Who Is Considered A Tax Return Preparer A tax return preparer is any person who prepares for compensation or who employs one or more persons to prepare for compensation all or a substantial portion of any return of

Anyone can be a paid tax return preparer as long as they have an IRS Preparer Tax Identification Number PTIN However tax return preparers have differing levels of If you choose to have someone prepare your tax return choose that preparer wisely A paid tax return preparer is primarily responsible for the overall

Who Is Considered A Tax Return Preparer

Who Is Considered A Tax Return Preparer

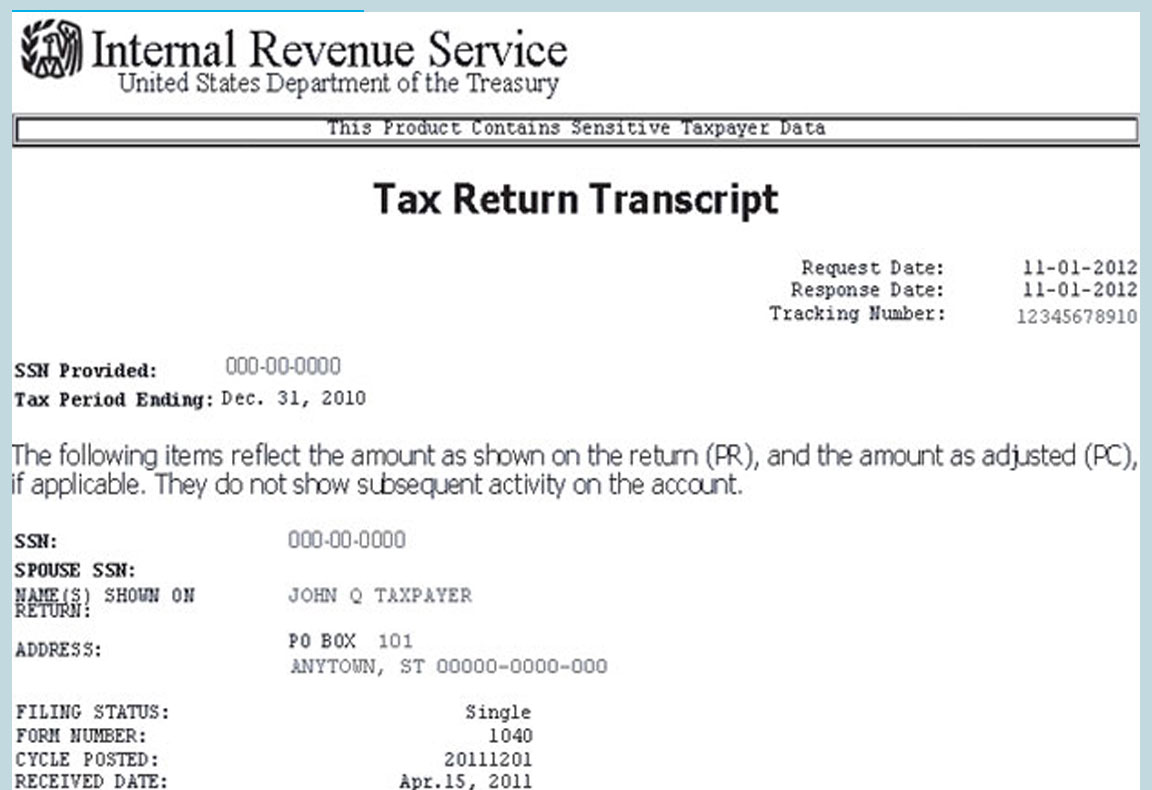

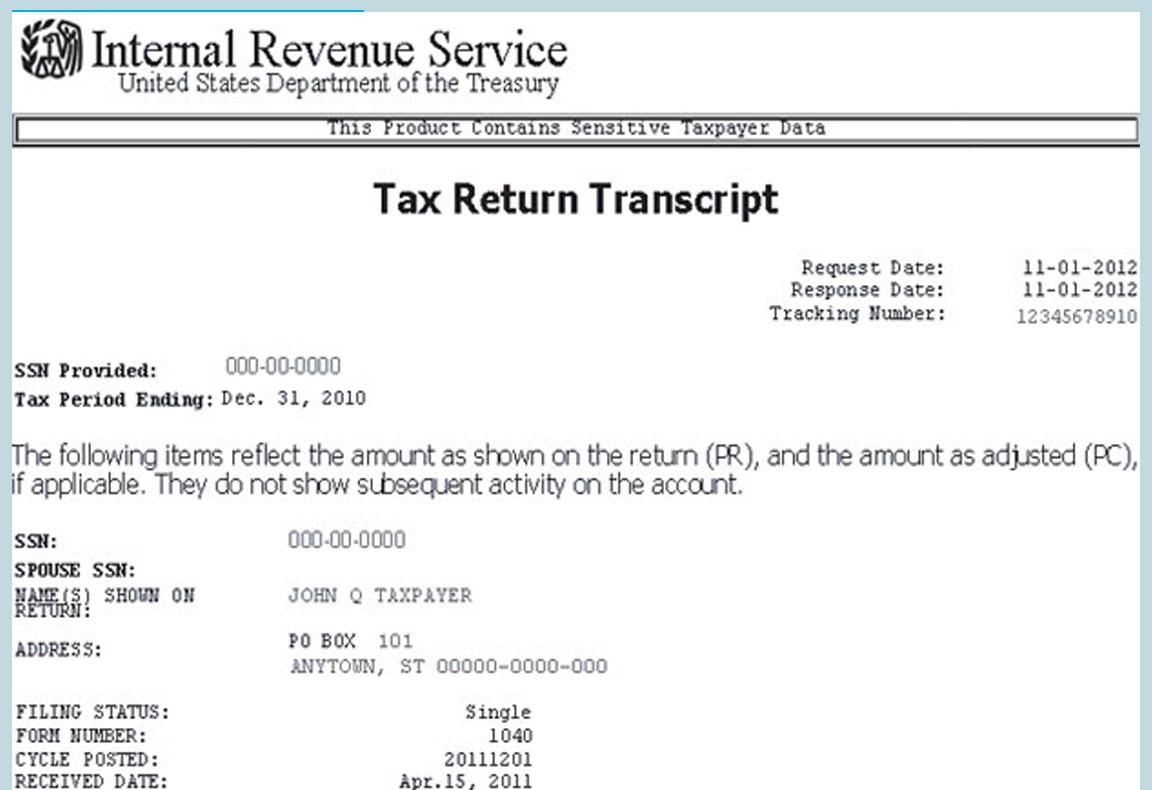

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/31212/Tax_Return_Transcript_M_1_.5b7dc4cc39e04.png

8 Reasons To Hire Someone To Help With Your Income Tax Planning Black

https://blackdiamondfs.com/wp-content/uploads/2021/08/taxfilingstatus.jpeg

Tax Return Engagement Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-return-engagement-letter-b367df64e2cb9e588c62860163aa9e7e_og.png

Directory of Federal Tax Return Preparers with Credentials and Select Qualifications Anyone with a Preparer Tax Identification Number PTIN can prepare The Code contains a broader definition of who is a tax return preparer A tax return preparer is any person who prepares for compensation or who employs one or

You are legally responsible for everything listed on your tax return even if you followed the advice of a tax return preparer Most preparers are trustworthy and Tax preparation is the process of preparing tax returns often income tax returns often for a person other than the taxpayer and generally for compensation Tax preparation may

Download Who Is Considered A Tax Return Preparer

More picture related to Who Is Considered A Tax Return Preparer

5 Tips For Finding A Tax Preparer Kiplinger

https://mediacloud.kiplinger.com/image/private/s--5FWjoa9o--/v1584618367/slideshow/taxes/T056-S001-tips-for-choosing-a-tax-preparer/images/intro.jpg

Tax Return Preparer Penalty Explained

https://irstaxtrouble.com/wp-content/uploads/sites/5/2021/11/tax-return-preparer-penalty.jpg

Tax Preparer Profits Tax Preparer Profits Home

http://2.bp.blogspot.com/-DNc3Kf9MBc8/U9Lh2v_l4JI/AAAAAAAAAEs/Hxt7NdGj1f8/s1600/become-a-tax-preparer-graphic.png

Virtually all individuals who prepare tax returns for compensation must have a Preparer Tax Identification Number PTIN This requirement generally applies to all attorneys accountants and enrolled agents who prepare Under the return preparer registration requirements individuals including CPAs who are tax return preparers and prepare all or substantially all of a tax return or claim for refund

Treasury Regulation 301 7701 15 generally defines a tax return preparer as any person who prepares for compensation or who employs one or more persons to The definition of a tax return preparer in Regs Sec 301 7701 15 includes both signing and nonsigning preparers Signing preparers have primary responsibility

Tax Return Free Of Charge Creative Commons Clipboard Image

http://www.picpedia.org/clipboard/images/tax-return.jpg

Tax Filing Season Opens With Official Launch And Ask A Tax Preparer

http://photos.prnewswire.com/prnfull/20130130/NY51128LOGO?max=200

https://www.law.cornell.edu/cfr/text/26/301.7701-15

A tax return preparer is any person who prepares for compensation or who employs one or more persons to prepare for compensation all or a substantial portion of any return of

https://www.irs.gov/tax-professionals/choosing-a-tax-professional

Anyone can be a paid tax return preparer as long as they have an IRS Preparer Tax Identification Number PTIN However tax return preparers have differing levels of

Can A Tax Preparer Save Me Money SmartGuy

Tax Return Free Of Charge Creative Commons Clipboard Image

The Market Future For Tax Preparers Huntersure

What You Need To Know Before Choosing A Tax Preparer

The Top 5 Ways To Effectively Work With Your Tax Preparer

Completing Form 1040 The Face Of Your Tax Return US 2021 Tax Forms

Completing Form 1040 The Face Of Your Tax Return US 2021 Tax Forms

How To Use The Tax Return Preparer Directory YouTube

100 OFF US Income Tax Preparation IRS Tutorial Bar

How To Become A Tax Preparer

Who Is Considered A Tax Return Preparer - Taxpayers are responsible for all the information on their income tax return regardless of who prepares the return Here are some tips to remember when selecting