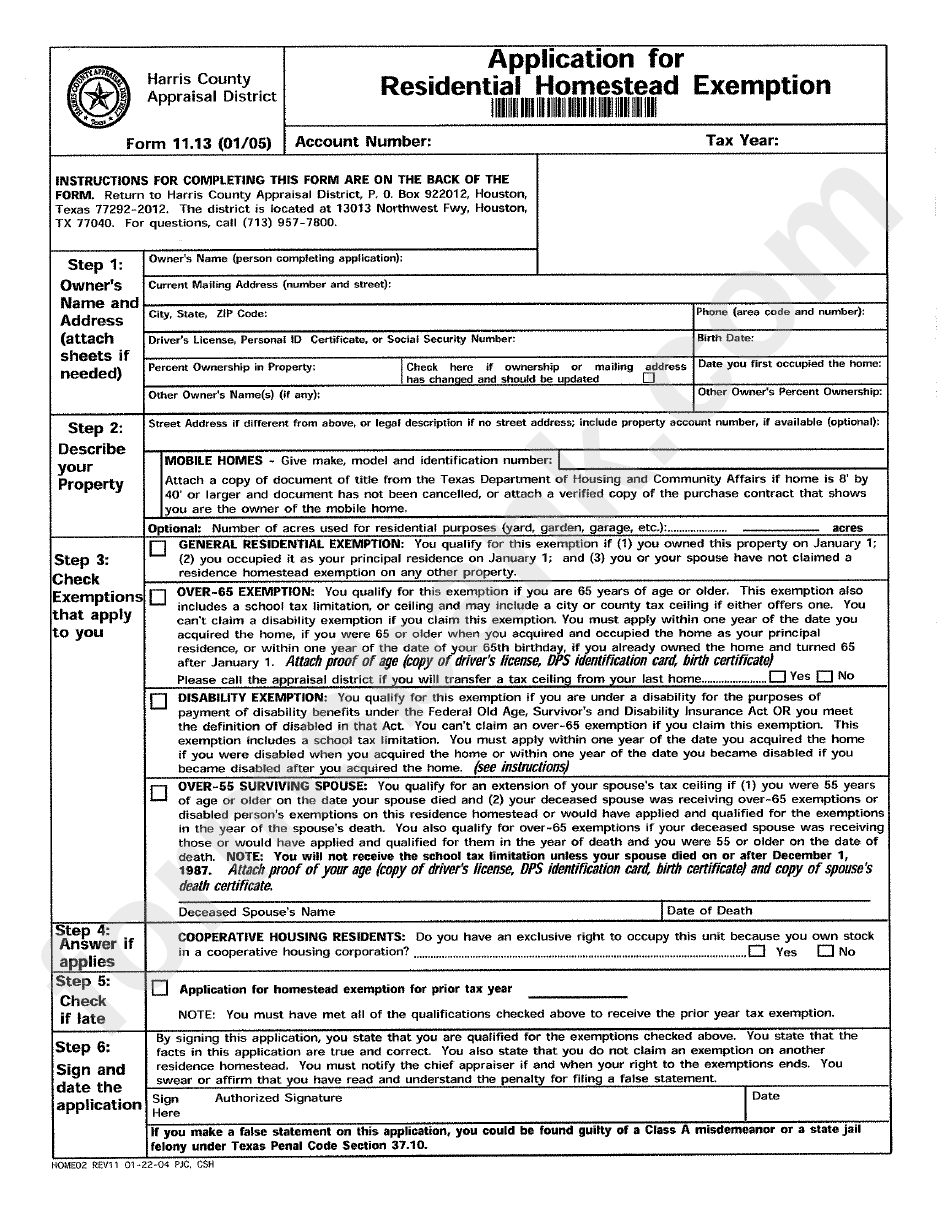

Where Do I Mail My Homestead Exemption Form GENERAL INSTRUCTIONS Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in which the

Location and address information for the appraisal district office in your county may be found at comptroller texas gov propertytax references directory cad GENERAL INSTRUCTIONS This Applications are taken year round The statutory filing deadline is March 1 with late filed applications taken up to the 25th day after the mailing of the yearly Notice of Proposed Property Taxes TRIM which is typically mailed in August

Where Do I Mail My Homestead Exemption Form

Where Do I Mail My Homestead Exemption Form

https://www.cityofcarrollton.com/home/showpublishedimage/26251/637914473903370000

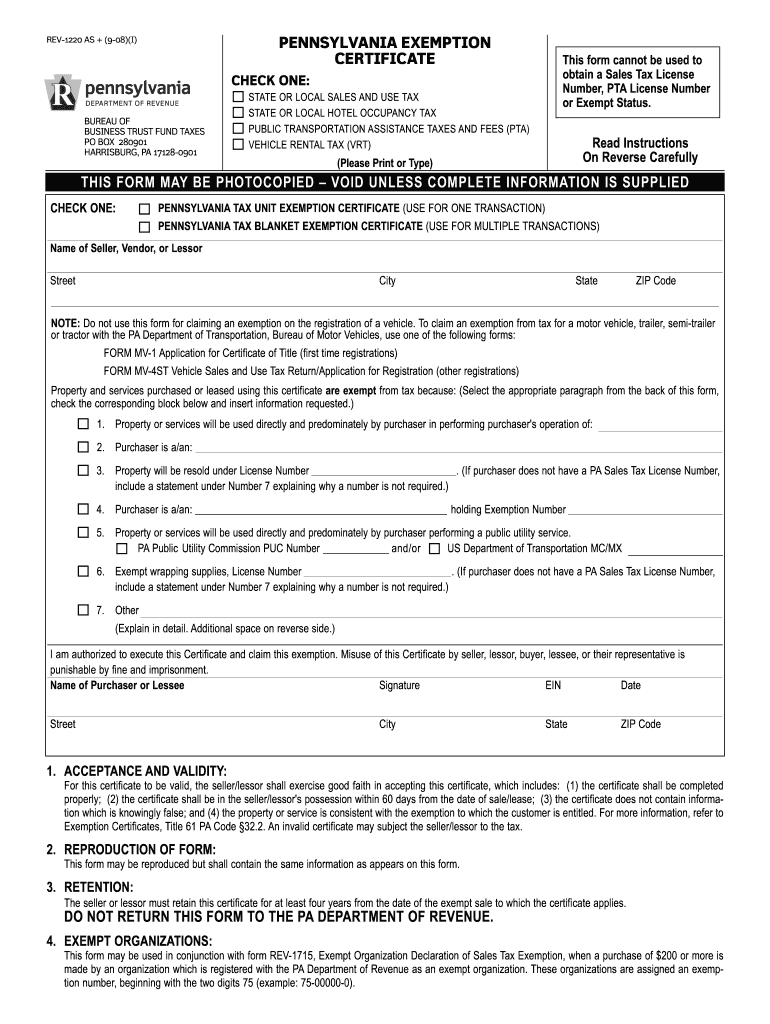

Pa Exemption Certificate Fill Out And Sign Printable PDF Template

https://www.exemptform.com/wp-content/uploads/2022/08/pa-exemption-certificate-fill-out-and-sign-printable-pdf-template-4.png

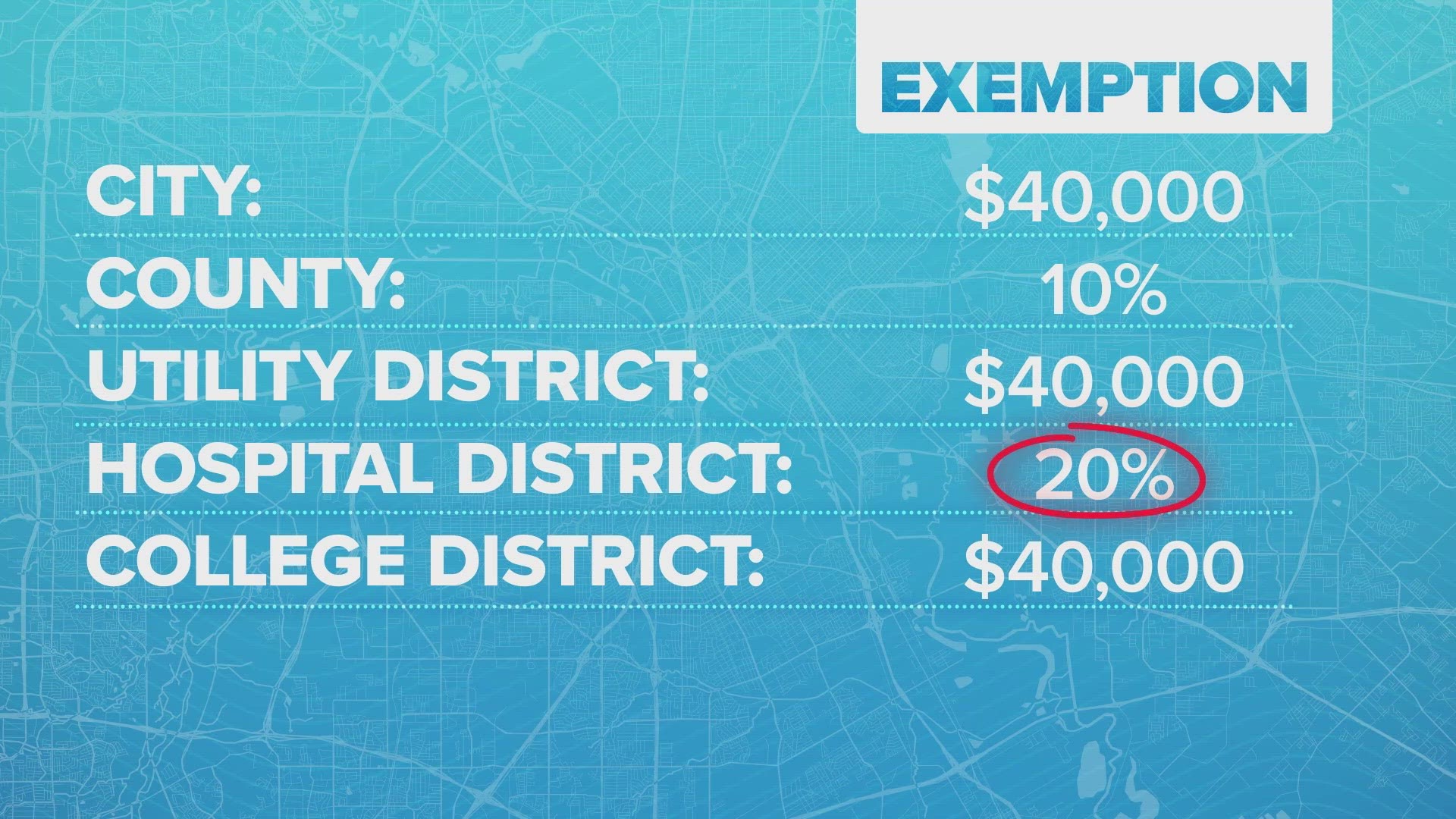

What To Know About Homesteads In Texas Wfaa

https://media.wfaa.com/assets/WFAA/images/660c02e6-aeff-4efa-8275-688205a6129d/660c02e6-aeff-4efa-8275-688205a6129d_1920x1080.jpg

File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between Jan 1 and April 30 of the year for which the You can apply for your homestead exemption online on your appraisal district website Else you can apply form 50 114 and submit to your county appraisal district

To better serve the residents of Lee County you may file for exemption in person by mail or on line The statutory timely filing period is January 1 through March 1 Late filed To claim your homestead exemption in Denton County you can mail or drop off your application form at the Denton Central Appraisal District office at 3911 Morse Street Denton TX 76208

Download Where Do I Mail My Homestead Exemption Form

More picture related to Where Do I Mail My Homestead Exemption Form

Texas Homestead Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/tx-application-for-residential-homestead-exemption-collin-county-2.png

Applying For A Homestead Exemption In Texas Elena Garrett Realtor In

https://www.elenagarrett.com/wp-content/uploads/2022/01/Important-Tax-Exemption-Information2-p2.png

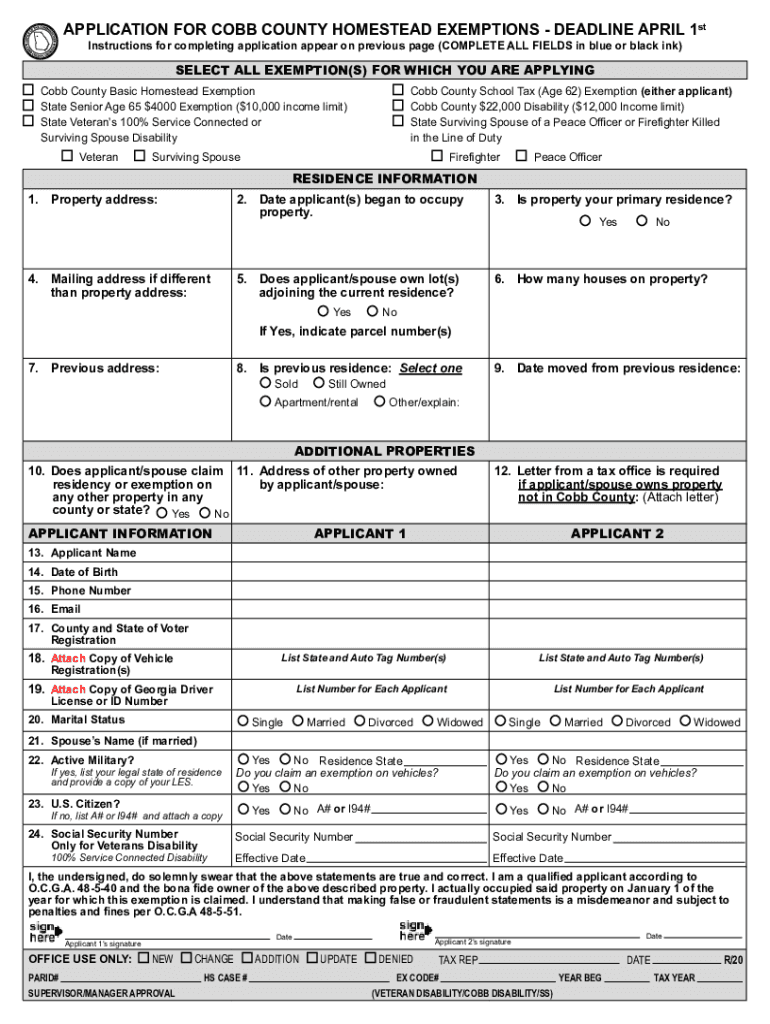

2020 Form GA Application For Cobb County Homestead Exemptions Fill

https://www.pdffiller.com/preview/479/580/479580693/large.png

Do you have your Residential Homestead Exemption To find out visit our website by clicking the green box here application and then mail to BCAD P O Box 830248 San Antonio TX 78283 For more information please call 210 School taxes All homeowners may receive a 100 000 homestead exemption for school taxes County taxes If a county collects a special tax for farm to market roads or flood

GENERAL RESIDENTIAL EXEMPTION You qualify for this exemption if 1 you owned this property on January 1 2 you occupied it as your principal residence on January 1 and 3 If Mailing Address is PO Box the Texas Driver License or Texas ID still has to match the situs both PO box and situs can be listed on the license id s The mailing address does not

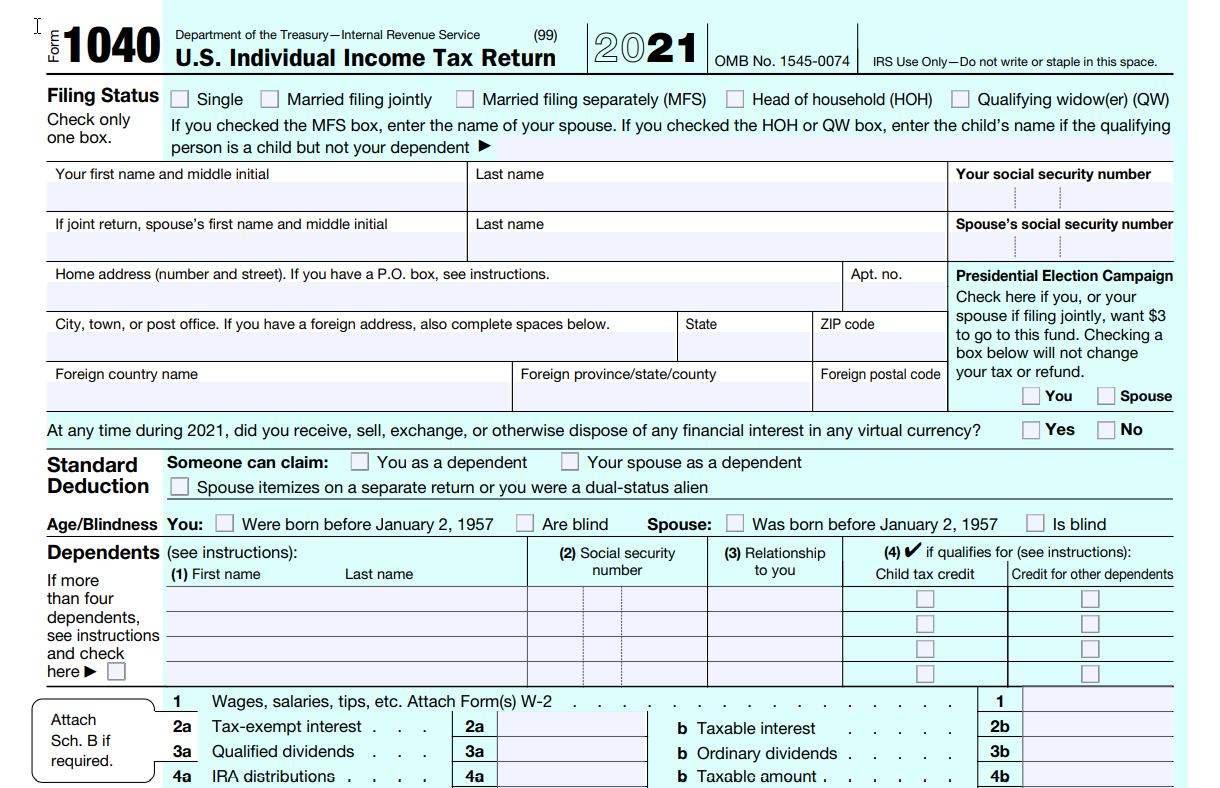

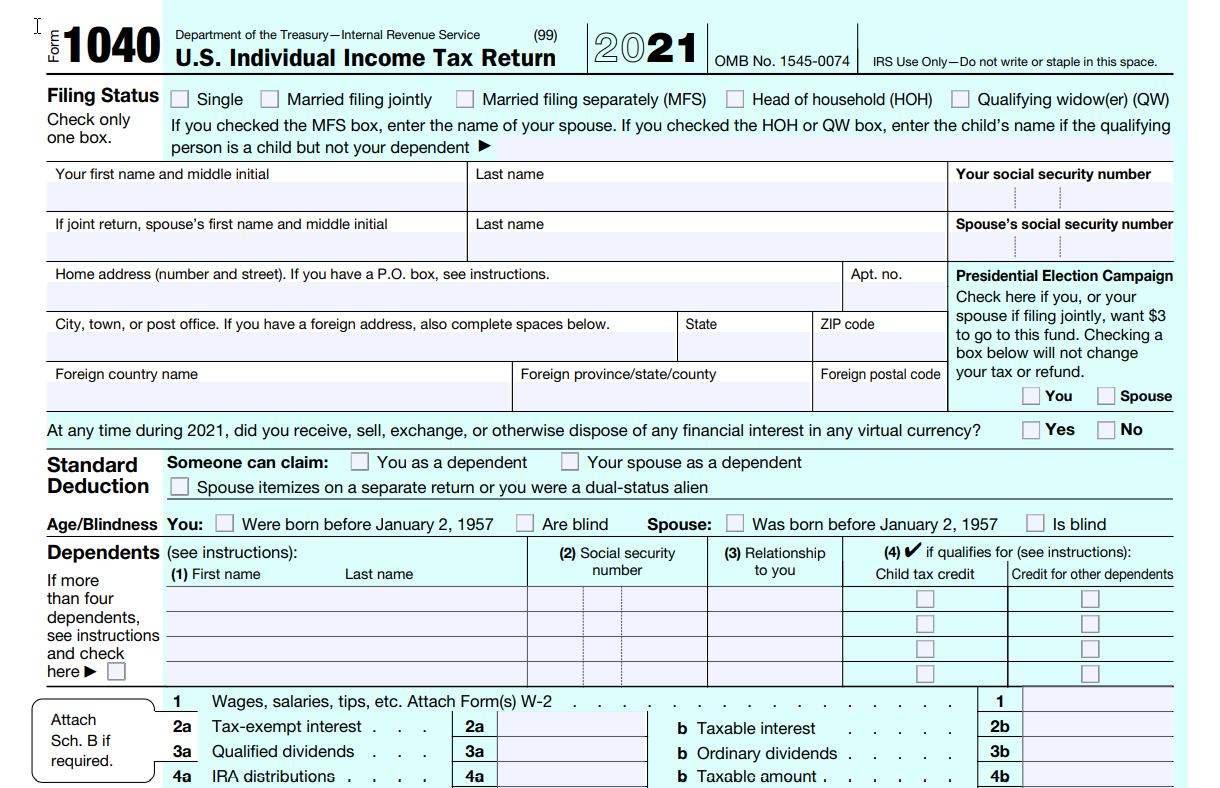

Where Do I Mail My Personal Tax Form 1040

https://www.loanglobally.com/wp-content/uploads/2022/06/form-1040-mailing-address.png

How To File Homestead Exemption Collin County YouTube

https://i.ytimg.com/vi/3oiXhVKFJu8/maxresdefault.jpg

https://www.bexar.org › ... › Homestead-Exemption

GENERAL INSTRUCTIONS Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in which the

https://kaufman-cad.org › ... › Homestead-Exemption.pdf

Location and address information for the appraisal district office in your county may be found at comptroller texas gov propertytax references directory cad GENERAL INSTRUCTIONS This

2021 Declaration Of Homestead Form Fillable Printable Pdf And Forms

Where Do I Mail My Personal Tax Form 1040

Application For Residential Homestead Exemption Tax Exemption Ownership

Homestead Exemption Form Fill Out Sign Online DocHub

2023 Homestead Exemption Form Printable Forms Free Online

Los Angeles County Homestead Declaration Form Fill Out Sign Online

Los Angeles County Homestead Declaration Form Fill Out Sign Online

Dallas Homestead Exemption Explained FAQs How To File

Harris County Homestead Exemption Form ExemptForm

Lorain County Homestead Exemption Fill And Sign Printable Template

Where Do I Mail My Homestead Exemption Form - Fill out the Homestead Tax Credit 54 028 form Return the form to your city or county assessor This tax credit continues as long as you remain eligible Applications are due by July 1 for the