Where To File Corporate Tax Return Canada You can use the Corporation Internet Filing service to file your corporation income tax returns for 2002 and following years About the Corporation Internet Filing service

The T2 form is available online as a PDF file you can complete online or print for mailing delivery to the CRA You can find the form through CRA s online Corporation All incorporated businesses operating within Canada must file a T2 Return with the CRA Corporations must file this 8 page tax form with various schedules and

Where To File Corporate Tax Return Canada

Where To File Corporate Tax Return Canada

https://res.cloudinary.com/jerrick/image/upload/c_scale,f_jpg,q_auto/5fbde517514ad0001c11e0f0.png

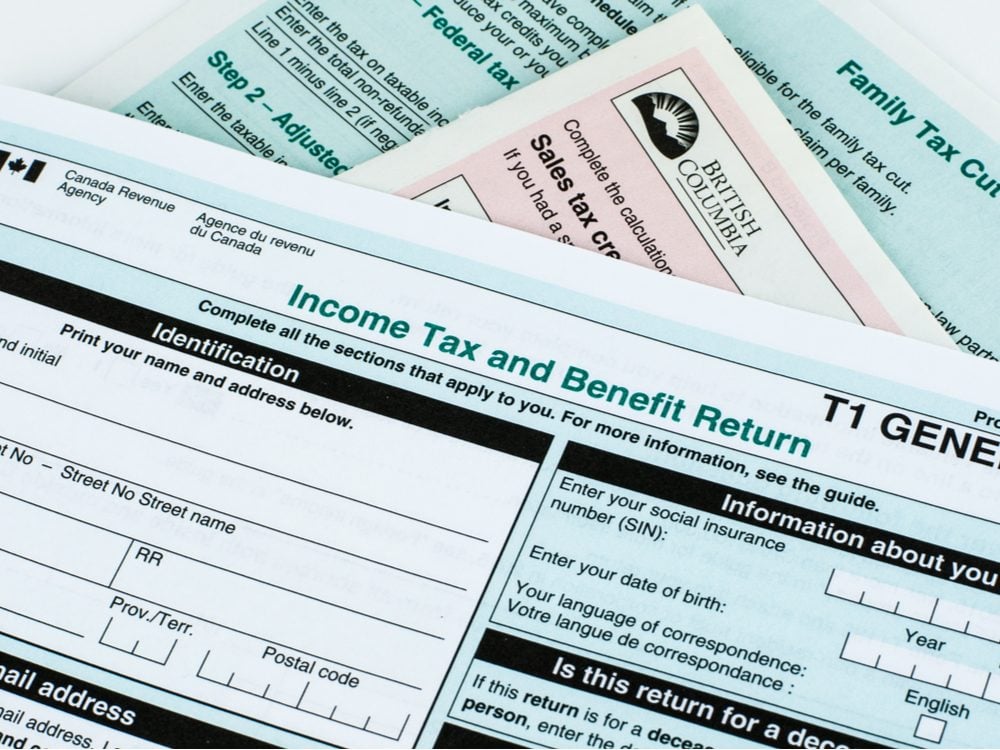

What Is Line 15000 Tax Return formerly Line 150 In Canada

https://thefinancekey.com/wp-content/uploads/2022/02/what-is-line-15000-on-tax-return-canada.jpg

Top 6 Tax Tips For Filing A Canadian Tax Return

https://workingholidayincanada.com/wp-content/uploads/2017/03/tax.png

You can register your company on the ClicS QUR site free of charge to file your corporate income tax return online However you will have to use an authorized software to file File your annual return online for 12 File now Not sure when to file Search for a federal corporation to find out if your annual return is due What you need to know about annual

The Canada Revenue Agency CRA has created Form T2 Corporation Income Tax Return for corporations to fill out in order to file their taxes All Canadian How are the corporate tax returns filed Corporate taxpayers can file their corporate income taxes in house or with the help of an external professional either with paper file or electronic There are a

Download Where To File Corporate Tax Return Canada

More picture related to Where To File Corporate Tax Return Canada

Why The Tax System In Canada Needs To Be Fixed Reader s Digest

https://www.readersdigest.ca/wp-content/uploads/2019/07/unfair-taxes-canadian-taxes.jpg

2023 Canada Tax Checklist What Documents Do I Need To File My Taxes

https://turbotax.intuit.ca/tips/images/turbotax-canada-tax-checklist.png

Canadian Final Income Tax Return US Canadian Cross Border Tax

https://cbfinpc.com/wp-content/uploads/2020/04/Canadian-Income-Tax-Return-Preparation-cbfinpc.com_-scaled.jpg

A T2 tax return is the corporate income tax return form that all resident corporations in Canada must file annually with the Canada Revenue Agency CRA to For taxation years beginning after 2023 all corporations exceptions apply must electronically file e file their CIT returns via the internet Also for information

With UFileT2 corporate tax software you can prepare and file tax returns for Canadian corporations Free EFILE for Corporation Internet filing Step by step interview Whether you file electronically or use the traditional CRA issued return to complete your T2 return you will have different options for filing your return and preparing your financial

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Draht Verantwortlicher F r Das Sportspiel Vermuten States Of Jersey

https://www.thebalance.com/thmb/n0qY5_o0VzoZ5tk64K_PBHbmHrs=/1333x1000/smart/filters:no_upscale()/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif

How To File Corporate Tax Return In Singapore

https://relinconsultants.com/wp-content/uploads/2023/01/How-To-File-Corporate-Tax-Return-In-Singapore-1024x682.jpg

https://www.canada.ca/en/revenue-agency/services/e...

You can use the Corporation Internet Filing service to file your corporation income tax returns for 2002 and following years About the Corporation Internet Filing service

https://www.wealthsimple.com/en-ca/learn/t2

The T2 form is available online as a PDF file you can complete online or print for mailing delivery to the CRA You can find the form through CRA s online Corporation

PSAC Strike Refund Delay May Be Consequence Of Filing Taxes After

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Draht Verantwortlicher F r Das Sportspiel Vermuten States Of Jersey

VAT REQUIREMENTS FOR ARTISTS SOCIAL MEDIA INFLUENCERS SMI s

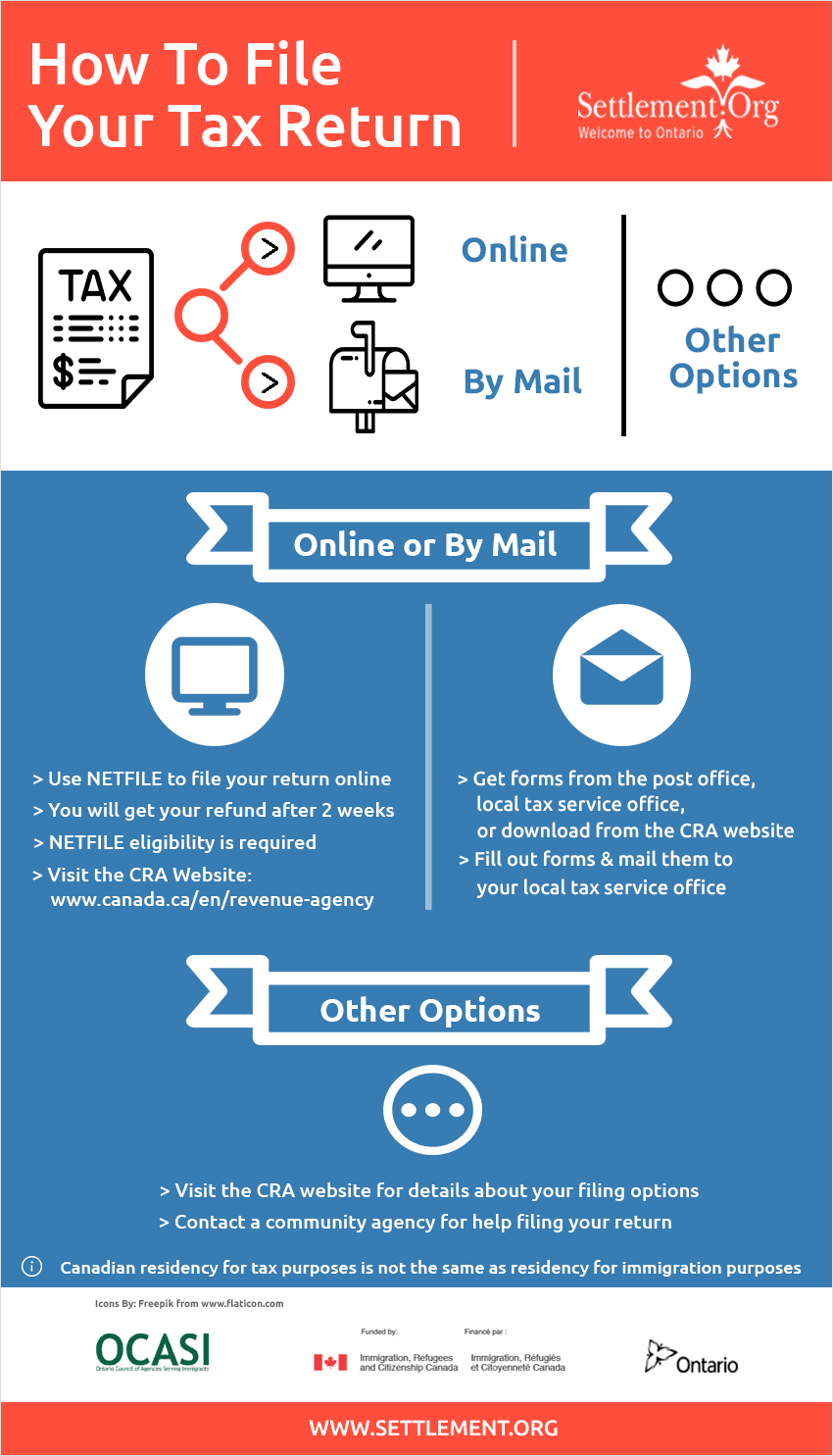

Infographic On How To File A Tax Return

Tax And Accounting Services Synapse Tax

Tax Services Personal Tax Returns Back Taxes Tax Planning Corporate

Tax Services Personal Tax Returns Back Taxes Tax Planning Corporate

Quiz And Answer 07 5120 30 Canadian Tax Principles 2020 2021 Byrd

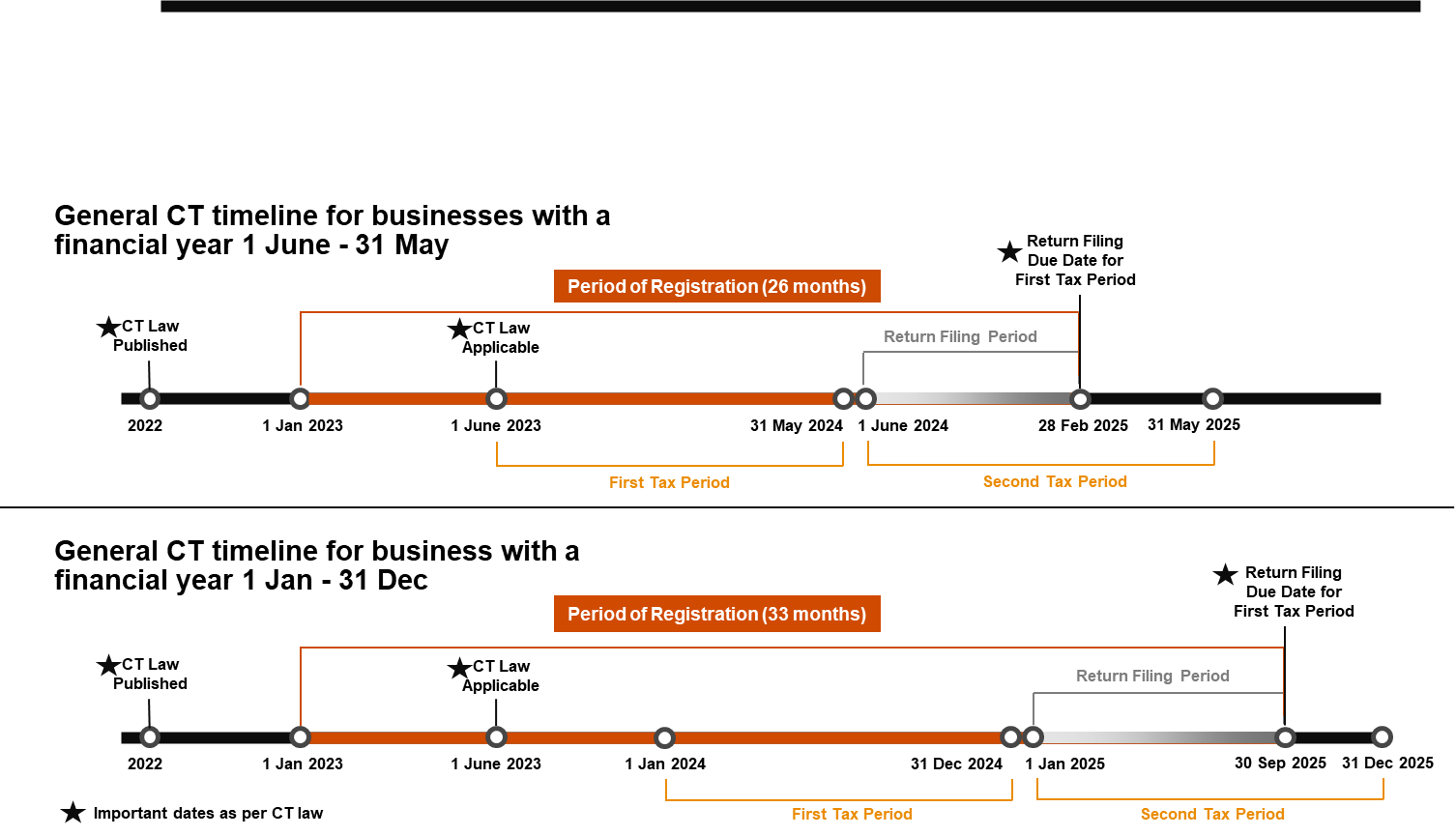

Federal Tax Authority Corporate Tax Topics

How To File Tax Returns In Dubai Or Anywhere Across The UAE ShuraaTax

Where To File Corporate Tax Return Canada - You can register your company on the ClicS QUR site free of charge to file your corporate income tax return online However you will have to use an authorized software to file