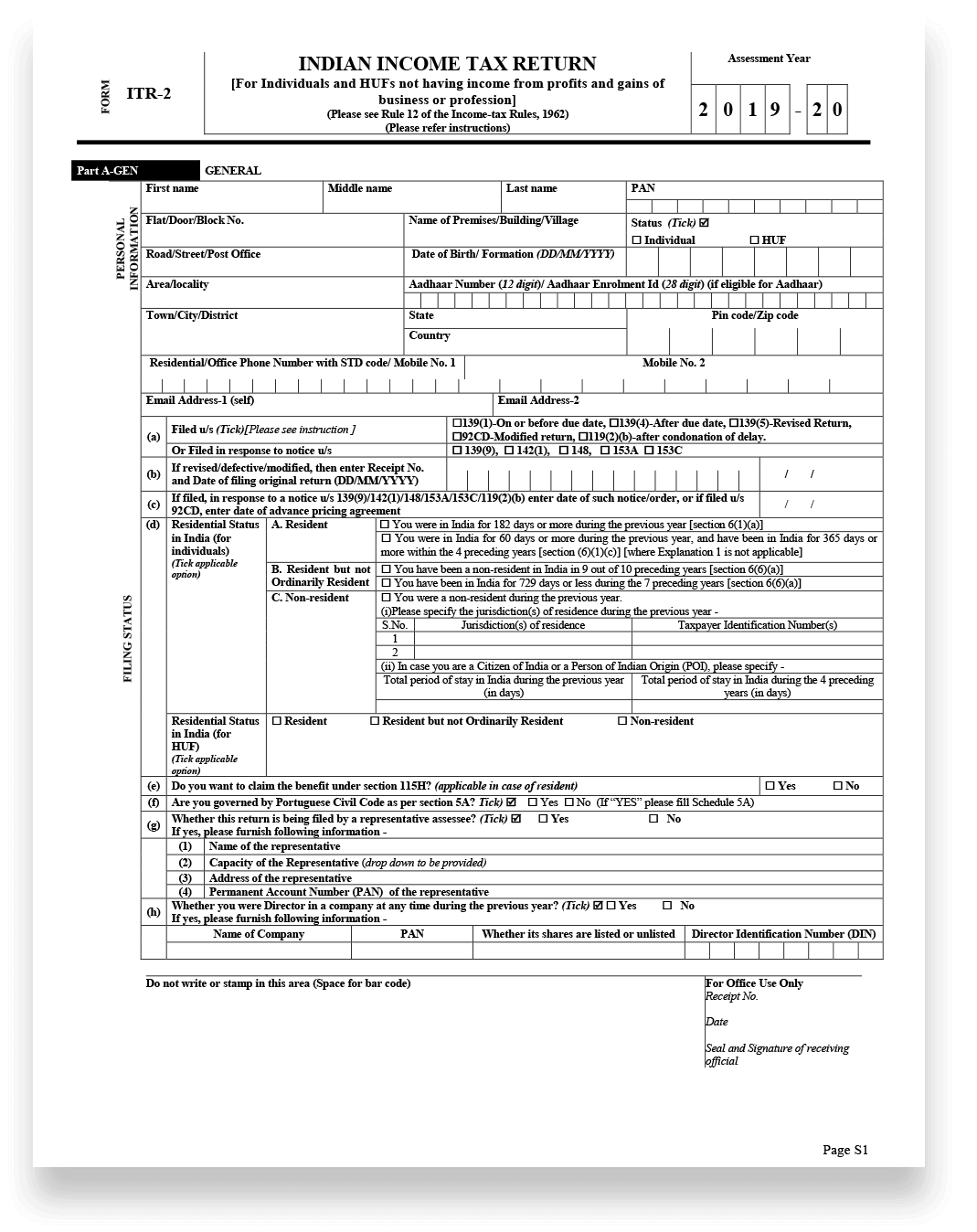

Which Itr Form For Salary And Share Trading Now the most important question Which ITR to file The answer would be it depends on the quantum of trading and what type of transaction is done Generally if a person is doing transaction in delivery based shares then ITR 2 needs to be filed and show such transaction under capital gain

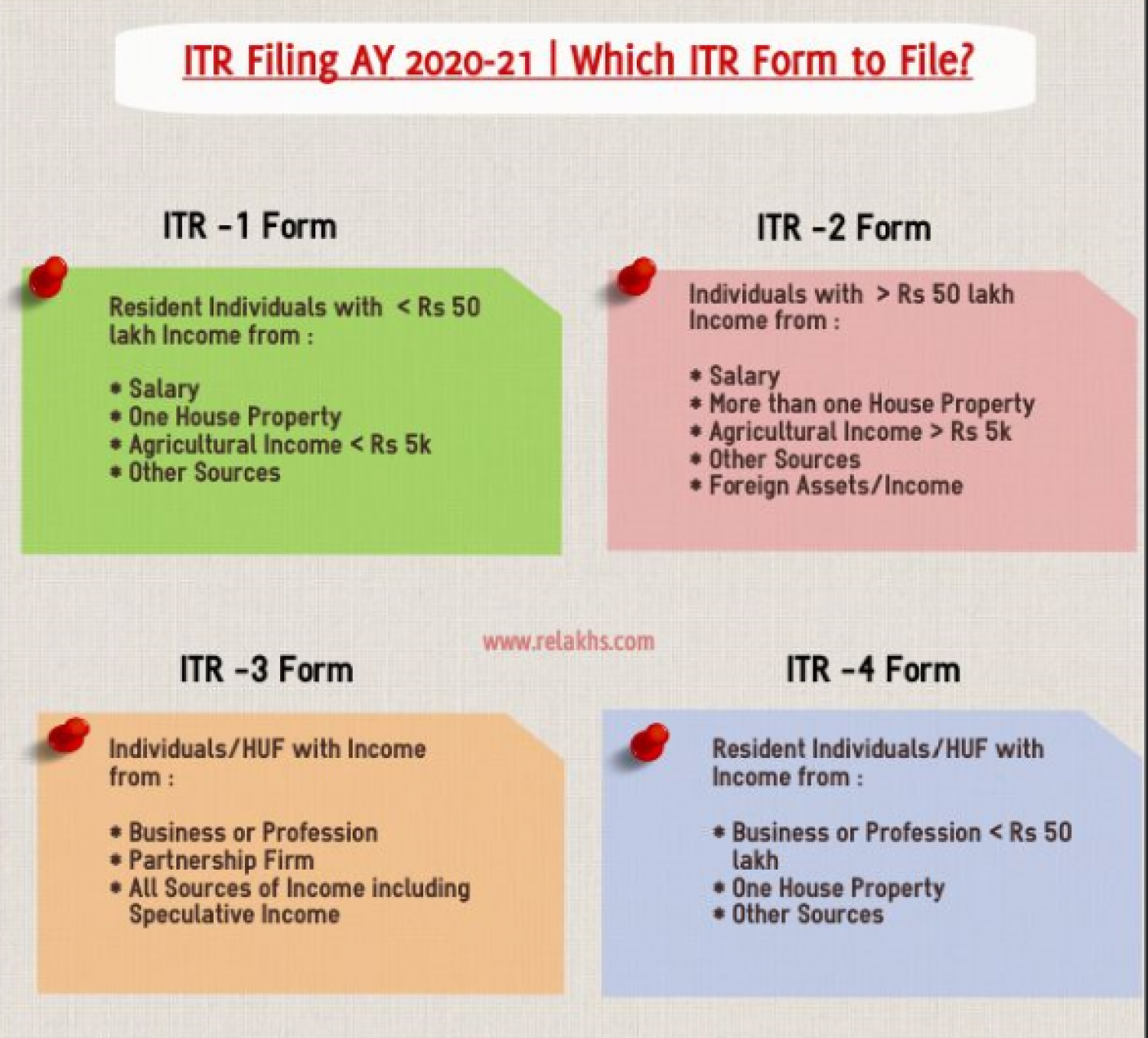

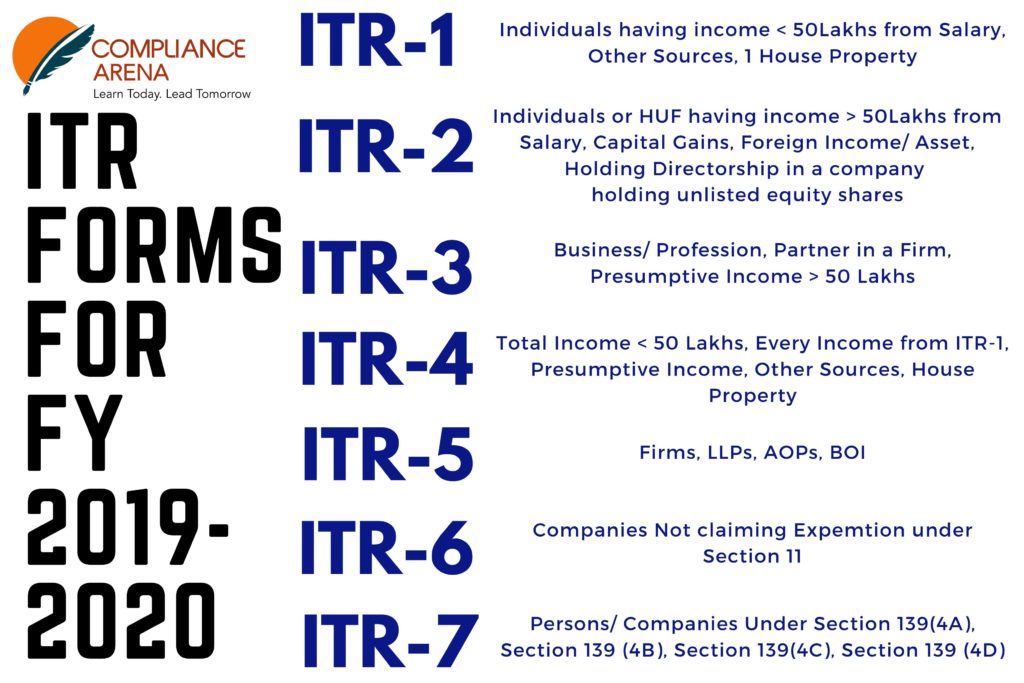

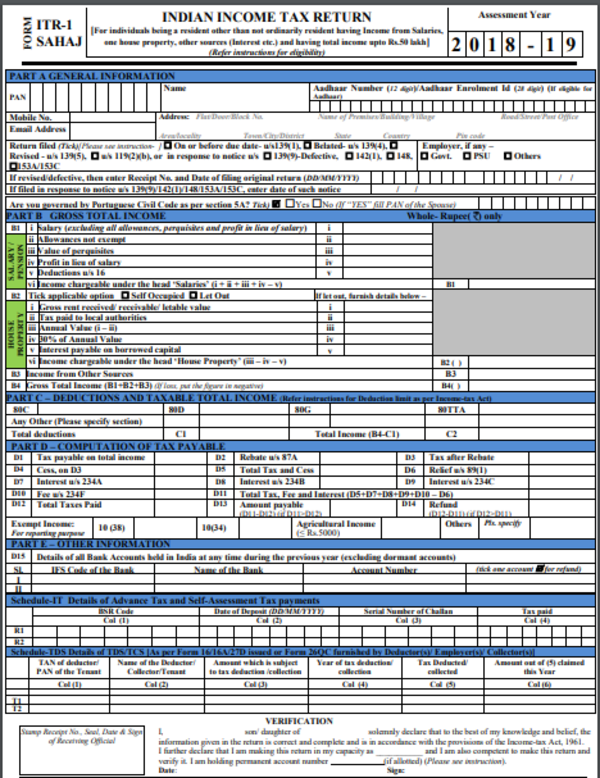

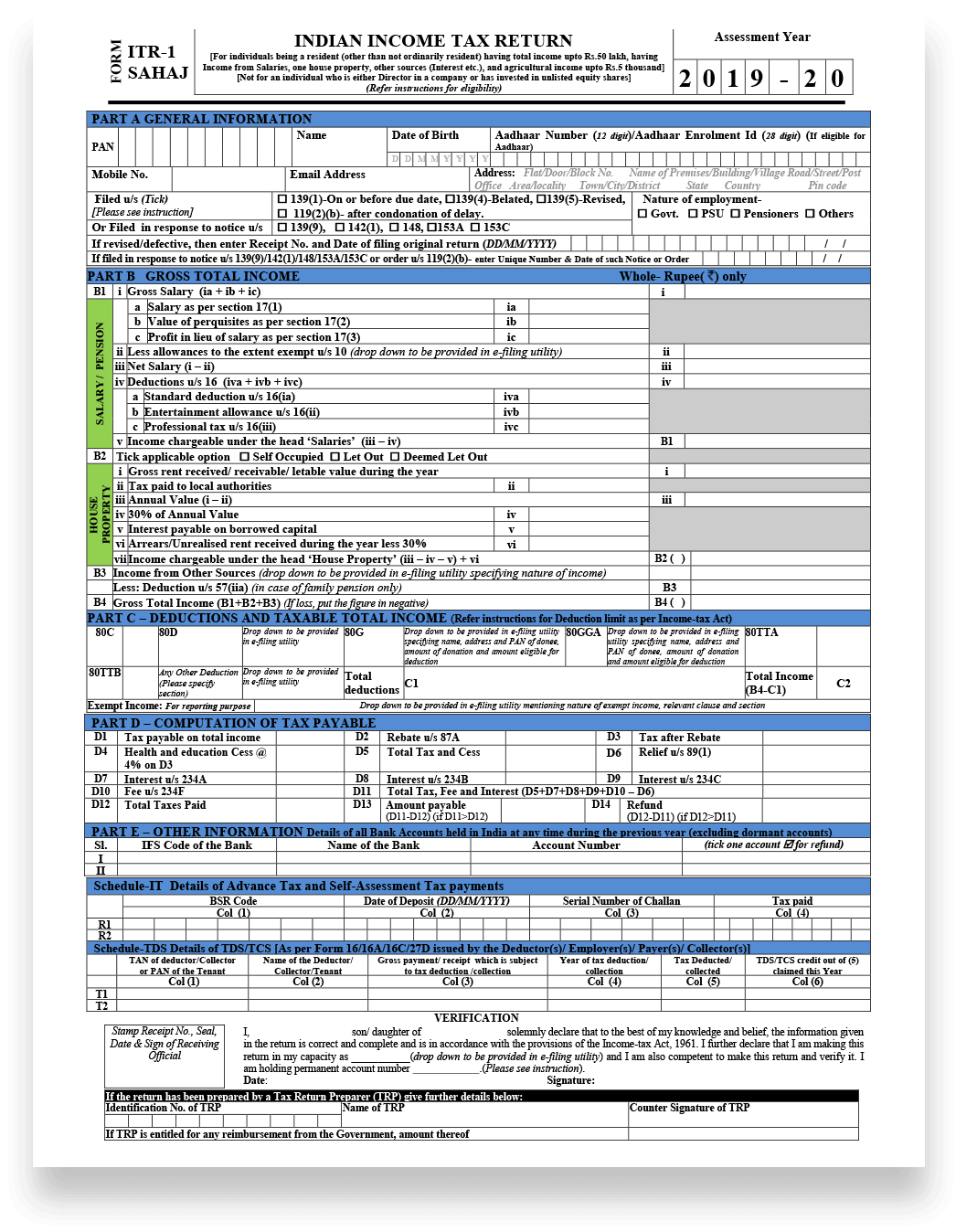

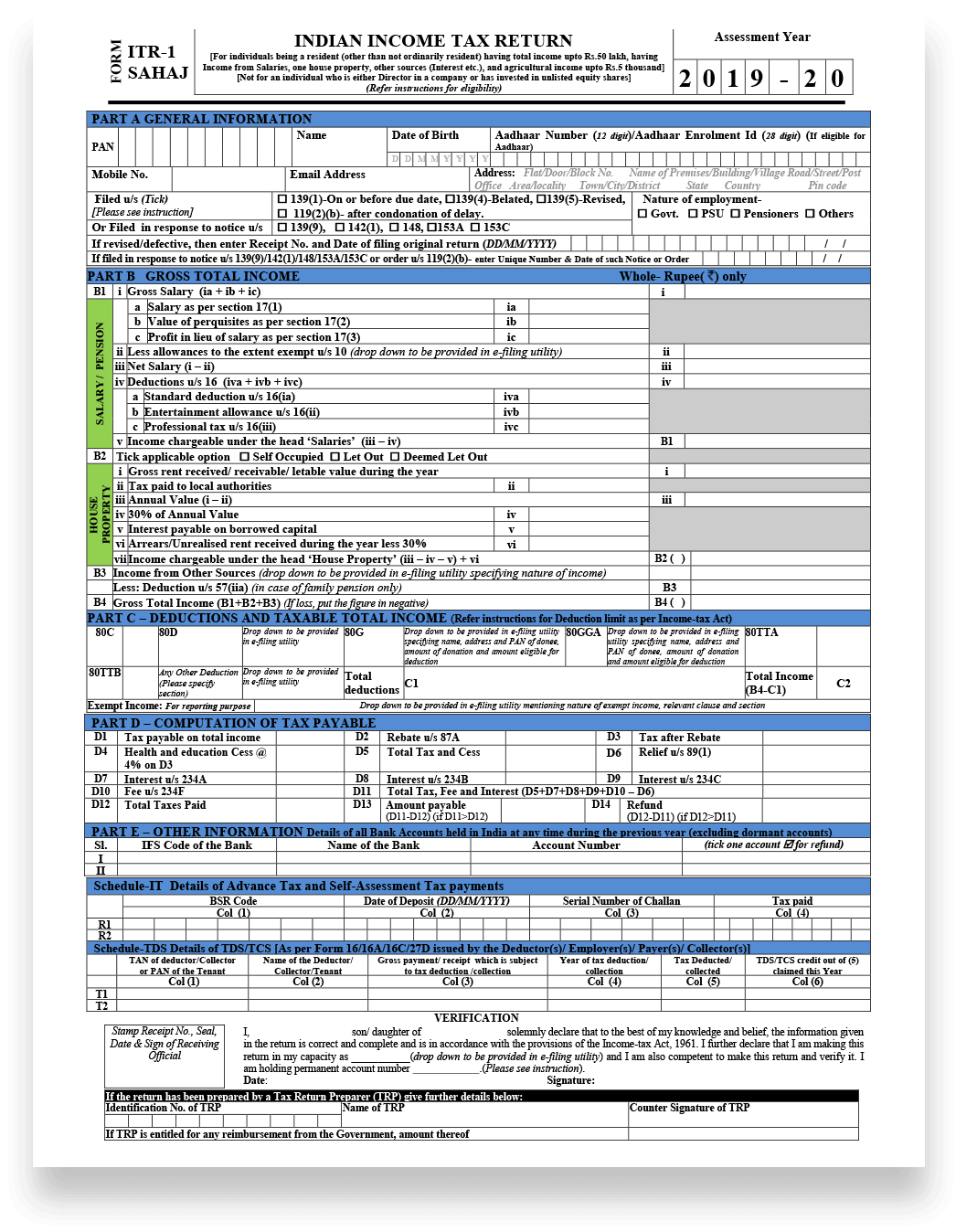

Contents What are ITR forms Can ITR Forms and Income Tax Returns be Used as Interchangeable Terms Who Should File the ITR Why Should You File ITR Types of ITR Forms and Which ITR to File ITR 1 or SAHAJ for FY 2023 24 ITR 2 FY 2023 24 ITR 3 for FY 2023 24 ITR 4 or Sugam for FY 2023 24 ITR 5 ITR 6 ITR 7 Filing an ITR for stock trading requires selecting the appropriate ITR form based on your income sources and the type of stock trading income you earn Refer to the table below to determine the suitable ITR form ITR 2 For those with income sources from salary house property and other sources and who earn only capital gains

Which Itr Form For Salary And Share Trading

Which Itr Form For Salary And Share Trading

https://carajput.com/art_imgs/latest-update-on-income-tax-return-forms-for-fy-2020-21-new-itr-form.jpg

Types Of ITR Form And ITR Form Applicability CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/03/type-of-ITR.jpg

Definition Meaning Of ITR Forms Tax2win

https://emailer.tax2win.in/assets/guides/itr-forms/itr-form.jpg

A salaried individual can file his her tax return either using ITR 1 or ITR 2 It is important to ensure that tax return is filed using the correct form Filing ITR using an incorrect tax return form will lead to defective ITR filing ITR filing for stock market trader How to report income form required and more The deadline for filing ITR for financial year 2022 23 assessment year 2023 24 is July 31 2023 Read this to understand how a stock market trader can file ITR

There are different types of ITR forms You must choose the one that is relevant for you based on the nature of your income Income from F O transactions is shown in ITR 3 whether you are an individual who is trading an HUF or a company Synopsis An individual taxpayer is required to select the correct ITR form based on the sources of his her income in FY 2021 22 Though ITR 1 is usually filed by most individual taxpayers some will have to use the ITR 2 form Read on to know who is eligible to use ITR 2 and how to file ITR 2 completely online on the new income tax

Download Which Itr Form For Salary And Share Trading

More picture related to Which Itr Form For Salary And Share Trading

Which ITR Should I File Types Of ITR Forms Which One Should You File

http://cleartax-media.s3.amazonaws.com/cleartax/images/1657091719_frame17.jpg

Types Of Itr Forms My XXX Hot Girl

https://assets1.cleartax-cdn.com/finfo/wg-utils/retool/64d6f418-6dfb-4afa-86c7-135fe6aed4ed.jpg

ITR Income Tax Return Which ITR Should I File Compliance Arena

https://compliancearena.in/wp-content/uploads/2020/06/For-Individuals-and-HUFs-not-carrying-out-business-or-profession-under-any-proprietorship-having-income-more-than-50-Lakhs-1-1024x683.jpg

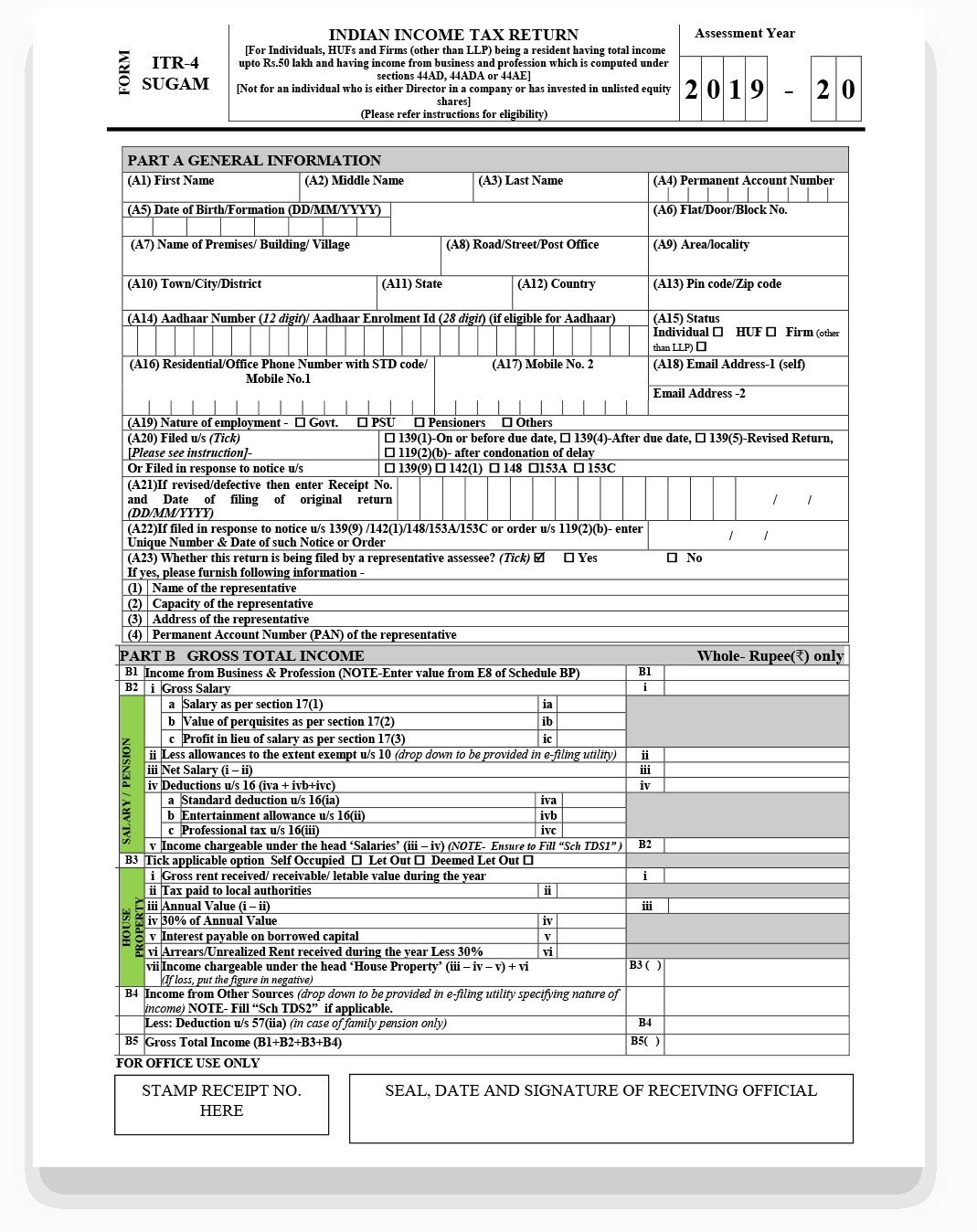

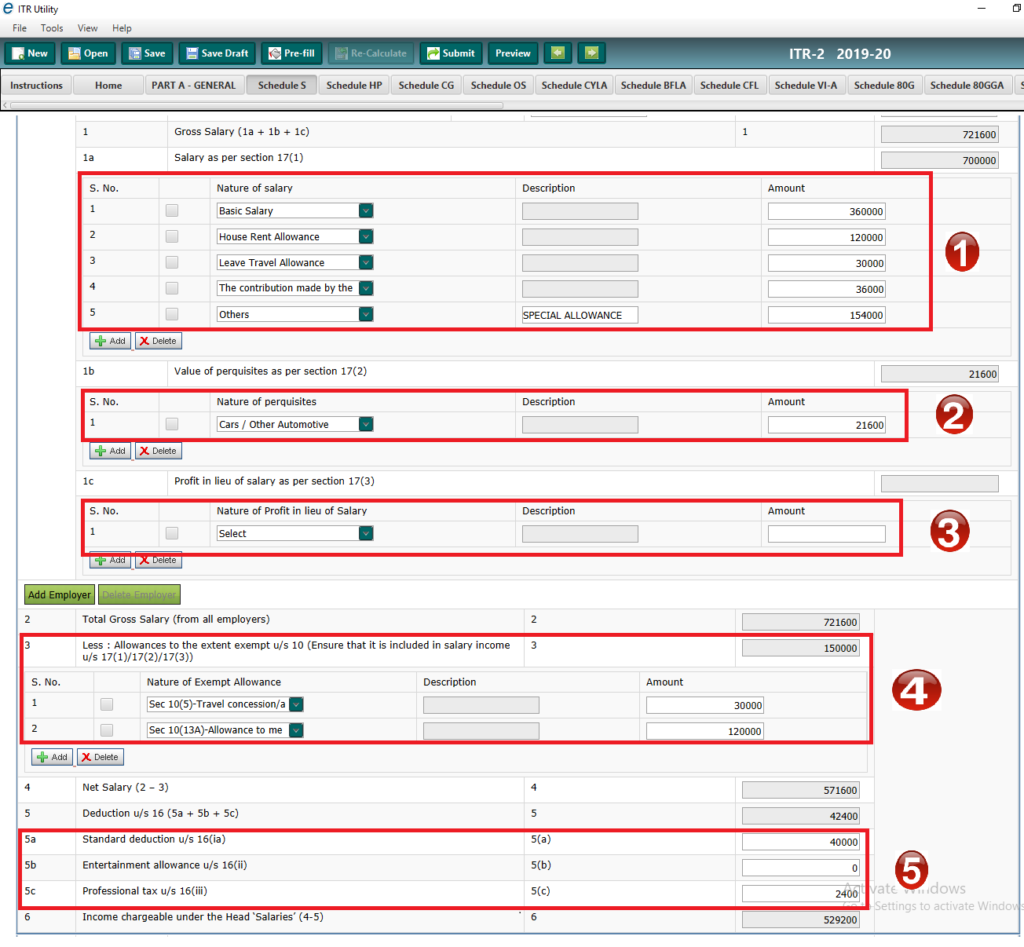

Salaried taxpayers can use their form 16 to file ITR The form 16 can be directly uploaded on https cleartax in income tax efiling to file your income tax return ITR 2 for individuals and HUF for their income other than income from business or profession The Form ITR V Income Tax Return Verification Form should reach within 120 days from the date of e filing the return The confirmation of the receipt of ITR V at Centralized Processing Centre will be sent to the assessee on e mail ID registered in

Salaried people who earn money from the intraday stock exchange or futures and options trading should file Form ITR 3 Individuals may use ITR 3 to record revenue from jobs real estate capital gains company or trade including presumptive income and other sources Know Complete Information on All Seven types of Income Tax Return ITR Forms Also Know which ITR Form Should File when Filing for AY 2024 25

What Is ITR 2 In Income Tax ITR 2 Form Structure Eligibility

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/itr-2.jpg

Business Income Tax Return Online Filing Infinity Compliance

https://www.infinitycompliance.in/wp-content/uploads/2019/11/ITR-4-Format.png

https://www. taxontips.com /are-you-a-salaried...

Now the most important question Which ITR to file The answer would be it depends on the quantum of trading and what type of transaction is done Generally if a person is doing transaction in delivery based shares then ITR 2 needs to be filed and show such transaction under capital gain

https:// tax2win.in /guide/itr-forms

Contents What are ITR forms Can ITR Forms and Income Tax Returns be Used as Interchangeable Terms Who Should File the ITR Why Should You File ITR Types of ITR Forms and Which ITR to File ITR 1 or SAHAJ for FY 2023 24 ITR 2 FY 2023 24 ITR 3 for FY 2023 24 ITR 4 or Sugam for FY 2023 24 ITR 5 ITR 6 ITR 7

Details Of Income From Salary In ITR Form

What Is ITR 2 In Income Tax ITR 2 Form Structure Eligibility

ITR 2 Form What Is An ITR 2 Form And How To File ITR 2 Online

Income Tax Return Forms 2019 20 How To Download ITR Forms Online

New ITR Forms Notified Salary Breakup GSTIN To Be Furnished Times

Income Tax E filing ITR 1 Form Virtual Auditor Learning Centre

Income Tax E filing ITR 1 Form Virtual Auditor Learning Centre

ITR 1 Sahaj Form For Salaried Individuals Learn By Quicko

Income Tax E filing ITR 2 Form Virtual Auditor Learning Centre

File ITR 2 Online User Manual Income Tax Department

Which Itr Form For Salary And Share Trading - A salaried individual can file his her tax return either using ITR 1 or ITR 2 It is important to ensure that tax return is filed using the correct form Filing ITR using an incorrect tax return form will lead to defective ITR filing