What Tax Relief Can I Claim As A Nurse Below we cover some of the main ways in which you might be eligible for tax relief as a nurse In each of the outlined examples you should keep receipts to document the costs you incur as you may be asked to evidence your tax claims up to five years later

As a registered nurse you may be eligible for various tax benefits that can help ease the financial burden associated with your profession In this informative guide we ll explore some of the key tax deductions available to nurses including work uniforms continuing education professional fees and travel expenses What can a Nurse claim a tax rebate for Most Nurses qualify for the following expenses Professional fees and Unison subscriptions membership costs for professional bodies like the NMC and RCN and others You can also claim for your UNISON fees

What Tax Relief Can I Claim As A Nurse

What Tax Relief Can I Claim As A Nurse

https://getassist.net/wp-content/uploads/2022/03/tax.jpg

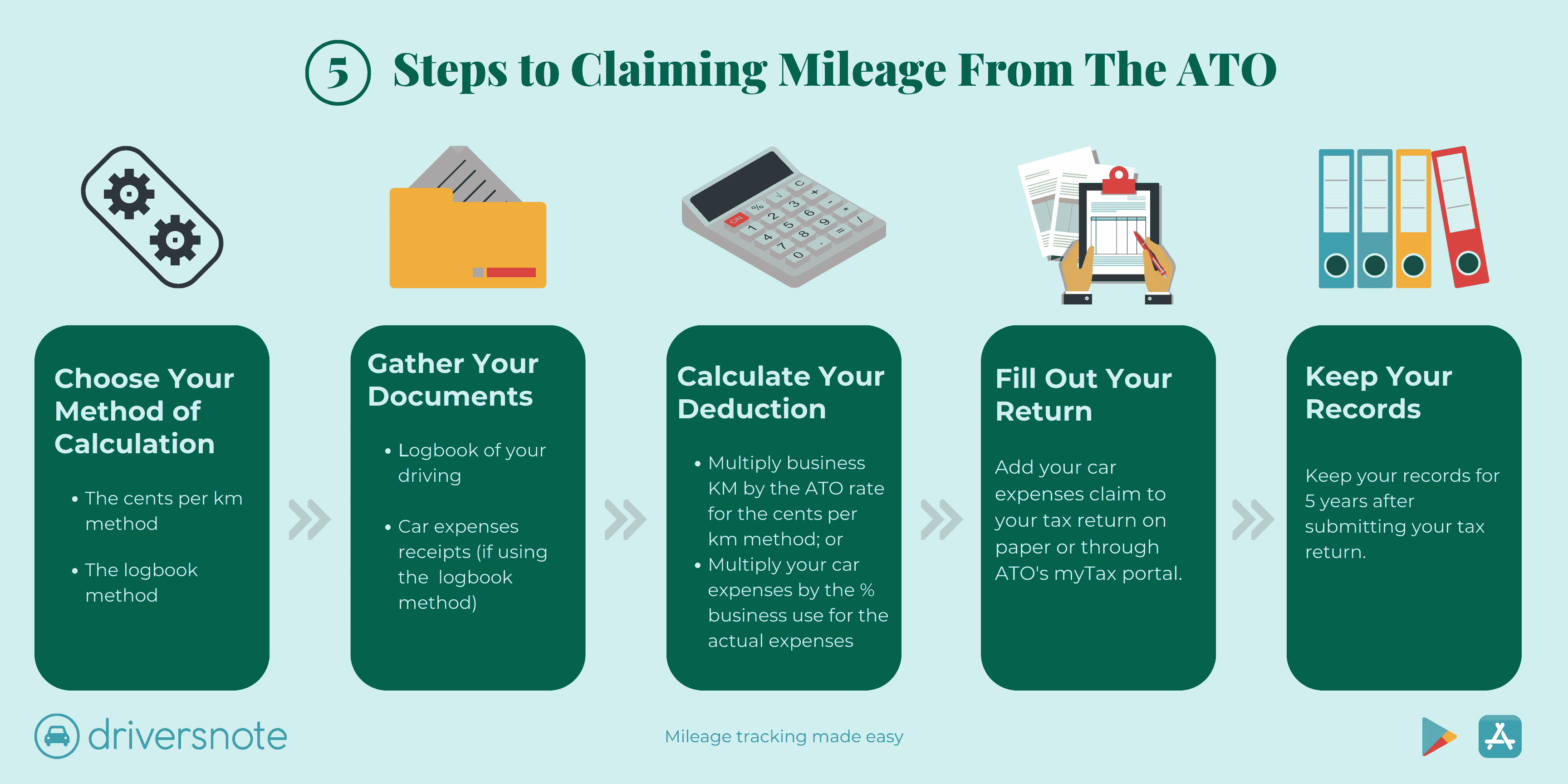

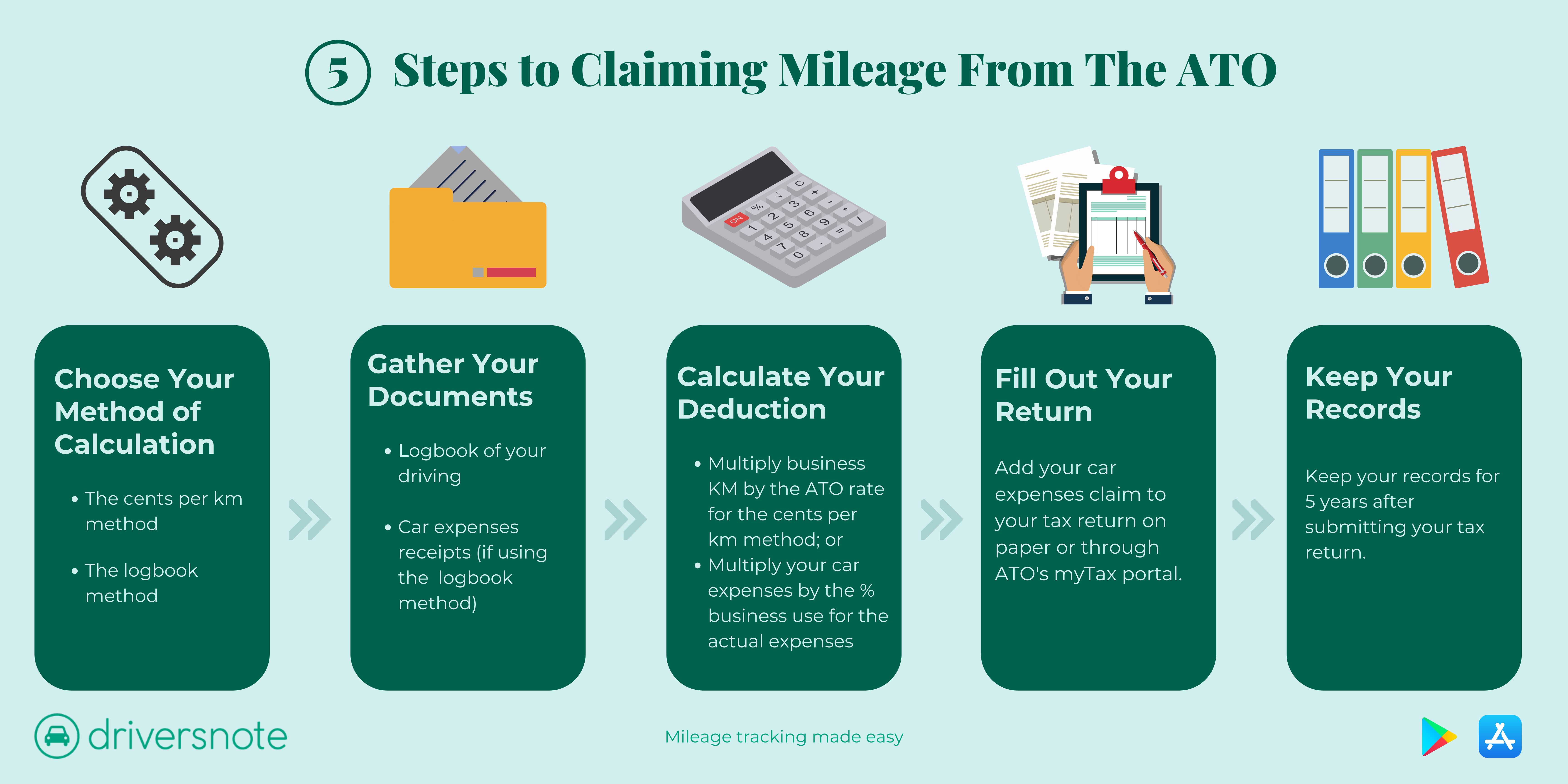

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

What Tax Relief Can I Claim On Expenses If I Serve In The Military

https://i.ytimg.com/vi/pe066xJRekI/maxresdefault.jpg

Claiming tax relief on your registration fee HM Revenue and Customs HMRC allow individuals to claim tax relief on professional subscriptions or fees which have to be paid in order to carry out a job This includes our registration fees Nurses can get the most back from their taxes by submitting claims for all the deductions they are eligible for To do so you must keep accurate and diligent records of the expenses related to your job including license and certification fees and any specialty supplies

Nurses and midwives guide to income allowances and claiming deductions for work related expenses For a summary of common expenses see Nurses and midwives PDF 440KB Flat rate expenses sometimes known as a flat rate deduction allow you to claim tax relief for an agreed fixed amount each tax year to cover what you spend on the clothing and tools you

Download What Tax Relief Can I Claim As A Nurse

More picture related to What Tax Relief Can I Claim As A Nurse

What Tax Relief Can I Claim While Working From Home YouTube

https://i.ytimg.com/vi/KyEHFVbn5PI/maxresdefault.jpg

Did You Know That You Can Claim Tax Relief On Your RCN Subscription

https://imgv2-1-f.scribdassets.com/img/document/470155599/original/2bea00c4d2/1704417160?v=1

Self employment What Tax Relief And Allowances Can I Claim Pandle

https://www.pandle.com/wp-content/uploads/2022/02/What_Tax_Relief_and_Allowances_Can_I_Claim.png

You may be eligible to claim tax relief on RCN membership fees NMC registration fees uniform purchases including shoes socks and tights laundry costs for your uniform your Nursing Standard subscription How to claim Income Tax relief Visit the HMRC website for full information on guidance and to claim If you re eligible you ll usually be able to claim tax relief on your job expenses online If you cannot claim online there are other ways you can claim

It is possible to claim nurse Tax relief for the majority of professional bodies paid into by nurses A claim for RCN tax relief or UNISON tax relief is very common for nurses along with the cost of fees into the Nursing Midwifery Council NMC Relief is calculated based on what you have spent and the rate at which you pay tax For example if you have spent 60 on expenses and your tax rate was 20 for that year you can claim 12 tax relief

What Tax Relief Can I Claim On Expenses I Use For Business Personal

https://i.ytimg.com/vi/gf2uqE8AUPU/maxresdefault.jpg

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/628f57631956b41f6612c16a_tax deductions table.png

https://countingup.com/resources/what-can-you-claim-on-tax-as-a-nurse

Below we cover some of the main ways in which you might be eligible for tax relief as a nurse In each of the outlined examples you should keep receipts to document the costs you incur as you may be asked to evidence your tax claims up to five years later

https://nursingeducation.org/insights/tax-benefits

As a registered nurse you may be eligible for various tax benefits that can help ease the financial burden associated with your profession In this informative guide we ll explore some of the key tax deductions available to nurses including work uniforms continuing education professional fees and travel expenses

What Tax Relief Can I Claim 2024 Updated RECHARGUE YOUR LIFE

What Tax Relief Can I Claim On Expenses I Use For Business Personal

Can I Claim My Laptop As An Education Expense Leia Aqui Is A Laptop

Main Residence Exemption When Does It Apply Accounting Firms

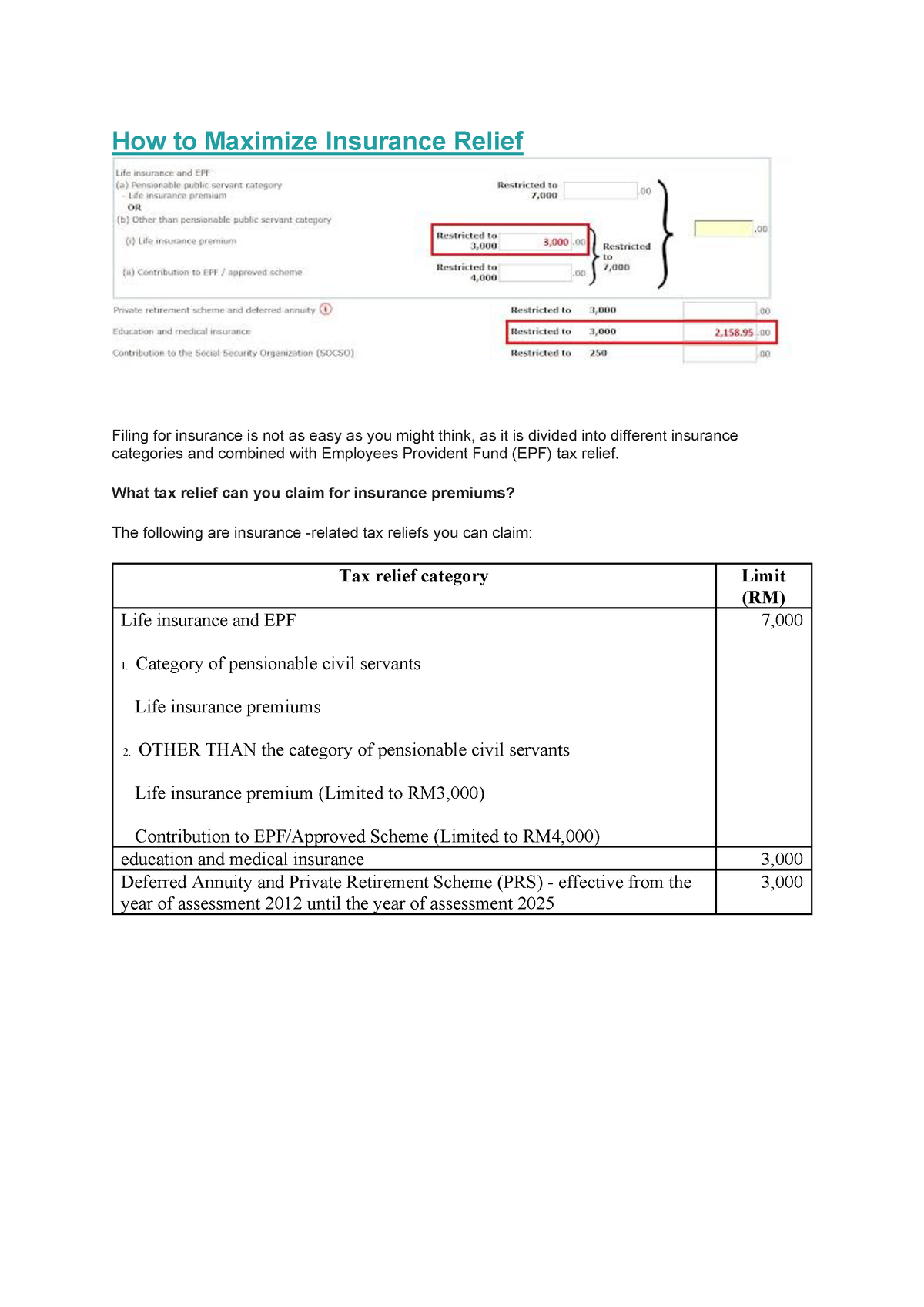

How To Maximize Insurance Relief What Tax Relief Can You Claim For

Just Started As A Contractor How Much Should I Save For Tax Kiwi Tax

Just Started As A Contractor How Much Should I Save For Tax Kiwi Tax

Making A Payment Claim

Who Can I Claim As A Dependent

How To Claim Tax Relief For Working From Home Debitam

What Tax Relief Can I Claim As A Nurse - Nurses can get the most back from their taxes by submitting claims for all the deductions they are eligible for To do so you must keep accurate and diligent records of the expenses related to your job including license and certification fees and any specialty supplies