Who Gets The Interest On Child Support Arrears In Texas The Texas Attorney General s Child Support Division offers a Ledger service to track child support payments This tool helps maintain an accurate record of your payments and outstanding arrears Understanding the exact amount owed is vital for managing your financial obligations effectively

This could include child support medical support or interest owed to the state on unpaid amounts Texas family law courts determine how much and in what way child support arrears are paid The support seeking spouse or the Texas Attorney General s office can file enforcement against the other parent Thirty four states Guam and Puerto Rico authorize interest charges for child support arrears Many charge interest at set rates per year 12 per annum Colorado Kentucky and Washington 10 per annum Arizona Arkansas California Iowa and Wyoming 9 per annum Illinois New York and Oregon

Who Gets The Interest On Child Support Arrears In Texas

Who Gets The Interest On Child Support Arrears In Texas

https://www.myphlaw.com/images/blog/shutterstock_1134923861.jpg

Past Due Child Support Laws Are Changing In Tennessee

https://phillipsandingrum.com/wp-content/uploads/2016/08/IMG_0166-scaled.jpg

Letter Child Support Doc Template PdfFiller

https://www.pdffiller.com/preview/497/308/497308721/large.png

Dental support cost of dental insurance Arrearages past due or back child support and Retroactive child support support from parents separation until orders are made by the court Texas Family Code 154 062 What is the basic guideline for child support Texas Family Code 154 125 b How long do I have to pay support Section 157 265 of the Texas Family Code applies simple interest rather than compound interest to child support arrears This means that interest only accumulates on the principle Interest does not accumulate on the previously accumulated interest

The lien secures payment of all child support arrearages owed by the obligor under the underlying child support order including arrearages that accrue after the lien notice was filed or delivered as provided by Section 157 314 Filing Lien Notice or Abstract of Judgment Notice to Obligor c Past Due Child Support Arrears Interest and Retroactive Support Even after the termination of regular child support payments the non custodial parent remains responsible for clearing any past due child support arrears accumulated interest and retroactive support

Download Who Gets The Interest On Child Support Arrears In Texas

More picture related to Who Gets The Interest On Child Support Arrears In Texas

Statute Of Limitations For Texas Child Support Arrears Her Lawyer

https://herlawyer.com/wp-content/uploads/2022/06/Statute-of-Limitations-for-Texas-Child-Support-Arrears.jpg

Is There Interest On Child Support In GA 2024 Atlanta Divorce Lawyer

https://attorneyshin.com/wp-content/uploads/2023/05/pexels-photo-1602726.jpeg

Texas Child Support Arrears Forgiveness How To Seek It Divorce And

https://www.divorceandfinance.org/wp-content/uploads/2023/02/Featuring-Child-Support-in-Texas.jpg

Child support arrears keep growing in Texas the state charges 6 percent interest on unpaid balances It s simple interest not compound so you won t have to pay interest on the interest unless the court enters a judgment against you In this case the judgment is typically for all you owe at that point in time which may include interest The appeals court also reversed the denial of the child support arrearages and rendered judgment confirming the amount of the arrearage The court remanded the case so the trial court could determine prejudgment interest Is Your Co Parent in Arrears for Child Support Call McClure Law Group Today

A custodial aunt recently appealed an order that would allow a father to pay off child support and medical support arrearages he owed her over 25 to 30 years Aunt Awarded Child Support and Medical Support The child s aunt intervened in a suit affecting the parent child relationship in 2005 and was awarded child support from the If you re looking for a quick answer the interest on child support arrears in Texas is owed to the parent or guardian receiving the support not the state In this comprehensive guide we ll analyze Texas child support laws regarding arrears and the application of interest charges

2021 Colorado Child Support Changes Interest Rate Lowered

https://www.graham.law/wp-content/uploads/Feature0491.jpg

Free Child Support Demand Letter Template Sample Word PDF EForms

https://i0.wp.com/eforms.com/images/2018/04/Child-Support-Demand-Letter.png?fit=1600%2C2263&ssl=1

https://www.bryanfagan.com/blog/2021/april/how-to...

The Texas Attorney General s Child Support Division offers a Ledger service to track child support payments This tool helps maintain an accurate record of your payments and outstanding arrears Understanding the exact amount owed is vital for managing your financial obligations effectively

https://familytexas.com/child-support-arrears

This could include child support medical support or interest owed to the state on unpaid amounts Texas family law courts determine how much and in what way child support arrears are paid The support seeking spouse or the Texas Attorney General s office can file enforcement against the other parent

Child Support Forgiveness Texas Navigating Arrears Modifications

2021 Colorado Child Support Changes Interest Rate Lowered

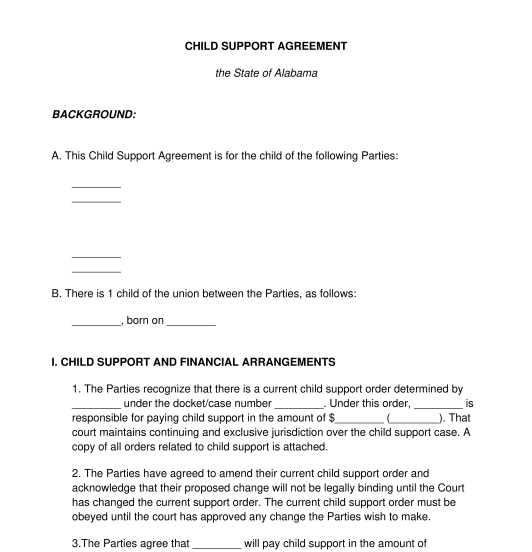

Child Support Agreement Template Word PDF

CHILD SUPPORT ARREARS VS RETROACTIVE CHILD SUPPORT IN TEXAS FAMILY LAW

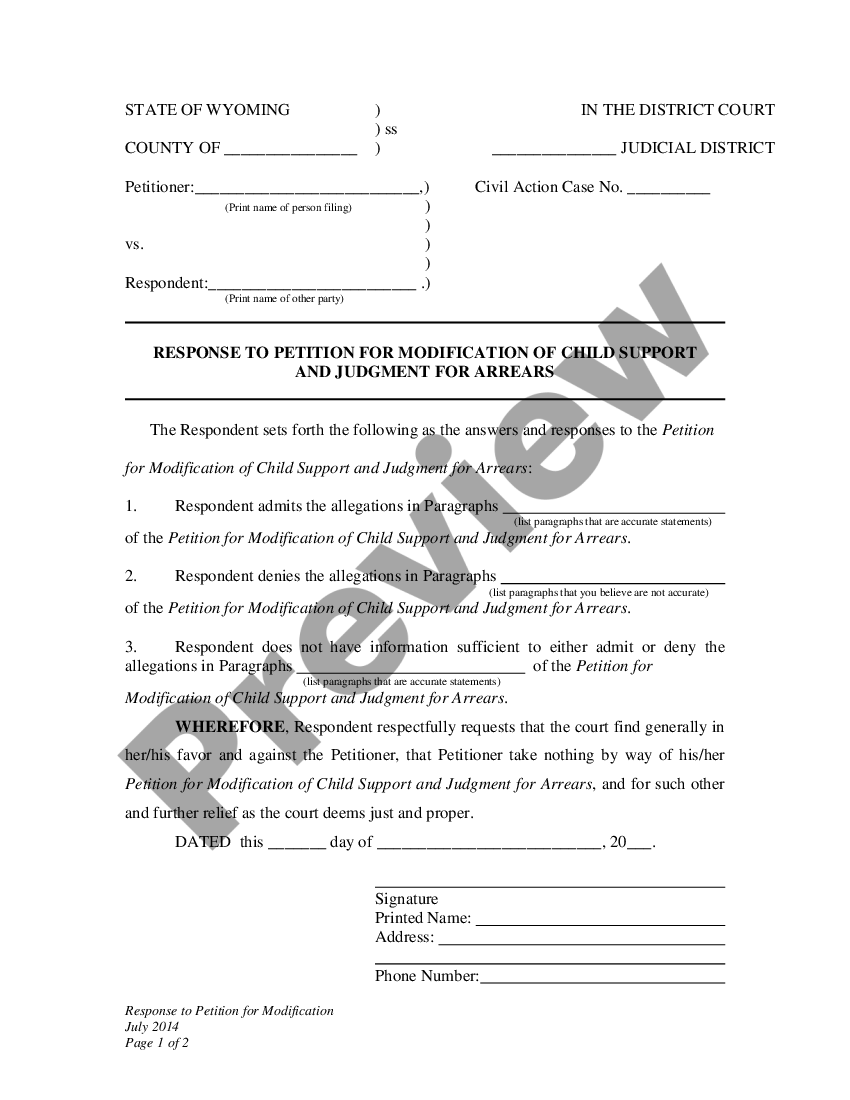

Child Support Arrears Forgiveness Form US Legal Forms

Assessing Child Support Arrears In Nine Large States And The Nation ASPE

Assessing Child Support Arrears In Nine Large States And The Nation ASPE

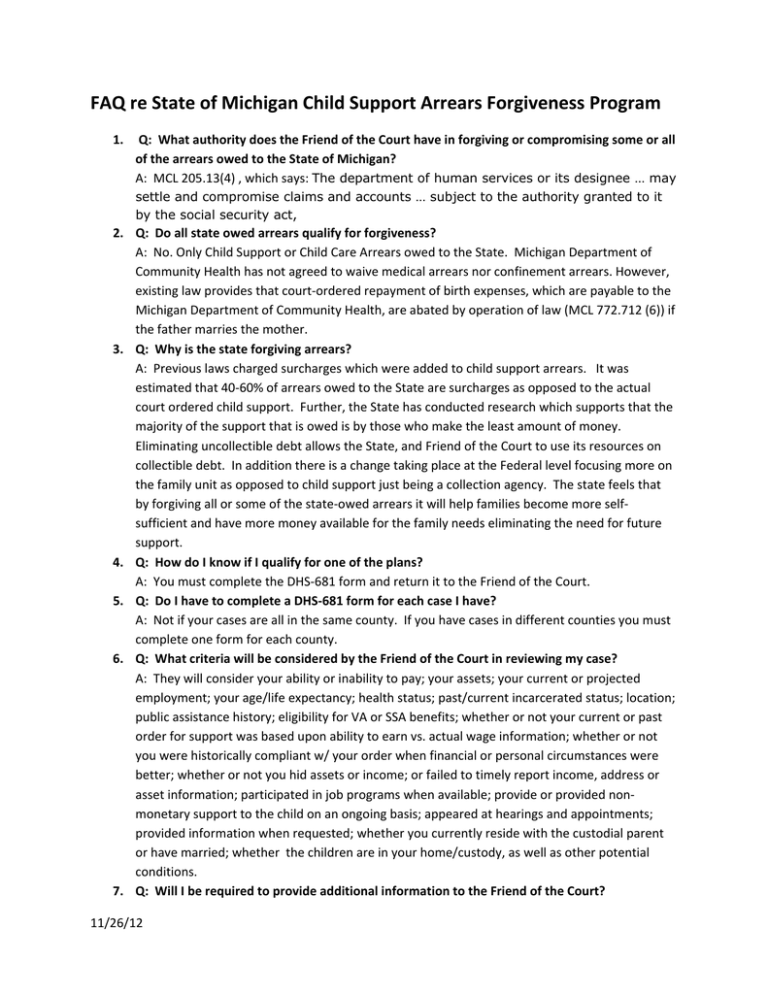

FAQ Re State Of Michigan Child Support Arrears Forgiveness Program

Can You Still Collect Child Support Arrears After Your Child Turns 18

How To Pay Back Child Support Arrears PEYNAMT

Who Gets The Interest On Child Support Arrears In Texas - Dental support cost of dental insurance Arrearages past due or back child support and Retroactive child support support from parents separation until orders are made by the court Texas Family Code 154 062 What is the basic guideline for child support Texas Family Code 154 125 b How long do I have to pay support