What Qualifies For A Reduction In Council Tax Your bill could be reduced by up to 100 You can apply if you own your home rent are unemployed or working What you get depends on where you live each council runs its own scheme your

The council tax bill for the property might be reduced You must be able to show that a disabled person lives in the property to claim a reduction The property must also have either an extra kitchen or bathroom to meet the needs of a disabled person What qualifies for council tax reduction There s a range of circumstances that qualify for a council tax reduction yet thousands of people are believed to be missing out on these valuable savings You might qualify for a small reduction or you could find you re completely exempt

What Qualifies For A Reduction In Council Tax

What Qualifies For A Reduction In Council Tax

https://www.homestratosphere.com/wp-content/uploads/2022/02/mansion-feb182022-02-960x640.jpg

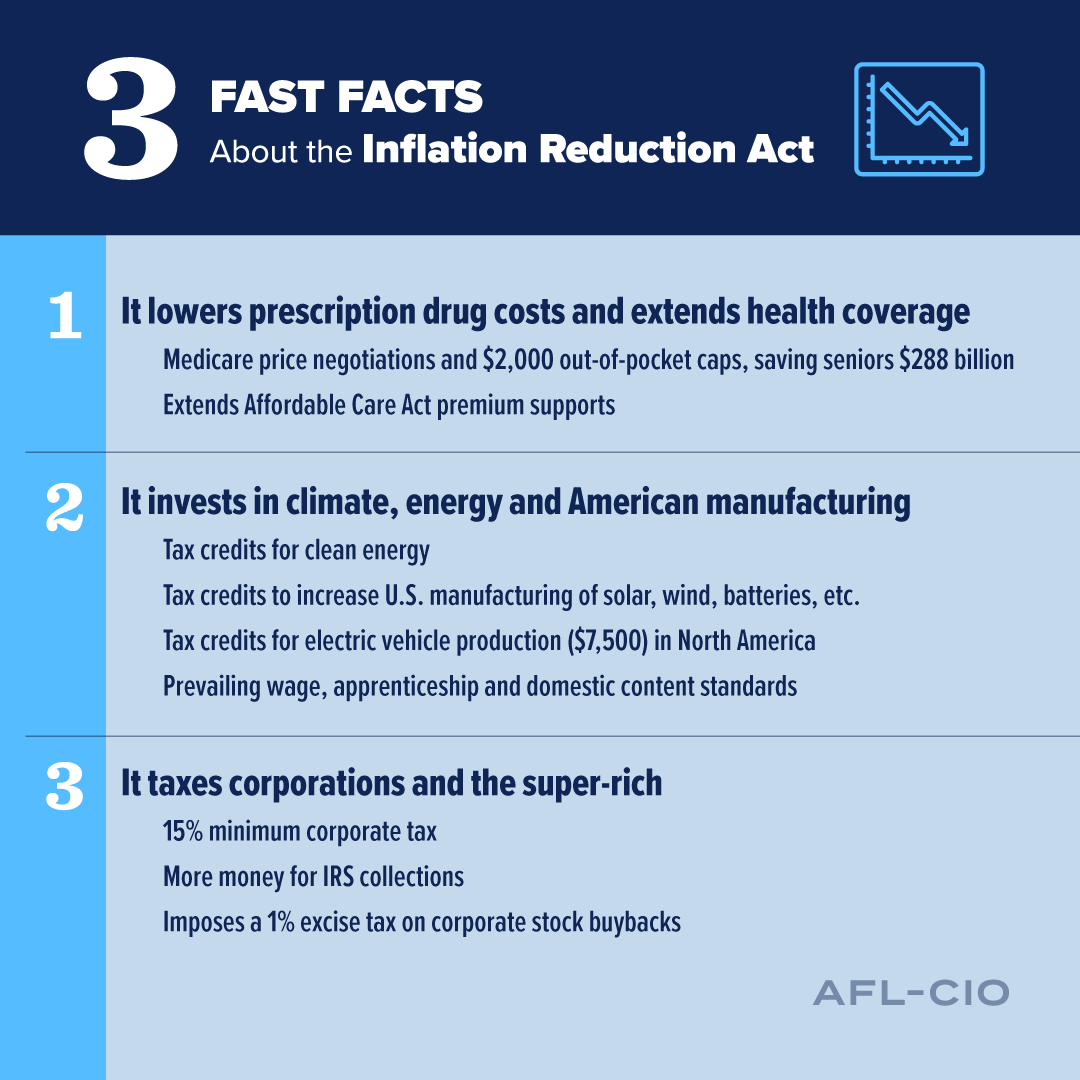

Understanding The Inflation Reduction Act The Council Of State

https://www.csg.org/wp-content/uploads/sites/7/2022/08/MicrosoftTeams-image-7-1024x1007.jpg

The Inflation Reduction Act Is A Victory For Working People AFL CIO

https://aflcio.org/sites/default/files/2022-08/inflation.png

You ll have to apply to your local council to get Council Tax Reduction CTR or Second Adult Rebate Before you apply you need to check if you re eligible for CTR or the Second Adult Rebate There are 2 sets of CTR rules You should check which rules apply it affects things like how much CTR you can get and when you can make the application If you re on a low income or claim benefits such as universal credit your household may qualify for a council tax reduction which can be as much as 100 It doesn t matter if you own your own home or rent or whether you re employed or not Yet what you get depends on Where you live

Council tax reduction for low income earners If you re on a low income you may be eligible for a council tax reduction of up to 100 Each local authority has different criteria for who is eligible to claim a council tax reduction People living alone are entitled to a 25 per cent reduction to their bill known as the single person discount This also applies if you are the only eligible person in a household living with

Download What Qualifies For A Reduction In Council Tax

More picture related to What Qualifies For A Reduction In Council Tax

What Qualifies For Council Tax Reduction Eligible Circumstances Explained

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA13keDT.img?h=630&w=1200&m=6&q=60&o=t&l=f&f=jpg&x=521&y=233

Help For Those Struggling To Pay Council Tax The Knowledge

http://www.knowlewest.co.uk/blog/wp-content/uploads/2020/04/Council-Tax-800x445.jpg

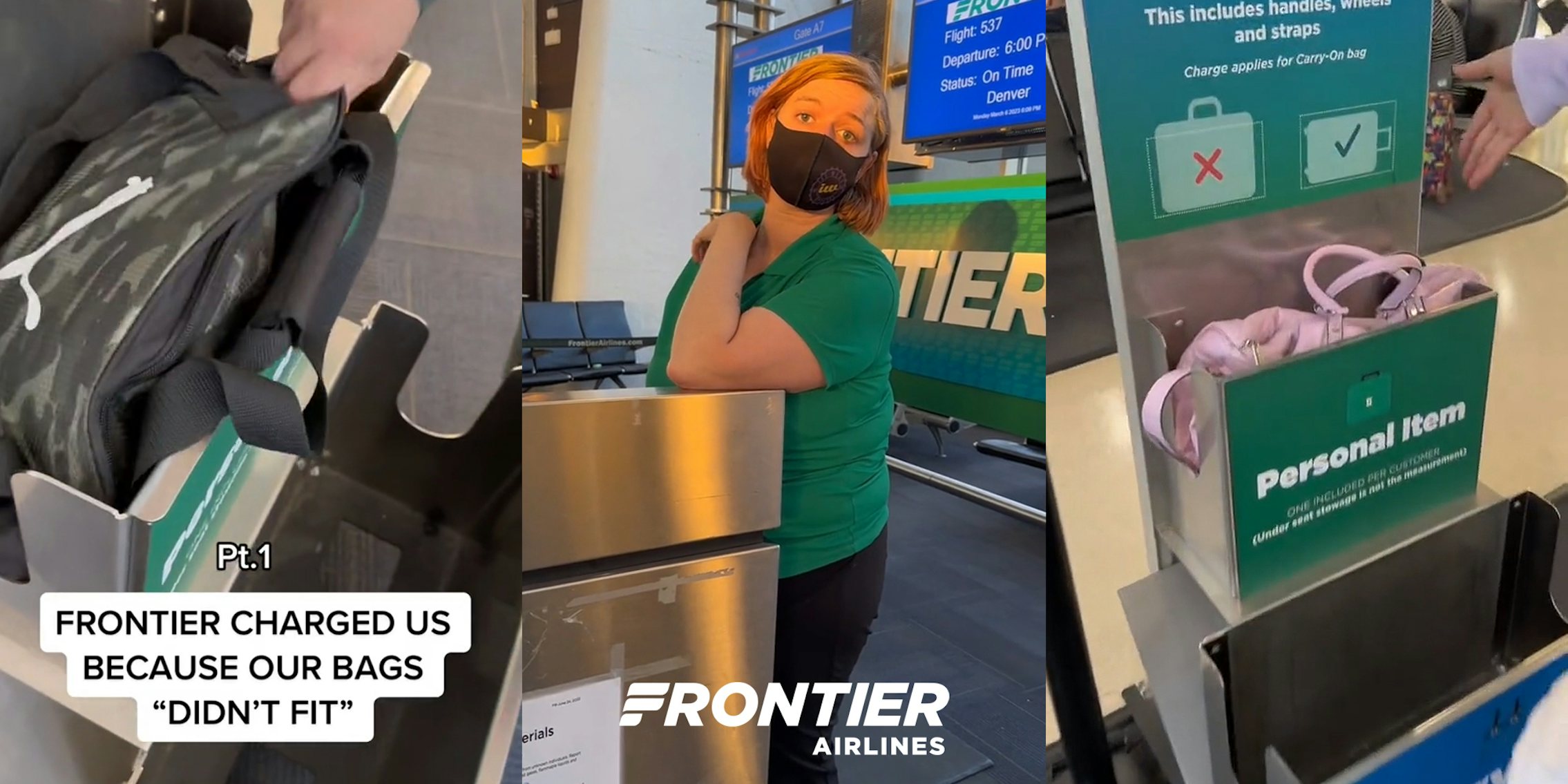

Video Shows Frontier Airlines Making Customers Pay For Free Bags

https://uploads.dailydot.com/2023/03/frontier-charged-them-for-bags-that-fit-tiktoks.jpg?q=65&auto=format&w=2270&ar=2:1&fit=crop

If you are a single person household you are eligible to a 25 reduction on your yearly council tax bill which can make a huge difference to your yearly living costs You can apply for Council Tax Reduction CTR if you re liable for the Council Tax bill and you get guarantee credit part of Pension Credit either on its own or with the savings credit You can apply for full CTR even if your weekly entitlement to the guarantee credit is too small to be payable

A Council Tax bill is normally based on 2 adults living in a property however in some circumstances you could have your bill reduced You may be eligible to receive a reduction or discount for more than one reason You may be entitled to pay less Council Tax if you live in a low income household you live alone SMI living with one qualifying adult home gets single person reduction so 25 discount SMI living with two or more qualifying adults home pays full council tax so no discount

Council Tax Reduction For People With Dementia Birmingham Carers Hub

https://birminghamcarershub.org.uk/wp-content/uploads/2022/08/Council-tax-reduction.png

Tax Credit Survey

https://wotcgs.ey.com/Images/Banners/880de225-75a6-4cab-84f1-8d7e59a6435a.gif

https://www.gov.uk/apply-council-tax-reduction

Your bill could be reduced by up to 100 You can apply if you own your home rent are unemployed or working What you get depends on where you live each council runs its own scheme your

https://www.citizensadvice.org.uk/housing/council...

The council tax bill for the property might be reduced You must be able to show that a disabled person lives in the property to claim a reduction The property must also have either an extra kitchen or bathroom to meet the needs of a disabled person

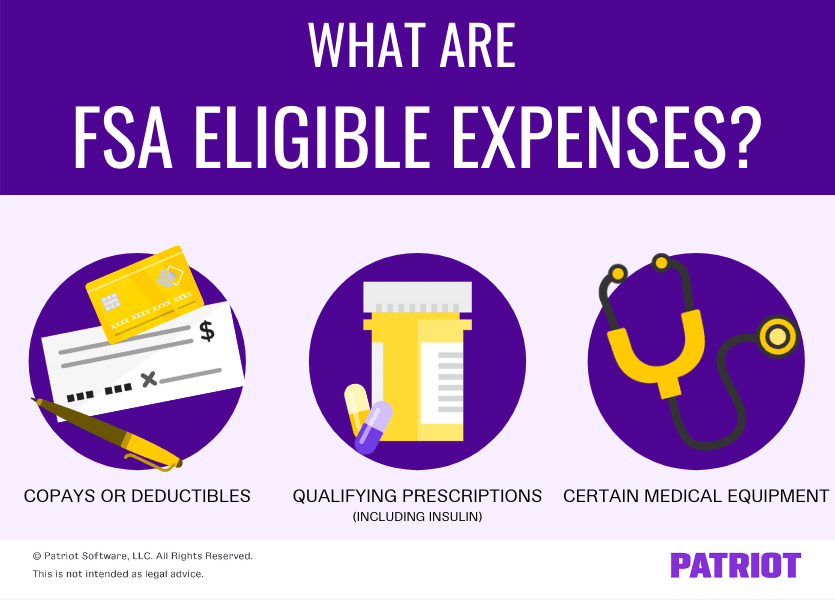

What Is An FSA Definition Eligible Expenses More Finansdirekt24 se

Council Tax Reduction For People With Dementia Birmingham Carers Hub

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

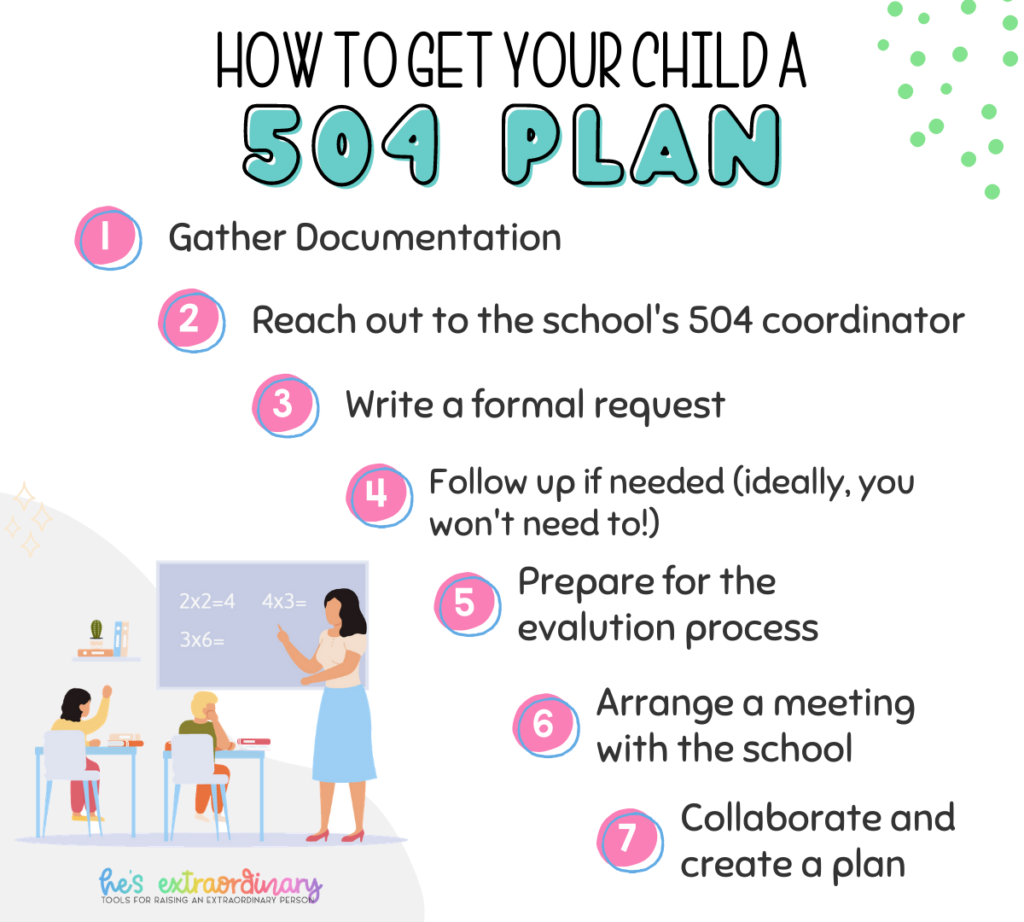

Sample 504 Plan Template

Council Tax Reduction Who Qualifies For Council Tax Reduction

Economic Growth Of 6 Percent Possible Despite Budget Impasse RCBC

Economic Growth Of 6 Percent Possible Despite Budget Impasse RCBC

Council Tax Reduction Who Qualifies For Council Tax Reduction

Congress Needs To Come Up With A Way To Pay For tax Extenders Bill

Skin Removal Surgery After Weight Loss Covered By Insurance Noclutter

What Qualifies For A Reduction In Council Tax - You ll have to apply to your local council to get Council Tax Reduction CTR or Second Adult Rebate Before you apply you need to check if you re eligible for CTR or the Second Adult Rebate There are 2 sets of CTR rules You should check which rules apply it affects things like how much CTR you can get and when you can make the application