When Can A Business Claim Vat Back When can you claim a VAT refund If you are charged VAT on business activities in an EU country where you are not established you may be entitled to have the VAT refunded by the authorities in that country

Only VAT registered businesses can claim back VAT Every business with a turnover of 90 000 must register but you can register voluntarily if your turnover is below this level Once registered you ll have to charge VAT on the goods and services you sell but you can also claim it back on the expenses your business incurs Claiming a refund on or after 1 January 2021 If you re charged VAT in an EU member state you ll normally be able to reclaim this from the tax authority in that country You ll need to

When Can A Business Claim Vat Back

When Can A Business Claim Vat Back

https://www.xero.com/content/dam/xero/pilot-images/guides/guide-to-gst-bas-vat/354050_Hero_Guide to VAT_claimingx2.1646877578209.png

Can You Claim Back VAT Without Receipt Accountant s Answer

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/10/Can-you-claim-back-VAT-without-a-receipt.jpg

Can You Claim Vat Back On Fuel Without A Receipt 2024 Updated

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/can-you-claim-vat-back-on-fuel-without-a-receipt_447356-1.jpg

Contents Charging VAT When not to charge VAT VAT on discounts and gifts Reclaim VAT on business expenses Keeping VAT records Charging VAT All VAT registered businesses should now be signed Chapter 4 Claiming back VAT VAT registered businesses can claim back the VAT they pay on business expenses Let s learn how When you can claim VAT back You can claim VAT back when you ve purchased goods or services for your business a customer leaves you with a bad debt VAT on business expenses

Learn how to effectively claim back VAT for your business with this comprehensive guide Explore step by step instructions common FAQs and essential tips for a seamless VAT reclamation process Businesses can generally claim back VAT on goods purchased up to four years before VAT registration or services bought up to six months before being registered for VAT

Download When Can A Business Claim Vat Back

More picture related to When Can A Business Claim Vat Back

How To Claim VAT Back On Expenses

https://goselfemployed.co/wp-content/uploads/2019/07/claiming-back-vat.png

Can A Business Claim VAT Back On An Electric Car

https://images.ctfassets.net/rww4geymw7g8/5gK0X2rhuT9Ibc7KOEK3PO/4e57ae2019bd7baf202373e4be104ee5/business-claim-vat-banner.png?w=640&q=75

Can Charities Claim Back VAT Helpful Guide AccountingFirms

https://www.accountingfirms.co.uk/wp-content/uploads/2022/11/can-charities-claim-back-VAT.png

You can only claim back VAT if you are a VAT registered business Your business must be registered for VAT if your VAT taxable revenue has exceeded 85 000 over the past 12 months Your VAT taxable revenue is the total value of everything you sell that is not exempt from VAT A business registered for VAT in one EU member state can reclaim VAT incurred in another member state However where the business is registered or otherwise liable or

The deadline for claiming VAT incurred on expenses in the EU on or before 31 December 2020 was 31 March 2021 How to claim a refund on or after 1 January 2021 Any VAT incurred in EU member states can be claimed via the following systems the EU VAT refund system the 13th Directive process Who should use the EU VAT refund system To request a refund claimants must send an electronic refund claim to their own national tax authorities who will confirm the claimant s identity VAT identification number and the validity of the claim The request will then be forwarded

VAT Refund In UK For Non established Businesses FastVAT

https://fastvat.com/wp-content/uploads/2022/12/Vat-refund-in-UK-Fastvat.png

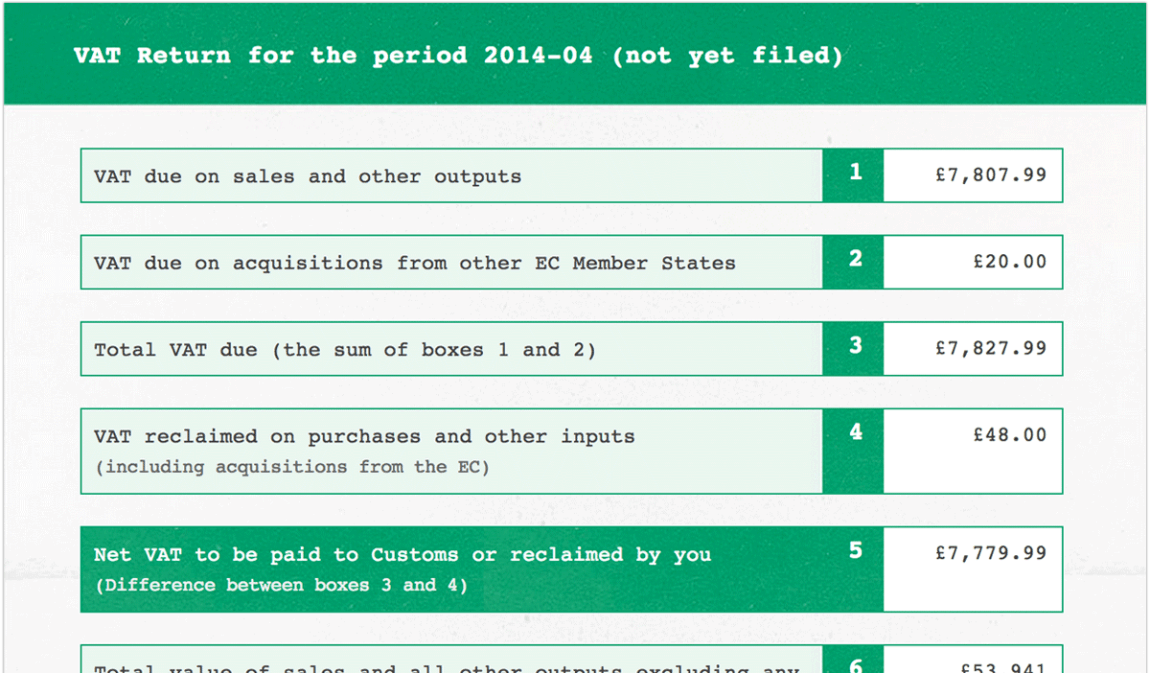

FreeAgent VAT Online Submission 1Stop Accountants

https://1stopaccountants.co.uk/wp-content/uploads/2014/10/freeagent-vat-return-example-1150x673.png

https://europa.eu/youreurope/business/taxation/vat/vat-refunds

When can you claim a VAT refund If you are charged VAT on business activities in an EU country where you are not established you may be entitled to have the VAT refunded by the authorities in that country

https://www.unbiased.co.uk/discover/tax-business/...

Only VAT registered businesses can claim back VAT Every business with a turnover of 90 000 must register but you can register voluntarily if your turnover is below this level Once registered you ll have to charge VAT on the goods and services you sell but you can also claim it back on the expenses your business incurs

Can A Business Claim Refund Of VAT On Its Expenses

VAT Refund In UK For Non established Businesses FastVAT

How To Claim Back VAT As A Small Business

Why Businesses Are Allowed To Claim VAT Back Online Accounting Guide

Can I Claim Back VAT Small Business UK

How Can You Claim VAT Back LJS Accounting Services

How Can You Claim VAT Back LJS Accounting Services

Can Businesses Claim Vat Back Icsid

When Can A Business Claim The JobKeeper Payment For A Business

The Right To Claim Back VAT

When Can A Business Claim Vat Back - If you buy second hand goods they have different rules when it comes to reclaiming VAT Claiming VAT on previous costs If you decide to register to VAT you can use your first