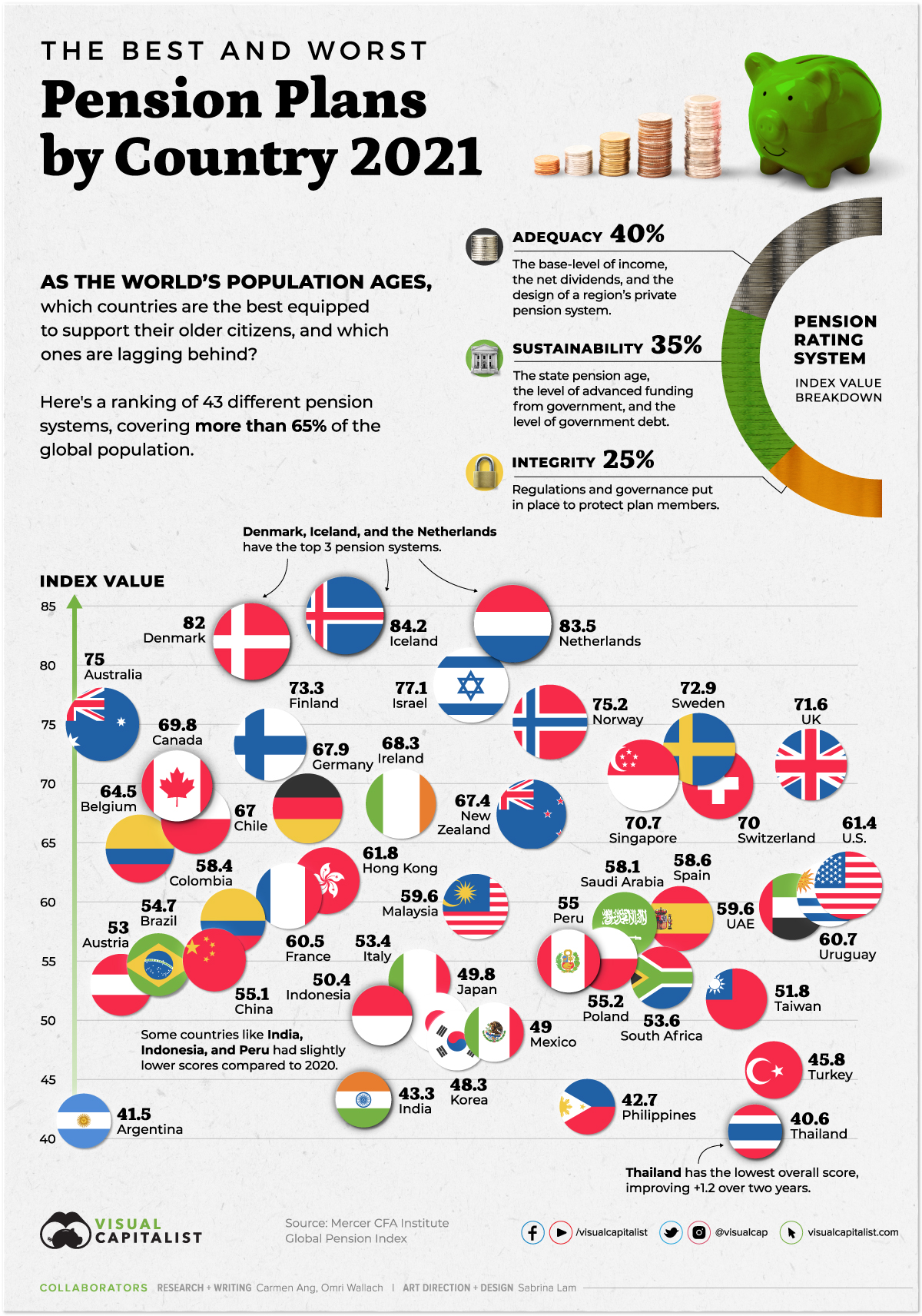

What Pensions Are Not Taxable In Nys Most NYSLRS pensions are subject to federal income tax some disability benefits are not taxable NYSLRS pensions are not subject to New York State or local income tax but if you move to another state that state may tax your pension

NYS pension exempt as a defined benefit plan No income tax Tax info 907 269 6620 or Less than 50 000 single and 60 000 married you can subtract Social Security Some pension distributions from certain sources are nontaxable in the state of New York while others are taxable If your pension distributions are taxable you could still qualify to exclude up to 20 000 per year depending on your age and your situation

What Pensions Are Not Taxable In Nys

What Pensions Are Not Taxable In Nys

https://www.truepotential.co.uk/wp-content/uploads/2022/04/What_type_of_pension_is_available.jpg

Living Stingy The Pension Crisis

http://macfinancial.uk.com/wp-content/uploads/2016/02/pension1.jpg

What Counts As Taxable And Non Taxable Income For 2023 The Official

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Taxable-vs-Nontaxable-Income-min-2-818x1536.jpg

If your pension IS taxable in NY but were 59 before January 1 2023 you may qualify for a pension annuity exclusion of up to 20 000 If you became 59 during 2023 you can only exclude up to 20 000 of the pension income you received after turning 59 In New York all Social Security retirement benefits are exempt from taxation Income from retirement accounts or a private pension is deductible up to 20 000 Sales and property taxes are both relatively high in New York

Note You might qualify for New York s 20 000 pension and annuity exclusion even if your retirement income is classified as taxable above You can view Publication 36 for more information Not Taxed by New York State Your NYSLRS pension is not subject to New York State or local income taxes Visit our Taxes and Your Pension page for more information If you move to another state your pension may be

Download What Pensions Are Not Taxable In Nys

More picture related to What Pensions Are Not Taxable In Nys

401k

https://www.visualcapitalist.com/wp-content/uploads/2021/11/The-Best-and-Worst-Pensions-Plans-Around-the-World-2021_Nov23_main.jpg

Leaflet Your TFL Pension Is Fully Funded Solvent And Healthy RMT

https://www.rmtlondoncalling.org.uk/files/screenshot_2021-12-28_122510.png

Local Government Pensions The 95k Cap On Exit Payments

https://i0.wp.com/www.unisonmanchester.org/wp-content/uploads/2020/09/pensions.jpg?fit=1200%2C796

As a NYSLRS retiree your pension will not be subject to New York State or local income tax New York doesn t tax Social Security benefits either You may also get a tax break on any distributions from retirement savings such as deferred compensation and benefits from a private sector pension If you re wondering What pensions are not taxable Here s the answer You don t pay tax on the portion of the pension payments that represent a return of the after tax amount you contributed

Your state might have a pension exclusion but chances are it s limited based on your age and or income However some states don t tax pension income no matter your age or how much money New York excludes 20 000 of annuity or retirement benefits for those 59 or older as well as government pension income from the U S New York State or New York localities Shopping Groceries

IRS Tax Charts 2021 Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/07/2021-tax-chart-cmh-3.jpg

Are Pensions Taxable The Motley Fool UK

https://www.fool.co.uk/wp-content/uploads/2022/06/are-pensions-taxable-768x384.png

https://www.osc.ny.gov › ... › taxes-and-your-pension

Most NYSLRS pensions are subject to federal income tax some disability benefits are not taxable NYSLRS pensions are not subject to New York State or local income tax but if you move to another state that state may tax your pension

https://rpea.org › ... › pension-tax-by-state

NYS pension exempt as a defined benefit plan No income tax Tax info 907 269 6620 or Less than 50 000 single and 60 000 married you can subtract Social Security

Chancellor Raises Income Level At Which GP Tax free Pensions Are

IRS Tax Charts 2021 Federal Withholding Tables 2021

Pensions Millbank Financial Solutions

What Pensions Are Not Taxable Honestly Answered In 2023 Personal

Corporate Pensions Will Soon Be A Thing Of The Past Reactionary Times

What Is Taxable Income Explanation Importance Calculation Bizness

What Is Taxable Income Explanation Importance Calculation Bizness

State Pension Funding State Pension Plan Finances Tax Foundation

Britain Ranks Bottom On State Pensions Among Advanced Nations

Changes In NHS Pension Contributions Are You A Winner Or Loser

What Pensions Are Not Taxable In Nys - Not Taxed by New York State Your NYSLRS pension is not subject to New York State or local income taxes Visit our Taxes and Your Pension page for more information If you move to another state your pension may be