Which Comes First State Or Federal Income Tax Check You need your filing status your Social Security number and the exact amount line 35a of your 2022 Form 1040 of your federal refund to track your Federal refund https www irs gov refunds To track your state refund https ttlc intuit questions 1899433 how do i track my state refund

Federal Tax Refunds are Processed First The first point to understand is that federal tax refunds are processed first This is because the federal government is responsible for processing tax returns and issuing refunds for federal income taxes Generally rule you can expect your state tax refund within 30 days of the electronic filing date or postmark date You can check on the status of your refund by going to your state s department

Which Comes First State Or Federal Income Tax Check

Which Comes First State Or Federal Income Tax Check

https://thumbs.dreamstime.com/z/us-federal-income-tax-return-form-individual-210172272.jpg

Federal Income Tax Income Tax Calculator And Rates

https://moneyvests.com/wp-content/uploads/2021/05/tax.jpg

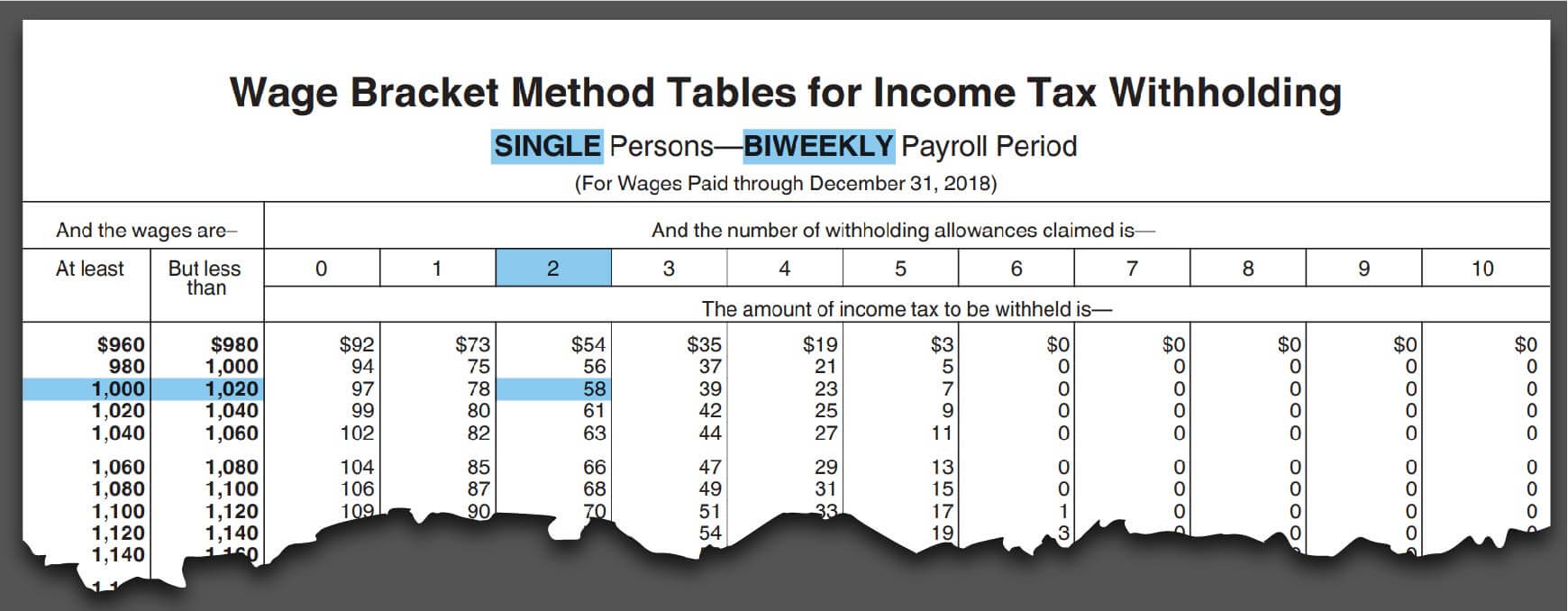

Federal Withholding Tax Chart Federal Withholding Tables 2021

https://federalwithholdingtables.net/wp-content/uploads/2021/07/what-is-federal-income-tax-withholding-guidelines-and-more-3.jpg

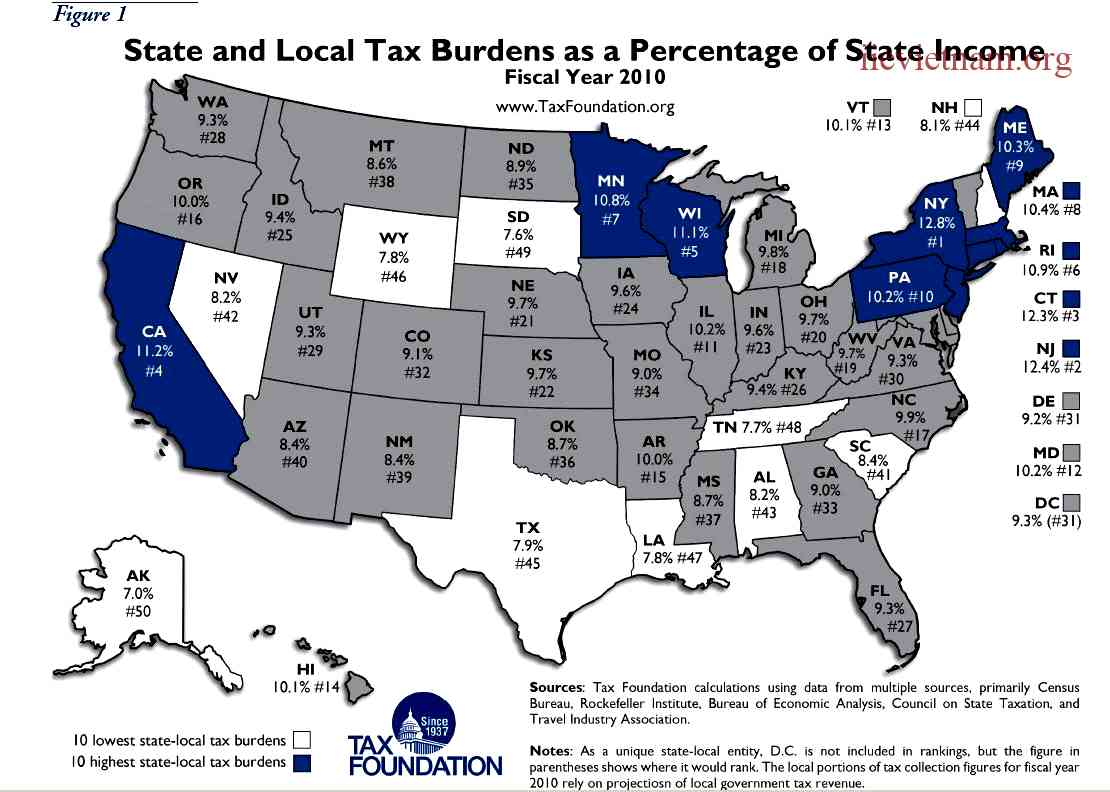

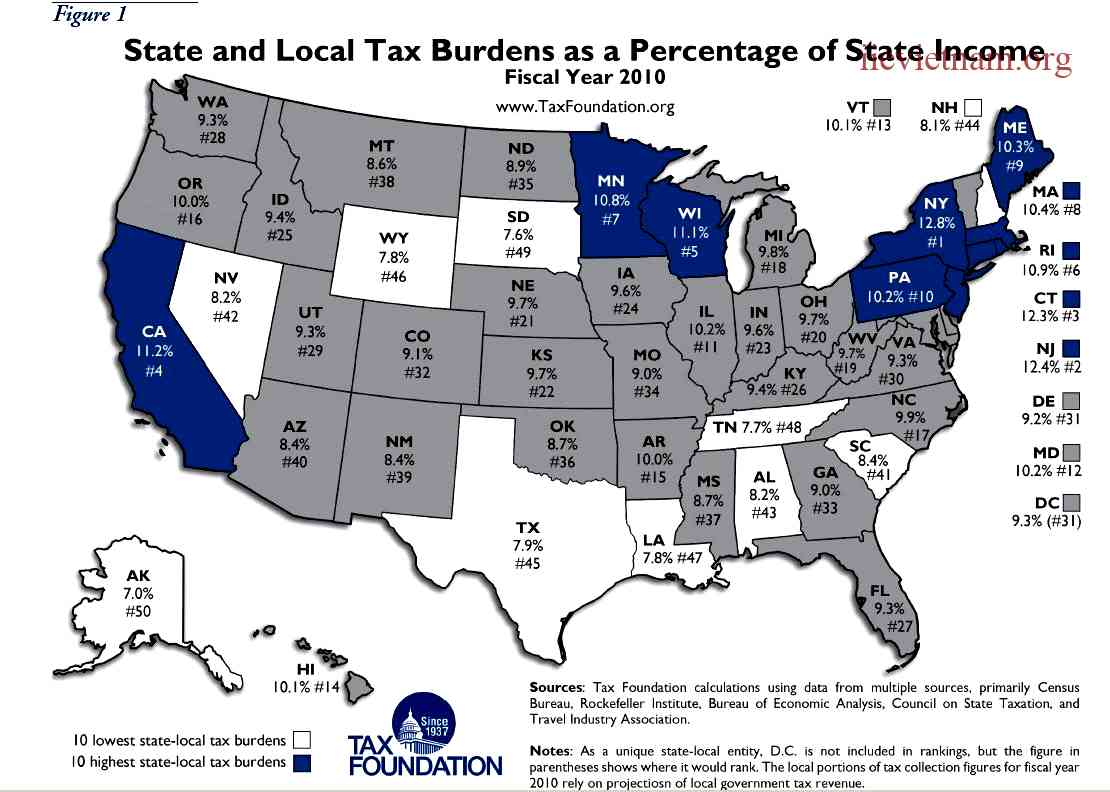

They are Wyoming Washington Texas South Dakota Nevada Florida and Alaska Along with this Tennessee and New Hampshire only impose tax on income from dividends and interest State income taxes are due every year usually by April 15th similar to federal income tax although you should check with your State to make sure Filing status The exact whole dollar amount of your refund Use the IRS Where s My Refund tool or the IRS2Go mobile app to check your refund online This is the fastest and easiest way to track your refund The systems are updated once every 24 hours You can contact the IRS to check on the status of your refund

Nerdy takeaways State income taxes are different from federal income taxes Some states have a progressive tax system similar to the federal income tax system while others IR 2023 158 Aug 30 2023 WASHINGTON The IRS today provided guidance PDF on the federal tax status of refunds of state or local taxes and certain other payments made by state or local governments to individuals

Download Which Comes First State Or Federal Income Tax Check

More picture related to Which Comes First State Or Federal Income Tax Check

Read Federal Income Tax Examples Explanations

https://m.media-amazon.com/images/I/41PoAvZEHEL.jpg

What Is Federal Income Tax Theauldshillelagh

https://www.patriotsoftware.com/wp-content/uploads/2017/05/federal-income-tax-withholding.jpg

British Literature Examville

https://media.sellfy.com/images/oAWFl3Mz/9cobUZWk7o3vQNVFhXaB/9781423208358.jpeg?w=600

Taxpayers are also encouraged to read Publication 17 Your Federal Income Tax For Individuals for additional guidance Essentials to filing an accurate tax return The deadline this tax season for filing Form 1040 U S Individual Income Tax Return or 1040 SR U S Tax Return for Seniors is April 15 2024 However those who live in Maine To check your refund status you will need your social security number or ITIN your filing status and the exact refund amount you are expecting The IRS updates the tool s refund status daily

For the first time ever some taxpayers will soon be able to file their taxes online directly with the IRS for free without using a third party service like TurboTax or H R Block For the 2024 1 4 7 013 Reply Bookmark Icon xmasbaby0 Level 15 Federal and state refunds come from two completely separate entities so there is no telling which one will arrive first TurboTax gives you an estimated date for receiving your refund based on a 21 day average from your date of acceptance but it can take longer

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

http://4.bp.blogspot.com/-4cLQaqI0jYM/TkmIL611lAI/AAAAAAAAPlc/z5MYhmcnqd0/s1600/taxrate.jpg

How To Use 2020 Income Tax Refund Check From IRS To Spend And Save

https://image.cnbcfm.com/api/v1/image/102500153-treasury-check-1040.jpg?v=1582222854

https://ttlc.intuit.com/community/after-you-file/...

You need your filing status your Social Security number and the exact amount line 35a of your 2022 Form 1040 of your federal refund to track your Federal refund https www irs gov refunds To track your state refund https ttlc intuit questions 1899433 how do i track my state refund

https://defensetax.com/blog/do-you-receive-federal...

Federal Tax Refunds are Processed First The first point to understand is that federal tax refunds are processed first This is because the federal government is responsible for processing tax returns and issuing refunds for federal income taxes

_0.png)

Income Tax Law State Income Tax Law

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

Julia Wilson

Income Tax Returns 2017 Know The Tax Slabs And Your Tax Liability To

Tax Refund To Do List

What States Dont Have State Income Tax Discover Income Tax

What States Dont Have State Income Tax Discover Income Tax

State Income Tax Refund State Income Tax Refund Calculator

Why Is The Government Charging 23 For An IRS Form That Was Free Last

How Is Tax Liability Calculated Common Tax Questions Answered

Which Comes First State Or Federal Income Tax Check - Filing status The exact whole dollar amount of your refund Use the IRS Where s My Refund tool or the IRS2Go mobile app to check your refund online This is the fastest and easiest way to track your refund The systems are updated once every 24 hours You can contact the IRS to check on the status of your refund