Which Electric Vehicles Still Qualify For Tax Credit You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

Electric Cars and Plug In Hybrids That Qualify for Federal Tax Credits Here s how to find out which new and used EVs may qualify for a tax credit of up to 7 500 for 2023 and 2024 By Keith If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

Which Electric Vehicles Still Qualify For Tax Credit

Which Electric Vehicles Still Qualify For Tax Credit

https://evtaxincentives.com/wp-content/uploads/2022/07/polstar-3.png

New EV Tax Credits 2023 See Which Electric Hybrid Vehicles Qualify

https://www.usatoday.com/gcdn/presto/2022/07/21/USAT/8b00687d-f433-4ec8-b983-560bdd7d4b07-CapOne_1.jpg?crop=2119,1192,x0,y0&width=2119&height=1192&format=pjpg&auto=webp

These 28 Electric Cars Qualify For A Tax Credit The Plugin Report

https://pluginreport.com/wp-content/uploads/2020/11/which-electric-cars-qualify-for-a-tax-credit.jpg

The 2022 law revised the tax credit for new EVs and PHEVs bought by individuals for personal use It split the credit in two with 3 750 awarded for a vehicle s battery component production The IRS says the following vehicles are still eligible for both tax credits worth 7 500 Cadillac Lyriq Chevy Bolt Chevy Bolt EUV Chevy Silverado EV Chrysler

Most of the eligible cars so far are made by the big three EV automakers in the US Ford F General Motors and Stellantis plus Tesla TSLA Here s what you need to know Which models are Federal tax credits for plug in electric and fuel cell electric vehicles Vehicles placed in service on or after January 1st 2024 and before January 1st 2025 Other than that it s a pretty

Download Which Electric Vehicles Still Qualify For Tax Credit

More picture related to Which Electric Vehicles Still Qualify For Tax Credit

Electric Vehicles Qualify For Tax Credit Electric Vehicle Latest News

https://infoevs.com/wp-content/uploads/2022/08/cropped-These-electric-vehicles-qualify-for-7500-tax-credit-under-Inflation-Reduction-Act-1.jpg

New Rules Which Electric Vehicles Qualify For The Federal Tax Credit

https://s.hdnux.com/photos/01/27/02/00/22814758/4/rawImage.jpg

Electric Vehicles That Qualify For Tax Credit Latest News And Media N

https://pakistanfacts.info/wp-content/uploads/2021/06/WhatsApp-Image-2021-06-13-at-8.52.06-PM-768x410.jpeg

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The electric vehicle tax credit also known as the clean vehicle tax credit or 30D if you like IRS code can offer up to 7 500 off the purchase of a new EV Sounds nice right But of

These include the Ford F Mustang Mach E and Volkswagen s ID 4 Ten Most Important EV Tax Credit Rules In 2024 Here are the 10 most important things to know about the 2024 EV tax credits as of Which cars qualify for a federal EV tax credit How to qualify for the 2024 EV tax credit Used EV tax credit qualifications How the electric vehicle tax credit is calculated How to claim the

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

Tesla Model Y And Other Electric Vehicles Will Now Qualify For 7 500

https://assets1.cbsnewsstatic.com/hub/i/r/2023/02/03/37584224-0091-4ba7-b367-fd80a864c391/thumbnail/1200x630/596d68b3a930a35770b458a1c0b28b64/ae5f0c70-0a2a-440a-90b2-7d41a2a09a41.jpg

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

https://www.consumerreports.org/cars/hybrids-evs/...

Electric Cars and Plug In Hybrids That Qualify for Federal Tax Credits Here s how to find out which new and used EVs may qualify for a tax credit of up to 7 500 for 2023 and 2024 By Keith

Battery Passports Could Help Electric Cars Qualify For Tax Credits

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

Electric Vehicles Qualify For Tax Credit Electric Vehicle Latest News

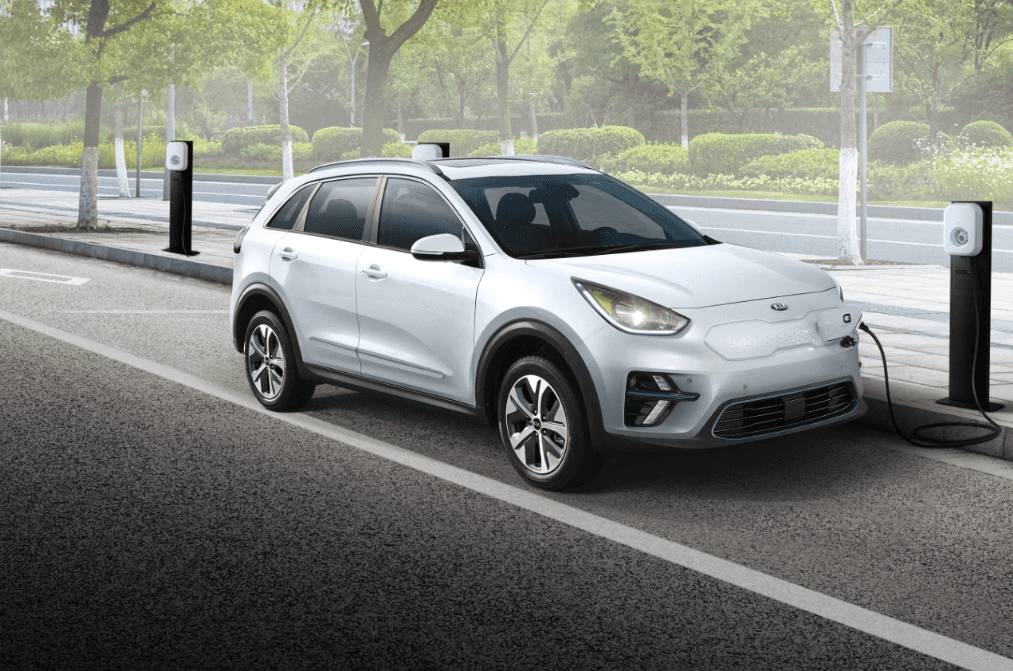

Does The Kia Niro EV Qualify For Tax Credit Electric Vehicle

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Just 10 Electric Vehicles Qualify For Full 7 500 U S Tax Credit CPA

Just 10 Electric Vehicles Qualify For Full 7 500 U S Tax Credit CPA

Which Vehicles Qualify For New 7 500 Electric Vehicle Tax Credit

These Electric Cars Qualify For The EV Tax Credits

Leased And Used Electric Vehicles Now Qualify For Federal Tax Credits

Which Electric Vehicles Still Qualify For Tax Credit - Most of the eligible cars so far are made by the big three EV automakers in the US Ford F General Motors and Stellantis plus Tesla TSLA Here s what you need to know Which models are