Which Self Employed Tax Calculator Calculate your tax bill Which self employment supplement should I choose It s important to make sure you declare all relevant income on your tax return most income sources are given different sections if you file online If you file a paper tax return you ll need to fill out supplementary pages

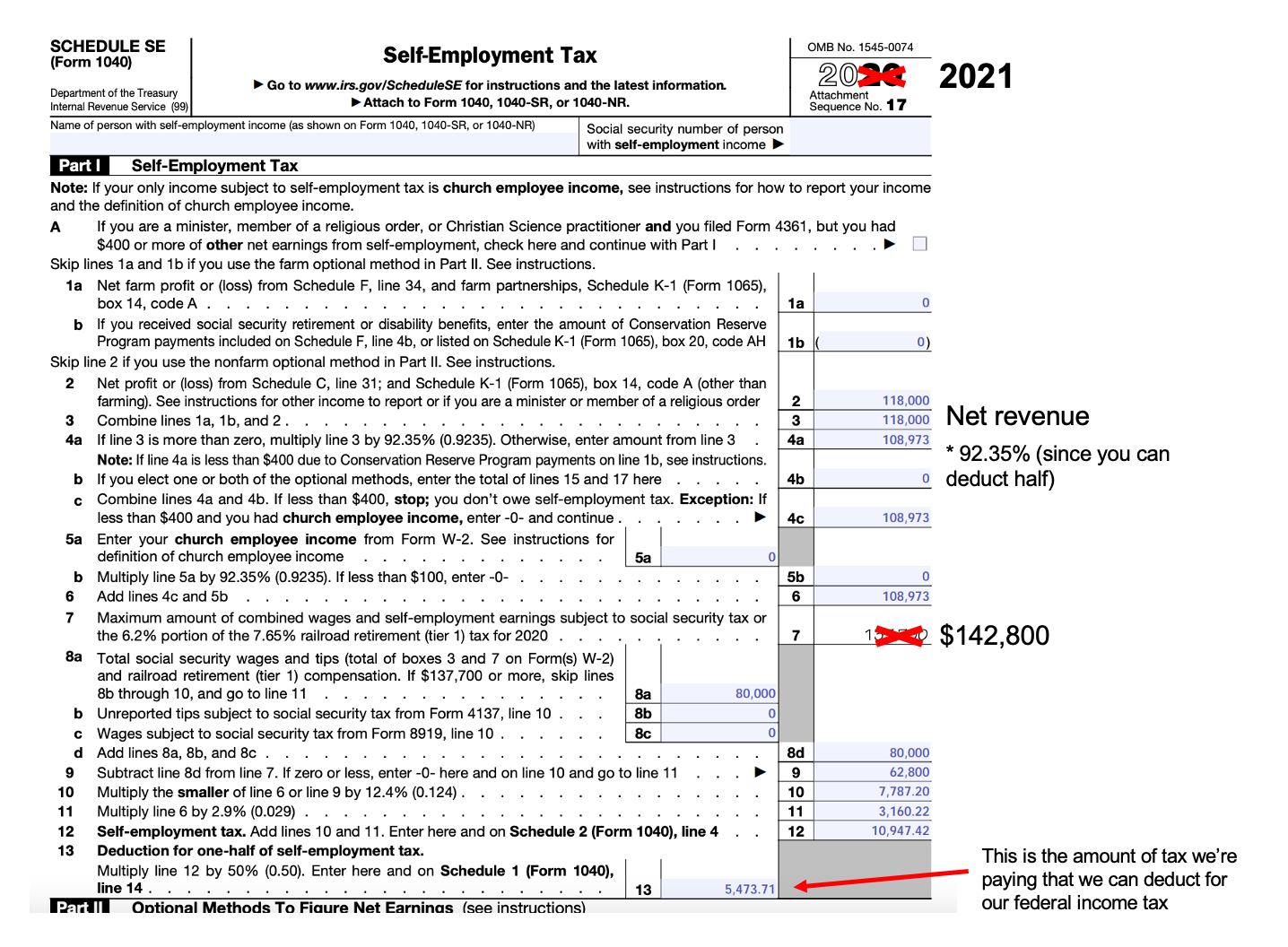

Use our self employed tax calculator to check the tax and other deductions from self employment profits updated for the 2024 2025 tax year Determine your self employment tax base Multiply your net earnings by 92 35 0 9235 to get your tax base 50 000 x 92 35 46 175 Calculate your self employment tax

Which Self Employed Tax Calculator

Which Self Employed Tax Calculator

https://customprintingdeals.com/wp-content/uploads/2020/01/a5a5ebb91bd02e253cdc6639bf3da23d.jpeg

Self Employed Tax Refund Calculator JaceDillan

https://images.squarespace-cdn.com/content/v1/5e94adbc25a0ae61d843b475/1631660328281-6URFQ1JKAFLIJEBCHYDD/Schedule_SE_Example_2021

Self Employed Tax Calculator Tax Withholding Estimator 2021

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/self-employment-tax-calculator-dirim.jpg

Use our self employment tax calculator to figure out what taxes you owe Nerdy takeaways Self employment tax applies to self employed people who earned more than 400 during the year The self employment tax rate a combination of Social Security and

Credits deductions and income reported on other forms or schedules Use our Self Employed Tax Calculator and Expense Estimator to find common self employment tax deductions write offs and business expenses for 1099 filers Use this calculator to estimate your self employment taxes Annual self employment income Annual employer income already taxed Tax filing status Calculate CalcXML s Self Employment Tax Calculator will help you determine what your self employment tax will be

Download Which Self Employed Tax Calculator

More picture related to Which Self Employed Tax Calculator

Self Employed Canada Tax Form Employment Form

https://i0.wp.com/www.employementform.com/wp-content/uploads/2022/10/self-employed-canada-tax-form.png

Form For Self Employed Taxes Employment Form

https://i0.wp.com/www.employementform.com/wp-content/uploads/2022/10/form-for-self-employed-taxes.jpg

2023 2024 Self Employment Tax Calculator

https://www.mortgagecalculator.org/images/self-employment-tax-calculator.png

Our calculator allows you to select your specific self employed industry over 30 and discover what self employed business tax write offs and expenses you can deduct as a 1099 independent contractor or freelancer Use the self employment Income Tax calculator to work out your take home pay after business expenses National Insurance contributions and Income Tax Enter your gross annual income into the calculator If your income varies use an average over a few months for the best results

Bankrate provides a FREE self employed tax calculator and other employment tax calculators to help small business owners determine the expenses to be deducted before taxes Employed and self employed tax calculator Quickly calculate how much Income Tax and National Insurance you owe on your earnings if you re both employed and self employed Tax year 2024 25 Your situation Annual salary gross Self employed income Self employed expenses Tax and profit Total earnings 70 000

Molecul Federal apte Self Employed Tax Calculator Men iune Bun Ucenic

https://www.irstaxapp.com/wp-content/uploads/2022/10/self-employment-tax-calculator.png

Self Employed Tax Credit Calculator 1099 Expert

http://1099.expert/wp-content/uploads/2023/12/image-title-Generate-high-resolution-25058.png

https://www.which.co.uk/money/tax/income-tax/income...

Calculate your tax bill Which self employment supplement should I choose It s important to make sure you declare all relevant income on your tax return most income sources are given different sections if you file online If you file a paper tax return you ll need to fill out supplementary pages

https://www.uktaxcalculators.co.uk/.../self-employed-tax-calculator

Use our self employed tax calculator to check the tax and other deductions from self employment profits updated for the 2024 2025 tax year

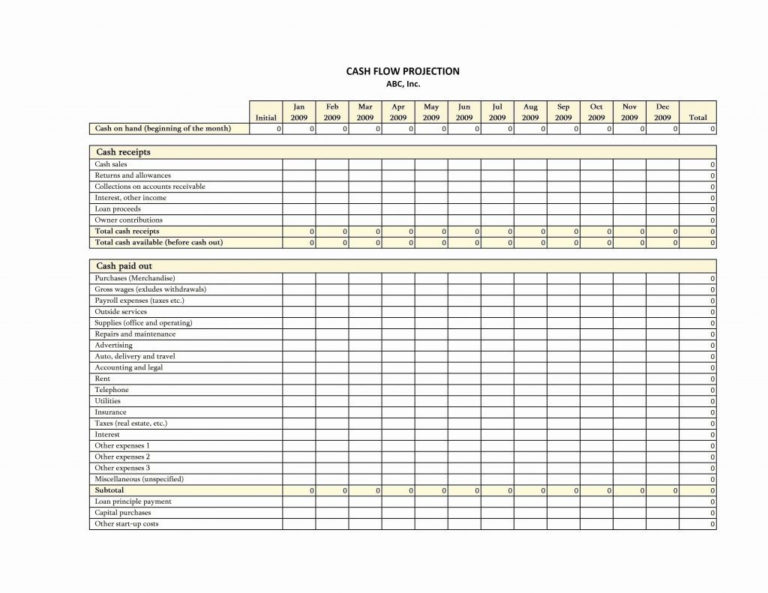

Self Employed Tax Spreadsheet Pertaining To Self Employed Expense Sheet

Molecul Federal apte Self Employed Tax Calculator Men iune Bun Ucenic

Self Employment Tax Calculator For 2020 Good Money Sense Self

Self Employment Tax Calculator 2021 IRS Tax Withholding Estimator 2021

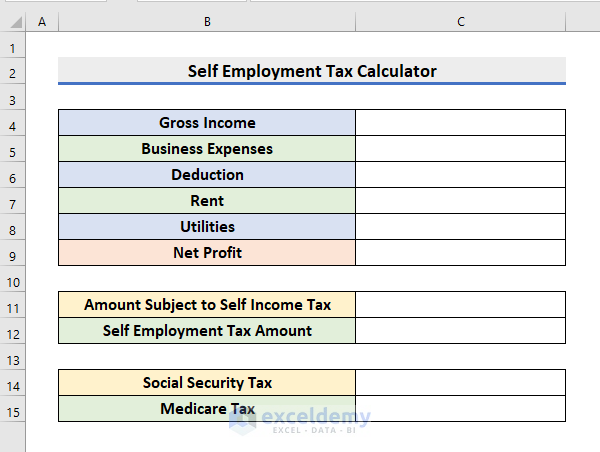

Self employed Tax Calculator

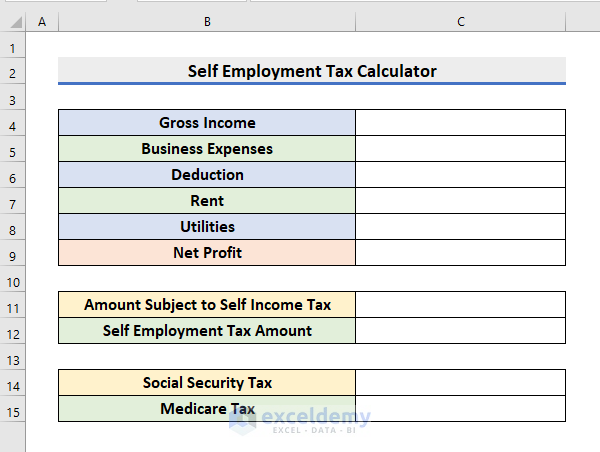

Self Employment Tax Calculator In Excel Spreadsheet

Self Employment Tax Calculator In Excel Spreadsheet

Self Employment Tax Calculator How Much Will Your Self Employment Tax

SETC Self Employed Tax Credit Organization The Official Organization

Self Employed Tax Mistakes To Avoid

Which Self Employed Tax Calculator - Credits deductions and income reported on other forms or schedules Use our Self Employed Tax Calculator and Expense Estimator to find common self employment tax deductions write offs and business expenses for 1099 filers