When Will Property Tax Rebate Checks Be Mailed 2024 2025 Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax

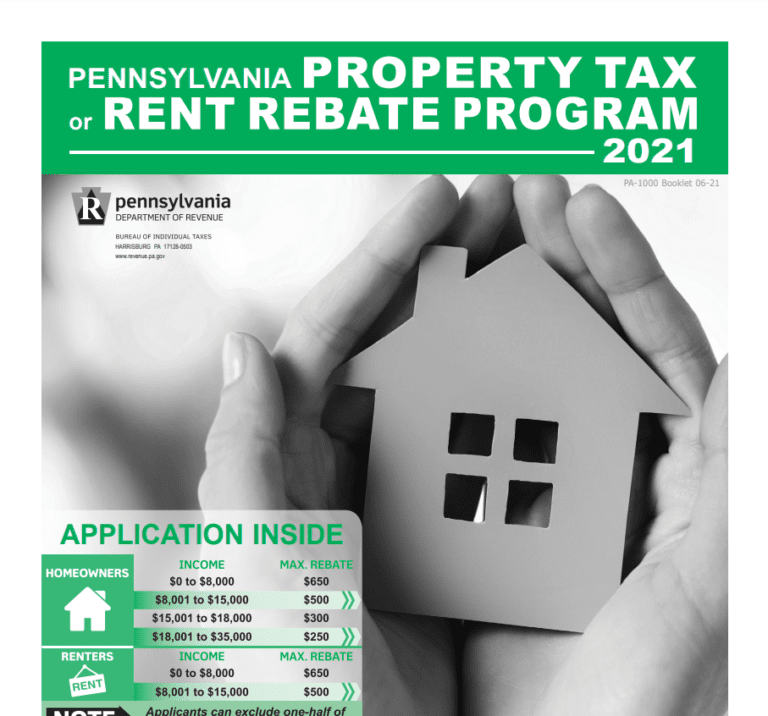

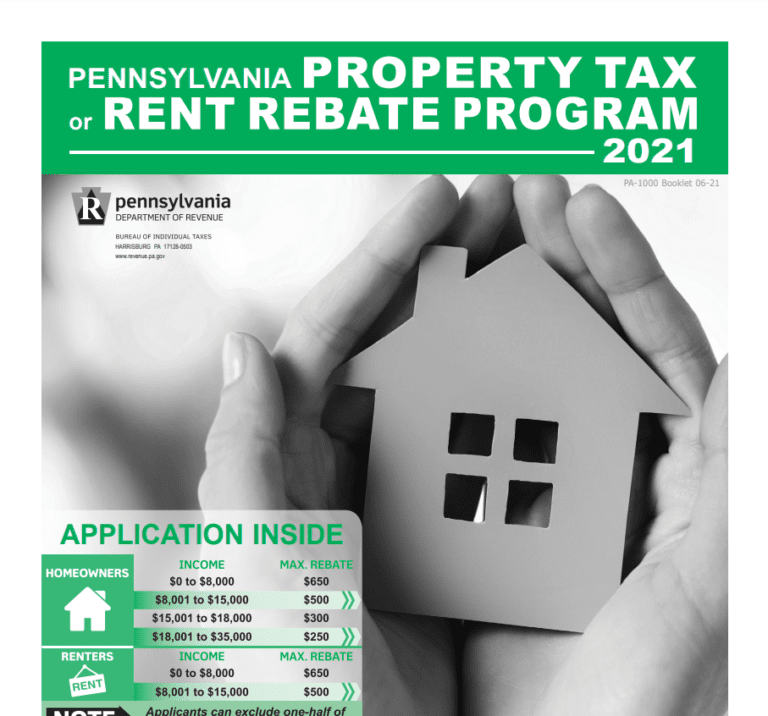

Payments will be made by direct deposit or check mailed to the applicant depending on the payment option you choose on your application With expanded income requirements nearly 175 000 more Pennsylvanians will be eligible to receive the Property Tax Rent Rebate in 2024 The majority of the 430 000 past claimants may see increased rebates In 2024 Gov Josh Shapiro said that older residents would receive more financial help courtesy of his signed Act 7 of 2023 The law expanded the Property Tax Rent Rebate to provide a larger tax

When Will Property Tax Rebate Checks Be Mailed 2024 2025

When Will Property Tax Rebate Checks Be Mailed 2024 2025

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

State Mailing Out 2 5M Property Tax Rebate Checks Newsday

https://cdn.newsday.com/ace/c:NGJiMDY3ZDgtOGE3ZC00:OWQ0ODc1/landscape/1280

Nys Property Tax Rebate Checks 2023 Eligibility Application Process Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Nys-Property-Tax-Rebate-Checks-2023.jpg?resize=768%2C555&ssl=1

The checks are part of the 1 billion in tax cuts Beginning February 13 2024 hundreds of thousands of Michigan residents will benefit from a 550 check in their mails The checks are part of The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 in 2025 as well as apply an inflation adjustment in 2025 that would make the cap match the credit maximum of 2 100 It would also quicken the phase in for taxpayers with multiple children and allow taxpayers an election to use

04 23 Rebates for eligible seniors widows widowers and people with disabilities HARRISBURG PA 17128 0503 www revenue pa gov IMPORTANT DATES Application deadline JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half New York State begins mailing out homeowner tax rebate credit checks wgrz 19 Closings The one year program was initiated to provide property tax relief to homeowners in 2022

Download When Will Property Tax Rebate Checks Be Mailed 2024 2025

More picture related to When Will Property Tax Rebate Checks Be Mailed 2024 2025

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

Property Tax Rebate Checks From New Jersey Who Will Get Them How Much And When ValueWalk

https://www.valuewalk.com/wp-content/uploads/2021/09/USD_dollar_1633017495.jpg

Ny Property Tax Rebate Checks 2023 RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/tax-rebate-checks-come-early-this-year-yonkers-times-7.jpg

ALBANY As many as 200 000 New Yorkers are still waiting for their Homeowner Tax Relief checks which the state began mailing in June under an expedited plan to combat inflation and help New Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

Minnesota rebate checks were sent beginning in mid August of last year to about 2 5 million Minnesota households The one time payments of up to 1 300 sometimes called Walz checks or Under current law the program would fund direct credits that could cut property tax bills in half for homeowners ages 65 and older making up to 500 000 annually with a maximum planned annual credit of 6 500

2022 Pa Property Tax Rebate Forms PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/return-to-claim-notice-4.jpg

Income Property Tax Rebate Checks To Be Mailed To Illinois Residents Starting Monday NBC Chicago

https://media.nbcchicago.com/2020/10/cubs_money.jpg?quality=85&strip=all

https://www.irs.gov/newsroom/get-ready-to-file-in-2024-whats-new-and-what-to-consider

Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRentRebateProgram/Pages/default.aspx?SiteID=1

Payments will be made by direct deposit or check mailed to the applicant depending on the payment option you choose on your application With expanded income requirements nearly 175 000 more Pennsylvanians will be eligible to receive the Property Tax Rent Rebate in 2024 The majority of the 430 000 past claimants may see increased rebates

Thousands Of NYers Still Waiting For Property Tax Rebate Checks Newsday

2022 Pa Property Tax Rebate Forms PropertyRebate

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Two Million Americans Could Get Automatic Checks Worth 970 Under State Proposal Are You

Property Tax Rebate Pennsylvania LatestRebate

Where To Mail Pa Property Tax Rebate Form Amended Printable Rebate Form

Where To Mail Pa Property Tax Rebate Form Amended Printable Rebate Form

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

PA Property Tax Rebate Forms Printable Rebate Form

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

When Will Property Tax Rebate Checks Be Mailed 2024 2025 - The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 in 2025 as well as apply an inflation adjustment in 2025 that would make the cap match the credit maximum of 2 100 It would also quicken the phase in for taxpayers with multiple children and allow taxpayers an election to use