What Tax Deductions Can I Claim As A Homeowner Web 26 Juni 2023 nbsp 0183 32 The standard deduction for the 2022 tax year is 25 900 for married couples filing jointly 12 950 for single filers and married individuals filing separately 19 400 for heads of

Web A tax deductible expense lowers your taxable income so you ll pay less in income tax Homeowners can often deduct interest property taxes mortgage insurance and more on taxes Web 19 Okt 2023 nbsp 0183 32 You can t deduct the following payments for a personal residence Dues to a homeowners association Insurance on your home Appraisal fees for your home The cost of improvements to your home except in the relatively rare case where they qualify as a medical expense But keep those receipts They may help reduce your taxes when you

What Tax Deductions Can I Claim As A Homeowner

What Tax Deductions Can I Claim As A Homeowner

https://www.racomi.org/wp-content/uploads/2023/08/overview-of-the-almighty-tax-deduction-for-small-businesses.png

Top 10 Tax Deductions Synchrony Bank Synchrony Bank

https://www.synchronybank.com/images/hero-top-10-tax-deductions-you-should-know-about_1140x570.jpg

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/628f57631956b41f6612c16a_tax deductions table.png

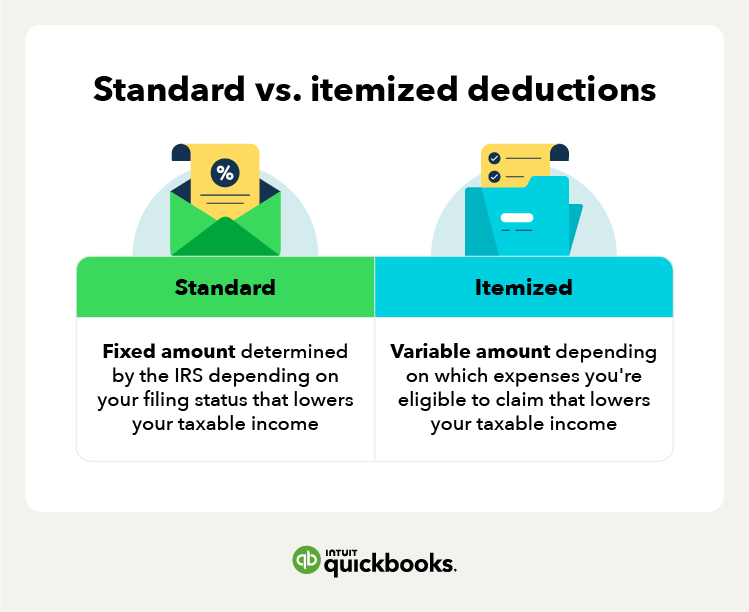

Web 17 M 228 rz 2023 nbsp 0183 32 Tax Deductions for Homeowners Ultimate Guide for 2023 Tax Deductions Homeowner Deductions for 2021 Most Vital Questions About Deductibles in 2021 100 Tax Deduction on Mortgage Interest What Is No longer Tax Deductible Itemize or Standard Deduction Deduct Property Taxes When Taking Standard Web 6 Feb 2023 nbsp 0183 32 5 tax deductions for homeowners 1 Mortgage interest Many U S homeowners can deduct what they paid in mortgage interest when they file their taxes each year The rule is that you can deduct a

Web 10 Aug 2021 nbsp 0183 32 This doesn t mean they weren t eligible for the mortgage deduction all the same it does mean their taxes didn t go down at all for incurring mortgage interest For 2021 the standard deduction Web One of the most significant changes brought about by the TCJA was to impose a 10 000 annual cap on the itemized deduction for property tax and other state and local taxes which had never been limited before From 2018 through 2025 homeowners may deduct a maximum of 10 000 of their total payments for

Download What Tax Deductions Can I Claim As A Homeowner

More picture related to What Tax Deductions Can I Claim As A Homeowner

What Tax Deductions Can I Claim TW Accounting

https://twaccounting.com.au/wp-content/uploads/2022/07/what-tax-deductions-can-i-claim.webp

10 Tax Deductions You Can Claim As A Landlord Baselane

https://www.baselane.com/wp-content/uploads/elementor/thumbs/Landlord-Tax-Deductions-polmq827l0ght88yubanndjvrrzbwgrlwvxwnmbuk2.png

Free LLC Tax Calculator How To File LLC Taxes Embroker

https://d2zqka2on07yqq.cloudfront.net/wp-content/uploads/2022/04/common-small-business-tax-deductions-1.png

Web Vor einem Tag nbsp 0183 32 The mortgage interest deduction MID allows borrowers to write off a portion of the interest on their home loan That lowers your taxable income and can move you into a lower tax bracket which Web 22 Mai 2023 nbsp 0183 32 Mortgage Interest Deduction Personal Residence If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary home up

Web Vor 2 Tagen nbsp 0183 32 All the Possible Tax Credits and Deductions for Homeowners Green Tax Breaks Give Money Back for Energy Efficiency All about tax refunds After you ve finished your 2023 tax return and sent it Web If the total is less you can forego using the itemized deduction and still claim the standard deduction 8 Homeowner Tax Deductions The following are IRS tax deductions for homeowners that you can include on your tax return 1 Mortgage Interest One of the primary tax deductions available to homeowners is the mortgage interest tax credit

What Tax Deductions Can I Claim Working From Home Fitzroy Financial

https://fitzroyfa.com.au/wp-content/uploads/2020/06/What-tax-deductions-can-I-claim-working-from-home-1024x667.jpg

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

https://www.nerdwallet.com/article/mortgages/tax-deductions-for-homeo…

Web 26 Juni 2023 nbsp 0183 32 The standard deduction for the 2022 tax year is 25 900 for married couples filing jointly 12 950 for single filers and married individuals filing separately 19 400 for heads of

https://www.businessinsider.com/.../tax-deductions-for-homeowners

Web A tax deductible expense lowers your taxable income so you ll pay less in income tax Homeowners can often deduct interest property taxes mortgage insurance and more on taxes

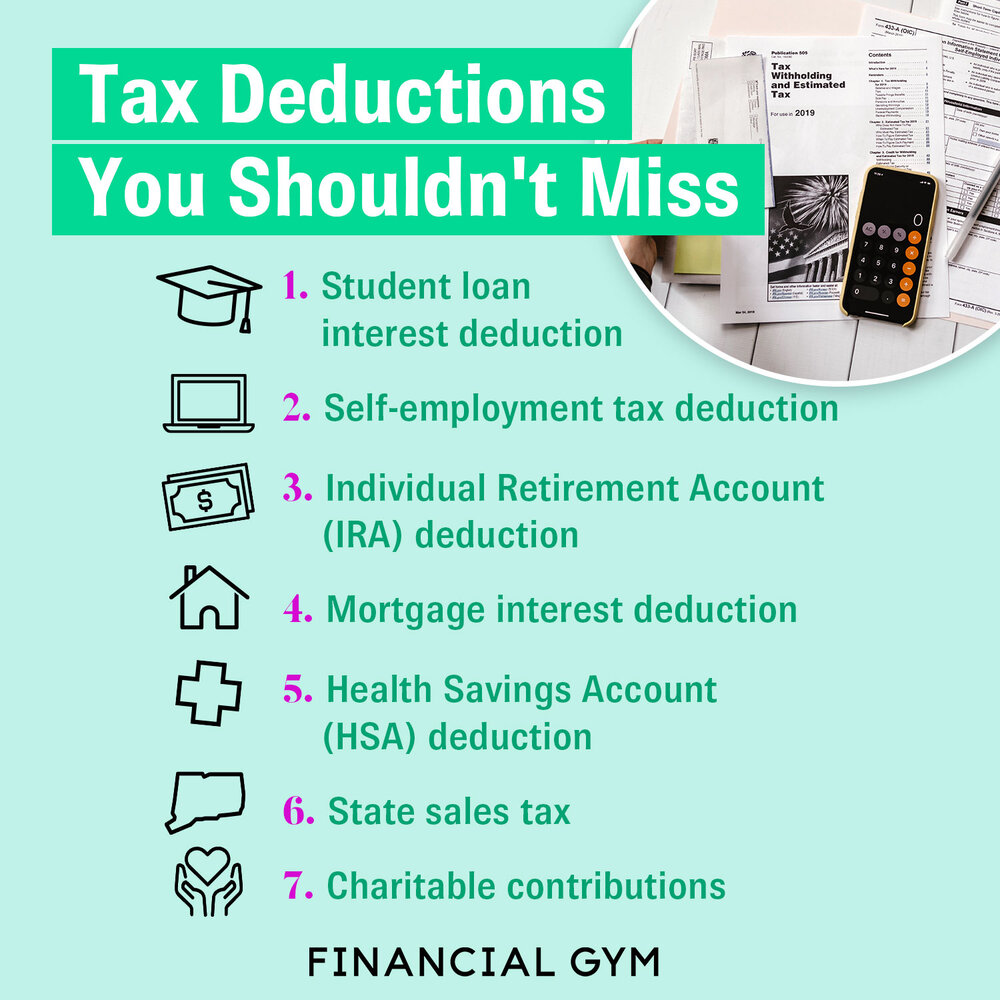

Tax Deductions Write Offs To Save You Money Financial Gym

What Tax Deductions Can I Claim Working From Home Fitzroy Financial

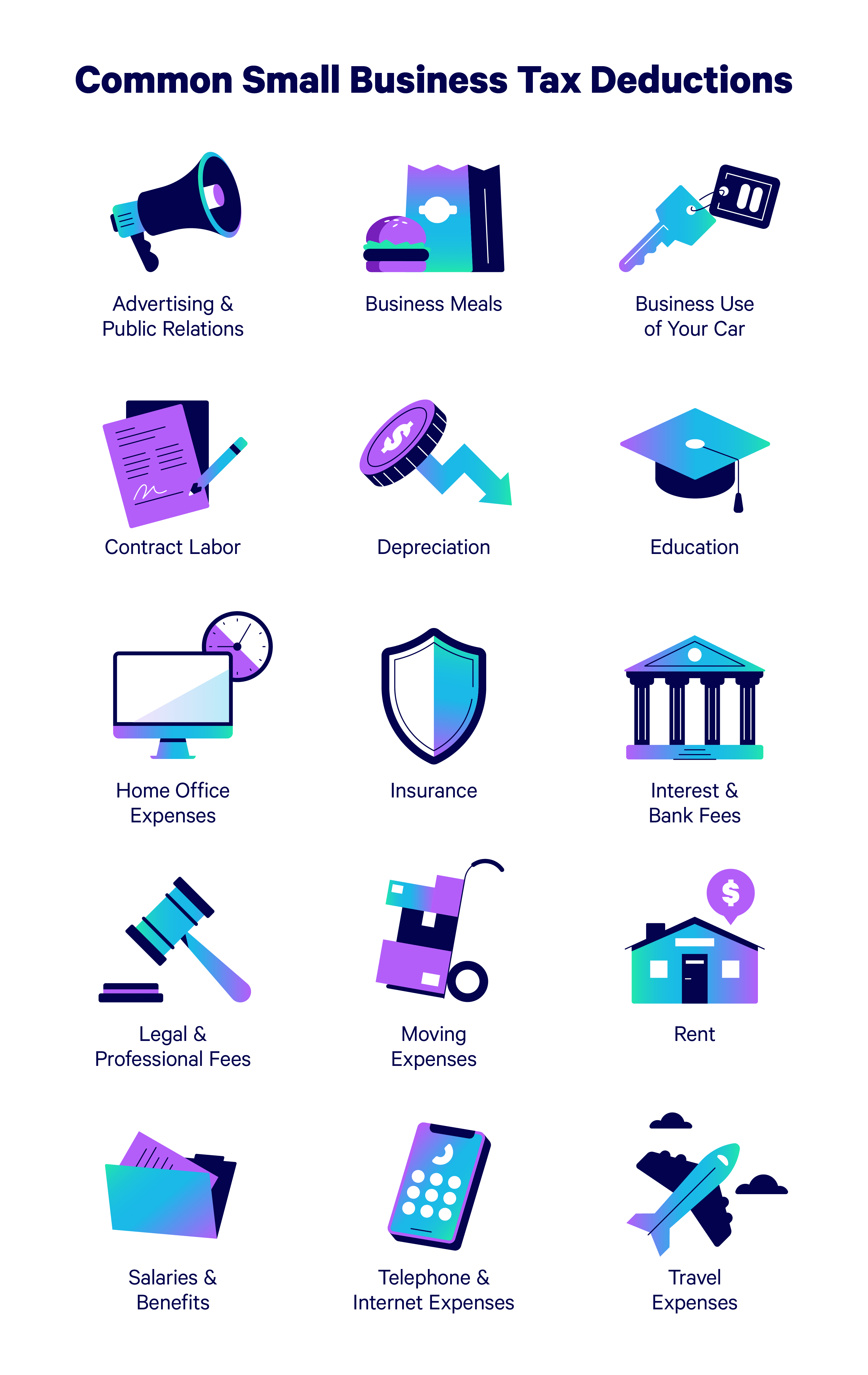

Small Business Expenses Tax Deductions 2023 QuickBooks

What Tax Deductions Can I Claim As A Locum Healthcare Professional

List Of Tax Deductions Here s What You Can Deduct

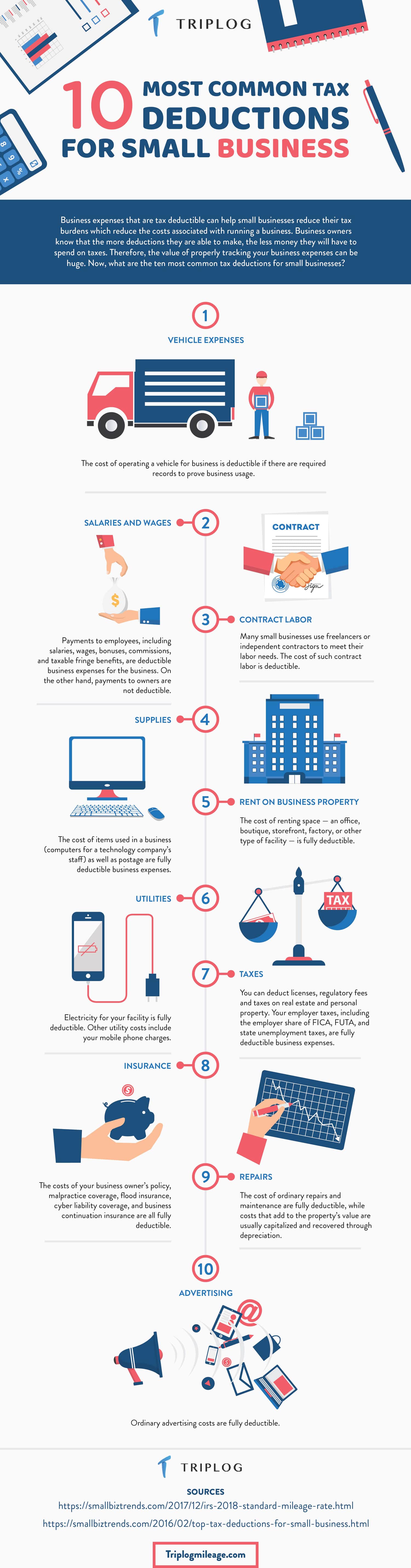

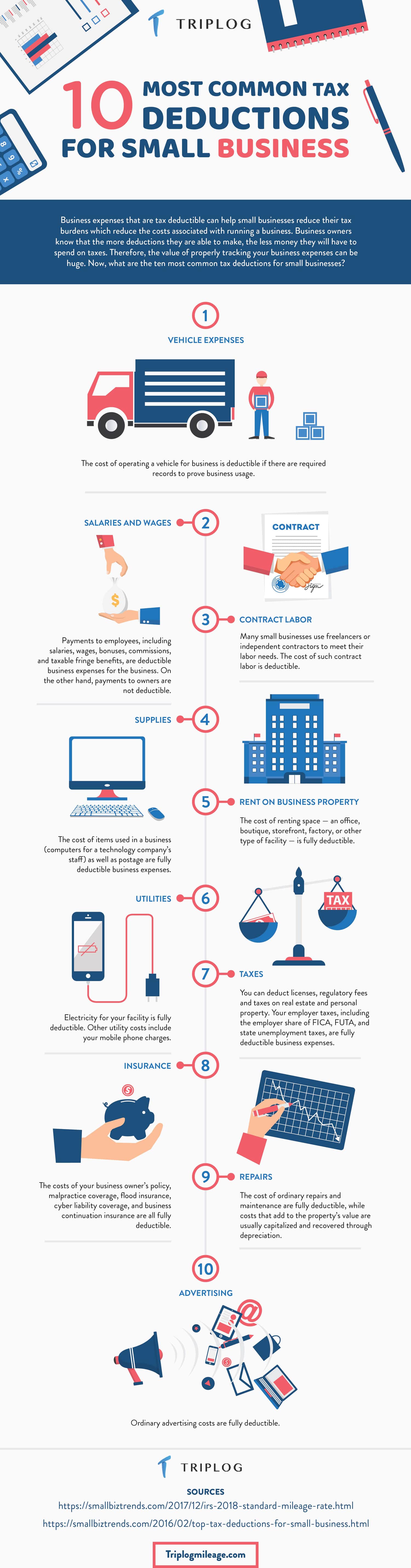

10 Most Common Small Business Tax Deductions Infographic

10 Most Common Small Business Tax Deductions Infographic

Teacher Tax Deductions Teacher Organization Teaching

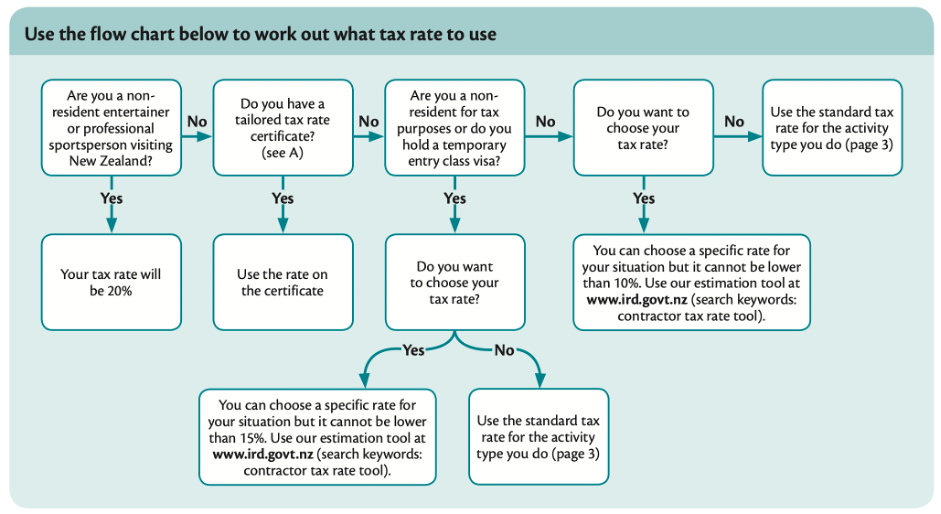

Tax Flow Chart Nz Flowchart Examples

What Expenses Can I Claim FREE Printable Checklist Of 100 Tax

What Tax Deductions Can I Claim As A Homeowner - Web 20 Juni 2023 nbsp 0183 32 What types of home expenses can you claim with the home office deduction Here are the most common Real estate taxes Home mortgage interest Mortgage insurance premiums Depreciation Insurance