When Are Tax Rebates Due 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

Keep in mind that the tax deadline will be back to the normal April 15 2024 except for residents of Maine and Massachusetts due to state holidays on April 15 their deadline is April 17 WASHINGTON The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season

When Are Tax Rebates Due 2024

When Are Tax Rebates Due 2024

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/Tax-Rebates-800x534.jpg

NY Tax Rebates Due In Late September

https://www.democratandchronicle.com/gcdn/-mm-/09fbf880b8eca7eaaca694c3a001559f21789c05/c=0-125-2105-1315/local/-/media/Rochester/2014/08/06/taxesimage.jpg?width=2105&height=1190&fit=crop&format=pjpg&auto=webp

Tax Rebates Worth At Least 75 To Start Going Out To 25 000 People This Week All You Need To

https://www.the-sun.com/wp-content/uploads/sites/6/2022/02/CW-COMP-MONEY-TIME-TO-ACT-US.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief We estimate on a conventional basis the tax deal would be roughly revenue neutral raising about 40 million from 2024 through 2033 The revenue losses from retroactively changing bonus depreciation R D expensing the interest limitation and the child tax credit amount to 110 billion and are reflected in 2024 in the table below because that is when tax revenues would change

The third estimated tax payment is due on Sept 16 2024 This is for taxes on money you earned from June 1 through Aug 31 The deadline is usually Sept 15 but it s Sept 16 in 2024 that date 2024 IRS tax calendar Use the calendar below to track the due dates for IRS tax filings each month Unless otherwise noted the dates are when the forms are due to be submitted to the IRS Download our complete 2024 Tax Calendar to keep your tax filing on track January January 2 Form 730 Monthly Tax Return for Wagers Nov 2023

Download When Are Tax Rebates Due 2024

More picture related to When Are Tax Rebates Due 2024

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Tax Rebates Review Of Tax Credits On The Agenda For Senate GOP

https://www.onlineathens.com/gcdn/presto/2023/01/26/NABH/eaccab76-da40-4b0b-8342-f8651981ad35-gooch-steve-752.jpg?crop=3808,2142,x0,y856&width=3200&height=1800&format=pjpg&auto=webp

1 000 Tax Rebate Residents In This State May Receive Extra Money This Summer Here s How To Be

https://1075914428.rsc.cdn77.org/data/thumbs/full/270850/820/0/0/0/tax-rebates-2023-eligible-americans-to-receive-up-to-3-000-heres-when-and-how.jpg

The proposed law would increase these amounts for property placed in service after 2023 For property placed in service in 2024 the deduction limitation is increased to 1 29 million and the expense limitation is increased to 3 22 million These amounts would be adjusted for inflation in tax years beginning after 2024 Employee Retention Tax Table of Contents When can I file my 2023 tax return the taxes you file in 2024 When is the deadline for filing my 2023 tax return What is the standard deduction for 2023 tax returns What are the 2023 tax law changes and the tax implications

IR 2024 01 Jan 4 2024 WASHINGTON The Internal Revenue Service encourages taxpayers to check out IRS gov for tips tools and resources to help them get ready to file their 2023 federal income tax return This is the third in a series of reminders to help taxpayers get ready for the upcoming filing season Sacramento The California Franchise Tax Board FTB kicked off the 2024 tax filing season by providing taxpayers with important information on cash back tax credits disaster loss relief and the advantages of filing electronically Taxpayers must pay any taxes owed by April 15 to avoid penalties The FTB started accepting state tax returns this month

Tax Rebates Who Will Start Receiving Checks Of Up To 1 000 From Today Marca

https://phantom-marca.unidadeditorial.es/8477fc2f6004169d9e59851ec62d16d0/resize/1320/f/jpg/assets/multimedia/imagenes/2022/11/01/16673106591434.jpg

Tax Rebates Are On The Way

https://static.wixstatic.com/media/3bbca9_510c41d2cd474aa78847d791ee8470ab~mv2.png/v1/fill/w_1000,h_568,al_c,q_90,usm_0.66_1.00_0.01/3bbca9_510c41d2cd474aa78847d791ee8470ab~mv2.png

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

https://www.cpapracticeadvisor.com/2023/11/22/estimated-2024-irs-tax-refund-calendar/97604/

Keep in mind that the tax deadline will be back to the normal April 15 2024 except for residents of Maine and Massachusetts due to state holidays on April 15 their deadline is April 17

Tax Rebate Services Find Out If You re Due A Tax Refund

Tax Rebates Who Will Start Receiving Checks Of Up To 1 000 From Today Marca

Over 80mn Americans To Receive Tax Rebates Directly In Their Accounts In 24 Hrs Ummid

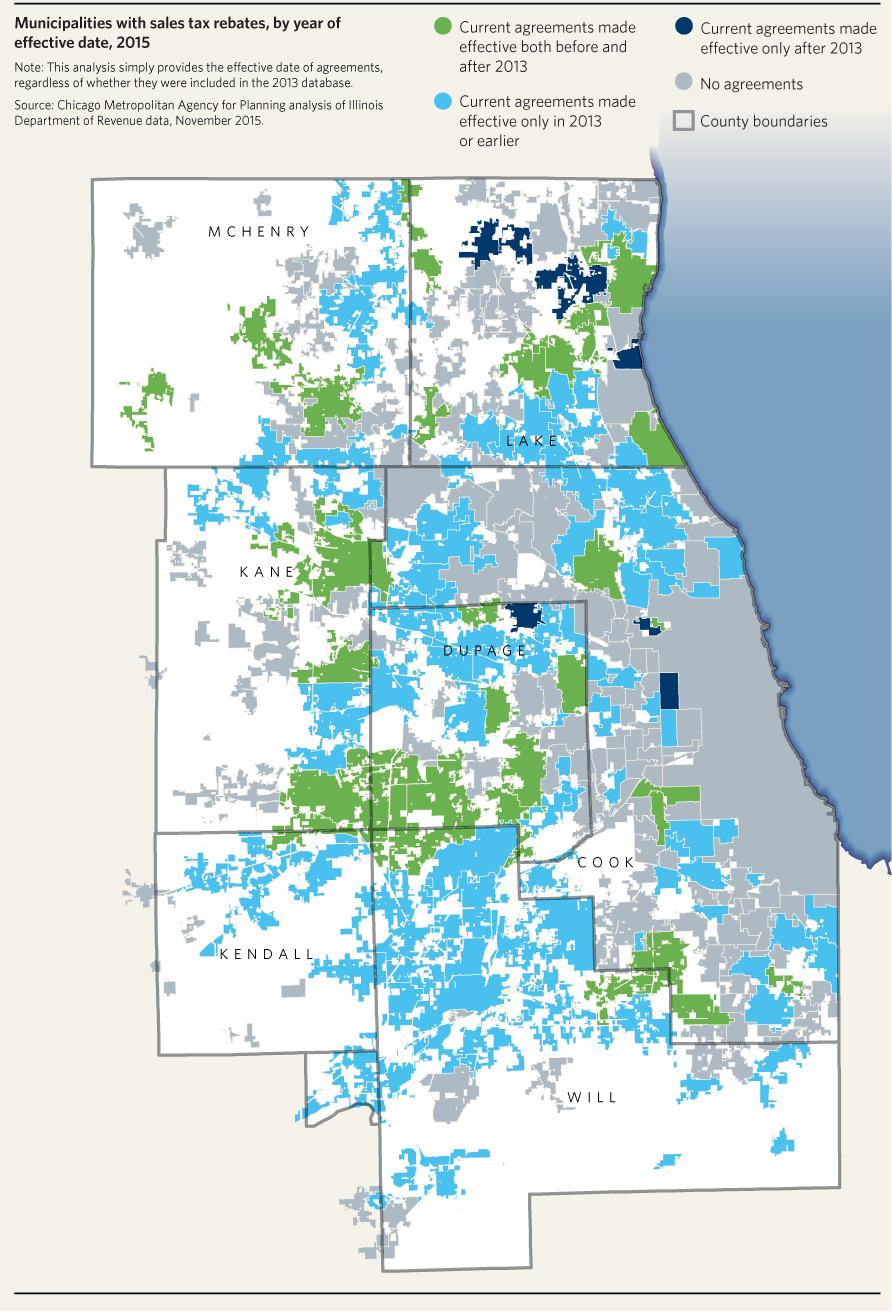

Sales Tax Rebates Remain Prevalent In Northeastern Illinois CMAP

TaxHoot TaxHoot

Calam o Get Up To 26 000 Per Employee In Tax Rebates Claim Funding With CPA Help

Calam o Get Up To 26 000 Per Employee In Tax Rebates Claim Funding With CPA Help

Solar Tax Credits Rebates Missouri Arkansas

What Are The Due Dates For Filing ITR Forms In AY 2023 2024

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg?strip=all)

Emancipation Day Dc 2023 Day 2023

When Are Tax Rebates Due 2024 - April 15 Due date of filing a tax return or requesting an extension for most of the nation April 17 Due date for Maine and Massachusetts Oct 15 Due date for extension filers