Where S My Renters Rebate Mn 2024 Are you ready Try to answer the questions below 1 Can I get a property tax refund if I own my own house Do I have to file my renter s refund with my regular taxes on April 15 Can I file my renter s refund after August 15 LawHelpMN does not collect any personal information when you take this quiz For more information see our privacy policy

How are claims filed Refund claims are filed using Minnesota Department of Revenue DOR Schedule M1PR Schedule M1PR is filed separately from the individual income tax form Claims filed before August 15 2023 will be paid beginning in August 2023 What if I threw away my check If you threw away your rebate check the Department of Revenue said it will reissue it after 60 days If a check is not cashed within 60 days a new check will

Where S My Renters Rebate Mn 2024

Where S My Renters Rebate Mn 2024

https://i.ytimg.com/vi/M2apAewJ_5g/maxresdefault.jpg

When Can I Expect My Renters Rebate MN YouTube

https://i.ytimg.com/vi/chf62vvz72M/maxresdefault.jpg

Printable Renters Auto Pay Form Printable Forms Free Online

https://handypdf.com/resources/formfile/images/10000/renters-rebate-sample-form-page1.png

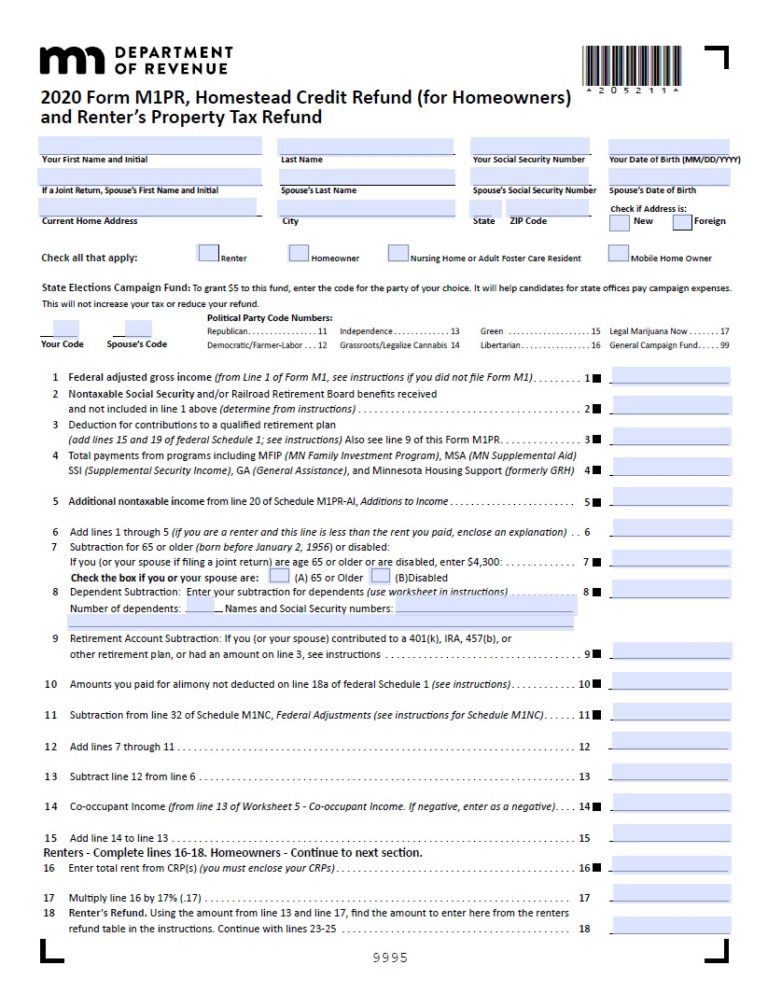

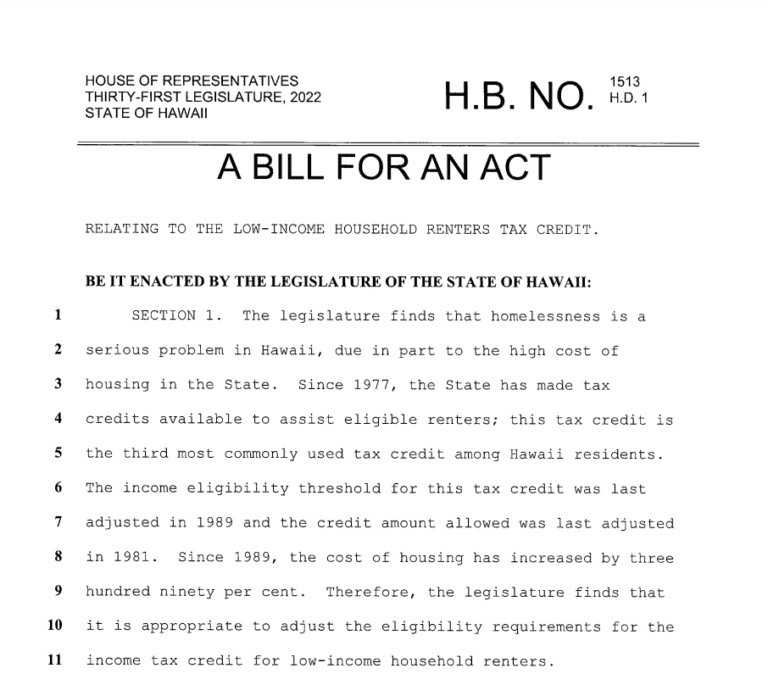

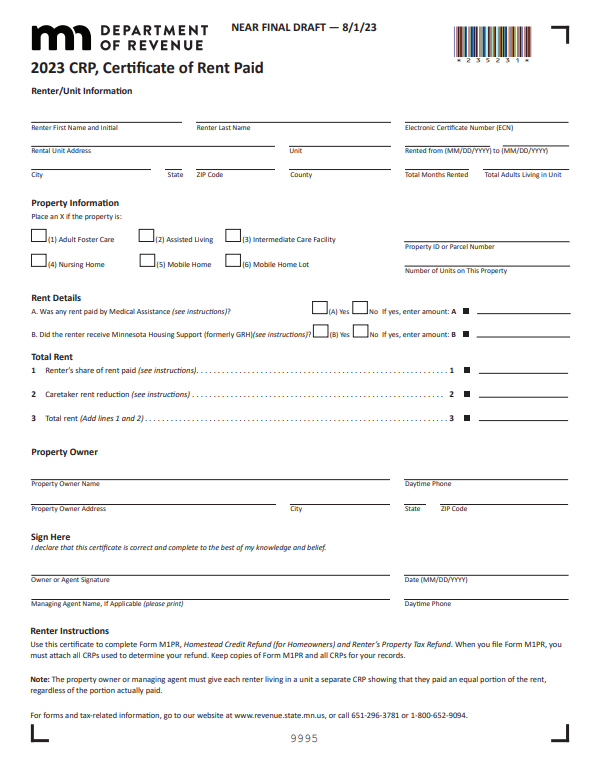

How do I get my refund If you rent your landlord must give you a Certificate of Rent Paid CRP by January 31 2024 If you own use your Property Tax Statement Get the tax form called the 2023 Form M 1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund Rep Nathan Coulter The bill s provisions would be effective for tax year 2023 or for refunds based on rent paid in 2023 meaning the first credits calculated as part of the income tax return would be claimed during the 2024 filing period

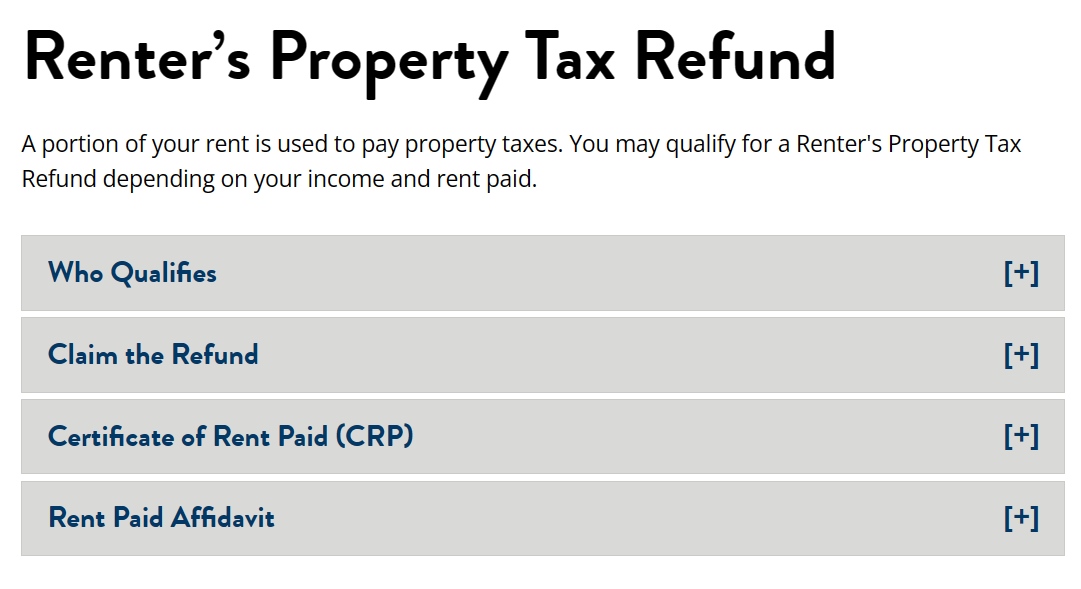

The renter s property tax refund program sometimes called the renters credit is a state paid refund that provides tax relief to renters whose rent and implicit property taxes are high relative to their incomes Rent constituting property taxes is assumed to equal 17 percent of rent paid If rent constituting property How to Apply There are a few ways to apply for the program online by mail or in person Learn more about your application options Application Deadline Applications for 2023 Property Tax Rent Rebates are due by June 30 2024 Under Pennsylvania law the Department of Revenue evaluates the program before the June 30 deadline every year

Download Where S My Renters Rebate Mn 2024

More picture related to Where S My Renters Rebate Mn 2024

Renters Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021-768x1007.jpg

Ohio Renters Rebate 2023 Printable Rebate Form RentersRebate

https://www.rentersrebate.net/wp-content/uploads/2023/05/ohio-renters-rebate-2023-printable-rebate-form-28.jpg

Maine Renters Rebate 2023 Printable Rebate Form RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2023/05/maine-renters-rebate-2023-printable-rebate-form-9.png

The increase was at least 100 Renters with household income of less than 73 270 can claim a refund up to 2 570 You must have lived in a building where the owner of the building Made property tax payments to a local government in place of property taxes Renters who are residents of another state but present in Minnesota for more than 183 Important If you ve changed their address or banking information since their 2021 tax return you can go to the Department of Revenue s new portal taxrebate mn gov submit to update your information Deadline July 28 2023 at 5 p m CT Minnesotans who died before Jan 1 2023 are not eligible for the rebate check Is there anything else

Free legal educational and advocacy services to Minnesota renters We have advised over 300 000 renters since 1992 Our primary program is a free and confidential legal hotline 2024 It s great news for tenants allows for tenants to redeem by letter of guarantee 504B 291 Eviction Action For Nonpayment Published December 10 2023 According to Minnesota Gov Tim Walz the IRS will tax state rebates sent to many Minnesota residents last year These rebates commonly known as Walz checks

How To Fill Out Renters Rebate Mn RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/renter-s-property-tax-refund-minnesota-department-of-revenue-fill-out-1.png

Pa Renters Rebate Status RentersRebate RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2023/05/pa-renters-rebate-status-rentersrebate-20.png

https://www.lawhelpmn.org/self-help-library/fact-sheet/renters-refund-and-property-tax-refund

Are you ready Try to answer the questions below 1 Can I get a property tax refund if I own my own house Do I have to file my renter s refund with my regular taxes on April 15 Can I file my renter s refund after August 15 LawHelpMN does not collect any personal information when you take this quiz For more information see our privacy policy

https://www.house.mn.gov/hrd/pubs/ss/ssrptrp.pdf

How are claims filed Refund claims are filed using Minnesota Department of Revenue DOR Schedule M1PR Schedule M1PR is filed separately from the individual income tax form Claims filed before August 15 2023 will be paid beginning in August 2023

Mn Renters Rebate Form RentersRebate

How To Fill Out Renters Rebate Mn RentersRebate

Mn Renter s Rebate Form 2023 Rent Rebates

Hawaii Renters Rebate 2023 PrintableRebateForm

MN Renters Rebate Form Printable Rebate Form

Colorado Renters Rights 2023 Printable Rebate Form RentersRebate

Colorado Renters Rights 2023 Printable Rebate Form RentersRebate

Electronically File Mn Renters Rebate RentersRebate

Renters Rebate Vt Printable Rebate Form RentersRebate

Montana Renters Rebate 2023 Printable Rebate Form

Where S My Renters Rebate Mn 2024 - How do I get my refund If you rent your landlord must give you a Certificate of Rent Paid CRP by January 31 2024 If you own use your Property Tax Statement Get the tax form called the 2023 Form M 1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund