What Uniform Expenses Can I Claim Verkko 84 rivi 228 nbsp 0183 32 1 tammik 2015 nbsp 0183 32 Flat rate expenses sometimes known as a flat rate

Verkko 15 toukok 2023 nbsp 0183 32 As we ve already covered if you re self employed you can claim the cost of buying uniform as a business expense Verkko If you have to buy a uniform that identifies clearly what you do you can put that into your accounts and claim tax relief on it An example would be a uniform for a self

What Uniform Expenses Can I Claim

What Uniform Expenses Can I Claim

https://www.theaccountancy.co.uk/wp-content/uploads/2014/02/manage-your-expenses-1110x511.jpg

What Expenses Can I Claim With My Novated Lease Maxxia

https://www.maxxia.com.au/sites/default/files/styles/infographic/public/2021-11/MAX_Blog_Article_WhatExpensesCanIClaim_800x392.jpg?itok=FgEoQAM_

How To Write Off Business Expenses Knowdemia

https://i0.wp.com/knowdemia.com/wp-content/uploads/2021/11/how-to-write-off-business-expenses.jpg?w=735&ssl=1

Verkko Which Expenses can be Claimed You are able to claim for the purchase dry cleaning laundry repair replacement and renting of all items deemed to be part of your Verkko 29 jouluk 2023 nbsp 0183 32 The cost of maintaining their uniforms should be dealt with via their tax code with their tax free personal allowance raised to compensate And if you re self employed instead of claiming via the

Verkko Uniforms work clothing and tools Vehicles you use for work Professional fees and subscriptions Travel and overnight expenses Buying other equipment Working from Verkko You can t claim for the initial cost of buying a uniform However the cleaning repairing or replacing of protective clothing and uniform necessary for your job is eligible for tax relief In some cases HMRC

Download What Uniform Expenses Can I Claim

More picture related to What Uniform Expenses Can I Claim

What Expenses Can I Claim CIS EEBS

https://eebs.co.uk/wp-content/uploads/2021/02/expenses.jpg

Self Employed Allowable Expenses Accounting Basics Best Accounting

https://i.pinimg.com/originals/de/81/c7/de81c7177a75fa53363d95cb5e077283.png

Ask Integro What Expenses Can I Claim If My Company Is Dormant

https://www.integroaccounting.com/wp-content/uploads/2022/07/expenses-can-I-claim-if-my-Limited-Company-is-dormant.jpg

Verkko Are tools and work clothes tax deductible Determining if work tools and uniforms as well as works clothes are tax deductible depends on a couple of factors In regard to Verkko 5 tammik 2020 nbsp 0183 32 Employees can claim uniform tax rebates for the cost of cleaning repairing or replacing qualifying staff clothing if they pay the costs themselves and do not receive reimbursement from the

Verkko the cost of the uniforms or protective clothing is reasonable by law the employee has to wear the protective clothing on the work site If you pay an allowance to your Verkko 3 p 228 iv 228 228 sitten nbsp 0183 32 You pay 40 tax so you can personally claim back 20 of 163 125 163 25 If you ever donate via sites such as JustGiving search your emails you should have

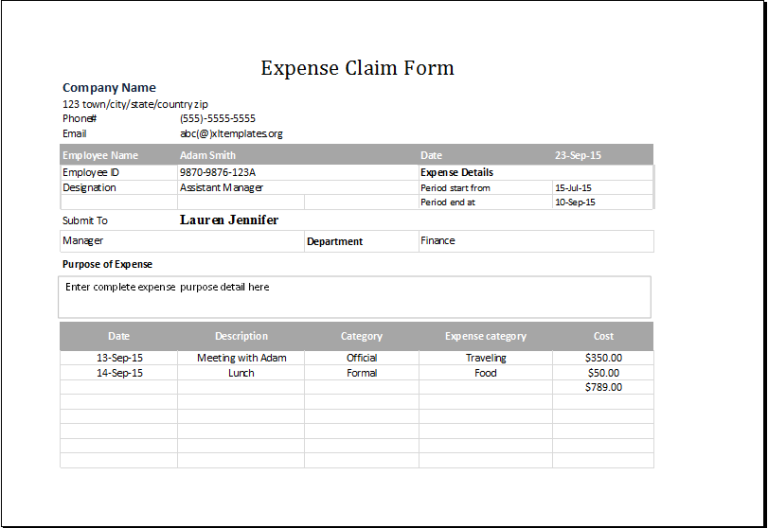

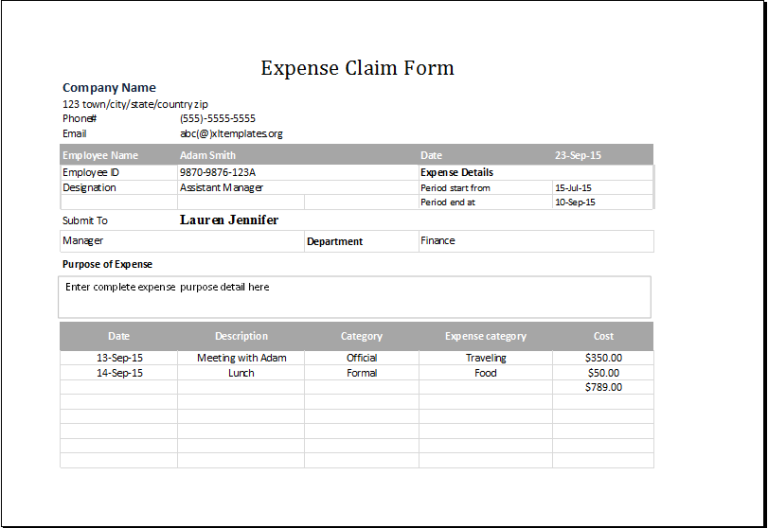

Expenses Form Template Free In With Images My XXX Hot Girl

https://www.xltemplates.org/wp-content/uploads/2016/02/expense-claim-form-1-768x528.png

What Expenses Can I Put Against My Tax Return As A Stoke on Trent

https://www.belvoir.co.uk/stoke-on-trent-estate-agents/wp-content/uploads/sites/138/2021/05/Expenses-1-scaled.jpg

https://www.gov.uk/guidance/job-expenses-for-uniforms-work-clothing...

Verkko 84 rivi 228 nbsp 0183 32 1 tammik 2015 nbsp 0183 32 Flat rate expenses sometimes known as a flat rate

https://www.theaccountancy.co.uk/expenses/…

Verkko 15 toukok 2023 nbsp 0183 32 As we ve already covered if you re self employed you can claim the cost of buying uniform as a business expense

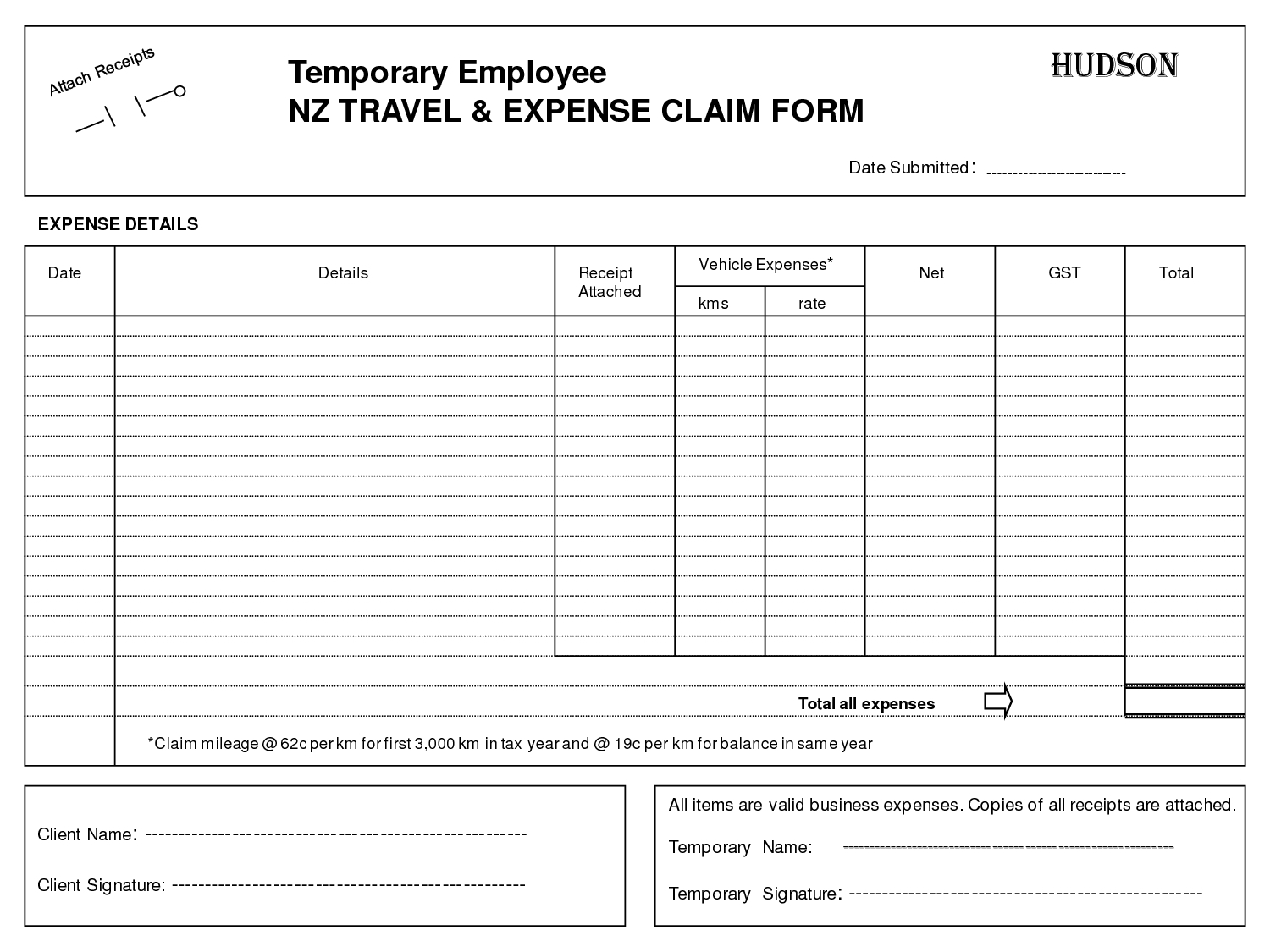

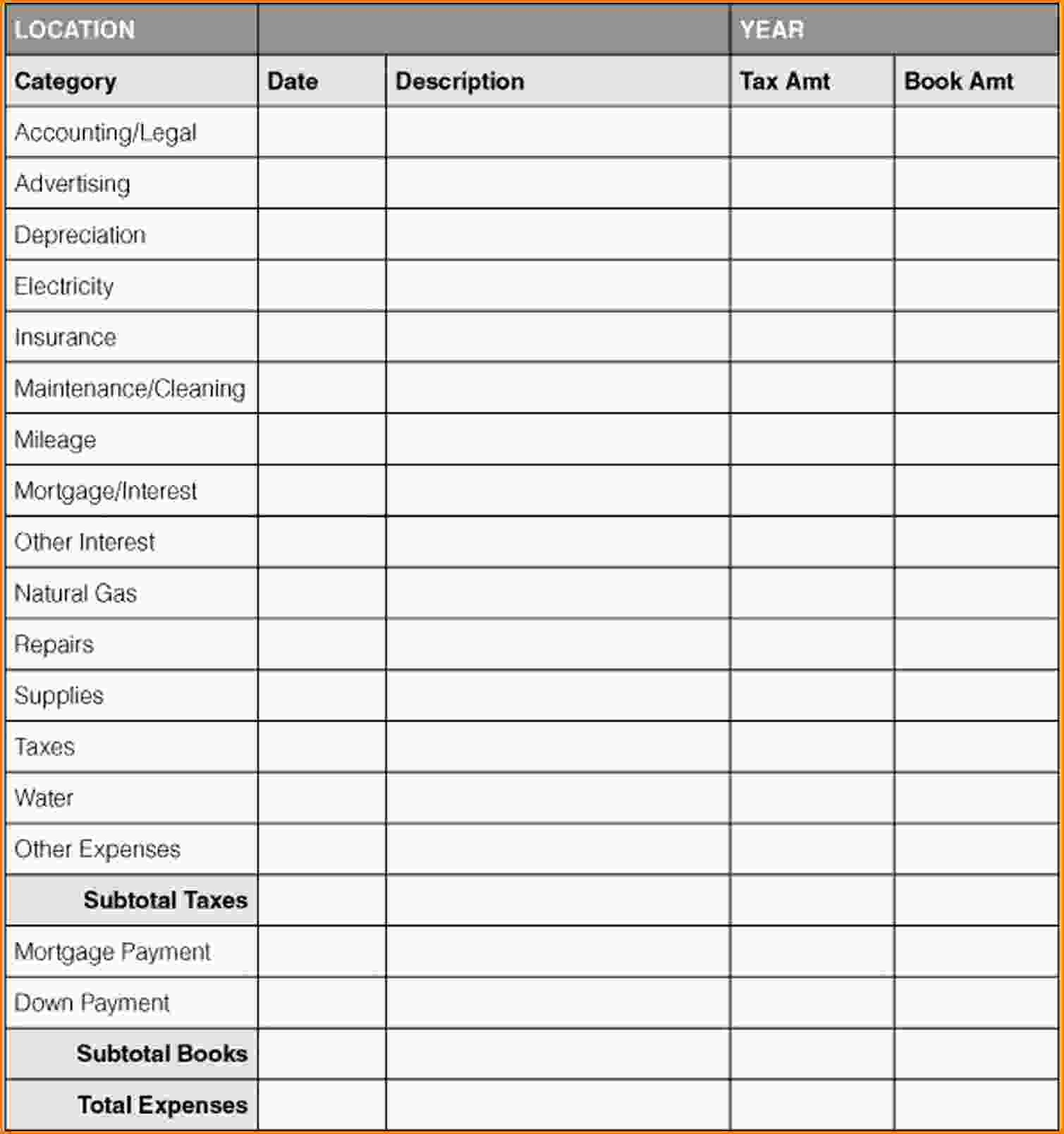

Expense Claim Sheet

Expenses Form Template Free In With Images My XXX Hot Girl

Work Uniform Expenses Claim Work Uniform Tax Deductions

Ms Excel Expense Claim Form Template Word Excel Templates Vrogue

The Ultimate List Of Self Employed Expenses You Can Claim

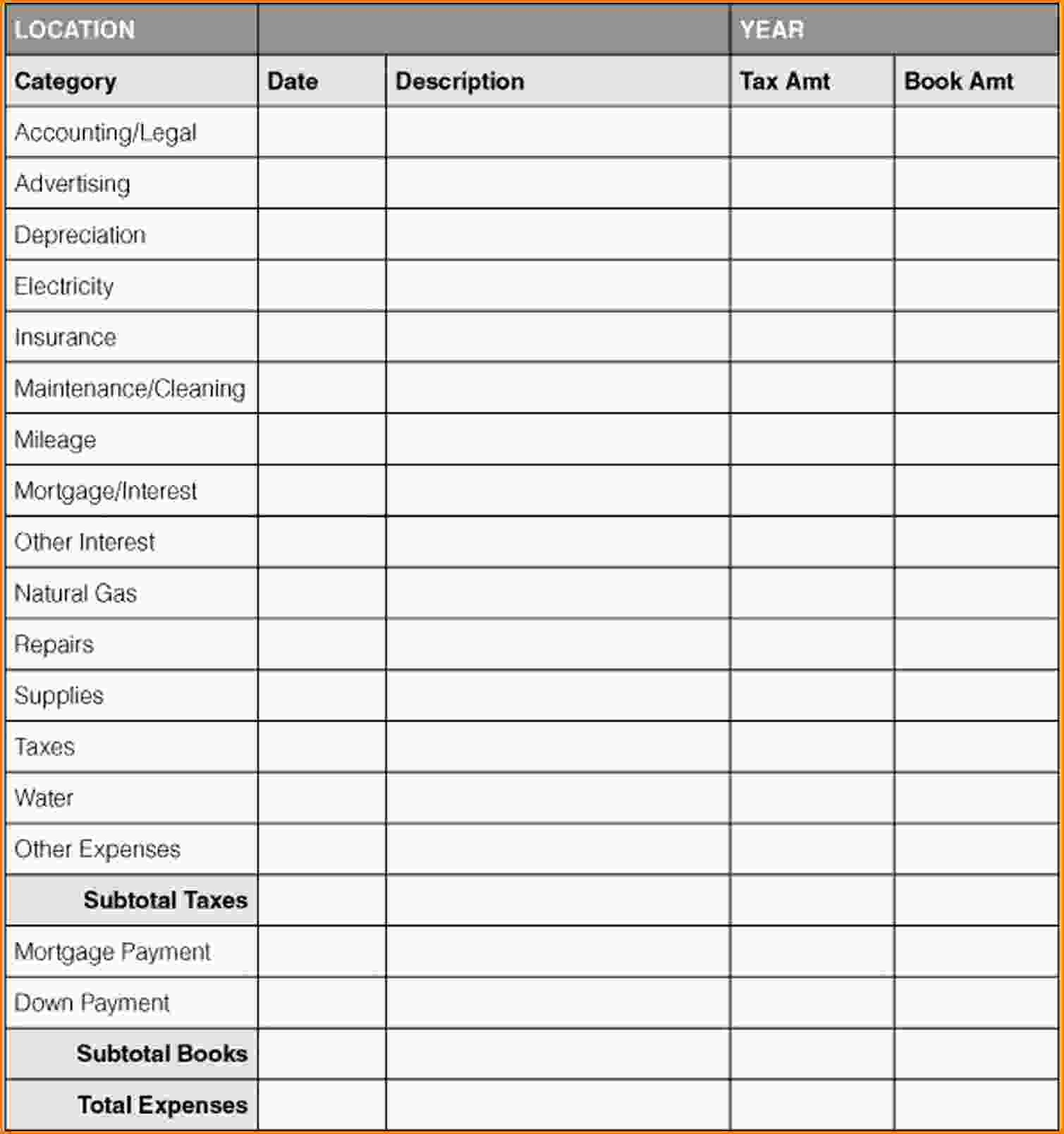

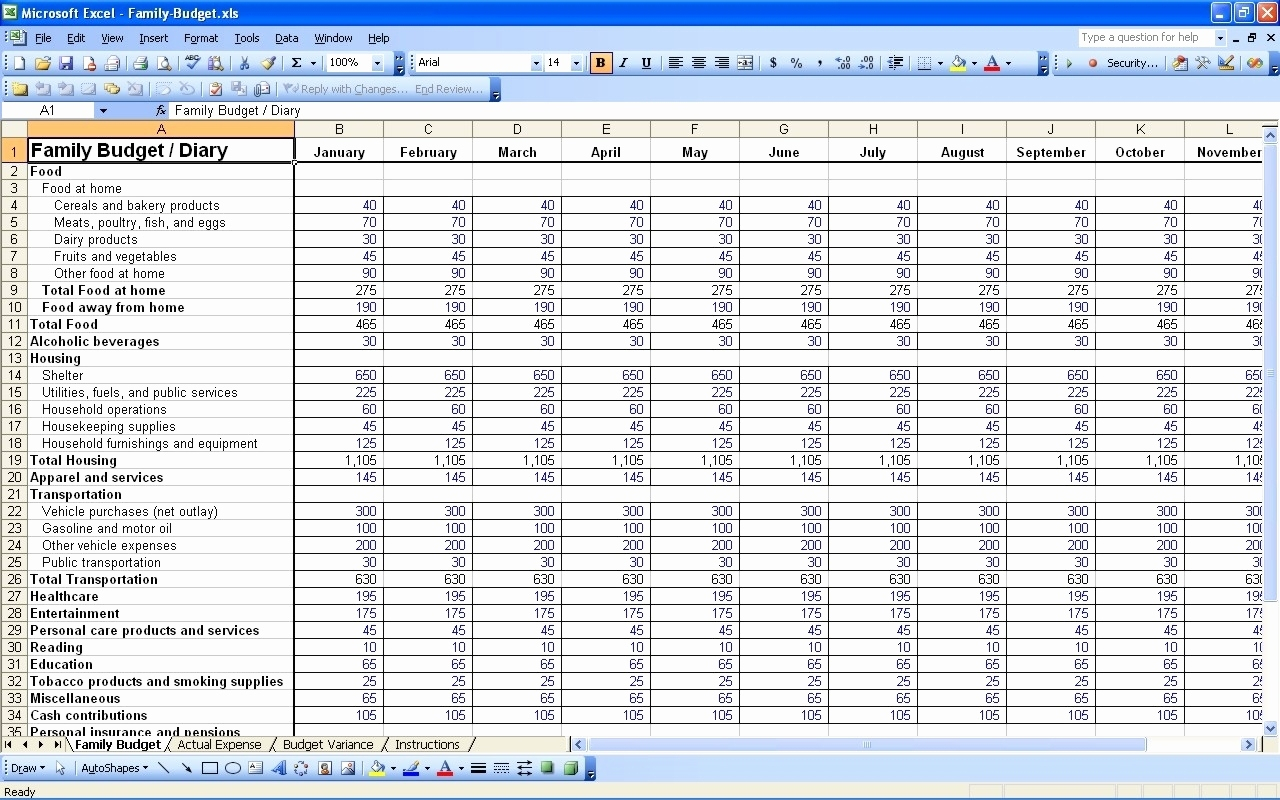

Small Business Excel Accounting Worksheet New Excel Accounting With

Small Business Excel Accounting Worksheet New Excel Accounting With

How To Claim Home Office Utility Expenses On Taxes Liu Associates

Tax Expenses Spreadsheet Template

Businesses Receiving A Compulsory Purchase Order What Can I Claim For

What Uniform Expenses Can I Claim - Verkko 29 jouluk 2023 nbsp 0183 32 The cost of maintaining their uniforms should be dealt with via their tax code with their tax free personal allowance raised to compensate And if you re self employed instead of claiming via the