What S The Social Security Tax Rate Social Security taxes in 2024 are 6 2 percent of gross wages up to 168 600 Thus the most an individual employee can pay this year is 10 453 Most workers pay their share through FICA Federal

The current tax rate for Social Security is 6 2 for the employer and 6 2 for the 35 rowsOASDI Medicare tax rates Maximum taxable earnings Tax rates for Social

What S The Social Security Tax Rate

What S The Social Security Tax Rate

https://i.ytimg.com/vi/q342U65tAgA/maxresdefault.jpg

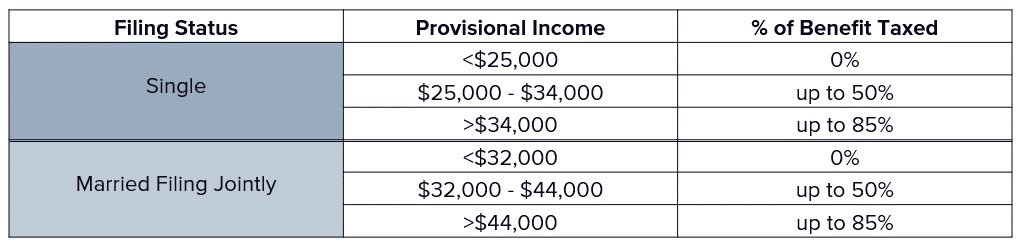

Understanding How Social Security Benefits Are Taxed

https://www.wealthenhancement.com/cms/delivery/media/MCFMWPXDOK6JBF7BTOD5IE2GD5JY

Payroll Tax Rates And Contribution Limits For 2023

https://www.payrollpartners.com/wp-content/uploads/2023/02/February-20-2023.jpg

The Social Security tax limit refers to the maximum amount of earnings that are subject to Social Security tax For 2024 the Social Security tax limit is 168 600 The Social Security tax rate for employees and employers is 6 2 of employee compensation each for a total of 12 4 The Social Security tax rate for those who are self employed is 12 4

The OASDI tax rate on employers remains at 6 2 6 Amounts for 1937 74 and for 1979 81 were set by statute all other amounts were determined under automatic adjustment The Social Security tax is part of the FICA taxes withheld from your paychecks For 2022 the total Social Security tax rate is 12 4 on a worker s first

Download What S The Social Security Tax Rate

More picture related to What S The Social Security Tax Rate

States That May Cut Taxes On Social Security Income SSI Texas

https://texasbreaking.com/wp-content/uploads/2023/02/GettyImages-1136346827-3eba69ab996a4abeb0836afe62abfd3c.jpg

Social Security Tax Calculator Rates Limits How To Pay

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg3Npfy5dEzz9p6nYLMnEOfxHBEX0yGKZGFeKqzeyhIBRloiBI9Rj90a-dHtDplj2w9a4D6DvGuOFkuOhdPE_RdWAEVMLgDQXu0E5Cv8yR8GwXKZy-cc3FVGcVcqtLQT4NSeQRrzdbOVeblZEOIfNoUT_e0kBpAam3sDJ3GlR182q8OF7taOgwBp3YS/s820/sst.jpg

Social Security Tax Definition How It Works And Tax Limits

https://learn.financestrategists.com/wp-content/uploads/HistoryofSocialSecurityTaxLimits.png

29 rowsTax rates for each Social Security trust fund Maximum taxable earnings Social Security s Old Age Survivors and Disability Insurance OASDI program and The rate of social security tax on taxable wages including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after March

As of 2021 a single rate of 12 4 is applied to all wages and self employment income earned by a worker up to a maximum dollar limit of 142 800 Half The wage base or earnings limit for the 6 2 Social Security tax rises every year The 2024 limit is 168 600 up from 160 200 in 2023

Solved Calculate Payroll K Mello Company Has Three Employees a

https://www.coursehero.com/qa/attachment/34807877/

Social Security Tax Limit 2022 Antwan Nettles

https://www.cdscpa.com/wp-content/uploads/2021/10/SS-and-Medicare-Tax-Rates.jpg

https://www.aarp.org/retirement/social …

Social Security taxes in 2024 are 6 2 percent of gross wages up to 168 600 Thus the most an individual employee can pay this year is 10 453 Most workers pay their share through FICA Federal

https://www.irs.gov/taxtopics/tc751

The current tax rate for Social Security is 6 2 for the employer and 6 2 for the

Social Security Tax Increase In 2023 City Of Loogootee

Solved Calculate Payroll K Mello Company Has Three Employees a

2023 Social Security Taxable Wage Amounts Increase

Leaders Debate Whether Raising Taxes Is Answer To Social Security Woes

California Social Security Tax Rate 2023 2024

What Percentage Of Your Income Is Social Security Tax

What Percentage Of Your Income Is Social Security Tax

The Basics Of Social Security Tax When You Are Self employed AFE

Foreign Social Security Taxable In Us TaxableSocialSecurity

Uncapping The Social Security Tax People s Policy Project

What S The Social Security Tax Rate - For combined income between 25 000 and 34 000 single or 32 000 and 44 000 joint filing up to 50 of benefits can be taxed With combined income