What Rental Expenses Are Tax Deductible In general you can deduct expenses of renting property from your rental income You can generally use Schedule E Form 1040 Supplemental Income and Loss to report

Landlords can deduct most ordinary and necessary expenses related to the renting of residential property This includes rental property tax deductions for use of a car cleaning costs mortgage interest payments repairs property taxes You can reduce your tax bill as a landlord by deducting many of the expenses you incur when letting out a property Find out how these work and what you can claim

What Rental Expenses Are Tax Deductible

What Rental Expenses Are Tax Deductible

https://i.pinimg.com/736x/b0/f7/a8/b0f7a8d1266429db15ed66c2cd568360.jpg

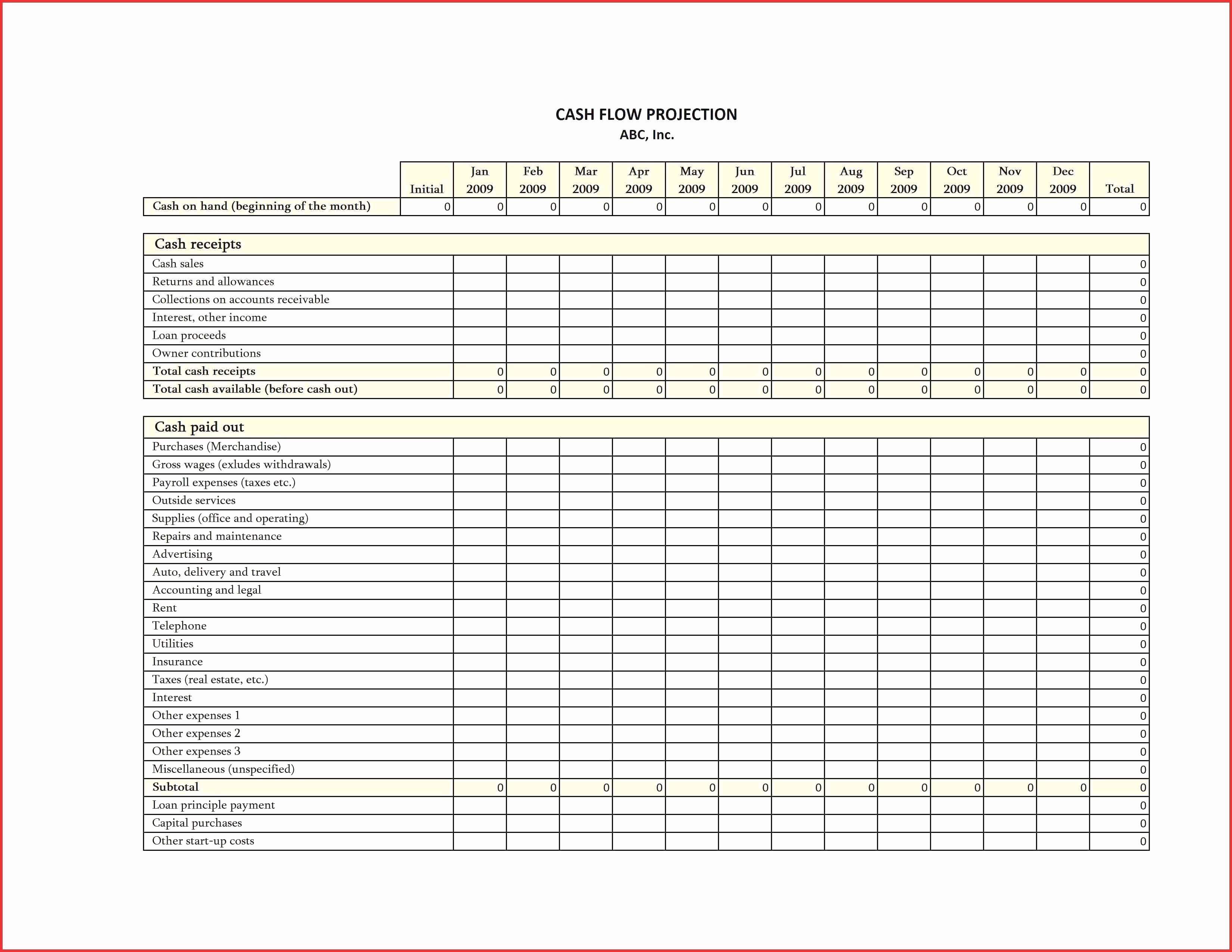

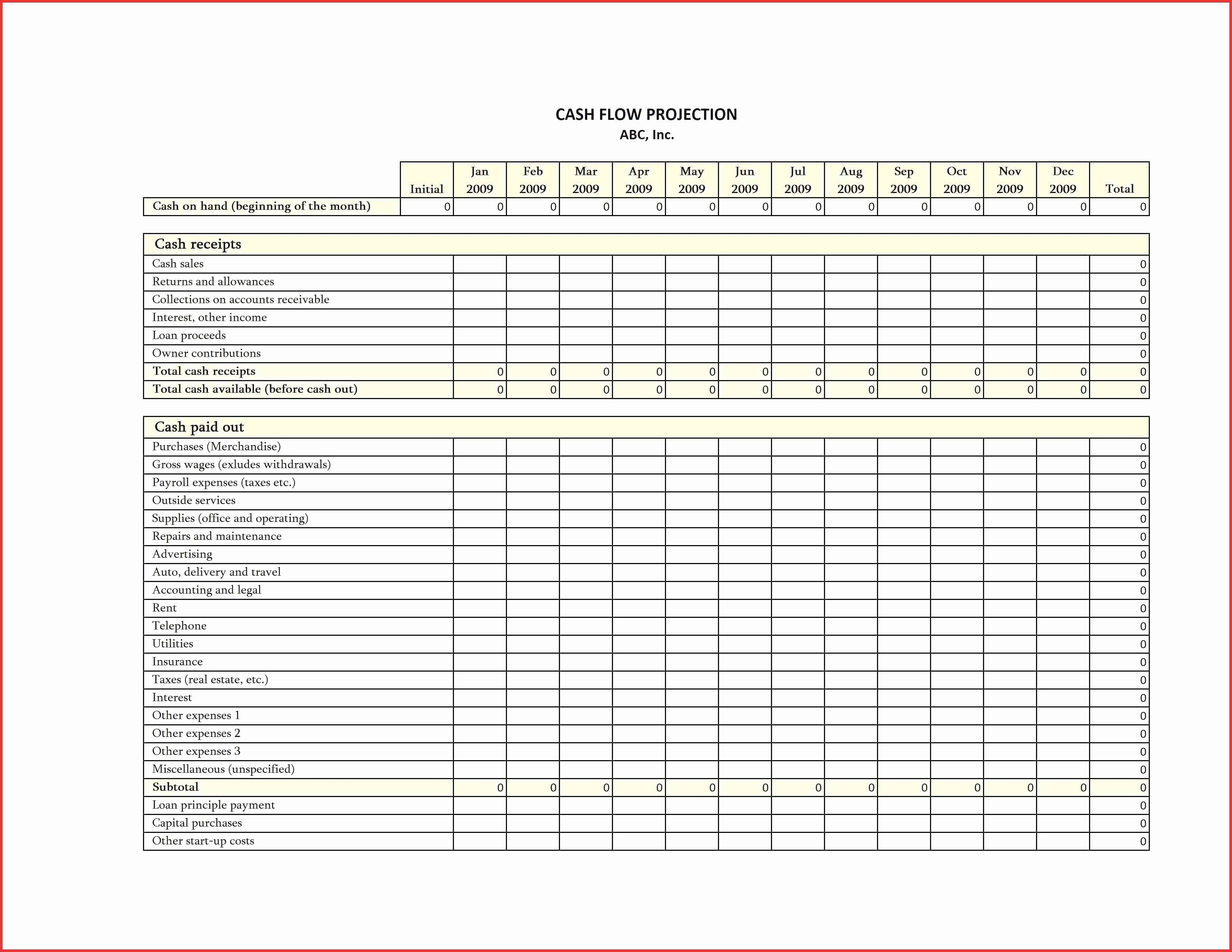

Tax Expenses Template

https://db-excel.com/wp-content/uploads/2019/01/tax-return-spreadsheet-australia-regarding-rental-property-expenses-spreadsheet-template-australia-expense.jpg

How Do I Deduct Rental Property Expenses Similar Tips

https://img.youtube.com/vi/QdKmwq_FYJY/maxresdefault.jpg

Learn about the most common rental property tax deductions as well as some costs that owners aren t legally allowed deduct What Are Rental Property Tax Deductions One significant advantage of owning a rental You can deduct any reasonable expenses you incur to earn rental income The two basic types of expenses are current expenses and capital expenses For more information on what we

Tax deductible rental property expenses are costs associated with owning operating and maintaining rental properties that can be subtracted from rental income to What Rental Property Expenses Are Tax Deductible Owning rental properties can be a great way to supplement your income and generate long term wealth However to maximize your tax savings it s essential to understand what

Download What Rental Expenses Are Tax Deductible

More picture related to What Rental Expenses Are Tax Deductible

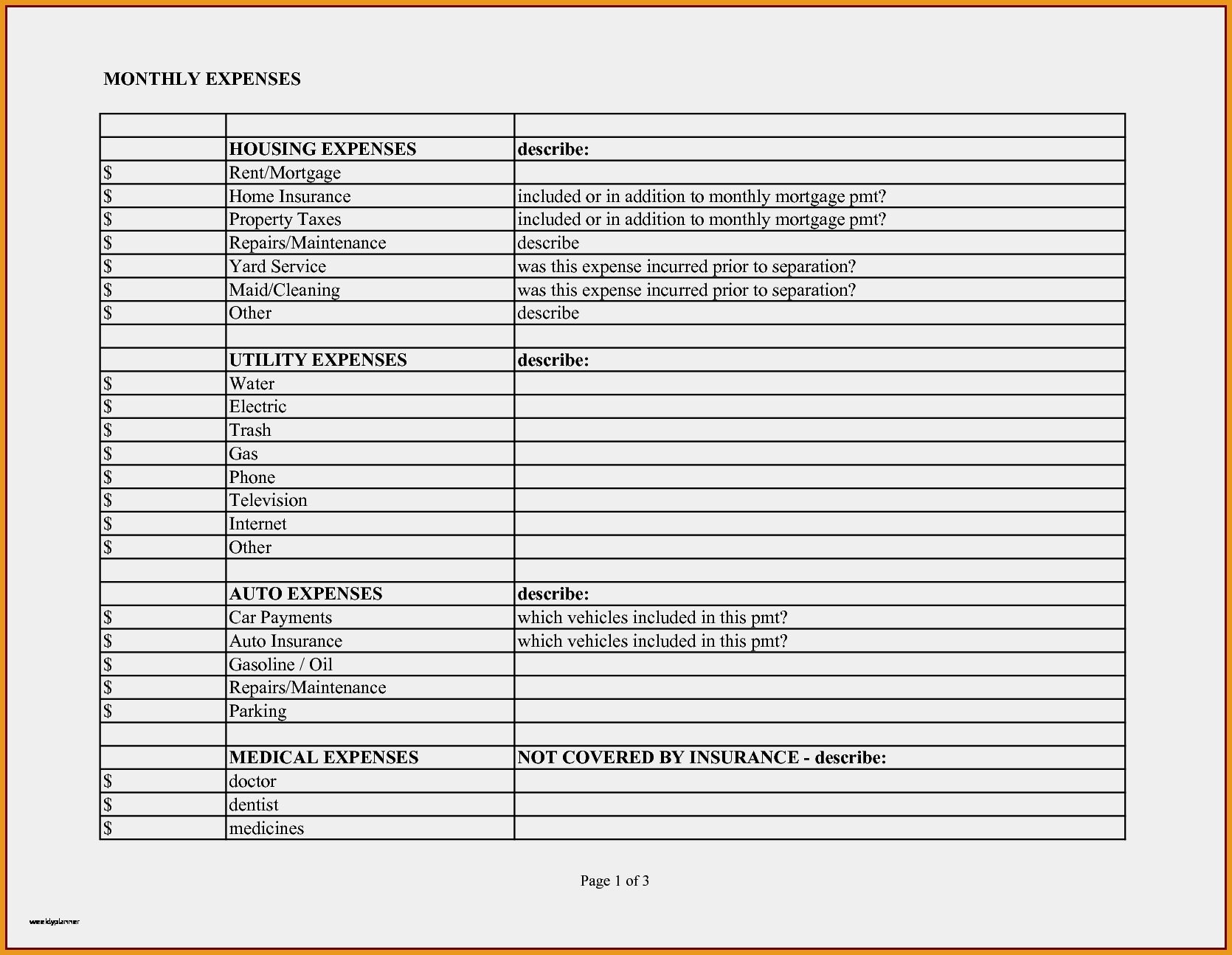

What Kind Of Medical Finance Expenses Are Tax Deductible Medical

https://i.pinimg.com/originals/ce/7c/ea/ce7cea1b1d1bf1c7904a76f16a6f0065.jpg

![]()

Tax Deduction Tracker Spreadsheet Spreadsheet Downloa Tax Deduction

http://db-excel.com/wp-content/uploads/2019/01/tax-deduction-tracker-spreadsheet-with-donation-spreadsheet-for-taxes-with-checklist-plus-mileage-google.jpg

Business Expense Spreadsheet For Taxes Rental Property Tax With

https://db-excel.com/wp-content/uploads/2018/11/business-expense-spreadsheet-for-taxes-rental-property-tax-with-business-expense-deductions-spreadsheet.jpg

The two most common taxes for rental property owners are property tax and sales occupancy or innkeeper tax depending on your geographic location and local What kinds of rental property expenses can I deduct The IRS lets you deduct ordinary and necessary expenses required to manage conserve or maintain property that you rent to

Personal expenses fines fees or uncollected rent are generally not deductible Real estate is generally considered a passive activity However your level of participation Property Taxes Local and state property taxes paid on rental properties are deductible against rental income Insurance The premiums you pay for insurance on your rental property can be

Tax Deductible Business Expenses Under Federal Tax Reform CCG

https://www.commercialcreditgroup.com/hs-fs/hubfs/CCG 2018/Tax-Deductible-Business-Expenses-Under-Federal-Tax-Reform.jpg?width=5565&height=3000&name=Tax-Deductible-Business-Expenses-Under-Federal-Tax-Reform.jpg

Is Rent A Tax Deductible Expense PRFRTY

https://i.pinimg.com/originals/eb/07/67/eb0767d76fc286625d73aa1a8bd41a9c.jpg

https://www.irs.gov › taxtopics

In general you can deduct expenses of renting property from your rental income You can generally use Schedule E Form 1040 Supplemental Income and Loss to report

https://turbotax.intuit.com › tax-tips › rent…

Landlords can deduct most ordinary and necessary expenses related to the renting of residential property This includes rental property tax deductions for use of a car cleaning costs mortgage interest payments repairs property taxes

What Rental Expenses Are Tax Deductible YouTube

Tax Deductible Business Expenses Under Federal Tax Reform CCG

Investment Expenses What s Tax Deductible Charles Schwab

10 Most Common Small Business Tax Deductions Infographic

Real Estate Tax Deduction Worksheet

Are Moving Expenses Tax Deductible Under The New Tax Bill

Are Moving Expenses Tax Deductible Under The New Tax Bill

Finance Archive January 04 2017 Chegg

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Deductible Business Expenses For Independent Contractors Financial

What Rental Expenses Are Tax Deductible - Learn about the most common rental property tax deductions as well as some costs that owners aren t legally allowed deduct What Are Rental Property Tax Deductions One significant advantage of owning a rental