Which Health Benefits Are Taxable In Canada Taxable Benefits Here is a list of some common taxable benefits You can also check out the CRA s website to find more detailed information about each of these

Some benefits and allowances are subject to Canada Pension Plan CPP contributions Employment Insurance EI premiums the new BC Health Tax and income tax deductions For a A taxable benefit is a payment from an employer to an employee that is considered a positive benefit and can be in the form of cash or another type of payment

Which Health Benefits Are Taxable In Canada

Which Health Benefits Are Taxable In Canada

http://airdrielawyer.com/wp-content/uploads/2022/02/Are-Legal-Settlements-Taxable-in-Canada-Featured-Image.jpg

Is Disability Income Taxable In Canada Lionsgate Financial Group

https://www.lionsgatefinancialgroup.ca/wp-content/uploads/2021/11/Investing-3-1200x800-layout1194-1gnv4d6.png

Are Alimony Payments Taxable In Canada Know The Facts

https://moosejawdivorcelawyer.ca/wp-content/uploads/2022/06/Are-Alimony-Payments-Taxable-in-Canada-Featured-Image.jpg

Calculate payroll deductions File an information return Unfortunately the rules behind which benefits are and aren t taxable isn t a straightforward answer Check out this chart from the Canadian Taxation of Health and Dental Benefits in Canada The taxation of health and dental benefits in Canada is governed by the Income Tax Act According to the Act

Gifts or Awards Gifts or awards are non taxable if they have a fair market value of less than 500 Any gift or award given with a value greater than 500 is subject to taxation Group Benefits Life accident Is health insurance a taxable benefit in Canada The short answer is yes and no Learn here which of the 3 types of Health Insurance really a tax free benefit

Download Which Health Benefits Are Taxable In Canada

More picture related to Which Health Benefits Are Taxable In Canada

Is Life Insurance Taxable In Canada CanadaWise

https://canadawise.ca/wp-content/uploads/2022/06/is-life-insurance-taxable-in-canada-2048x1365.jpg

Is A Gift Of Money Taxable In Canada Our Guide On What Is Taxable

https://accufile.ca/blog_images/is-a-gift-of-money-taxable-in-canada-our-guide-on-what-is-taxable-800x300.jpg

Taxable Benefits In Canada What You Should Know As An Employer Kevin

https://ml2gqn5rfgol.i.optimole.com/ctLlDOQ.-BWa~25210/w:1024/h:535/q:mauto/f:avif/https://rattray.cpa/wp-content/uploads/2021/11/Taxable-benefits-1200x627-1.jpg

Examples of taxable benefits include company cars parking housing allowances health and dental insurance premiums employer provided meals gifts and Personal health insurance plans marketed and sold by private insurance companies are taxable benefits They are taxable because premiums are paid by

Private health services plan premiums If you make contributions to a private health services plan such as medical or dental plans for employees there is no taxable The employment income excluding the value of health benefits of a single 30 year old taxpayer living in Ontario with no children having employer paid health benefits valued

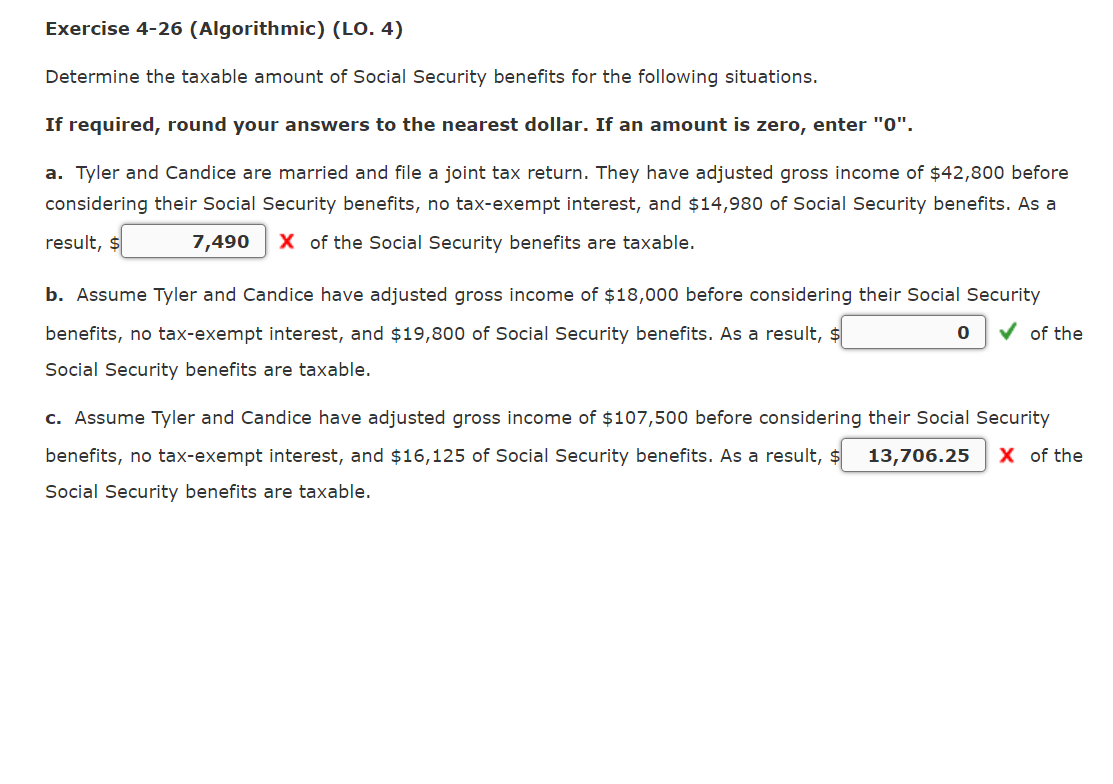

Solved Exercise 4 26 Algorithmic LO 4 Determine The Chegg

https://media.cheggcdn.com/media/2ef/2eff7402-7586-4d3e-9eed-44b97077e5e4/phpxOMA2y

Are Employee Benefits Taxable In Canada

http://www.olympiabenefits.com/hubfs/are employee benefits taxable in Canada.png#keepProtocol

https://www.simplybenefits.ca/blog/a-guide-to-taxable-benefits-in-canada

Taxable Benefits Here is a list of some common taxable benefits You can also check out the CRA s website to find more detailed information about each of these

https://blog.montridge.com/taxable-benefits-…

Some benefits and allowances are subject to Canada Pension Plan CPP contributions Employment Insurance EI premiums the new BC Health Tax and income tax deductions For a

Foreign Social Security Taxable In Us TaxableSocialSecurity

Solved Exercise 4 26 Algorithmic LO 4 Determine The Chegg

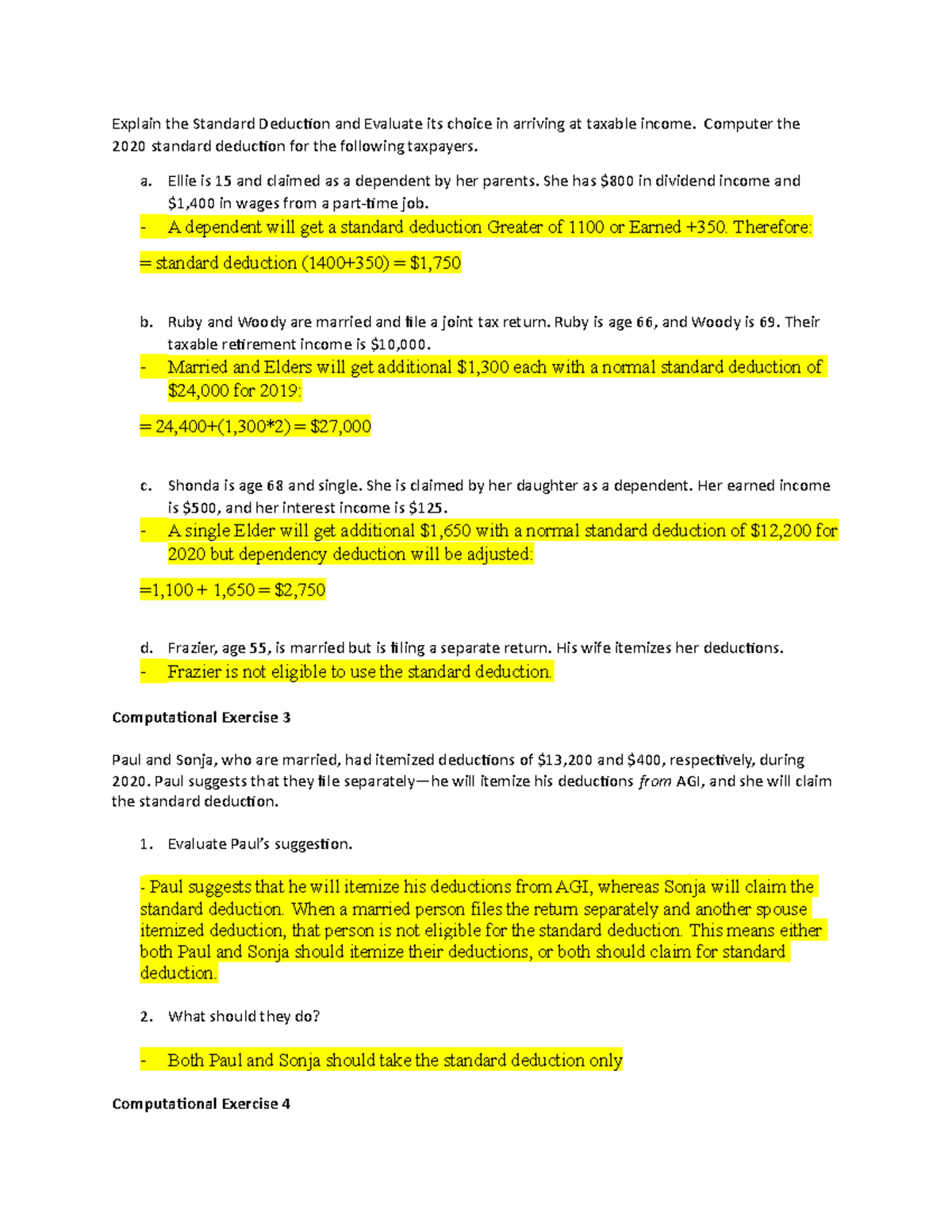

AC 407 Ch 9 Assignments For ACC Taxation Explain The Standard

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

What Is Pre Tax Commuter Benefit

What Group Benefits Are Taxable In Canada Perlinger

What Group Benefits Are Taxable In Canada Perlinger

Are Disability Insurance Benefits Taxable In Canada

Are Property Insurance Proceeds Taxable In Canada The Pinnacle List

What Is Taxable Income Explanation Importance Calculation Bizness

Which Health Benefits Are Taxable In Canada - Taxation of Health and Dental Benefits in Canada The taxation of health and dental benefits in Canada is governed by the Income Tax Act According to the Act