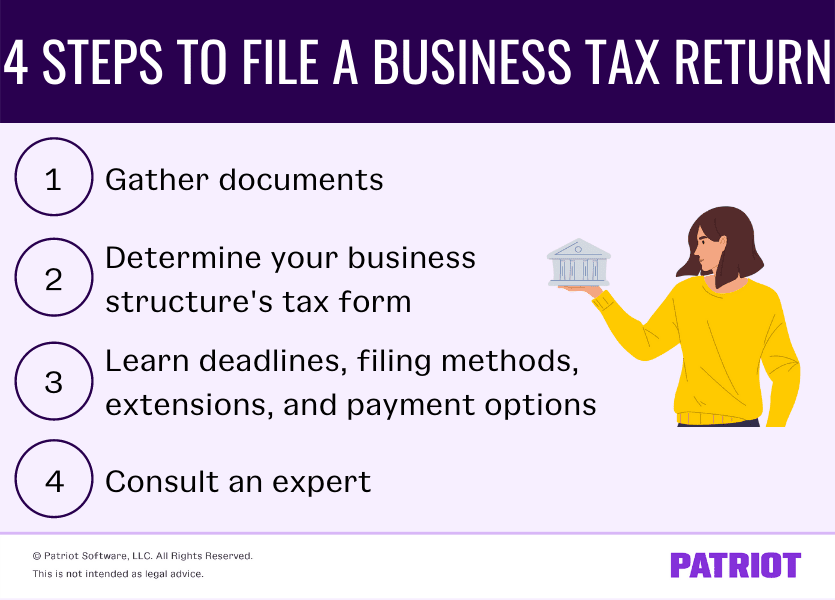

What Tax Form Do You Use For Llc The tax forms you ll use vary depending on whether you have a single or multi member LLC or are filing as a corporation However no matter what forms you re filing out keeping and having access to thorough records is key to smooth tax filing

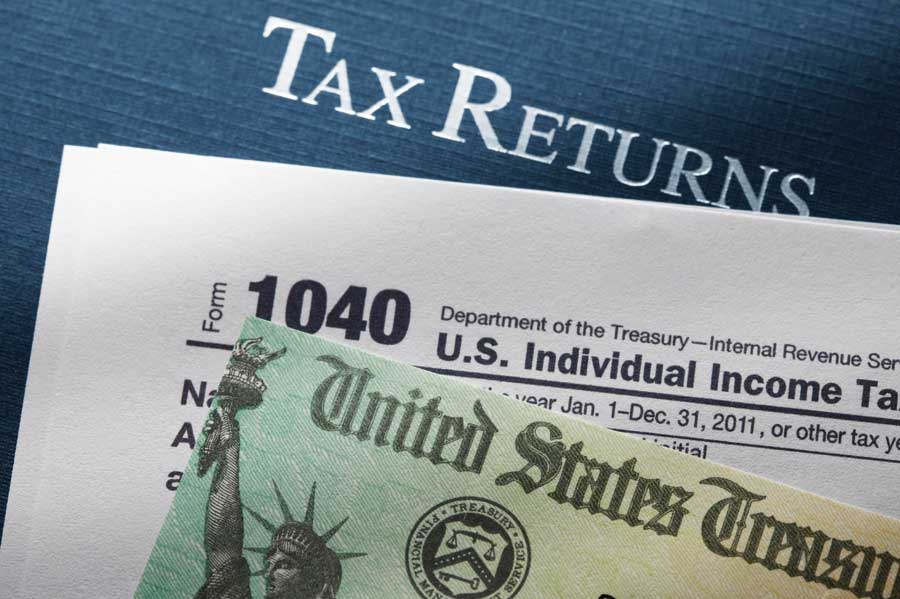

The LLC s income and expenses are reported on the individual s tax return on Form 1040 Schedule C E or F If the only member of the LLC is a corporation then the LLC s income and expenses are reported on the corporation s returns on Form 1120 or If you re the single member of a limited liability company LLC you ll typically file your business tax information on Schedule C and report the profit or loss from your business on Form 1040

What Tax Form Do You Use For Llc

What Tax Form Do You Use For Llc

https://www.patriotsoftware.com/wp-content/uploads/2018/11/filing-a-business-tax-return-1.png

Essential Tax Deductions For Homeowners Filing Their 2022 Taxes

https://www.housedigest.com/img/gallery/essential-tax-deductions-for-homeowners-filing-their-2022-taxes/l-intro-1678127015.jpg

Self Employed What Tax Form Do I Use Employment Form

https://i0.wp.com/www.employementform.com/wp-content/uploads/2022/10/self-employed-what-tax-form-do-i-use.jpg

A Limited Liability Company LLC will file one of the following depending on its situation Form 1040 Schedule C E or F appropriate for single member LLCs Form 1065 Partnership appropriate for multiple member LLCs In addition LLC must file under its name and EIN the applicable employment tax returns make timely employment tax deposits and file with the Social Security Administration and furnish to LLC s employees Kent Patricia and Tex Forms W 2

If you have an LLC you need to know how to file quarterly taxes for the LLC You will need to pay quarterly taxes as well as annual taxes and it is important that you know when the quarterly taxes are due to prevent additional tax implications as even An LLC might file their tax return on Schedule C Form 1065 Form 1120S or Form 1120 Learn how LLC taxes work and how to handle them

Download What Tax Form Do You Use For Llc

More picture related to What Tax Form Do You Use For Llc

Documenting COVID 19 Employment Tax Credits

https://www.thetaxadviser.com/content/tta-home/issues/2022/jan/documenting-covid-19-employment-tax-credits/_jcr_content/contentSectionArticlePage/article/articleparsys/image.img.png/1641843232476.png

Irs Releases Form 1040 For 2020 Tax Year Free Download Nude Photo Gallery

https://www.taxgirl.com/wp-content/uploads/2021/01/Screen-Shot-2021-01-10-at-3.09.05-PM.png

5498 Tax Forms For IRA Contributions Participant Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/5498-Tax-Form-Copy-B-for-Participant-L58B-FINAL-min.jpg

LLC owners use the corporate tax return also known as Form 1120 to report the corporation s income gains losses deductions and credits to calculate its tax liability Like Schedule C you ll need all of your company s important financial information and If you choose to have your LLC file taxes as a corporation you must tell the IRS by filing Form 8832 Entity Classification Election At tax time you ll use Form 1120 Corporation Income Tax Return or 1120S if you choose to be taxed as an S corporation

IRS Publication 3402 is Tax Issues for LLCs and it can provide assistance in determining which tax reporting form is best for your business Once you elect one tax status you are required to keep that status for five years Here are the top four tax advantages business owners are able to use when they form an LLC 1 Tax Flexibility

What Income Is Subject To The 3 8 Medicare Tax

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

How Do I Apply For The Tax Credit Tax Form For Energy Efficiency Tax

http://courtlandbuildingcompany.com/wp-content/uploads/2012/01/NH-ND11-tax-returns.jpg

https://smartasset.com/taxes/what-documents-do-i...

The tax forms you ll use vary depending on whether you have a single or multi member LLC or are filing as a corporation However no matter what forms you re filing out keeping and having access to thorough records is key to smooth tax filing

https://www.upcounsel.com/what-tax-form-does-an-llc-file

The LLC s income and expenses are reported on the individual s tax return on Form 1040 Schedule C E or F If the only member of the LLC is a corporation then the LLC s income and expenses are reported on the corporation s returns on Form 1120 or

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Printable Tax Declaration Form Printable Form Templates And Letter

What Income Is Subject To The 3 8 Medicare Tax

Live In N J You ll Pay More In Taxes Over A Lifetime Than Anywhere

What Tax Form Do I Use To Claim Medical Expenses ClaimForms

Printable Tax Forms For Your Budget Binder

New Employee Forms Montana 2023 Employeeform Net Www vrogue co

New Employee Forms Montana 2023 Employeeform Net Www vrogue co

How To File Your LLC Tax Return The Tech Savvy CPA

OCR Tax Declaration Form And Keep Things Organized

State Withholding Tax Form 2023 Printable Forms Free Online

What Tax Form Do You Use For Llc - In addition LLC must file under its name and EIN the applicable employment tax returns make timely employment tax deposits and file with the Social Security Administration and furnish to LLC s employees Kent Patricia and Tex Forms W 2