Where Do You Put Interest Paid On Tax Return Enter interest from the IRS like a 1099Int and put the amount in box 1 Enter it manually and just enter IRS for the payer Don t enter any other info like the address or

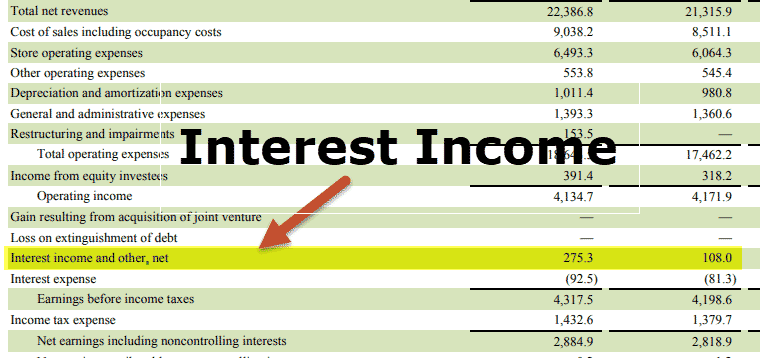

Sources of interest income include the money you put aside in a bank or money market account as well as on a few not so obvious sources bonds loans you made to others if the interest you charged Interest is an amount you pay for the use of borrowed money Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a

Where Do You Put Interest Paid On Tax Return

Where Do You Put Interest Paid On Tax Return

https://media.wfmynews2.com/assets/WFMY/images/c8486373-d681-4e4b-8901-d82069e767f9/c8486373-d681-4e4b-8901-d82069e767f9_1140x641.jpg

Understanding Your Forms W 2 Wage Tax Statement

https://blogs-images.forbes.com/kellyphillipserb/files/2015/03/w-2right.png

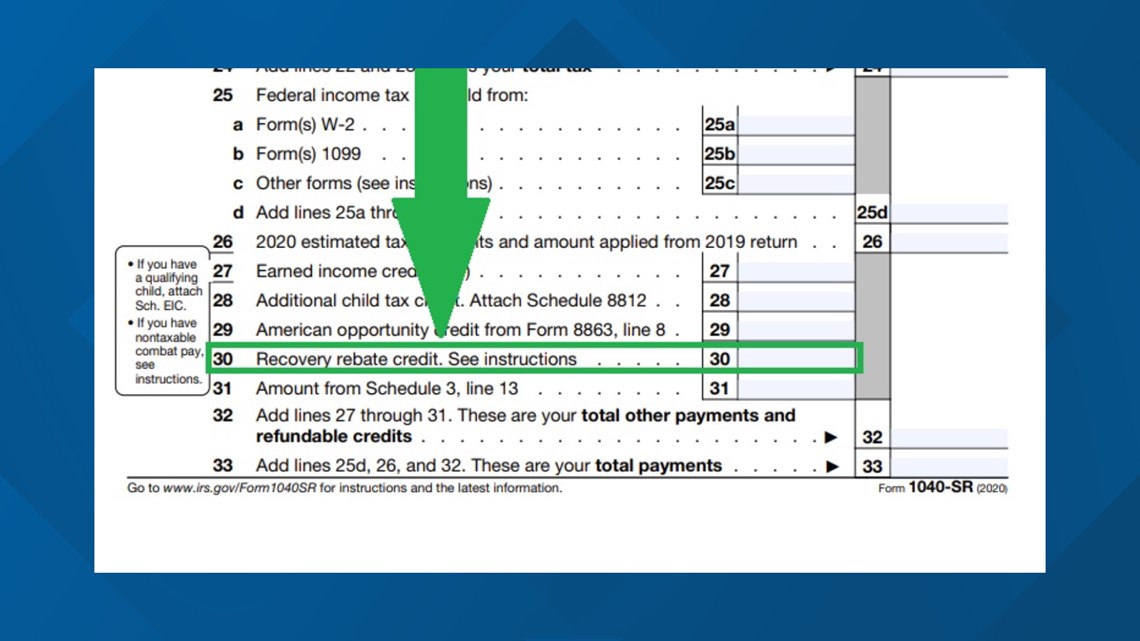

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

https://www.taxgirl.com/wp-content/uploads/2021/01/Screen-Shot-2021-01-10-at-3.09.05-PM.png

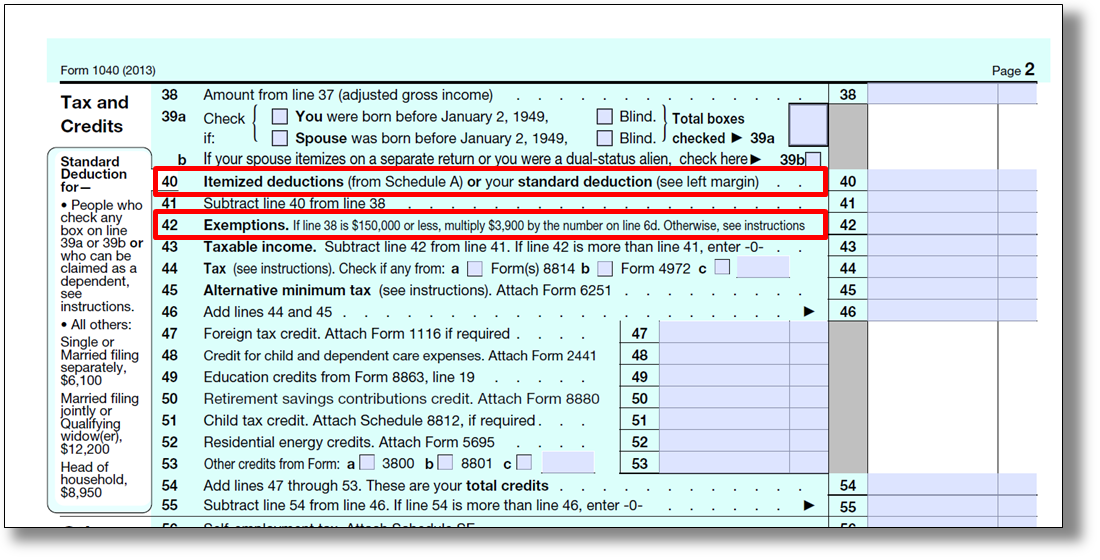

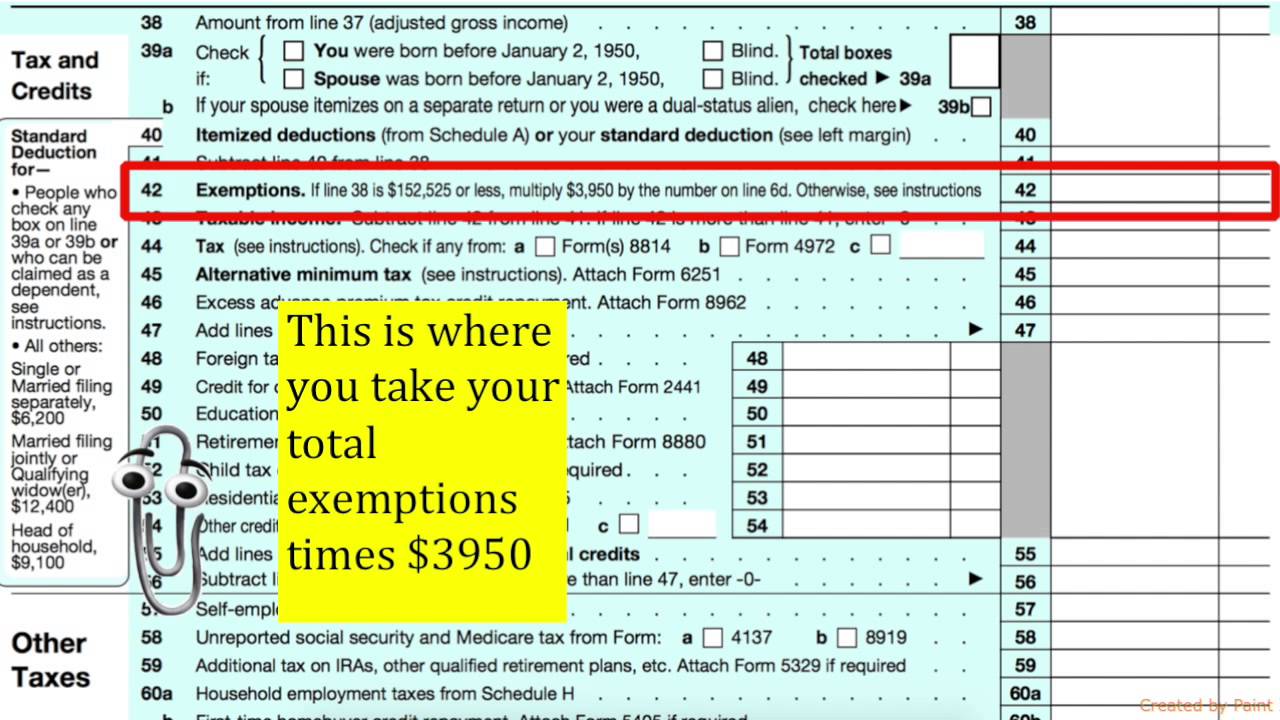

You must report all taxable and tax exempt interest on your federal income tax return even if you don t receive a Form 1099 INT or Form 1099 OID You must give the payer Step 3 Enter the Amount of Taxable Interest on Your Form 1040 Once you have all your taxable interest added up on your Schedule B you ll just enter that

Form if you earn interest from a financial institution This form will have all the information you need to add the income to your tax return Once you hit the 1 500 of earned interest income for the year you can Interest income The Internal Revenue Service requires most payments of interest income to be reported on tax form 1099 INT by the person or entity that makes

Download Where Do You Put Interest Paid On Tax Return

More picture related to Where Do You Put Interest Paid On Tax Return

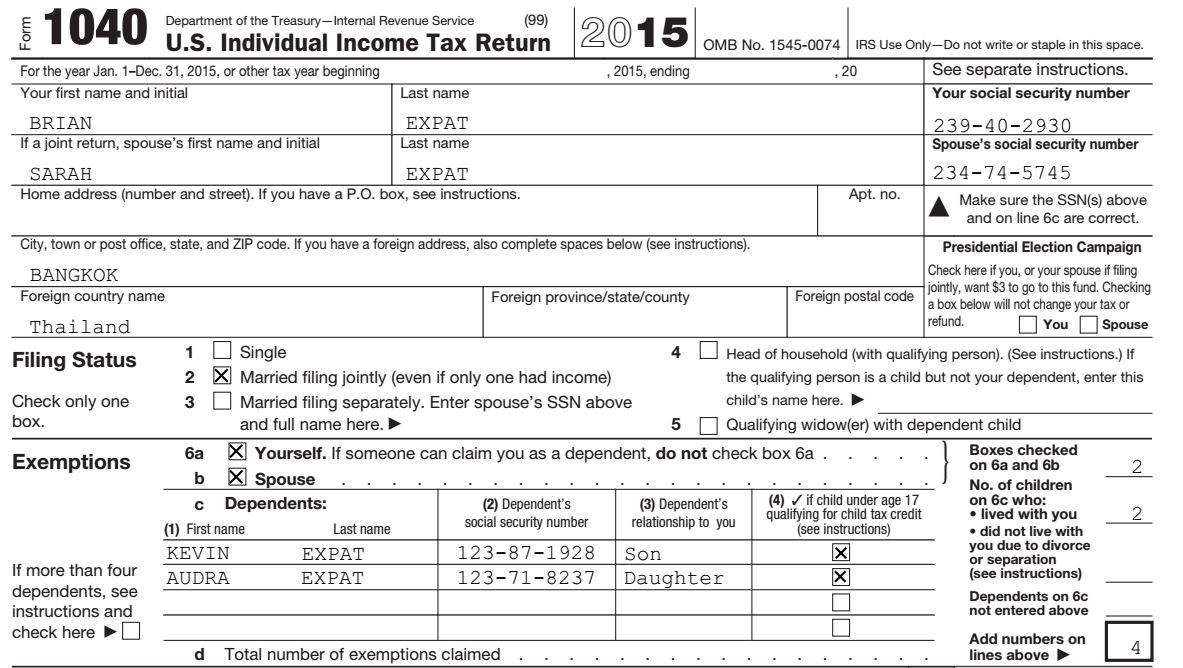

IRS Form 1040 Line 42 Instructions 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/ain-t-that-what-you-said-necessary-and-proper-3.png

Form 1040 Income Tax Return Guide YouTube

https://i.ytimg.com/vi/gRcd6a696gI/maxresdefault.jpg

Interest Income Definition Example How To Account

https://www.wallstreetmojo.com/wp-content/uploads/2018/09/Interest-Income-1.png

Apply for a Payment Plan If you can t pay the full amount of your taxes on time pay what you can now and apply for a payment plan You can enter into an If you must file Schedule B you need to include all taxable interest above 0 50 you received even if you didn t receive a copy of 1099 INT Do not report tax free interest on Schedule B as

If you purchased your home before Dec 16 2017 and are a single or joint filer you can deduct interest paid on the first 1 million of your mortgage If you are married Form 1098 is a form filed with the Internal Revenue Service IRS that details the amount of interest and mortgage related expenses paid on a mortgage during the

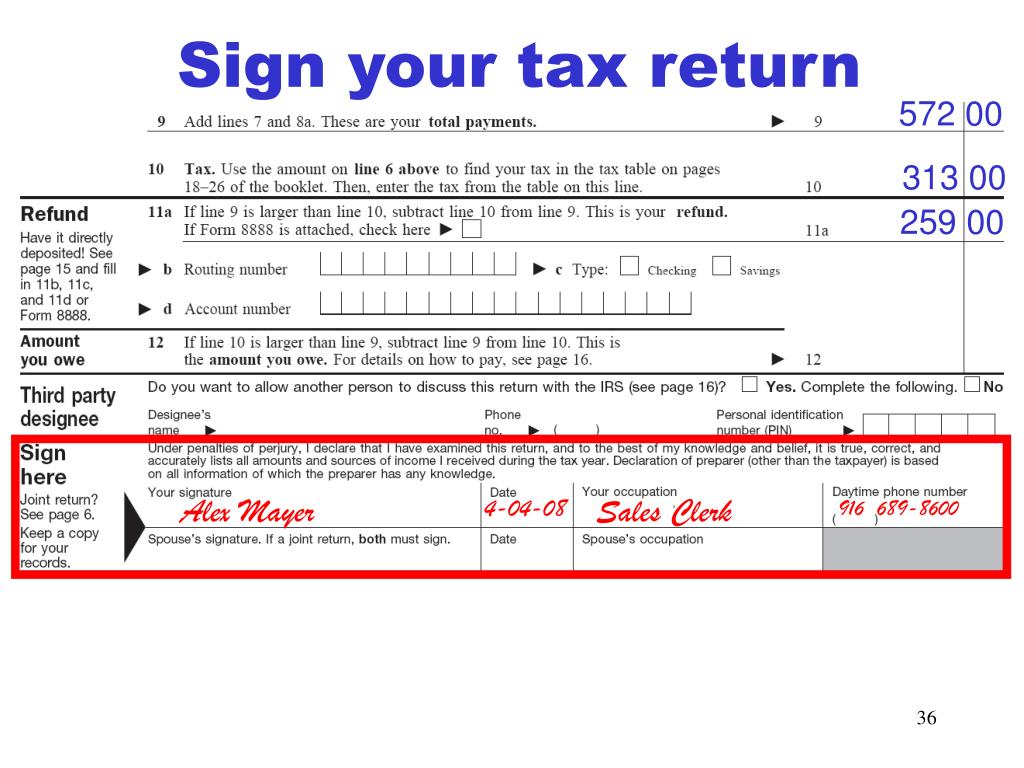

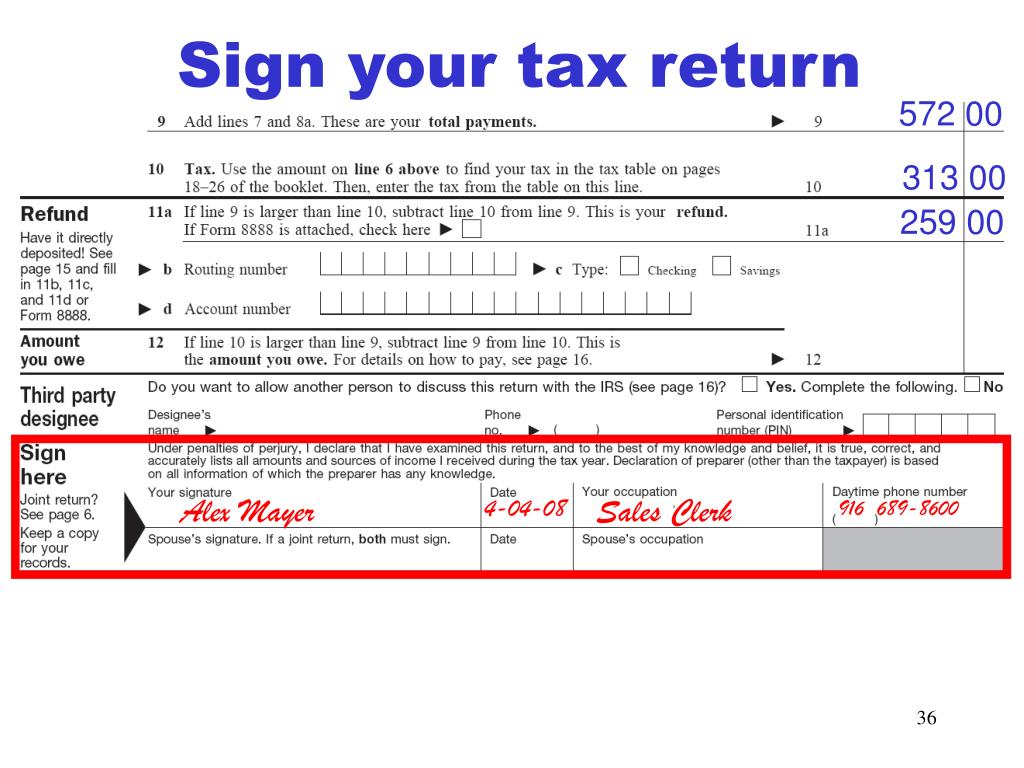

PPT How To Fill Out A Tax Return PowerPoint Presentation Free

https://image2.slideserve.com/4506162/sign-your-tax-return-l.jpg

Image Of 2020 IRS Form 1040 With Line 2a Highlighted

https://studentaid.gov/sites/default/files/2020-tax-exempt-interest-income.PNG

https://ttlc.intuit.com/community/taxes/discussion/...

Enter interest from the IRS like a 1099Int and put the amount in box 1 Enter it manually and just enter IRS for the payer Don t enter any other info like the address or

https://www.thebalancemoney.com/interest-in…

Sources of interest income include the money you put aside in a bank or money market account as well as on a few not so obvious sources bonds loans you made to others if the interest you charged

Interest Income Formula And Calculation

PPT How To Fill Out A Tax Return PowerPoint Presentation Free

Here s Where Your Federal Income Tax Dollars Go NBC News

Interest Expense What Is It Formula Journal Entry

Interest Income Tax Form 1040 1040 Form Printable

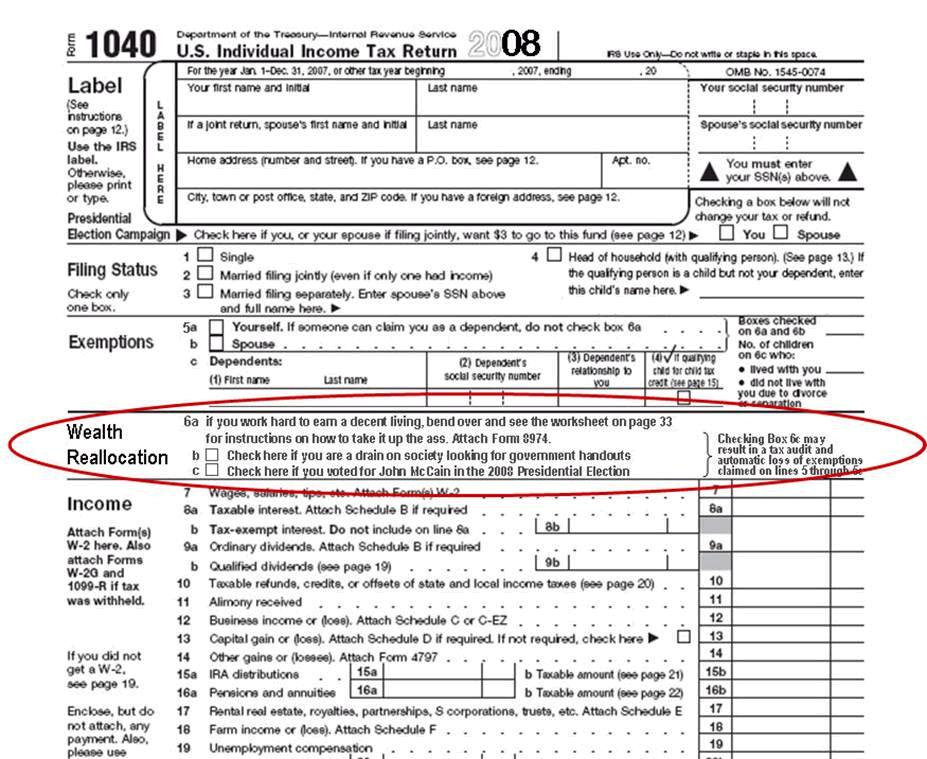

Obama S IRS Unveils New 1040 Tax Form International Liberty 2021 Tax

Obama S IRS Unveils New 1040 Tax Form International Liberty 2021 Tax

Form 11 Mortgage Interest Deduction Understand The Background Of Form

How To Calculate Interest On Late Payment Of Income Tax Tax Walls

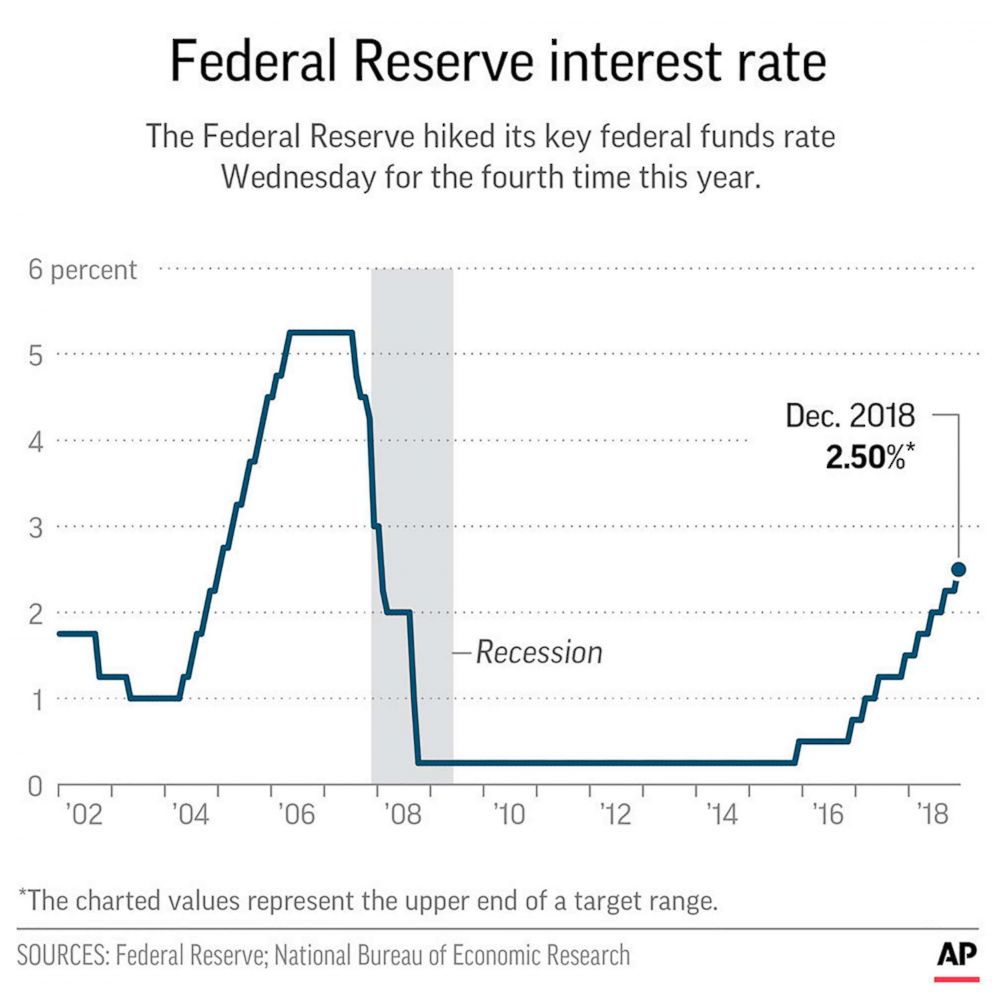

What Is The Federal Reserve And How Do Interest Rates Affect Me ABC News

Where Do You Put Interest Paid On Tax Return - Interest income The Internal Revenue Service requires most payments of interest income to be reported on tax form 1099 INT by the person or entity that makes