What Relocation Costs Are Tax Deductible Some relocation costs up to 8 000 are exempt from reporting and paying tax and National Insurance These are called qualifying costs and include the costs of buying or selling

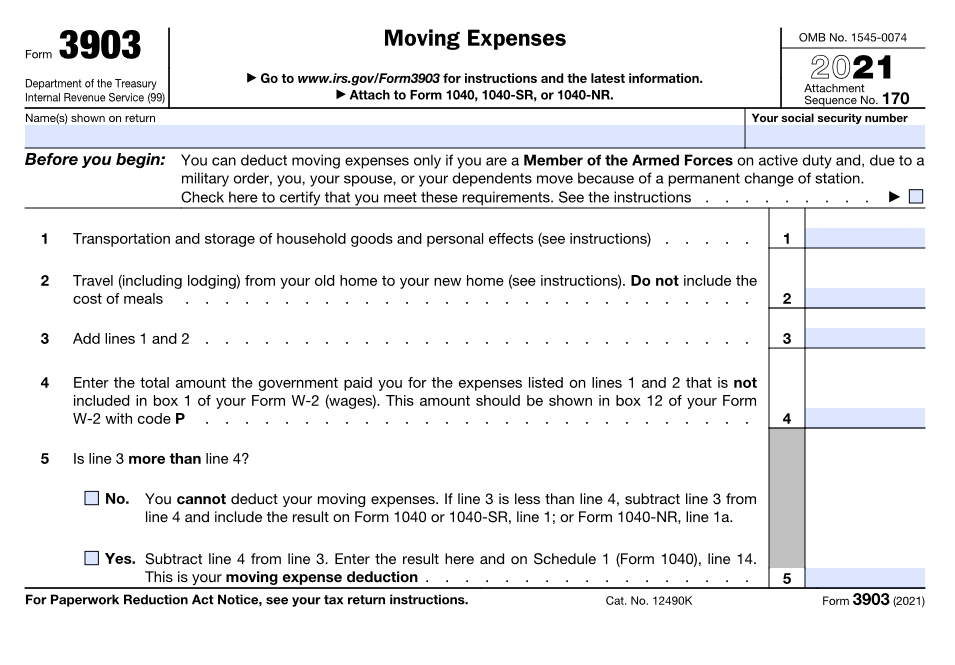

Where an employer reimburses the employee for relocation costs the costs are to be added to the employee s earnings and become tax deductible in the usual way To claim the moving expense deduction you must report all relocation expenses on IRS Form 3903 and attach it to the personal tax return that covers the year of your move

What Relocation Costs Are Tax Deductible

What Relocation Costs Are Tax Deductible

https://www.financialdesignsinc.com/wp-content/uploads/2020/11/Expenses-1.jpg

Moving For Work Tax Deductible Relocation Expenses Explained K K

https://www.kkcpa.ca/wp/wp-content/uploads/Webp.net-resizeimage.jpg

Are My Relocation Costs Tax Deductible Mortgage House

https://www1.mortgagehouse.com.au/wp-content/uploads/2022/04/young-family-with-little-daughter-moving-into-new-house-1-1.jpg

Understanding these criteria is essential for ensuring that your moving expenses can be legitimately claimed on your tax return Calculating Moving Find out more information on relocation expenses and benefits that qualify for exemption

Technical guidance Overview You have certain tax National Insurance and reporting obligations if you contribute to an employee s relocation costs as their employer When trying to determine if your moving expenses qualify as tax deductible the key phrase to consider at least in the eyes of the Internal Revenue Service IRS

Download What Relocation Costs Are Tax Deductible

More picture related to What Relocation Costs Are Tax Deductible

Did You Know Moving Expenses Can Be Tax Deductible Find Out If Your

https://i.pinimg.com/736x/b0/f7/a8/b0f7a8d1266429db15ed66c2cd568360.jpg

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

Are Training Costs Tax Deductible For The Self Employed

https://goselfemployed.co/wp-content/uploads/2019/01/training-courses-tax-deductible.jpg

So to answer the question are relocation expenses taxable the answer is yes Moving expenses including lump sum payments are considered taxable income Moving expenses are not tax deductible But if your employer contributes towards your relocation costs you may not have to pay tax on them This is called a relocation

Discover what moving expenses are tax deductible and non deductible according to the IRS Learn what costs related to your relocation are considered tax deductible moving Moving expenses were tax deductible if you relocated to start a new job or to seek work until the Tax Cuts and Jobs Act TCJA eliminated this provision from the

Tax Deductions For Charitable Donations

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA17y0HM.img?w=3000&h=2000&m=4&q=100

Can I Claim Apartment Expenses On My Taxes Leia Aqui Can You Claim

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/05/Form_3903_IRS.627935caded63.png

https://www.gov.uk/expenses-and-benefits-relocation/whats-exempt

Some relocation costs up to 8 000 are exempt from reporting and paying tax and National Insurance These are called qualifying costs and include the costs of buying or selling

https://www.davidsonmorris.com/relocation-costs

Where an employer reimburses the employee for relocation costs the costs are to be added to the employee s earnings and become tax deductible in the usual way

A Guide To Tax Deductible Donations Best Charities To Donate To

Tax Deductions For Charitable Donations

What Does Tax Deductible Mean And How Do Deductions Work

Are Closing Costs Tax Deductible Under The New Tax Law PNWR

Investment Expenses What s Tax Deductible Charles Schwab

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Tax Deductible Donations Bold

Are Moving Expenses Tax Deductible Under The New Tax Bill

Is My Relocation Package Taxable Experian

What Relocation Costs Are Tax Deductible - Moving expenses are not tax deductible That could change after 2025 unless lawmakers make changes to tax law Relocating for business reasons can be