What Qualifies For Federal Energy Tax Credit If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Related Resources How It Works The Residential Clean Energy Credit equals

What Qualifies For Federal Energy Tax Credit

What Qualifies For Federal Energy Tax Credit

https://s3media.angieslist.com/s3fs-public/HOUSE-~1.jpeg

Home Energy Improvements Lead To Real Savings Infographic Solar

https://i.pinimg.com/originals/d9/ad/96/d9ad96393cb13907229e3e2b1609bcc1.jpg

Are You Eligible For R D Tax Credit Find Out Using This Infographic

https://www.thinkastute.com/wp-content/uploads/2020/02/RD-Credits-Infographic-969x2048.jpg

In addition to the 1 200 credit limit above a separate aggregate yearly credit limit of 2 000 applies to electric or natural gas heat pump water heaters electric If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy

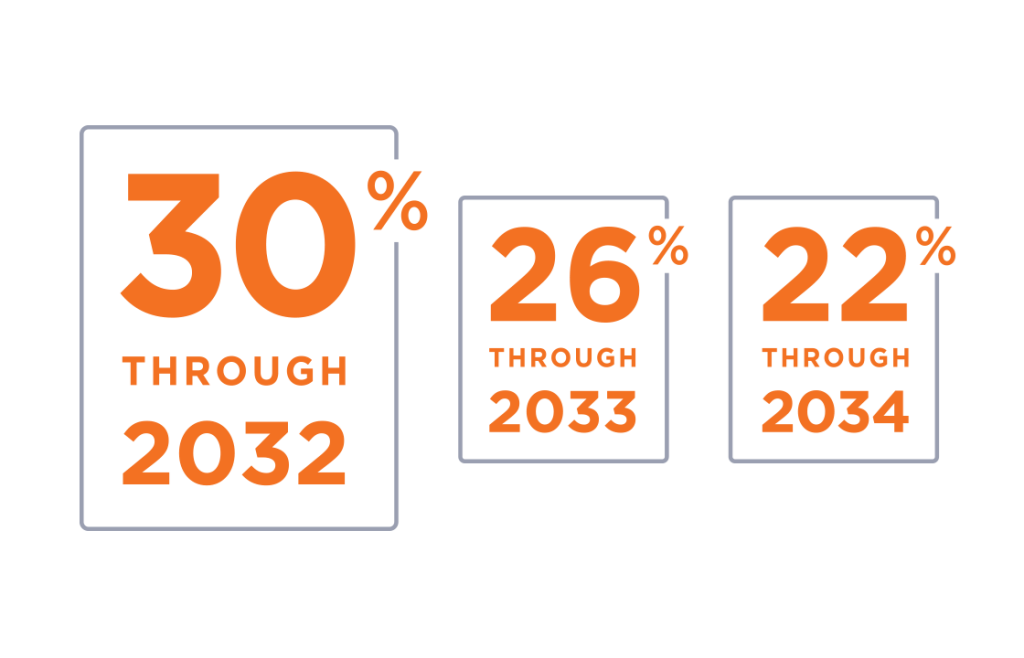

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products

Download What Qualifies For Federal Energy Tax Credit

More picture related to What Qualifies For Federal Energy Tax Credit

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits

https://www.greenmountainenergy.com/Images/GME-Blog-SolarIncentives-Infographic-2x_tcm465-57648.png

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Is There An Energy Tax Credit For 2023 Facts You Didn T Know

https://stimulusmag.com/wp-content/uploads/2022/12/will-there-be-an-energy-tax-credit-for-2023-1.png

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other eficient appliances and products Q Information updated 12 30 2022 The Non Business Energy Property Tax Credits outlined below apply retroactively through 12 31 2022 Tax Credit 10 of cost up to 500 or a

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other Claiming energy tax credits for 2022 and 2023 4 min read Share Making energy efficient updates to your home is a great move for our environment But you might feel the pinch in your household budget The good news

Tax Credit ClimaCool

https://climacoolcorp.com/images/18.14995922187eadd2c85269/1683913191583/TaxGuide-MockUp_BLUE.png

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

https://www. irs.gov /credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

https://www. investopedia.com /terms/e/energy-tax-credit.asp

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either

25C Tax Credit Fact Sheet Building Performance Association

Tax Credit ClimaCool

Make Sure You Get These Federal Energy Tax Credits Consumer Reports

U S Companies Score Partial Reprieve From Global Minimum Tax Deal WSJ

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Federal Energy Property Tax Credits Reinstated HB McClure

2023 Residential Clean Energy Credit Guide ReVision Energy

Geothermal Tax Credits Incentives A B Mechanical

What Qualifies For Federal Energy Tax Credit - Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products