What Social Class Pays The Most Taxes Payroll taxes are social insurance taxes that comprise 24 8 percent of combined federal state and local government revenue the second largest source of

The Top 0 1 Pay a Lower Rate Than Other Household Groups Too According to Saez and Zucman it s not only the bottom 50 of households who pay According to the latest IRS data for 2018 the year following enactment of the Tax Cuts and Jobs Act TCJA the top 1 percent of taxpayers paid 616 billion in

What Social Class Pays The Most Taxes

What Social Class Pays The Most Taxes

https://blogs-images.forbes.com/niallmccarthy/files/2015/03/20150319_Tax_Fo.jpg

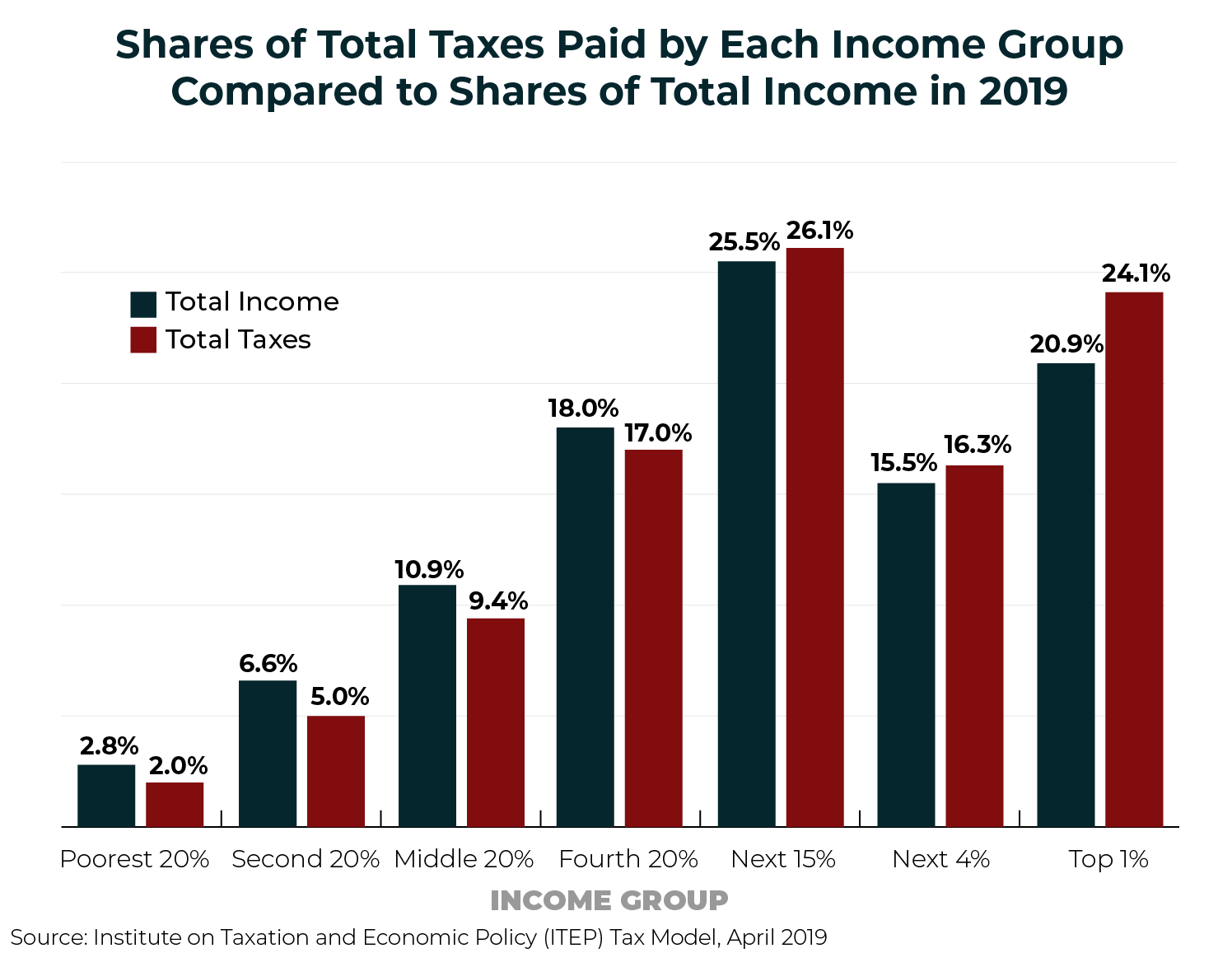

Who Pays Taxes In America In 2019 ITEP

https://itep.org/wp-content/uploads/WPTIA-2019_Chart1.png

Which Countries Pay The Most Income Tax Infographic

https://blogs-images.forbes.com/niallmccarthy/files/2016/04/20160413_Tax.jpg

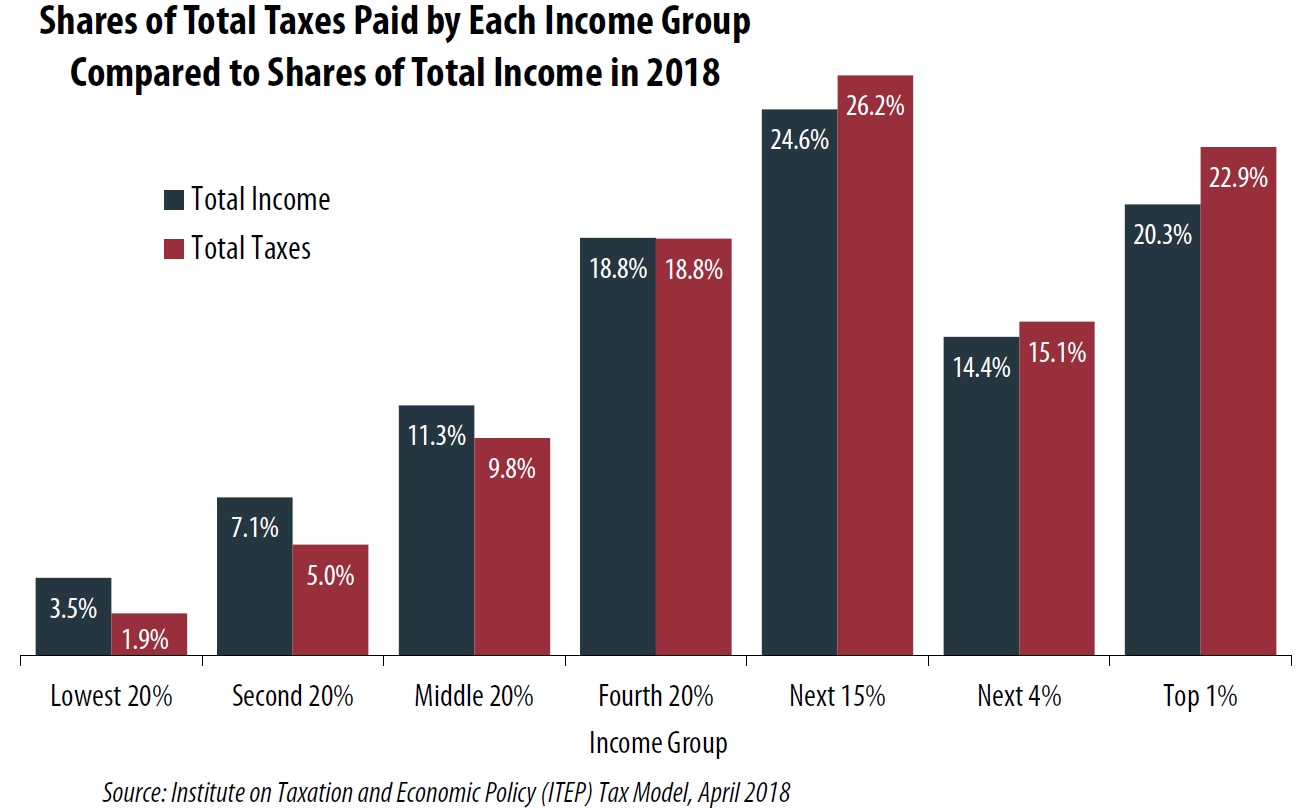

According to their research they concluded that in 2018 the top 0 1 the billionaires of America paid an average effective tax The remainder was comprised of payroll taxes i e Social Security and Medicare corporate tax revenue excise taxes and other revenue which made up

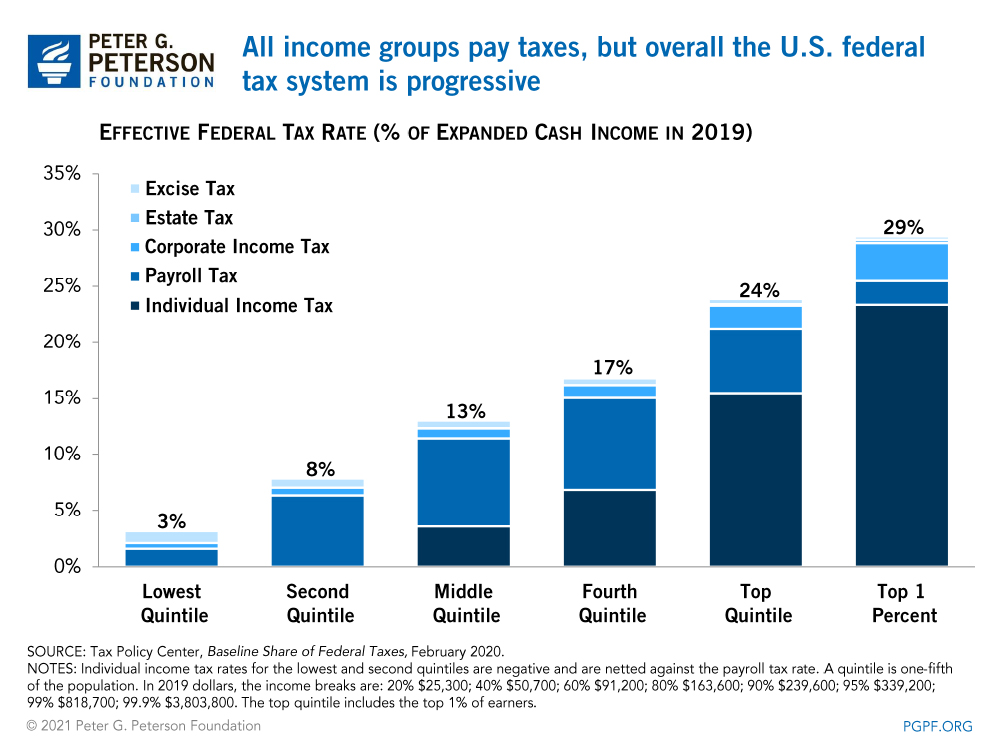

The United States has a system of progressive taxation This means that the richer you are the more you pay in taxes This first figure found at The American Prospect shows the percentage of total For most workers the biggest tax they pay isn t income tax but payroll tax the line marked FICA on your pay stub which finances Social Security and most of Medicare That tax is

Download What Social Class Pays The Most Taxes

More picture related to What Social Class Pays The Most Taxes

In 1 Chart How Much The Rich Pay In Taxes The Heritage Foundation

https://www.dailysignal.com/wp-content/uploads/FBIP-SOCIAL-04.jpg

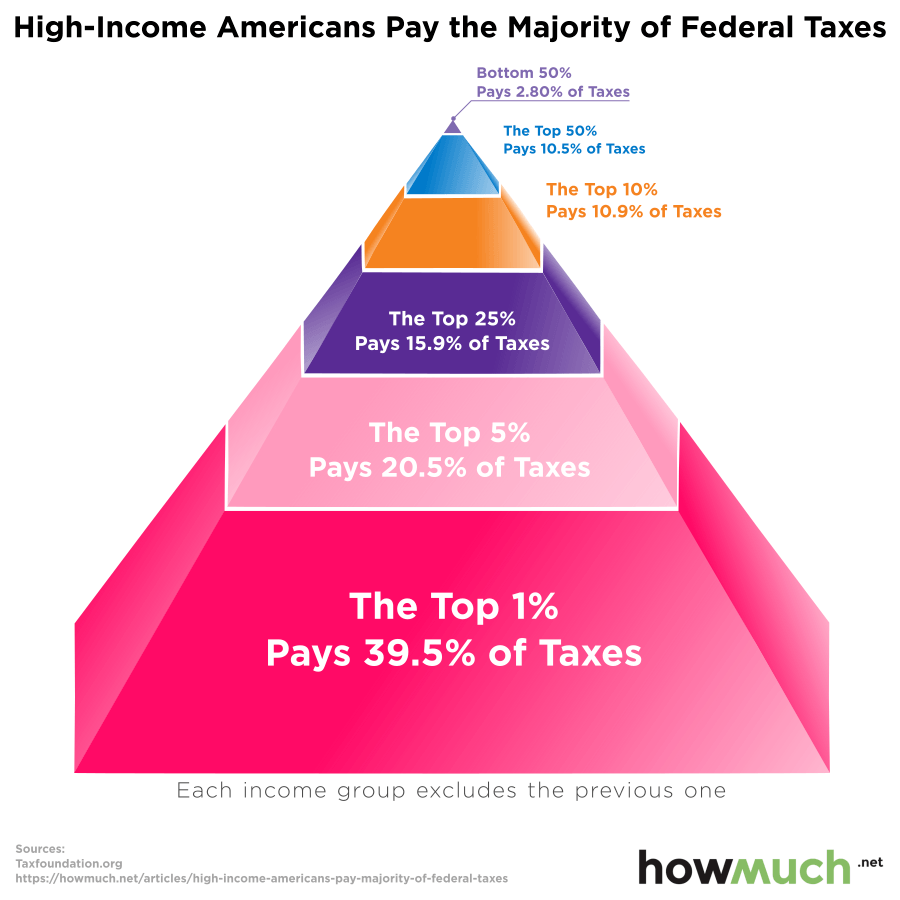

Believe It Or Not The Richest Americans Pay Most Of The Federal Bills

https://cdn.howmuch.net/content/images/high-income-americans-pay-the-taxes-e4f1.png

Taxes Paid By Income Class

https://www.mercatus.org/sites/default/files/figure_1._which_percentile_bears_the_burden_of_the_federal_personal_income_tax_-_v1_copy.png

Senator Elizabeth Warren s proposal would impose a 2 annual tax on households with a net worth of more than 50 million and a 3 tax on every dollar of net worth over 1 billion A family The payroll taxes that finance Social Security are flat for the first 132 900 that a person earns and then the rate drops to zero percent

But the three major tax law overhauls during this period have affected different classes of taxpayers quite differently The Bush tax cuts of 2001 and 2003 benefited the highest income taxpayers the The latest government data show that in 2018 the top 1 of income earners those who earned more than 540 000 earned 21 of all U S income while

Who Pays Income Tax GRAPH HuffPost

http://i.huffpost.com/gen/778005/images/o-47-PERCENT-GRAPH-facebook.jpg

Budget Basics Who Pays Taxes

https://www.pgpf.org/sites/default/files/who-pays-taxes-chart-2.jpg

https://taxfoundation.org/data/all/federal/summary...

Payroll taxes are social insurance taxes that comprise 24 8 percent of combined federal state and local government revenue the second largest source of

https://www.gobankingrates.com/taxes/tax-laws/...

The Top 0 1 Pay a Lower Rate Than Other Household Groups Too According to Saez and Zucman it s not only the bottom 50 of households who pay

Tax Day 2016 Charts To Explain Our Tax System Committee For A

Who Pays Income Tax GRAPH HuffPost

The Purpose And History Of Income Taxes St Louis Fed

Summary Of The Latest Federal Income Tax Data 2020 Update

Who Pays The Most Taxes Chart

Americans Pay More Than 525 000 In Tax Over A Lifetime CPA Practice

Americans Pay More Than 525 000 In Tax Over A Lifetime CPA Practice

Who Pays Taxes In America In 2018 ITEP

Who Pays Federal Taxes Source

What Age Group Pays The Most Taxes YouTube

What Social Class Pays The Most Taxes - Taxes are generally an involuntary fee levied on individuals or corporations that is enforced by a government entity whether local regional or national in order to