Who Is Eligible For Council Tax Reduction You might be able to pay less council tax or not pay it at all depending on your circumstances You might be able to get discounts for example for a single person or an empty property Council Tax Reduction CTR if you have low income a different reduction if

You may be eligible to claim Council Tax Support sometimes called Council Tax Reduction if you re on a low income or claiming certain benefits Visit our Council Tax Support webpage to find out about eligibility and how to claim If you re on a low income you may be eligible for a council tax reduction of up to 100 Each local authority has different criteria for who is eligible to claim a council tax reduction The size of the reduction depends on your income your savings and whether you live alone or with other adults in the same property

Who Is Eligible For Council Tax Reduction

Who Is Eligible For Council Tax Reduction

https://www.signnow.com/preview/556/694/556694551/large.png

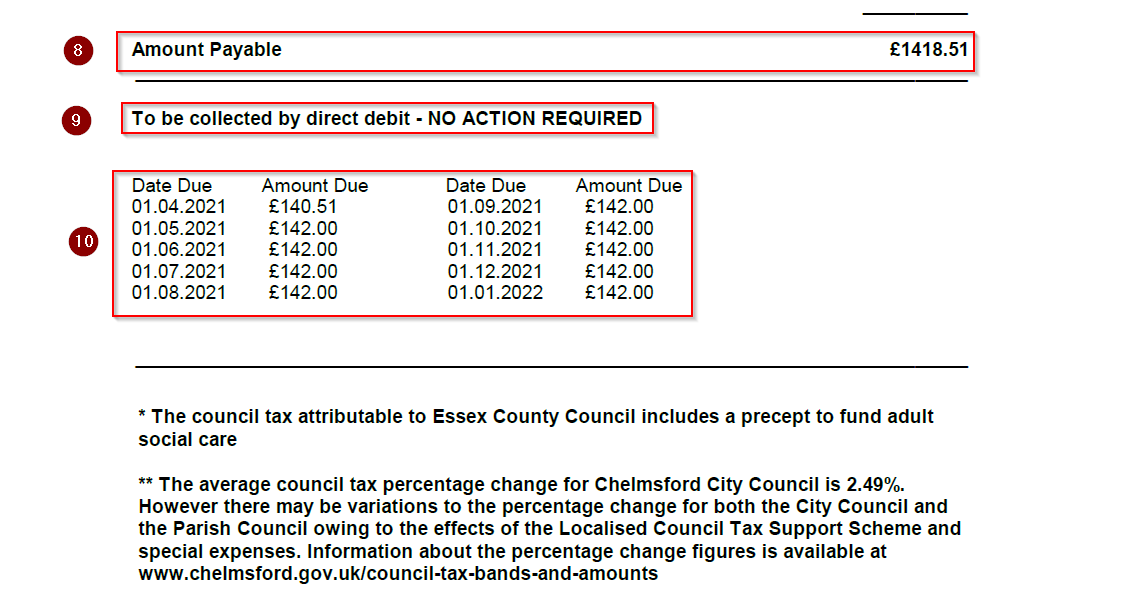

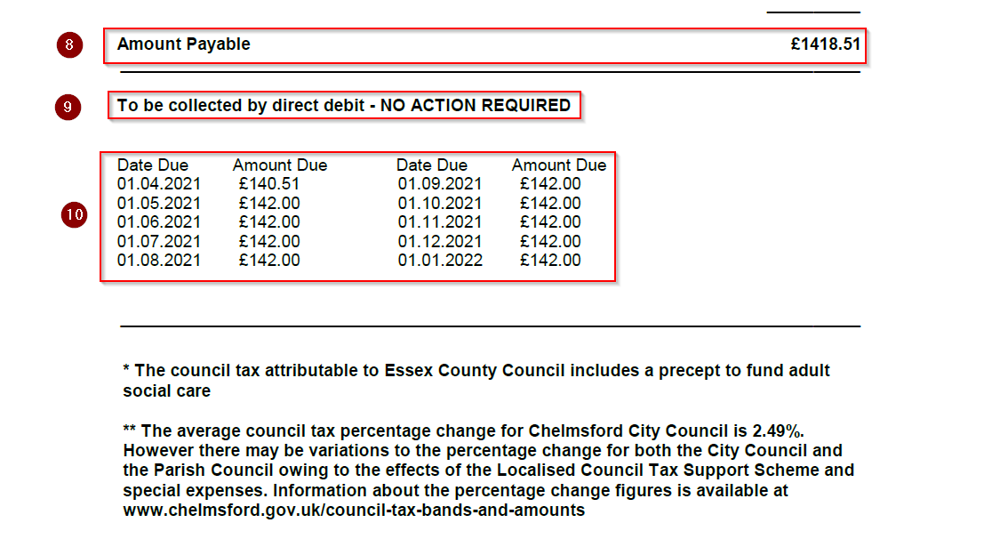

Understanding Your Council Tax Bill

https://www.chelmsford.gov.uk/media/zgqmihmh/council-tax-bill-bottom.png?rmode=max&width=1000&rnd=133114327087130000

Council Tax Reduction For People With Dementia Birmingham Carers Hub

https://birminghamcarershub.org.uk/wp-content/uploads/2022/08/Council-tax-reduction.png

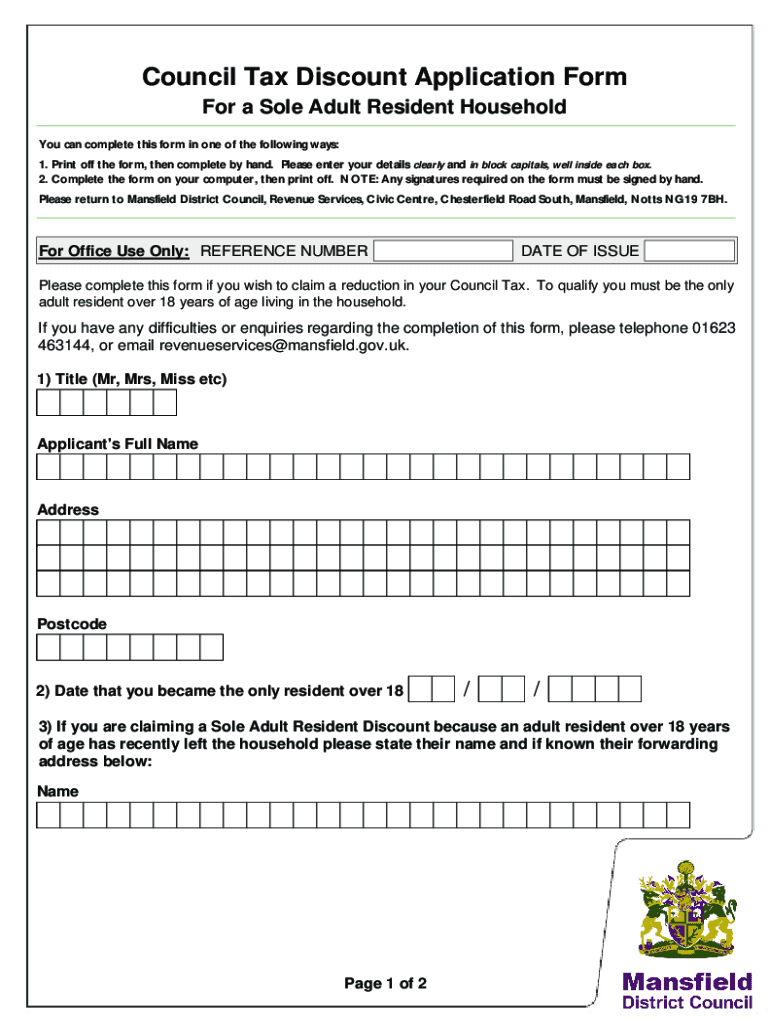

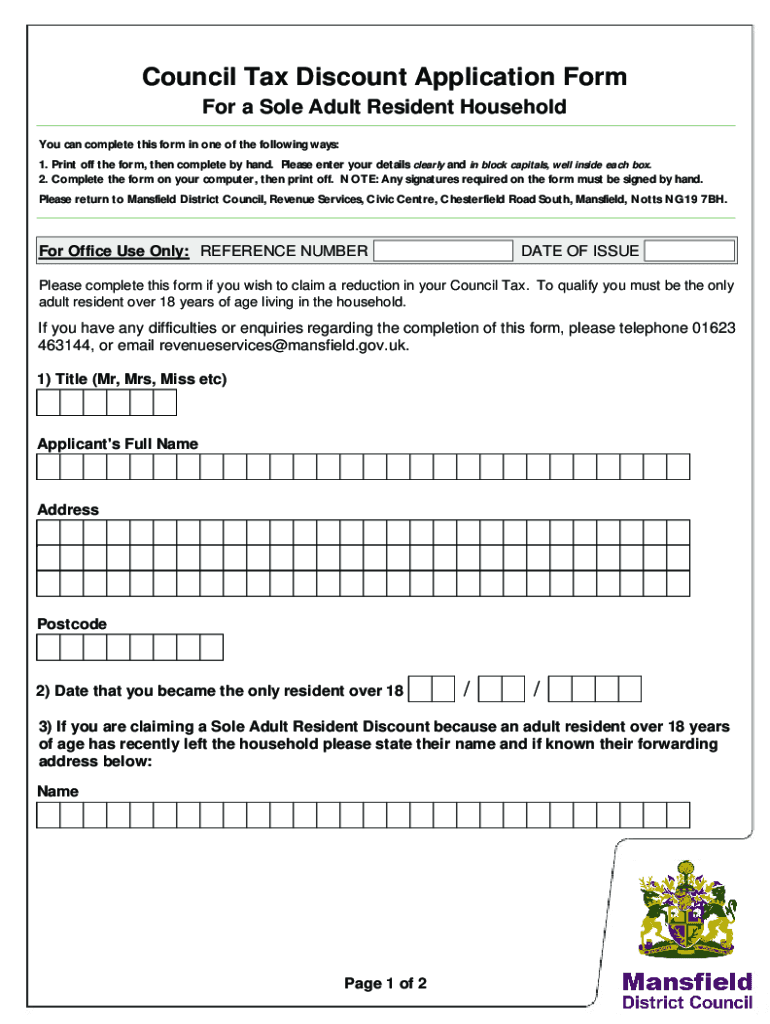

You ll have to apply to your local council to get Council Tax Reduction CTR or Second Adult Rebate Before you apply you need to check if you re eligible for CTR or the Second Adult Rebate There are 2 sets of CTR rules You should check which rules apply it affects things like how much CTR you can get and when you can make the application You ll get 25 off your bill if you pay Council Tax and either you live on your own everyone else in your home is disregarded Contact your local council if you re unsure about whether you

Am I eligible for Council Tax Reduction If you re on a low income or receiving certain benefits you might be eligible for Council Tax Reduction But whether you re eligible in your area and what you might be eligible for is up to your local council Apply for a Council Tax discount Check with your council if you re eligible for a discount which will reduce the Council Tax you pay Enter a postcode For example SW1A 2AA

Download Who Is Eligible For Council Tax Reduction

More picture related to Who Is Eligible For Council Tax Reduction

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

Who Is Eligible For VA Benefits The 2 Critical Factors Revealed

https://vaclaimsinsider.com/wp-content/uploads/2022/04/Who-is-Eligible-for-VA-Benefits--2048x1365.jpg

Council Tax 2015 2016 CSE News

https://curnockstreetestate.com/wp-content/uploads/2015/03/Council-Tax-Letter-2015a.jpg

How do I apply for a council tax reduction You may be eligible for a council tax reduction if you are on a low income or claim benefits Your bill could be reduced by up to 100 per cent You can apply for Council Tax Reduction CTR if you re liable for the Council Tax bill and you get guarantee credit part of Pension Credit either on its own or with the savings credit You can apply for full CTR even if your weekly entitlement to the guarantee credit is

People living alone are entitled to a 25 per cent reduction to their bill known as the single person discount This also applies if you are the only eligible person in a household living with Many individuals are eligible for a reduction in their Council Tax Bill by applying for Council Tax Reduction Different factors are set on qualification The following are the main groups that may be eligible 1 Low income Households Low income households may get a discount if their income is low This consists of salaries retirement

Council Tax Reduction Who Qualifies For Council Tax Reduction

https://cdn.images.express.co.uk/img/dynamic/23/590x/Council-Tax-reduction-latest-news-council-tax-coronavirus-applying-for-Council-Tax-reduction-1339365.jpg?r=1601330102077

Are You Eligible For A Council Tax Reduction Watford Community Housing

https://www.wcht.org.uk/getmedia/71f0fb63-e490-4f7c-9f32-99c1f0ded5a8/iStock-1183405922.jpg

https://www.citizensadvice.org.uk/housing/council...

You might be able to pay less council tax or not pay it at all depending on your circumstances You might be able to get discounts for example for a single person or an empty property Council Tax Reduction CTR if you have low income a different reduction if

https://www.ageuk.org.uk/information-advice/money...

You may be eligible to claim Council Tax Support sometimes called Council Tax Reduction if you re on a low income or claiming certain benefits Visit our Council Tax Support webpage to find out about eligibility and how to claim

What Is Classed As Low Income For Council Tax Reduction The Money Edit

Council Tax Reduction Who Qualifies For Council Tax Reduction

Council Tax Support Or Council Tax Reduction Is Not Claimed By Millions

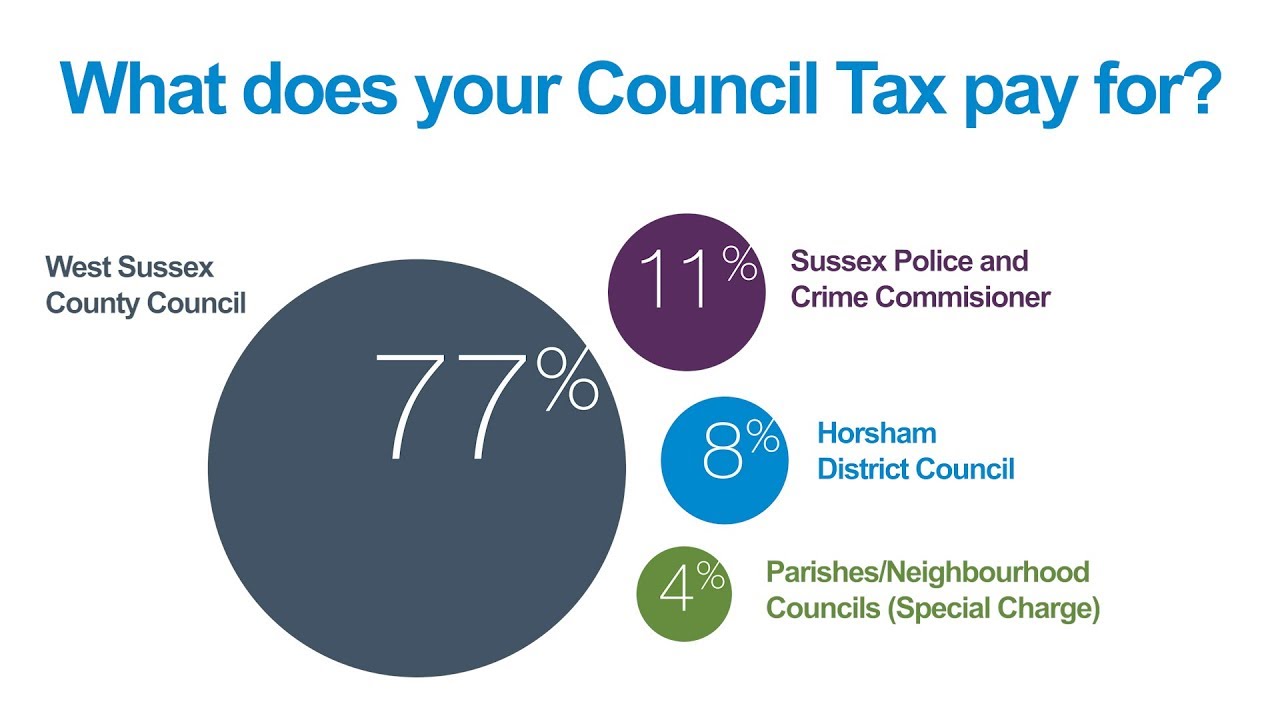

Your Council Tax What Are You Paying For YouTube

Welcome To Richmondshire District Council

Council Tax Postcode Calculator CALCULATORUK CVG

Council Tax Postcode Calculator CALCULATORUK CVG

How To Reduce Your Council Tax Bill Council Tax Discounts

Council Tax Payment Who Is Eligible For Reduction How To Apply For

Who Is Eligible For The Employee Retention Credit ERC On Vimeo

Who Is Eligible For Council Tax Reduction - Who Is Eligible You may be eligible for Council Tax Reduction if You are on a low income and Are working age with less than 10 000 in savings or capital such as property or Are