What Qualifies For Solar Tax Credit The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar

What Qualifies For Solar Tax Credit

What Qualifies For Solar Tax Credit

https://static.wixstatic.com/media/d685f4_764b64c81c544a9e97e4b2db56045551~mv2.jpg/v1/fill/w_980,h_980,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/d685f4_764b64c81c544a9e97e4b2db56045551~mv2.jpg

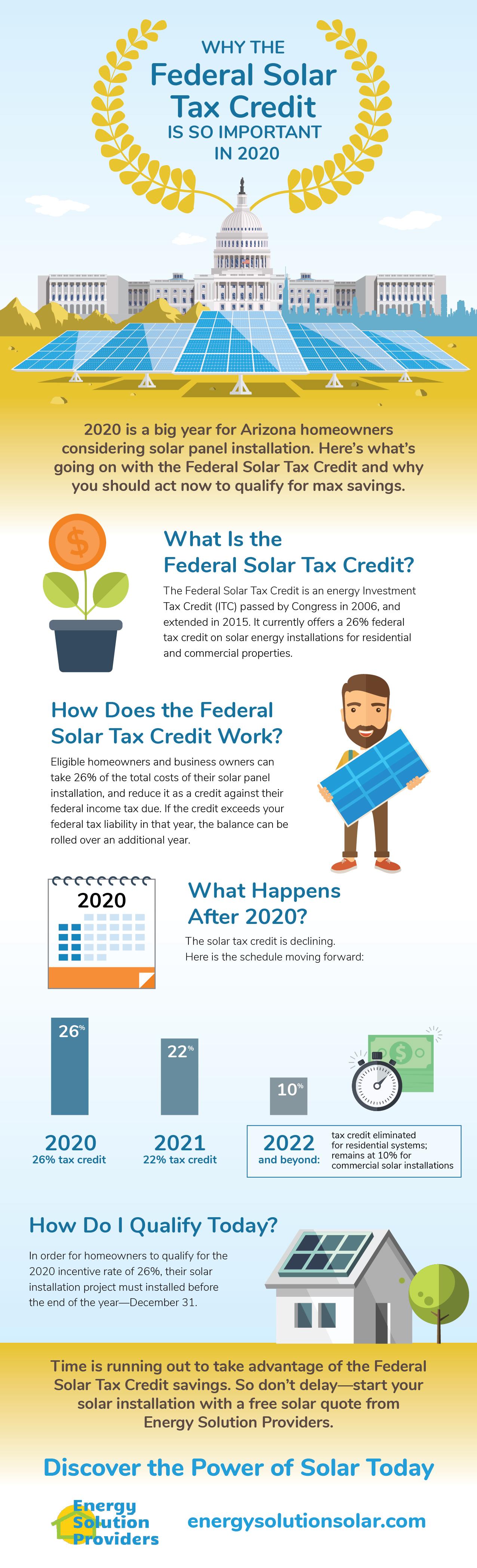

The Federal Solar Tax Credit Energy Solution Providers Arizona

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2020-03_1.jpg?itok=EB_bqkCL

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and

What Do I Need to File for the Federal Solar Tax Credit The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was

Download What Qualifies For Solar Tax Credit

More picture related to What Qualifies For Solar Tax Credit

26 Federal Solar Tax Credit Extended SolarTech

https://solartechonline.com/wp-content/uploads/011022-Fed-Solar-Tax-Credit.jpg

Commercial Solar Tax Credit Guide 2023

https://propertymanagerinsider.com/wp-content/uploads/2022/12/Commercial-Solar-Tax-Credit-Guide-2023.png

26 Solar Tax Credit Extended Oregon Incentives Green Ridge Solar

https://greenridgesolar.com/wp-content/uploads/2021/01/Solar-Tax-Credit-ITC-Step-Down-2.jpg

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your The Inflation Reduction Act renamed and extended the existing solar tax credit through 2034 for solar system installations on residential property It also increased the

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of The solar tax credit is currently equal to 30 of the eligible costs associated with your residential solar project Exactly how much you save ultimately depends on the cost of your project

The Solar Investment Tax Credit Extension

https://www.powerflex.com/wp-content/uploads/AdobeStock_47747648.jpeg

Solar Tax Benefits Guide Learn With Valur

https://learn.valur.io/wp-content/uploads/2023/02/Untitled.png

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year

https://www.irs.gov/credits-deductions/residential...

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy

How Does The Solar Tax Credit Work Advanced Solar

The Solar Investment Tax Credit Extension

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Federal Solar Tax Credit 2023 How Does It Work ADT Solar

How Does The Solar Tax Credit Work Solar Pricing NJ Solar Power

Solar Tax Credit Guide And Calculator

Solar Tax Credit Guide And Calculator

The Federal Solar Tax Credit What You Need To Know 2022

Federal Solar Tax Credit Guide Atlantic Key Energy

Solar Tax Credit

What Qualifies For Solar Tax Credit - Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was