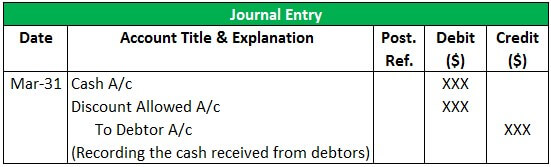

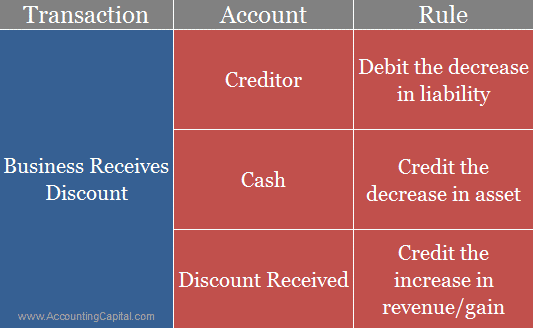

Where To Record Discount Received Web Discount received acts as a gain for the business and is shown on the credit side of a profit and loss account Trade discount is not shown in the main financial statements however cash discount and other types of discounts are shown in books of accounts

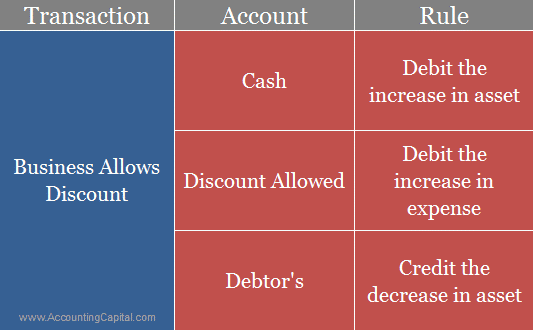

Web Following double entry is required to record the cash discount Crediting discount received has the effect of reducing gross purchases by the amount of cash discount received Consequently payables are debited to reduce their balance to the amount that is expected to be paid to them i e net of cash discount Example Web 11 Nov 2023 nbsp 0183 32 Accounting for the Discount Allowed and Discount Received When the seller allows a discount this is recorded as a reduction of revenues and is typically a debit to a contra revenue account For example the seller allows a 50 discount from the billed price of 1 000 in services that it has provided to a customer

Where To Record Discount Received

Where To Record Discount Received

https://i.ytimg.com/vi/dbqK7ue4Atw/maxresdefault.jpg

Invoice With Discount Experts In QuickBooks Consulting QuickBooks

https://qbkaccounting.com/wp-content/uploads/2014/04/invoice-with-discount.png

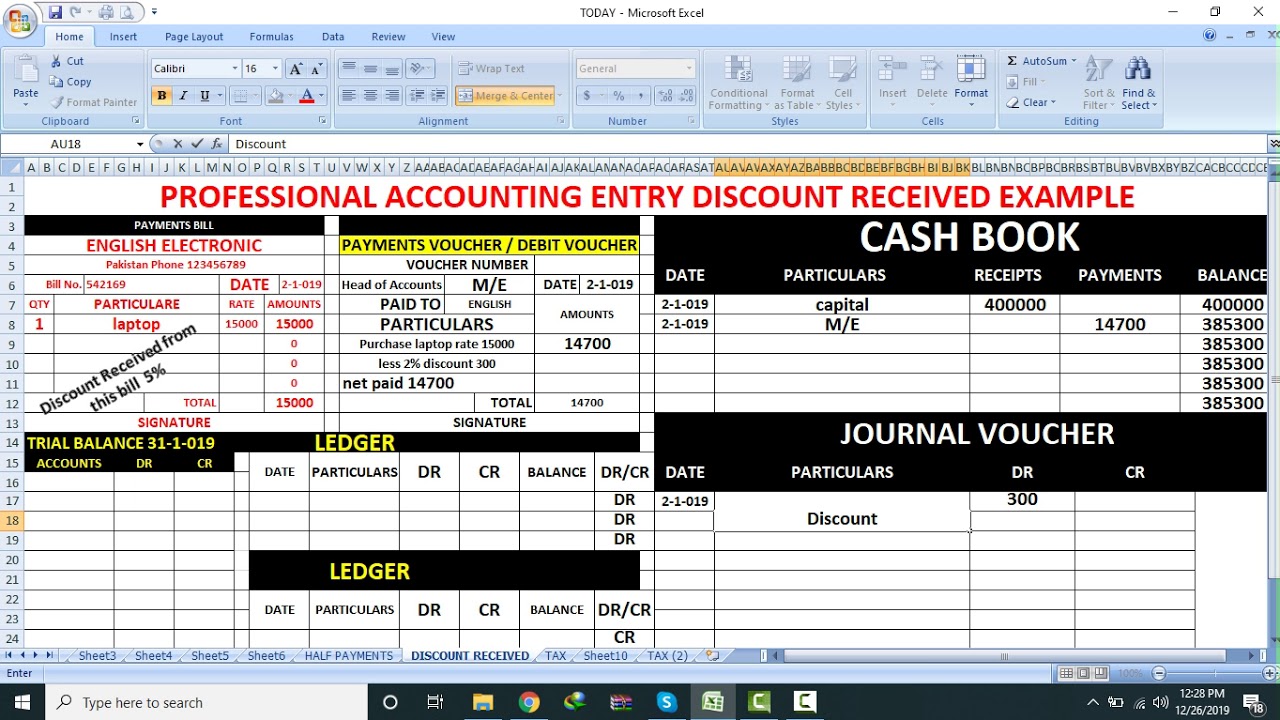

Journal Entries DISCOUNT RECEIVED JOURNAL ENTRY YouTube

https://i.ytimg.com/vi/FiV643Gikio/maxresdefault.jpg

Web The discount received is received by the buyer from the seller The discount allowed is the expense of the seller Discount Received is an income of the buyer Discount allowed is debited in the books of the seller Discount Received is Web The company can make the discount received journal entry by debiting the accounts payable and crediting the discount received account and the cash account Discount received example For example the company ABC makes an early payment in order to receive the discount on the credit purchase that it has made in the prior week

Web 20 Nov 2019 nbsp 0183 32 A cash discount received sometimes called an early settlement discount is recorded in the accounting records using two journals The first journal is to record the cash paid to the supplier The second journal records the cash discount received to clear the remaining balance on the suppliers account Journal 1 Entry for Cash Paid Web Journal Entries for Purchase Discount Journal Entries for Sales Discounts are posted in the following manner When a Purchase is made on credit the following journal entries are posted When the buyer avails of the cash discount offered the following journal entry is posted LLC Vs

Download Where To Record Discount Received

More picture related to Where To Record Discount Received

Discount Allowed Double Entry

https://keydifferences.com/wp-content/uploads/2014/12/journal-entry1.jpg

Discount Allowed And Discount Received Journal Entries With Examples

https://www.wallstreetmojo.com/wp-content/uploads/2020/07/Discount-Allowed-and-Discount-Received-Journal-Entry-1.4.jpg

Discount Received Journal Entry CArunway

https://www.carunway.com/wp-content/uploads/2023/02/Discount-Received-Journal-Entry-Snips-1024x512.png

Web 26 Sept 2019 nbsp 0183 32 How to record discounts received from suppliers Record a Vendor Credit I prefer using an income account called Discounts Refunds but you can also post as a contra expense either to a group discount expense account or to the same expense account the bill is for Web You can account for a discount as you please but then in the statement of financial position you need to present revenues net of discounts Using different accounts is a matter of convenience and it is OK as soon as you report it correctly in your balance sheet

Web 26 Feb 2023 nbsp 0183 32 Where do you record discount received It is an indirect operational Income So we will record it on the credit side of the journal entry Thus it will be alongside the Incomes section in the Statement of Profit and Loss Is discounts received a debit or credit Discount received is an indirect income gain So we need to credit it Web 11 Nov 2019 nbsp 0183 32 The sales discount in this example is calculated as follows Sales price 2 000 Sales discount 2 5 Sales discount Sales price x Discount Sales discount 2 000 x 2 5 50 Amount to pay Sales price Sales discounts Amount to pay 2 000 50 1 950 If the customer pays within 10 days then a 2 5 sales

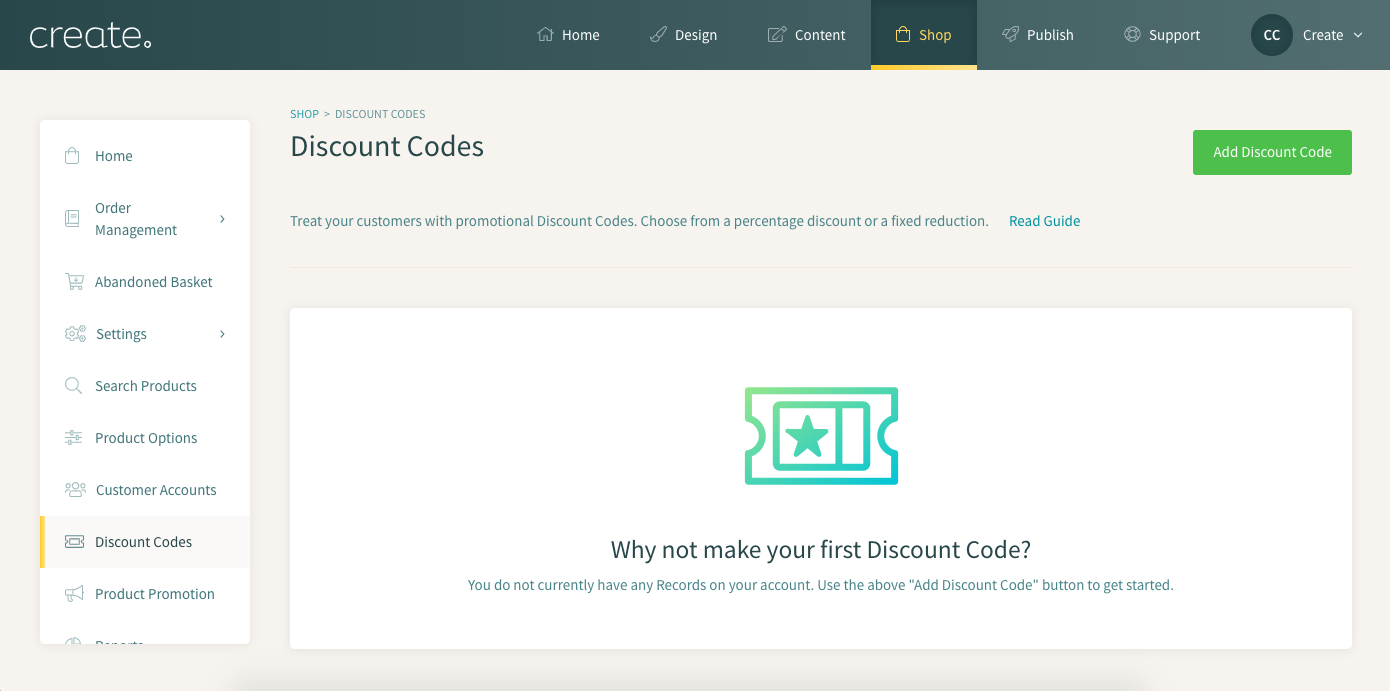

How To Set Up Discount Codes Create

https://marketing.create-cdn.net/assets/v2discountcodescreen.png

Discount Received Journal Entry KaydenceminJoyce

https://www.accountingcapital.com/wp-content/uploads/2018/08/Explanation-and-rules-for-journal-entry-for-discount-received.png

https://www.accountingcapital.com/.../journal-entry-for-discount-received

Web Discount received acts as a gain for the business and is shown on the credit side of a profit and loss account Trade discount is not shown in the main financial statements however cash discount and other types of discounts are shown in books of accounts

https://accounting-simplified.com/financial/purchases/discount-received

Web Following double entry is required to record the cash discount Crediting discount received has the effect of reducing gross purchases by the amount of cash discount received Consequently payables are debited to reduce their balance to the amount that is expected to be paid to them i e net of cash discount Example

Discount Received Journal Entry KaydenceminJoyce

How To Set Up Discount Codes Create

Where Is Discount Received Shown

Solved Prepare The Journal Entries To Record The Following

Journal Entry For Discount Received Examples TutorsTips

Projected Profit And Loss Statement Template Classles Democracy

Projected Profit And Loss Statement Template Classles Democracy

Journal Entry For Discount Allowed And Received GeeksforGeeks

What Is The Journal Entry To Record An Early Pay Discount Universal

Purchases With Discount gross Principlesofaccounting

Where To Record Discount Received - Web 20 Nov 2019 nbsp 0183 32 A cash discount received sometimes called an early settlement discount is recorded in the accounting records using two journals The first journal is to record the cash paid to the supplier The second journal records the cash discount received to clear the remaining balance on the suppliers account Journal 1 Entry for Cash Paid