What Us Legislation Provides Transferable Tax Credits For Renewable Energy Production The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022

Inflation Reduction Act related Guidance https www irs gov inflation reduction act of 2022 The renewable electricity production tax credit PTC is a per With the passage of the IRA certain renewable energy tax credits can now be transferred sold by those generating eligible credits to any qualified buyer seeking

What Us Legislation Provides Transferable Tax Credits For Renewable Energy Production

What Us Legislation Provides Transferable Tax Credits For Renewable Energy Production

https://uploads-ssl.webflow.com/641c9a0e52893915f02c6f13/64bedc38c8788d2a9bf58f17_CARBON-STORAGE_C1.jpg

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Extending Tax Credits For Renewable Energy Projects Is It An

https://www.law.georgetown.edu/environmental-law-review/wp-content/uploads/sites/18/2021/01/renewable-energy-montage-705444748-Shutterstock_FotoIdee-980x552.jpg

The IRS has released proposed rules REG 101610 23 on transferring renewable energy credits The Inflation Reduction Act added IRC Section 6418 Transferable tax credits granted by the Inflation Reduction Act IRA have encountered delays and challenges during their implementation However there are promising

Recent IRS guidance on provisions of the Inflation Reduction Act that make it easier to purchase renewable energy tax credits is helping to attract new types of New Inflation Reduction Act Provisions Allow State Local and Tribal Governments Non profits U S Territories Rural Energy Co ops and More to Access

Download What Us Legislation Provides Transferable Tax Credits For Renewable Energy Production

More picture related to What Us Legislation Provides Transferable Tax Credits For Renewable Energy Production

Renewable Energy Adoption In Australia A Pioneering Role

https://www.solar-secure.com.au/images/blog/renewable-energy-adoption-in-australia.png

Renewable Energy Tax Credits Iowa Utilities Board

https://iub.iowa.gov/sites/default/files/banner/renewable_tax_credits.jpg

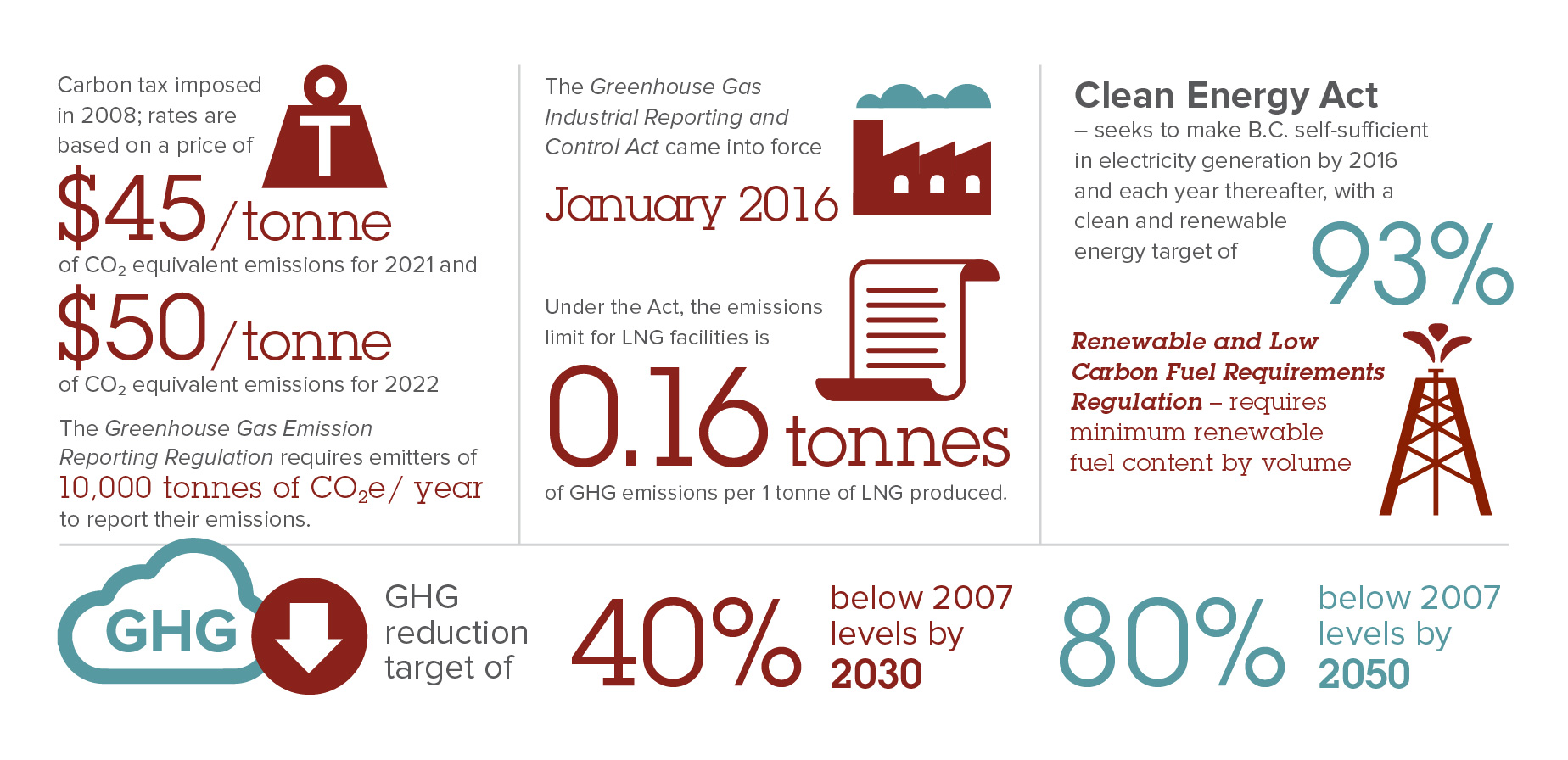

B C s Carbon And Greenhouse Gas Legislation

https://www.osler.com/osler/media/Osler/infographics/climate-change/20210617-ghg-BC.jpg

The Inflation Reduction Act removed the eligibility restrictions on governmental and tax exempt entities for clean energy credits by introducing direct pay which allows these entities to directly There are nine types of tax credits that can be sold U S tax code 45 45Y 48 48E 45Q 45V 45U 45Z 45X 48C and 30C set the rules for these credits The nine

By Ian Boccaccio The Inflation Reduction Act IRA of 2022 vastly increased funding and expanded federal tax credits available for renewable energy Elective pay and transferability Tax exempt and governmental entities that were generally unable to use tax credits can now benefit from clean energy tax credits

Federal Tax Credits To Support Affordable Housing In Detroit Friedman

https://friedmanrealestate.com/wp-content/uploads/2019/06/federal-tax-credits-to-support-affordable-housing.jpg

Colorado Tax Credits For Alternative fuel Vehicles Head To Senate

http://media.bizj.us/view/img/209831/bloombergphotochevroletvolt*1200.jpg

https://home.treasury.gov/news/press-releases/jy1830

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022

https://www.epa.gov/lmop/renewable-electricity...

Inflation Reduction Act related Guidance https www irs gov inflation reduction act of 2022 The renewable electricity production tax credit PTC is a per

Form 5695 Which Renewable Energy Credits Apply For The 2023 Tax

Federal Tax Credits To Support Affordable Housing In Detroit Friedman

Indiana A Guide To Tax Credits

Tax Credits For Giving Ozarks Food Harvest

The Value Of Investment Tax Credits For Your Business

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tax Credits Save You More Than Deductions Here Are The Best Ones

Can You Get A Tax Credit For Your Energy Saving Roof Slate Slate

Equipment Tax Credits For Primary Residences About ENERGY STAR

House Passes Historic Inflation Reduction Act V E Energy Update

What Us Legislation Provides Transferable Tax Credits For Renewable Energy Production - The Inflation Reduction Act of 2022 provides for the transferability of certain renewable energy tax credits including the investment tax credit ITC As preliminary