What Time Of Day Do State Taxes Get Deposited When you mail your tax return it takes approximately six weeks from the date the IRS receives it to process your refund regardless of whether you choose direct deposit or a paper check

According to the state it usually processes e filed returns the same day that it receives them That means you can expect your refund to arrive not too long after you file your taxes On the other hand paper The 2024 tax refund schedule for the 2023 tax year starts on January 29th Our tax refund chart lists the federal tax refund dates for direct deposits and mailed checks

What Time Of Day Do State Taxes Get Deposited

What Time Of Day Do State Taxes Get Deposited

http://dailysignal.com/wp-content/uploads/property_taxes-01.png

Visualizing Taxes By State

https://cdn.howmuch.net/articles/133_Income-tax-567b.jpg

Blue to Red Migration Part III The Slow Motion Suicide Of High Tax

https://files.taxfoundation.org/20230217151820/2023-state-individual-income-tax-rates-2023-state-income-taxes-by-state.png

Where s My Refund is available almost all of the time However our system is not available every Monday early from 12 a m Midnight to 3 a m Eastern Time If you file your tax return electronically and request direct deposit you can expect to receive your tax refund within 21 days

The IRS expects most EITC Additional CTC related refunds to be available in taxpayer bank accounts or on debit cards by February 27 if they chose direct deposit If you ve filed a state income tax return you could wait months to get any refund you re owed Taxpayers who e file and request a direct deposit can typically expect a quicker turnaround But the timeline

Download What Time Of Day Do State Taxes Get Deposited

More picture related to What Time Of Day Do State Taxes Get Deposited

-88ee-e466.jpg)

Understanding Taxes In America In 7 Visualizations

https://cdn.howmuch.net/articles/breakdown-americas-taxes-revenue-(2)-88ee-e466.jpg

The Purpose And History Of Income Taxes St Louis Fed

https://www.stlouisfed.org/-/media/project/frbstl/stlouisfed/blog/2018/march/ovtax_part1_taxsources-piechart_blog.jpg

How To Find Out If You Owe State Taxes Rowwhole3

https://i.insider.com/5f72177074fe5b0018a8dc61?width=1200&format=jpeg

Four weeks after mailing a paper return Taxpayers should note that the IRS updates the tool once a day usually overnight so there s no need to check more Trump s tax cuts Trump repeated his regular claim that his signature tax cuts in the Tax Cuts and Jobs Act of 2017 were the largest tax cut ever provided Facts

You can usually expect the IRS refund to be issued and money received via direct deposit within 21 days of the date your e filed return was accepted If you paper filed or It started on May 25 2020 Memorial Day a Monday when the Minneapolis Police Department received a call that someone spent a possible counterfeit 20 bill on

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What s The Difference

https://www.investopedia.com/thmb/9xFmEb6FVlX0hIqe4MC_vVtlHLk=/1355x1142/filters:no_upscale():max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg

Federal Tax Contributions State Rankings Insights

https://www.moneyrates.com/wp-content/uploads/imagesrv_wp/5015/Federal-tax-by-state.png

https://turbotax.intuit.com/tax-tips/tax-refund/...

When you mail your tax return it takes approximately six weeks from the date the IRS receives it to process your refund regardless of whether you choose direct deposit or a paper check

https://smartasset.com/taxes/wheres-my-stat…

According to the state it usually processes e filed returns the same day that it receives them That means you can expect your refund to arrive not too long after you file your taxes On the other hand paper

.png)

Monday Map Combined State And Local Sales Tax Rates Tax Foundation

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What s The Difference

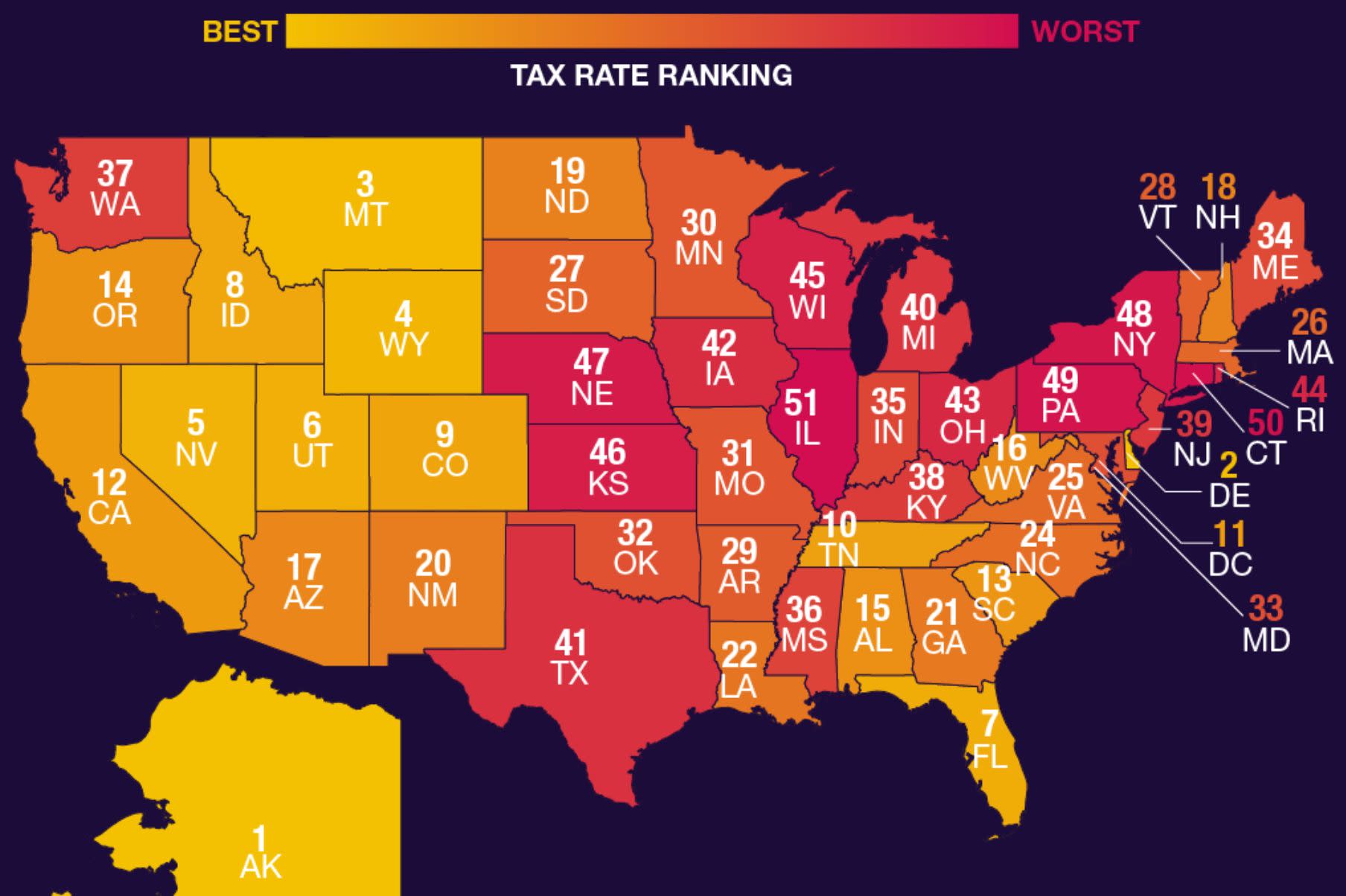

The Best And Worst U S States For Taxpayers

State Income Tax Rate Rankings By State Business Insider

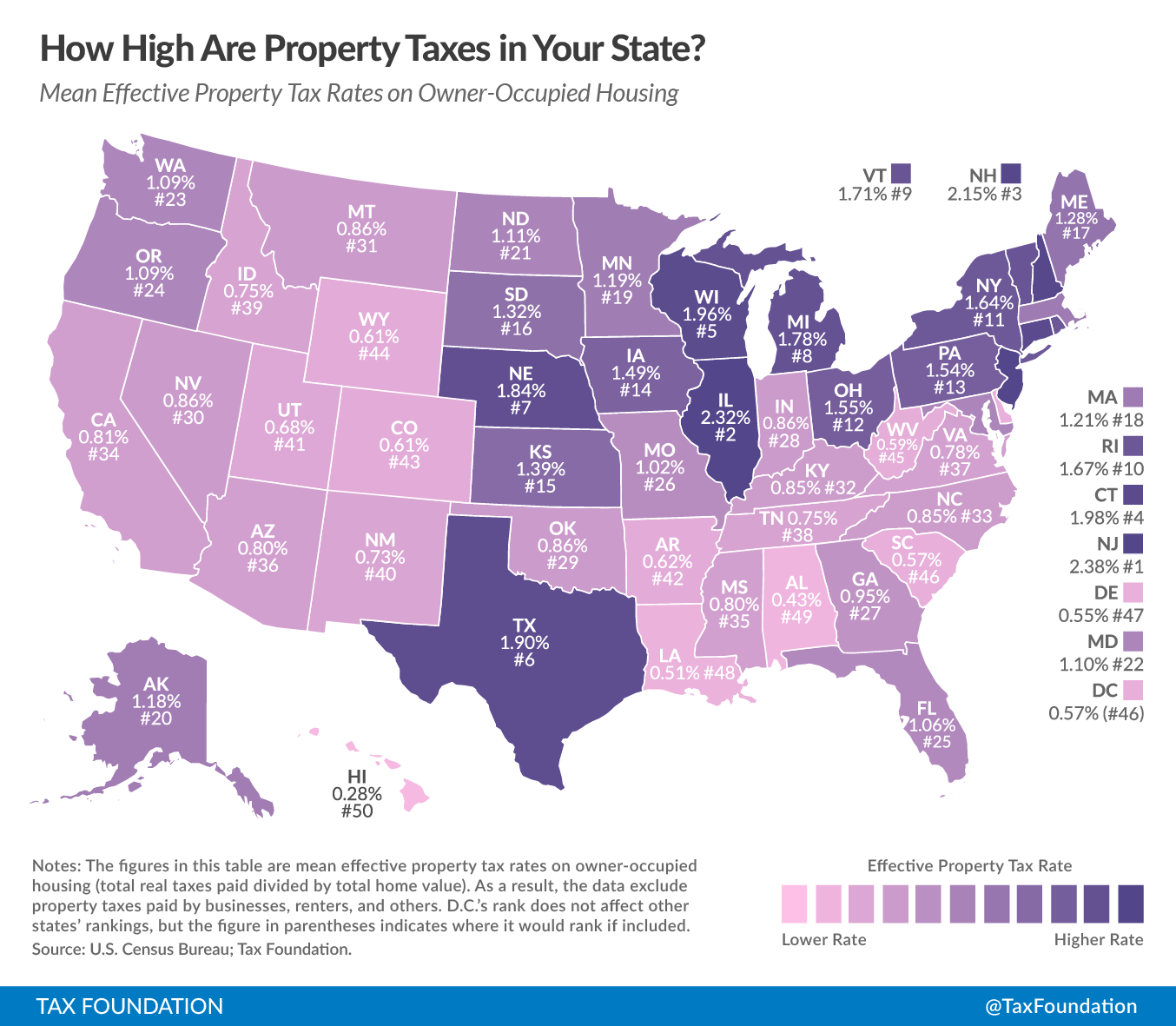

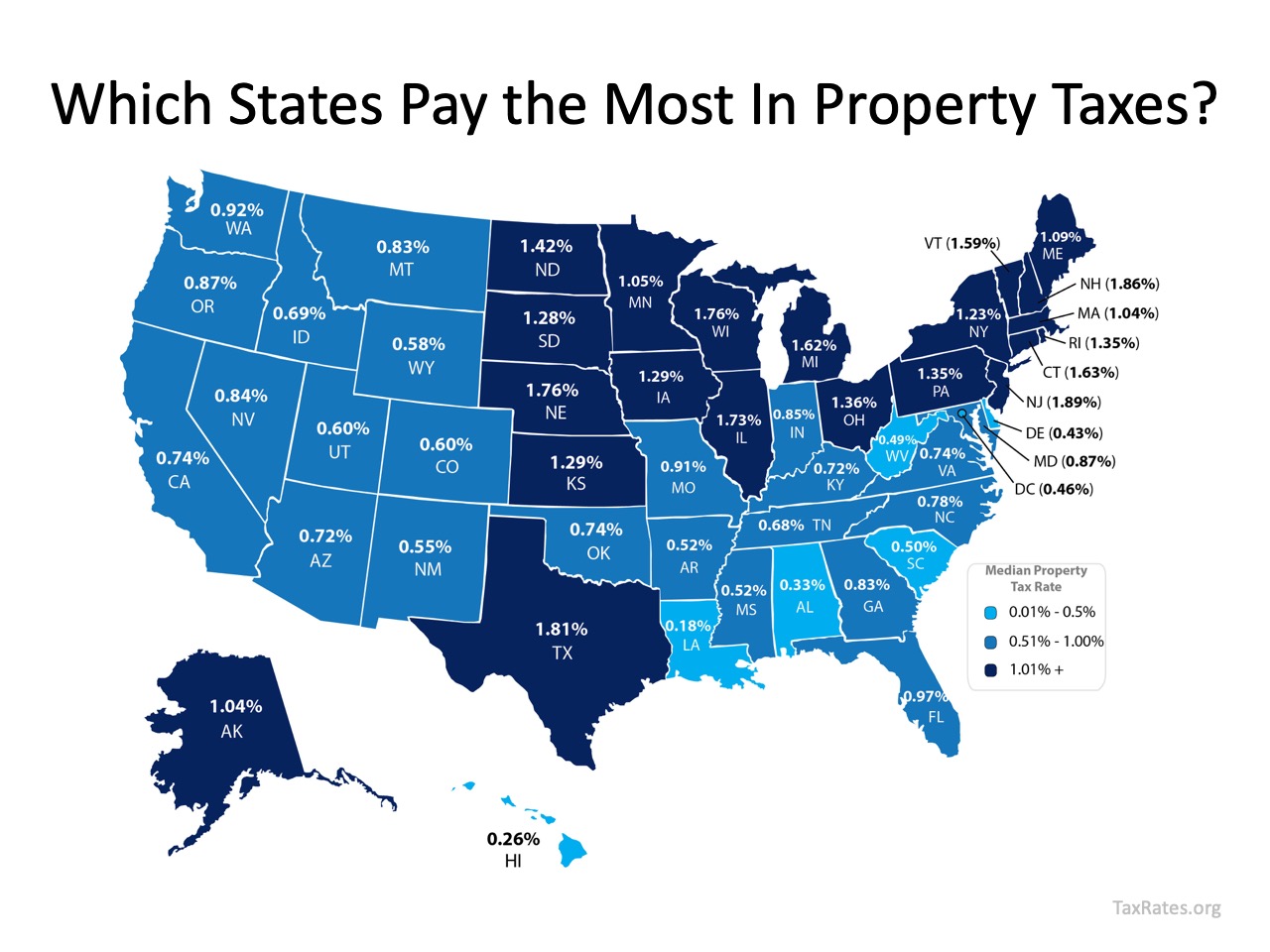

How Property Taxes Can Impact Your Mortgage Payment

So My Taxes Say I Should Get It Deposited Today But Nothing Has Updated

So My Taxes Say I Should Get It Deposited Today But Nothing Has Updated

Which States Pay The Most Federal Taxes A Look At The Numbers

SO LET ME GET THIS STRAIGHT I m Paying TAXES On My Wages Then

Where Do Your Tax Dollars Go Tax Foundation

What Time Of Day Do State Taxes Get Deposited - 2024 Tax Deadline Monday April 15 2024 The IRS does not release a calendar but continues to issue guidance that most filers should receive their refund