Who Is Eligible For Credit For Federal Tax Paid On Fuels In general only the ultimate user of a fuel is eligible for a credit for untaxed use In other words if you weren t the one who burned the fuel then you usually

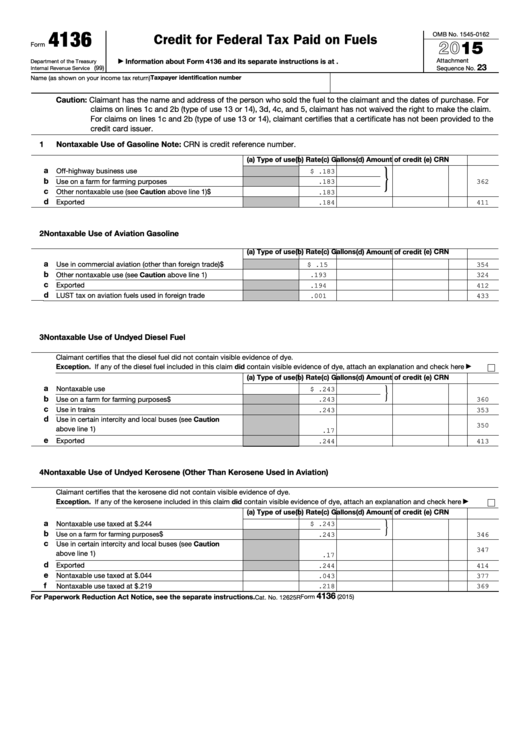

A credit for exporting dyed fuels or gasoline blendstocks Substainable aviation fuel SAF credit Attach Form 4136 to your tax return Instead of waiting to claim an annual If you are an individual or business that purchases fuel for one of these reasons you can claim a credit on your tax return for the tax paid Listed below are the nontaxable

Who Is Eligible For Credit For Federal Tax Paid On Fuels

Who Is Eligible For Credit For Federal Tax Paid On Fuels

https://spectracorphcfprogram.com/wp-content/uploads/2021/08/Rural-For-Profit-Hospital.png

3 Ways You Can Make Money From Credit Card Companies Today BlackDoctor

https://i0.wp.com/blackdoctor.org/wp-content/uploads/2020/01/GettyImages-88621207.jpg?fit=1998%2C1500&quality=50&strip=all&ssl=1

New Pathway To PR For 482 Visa Holders May 2022 Update

https://static.wixstatic.com/media/035c86_185f3b6e74e04f36a1098480cdd5419e~mv2.gif

The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types of fuel costs The federal excise taxes tax credits and exemptions for various types of fuel constitute a terribly confusing area of the tax law involving several Internal Revenue Code sections

Credit For Federal Tax Paid on Fuels by Zachery Starner MBA on August 8 2022 The summer heat is not the only thing on the rise this year National average However if you operate a business that consumes a significant amount of fuel you may be eligible for a federal fuel tax credit under certain circumstances by filing IRS Form 4136 This article will

Download Who Is Eligible For Credit For Federal Tax Paid On Fuels

More picture related to Who Is Eligible For Credit For Federal Tax Paid On Fuels

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

How To Apply Bank Of America Credit Card

https://progressforamerica.org/wp-content/uploads/2022/06/Add-a-subheading.jpg

Eligibility MACPAC

https://www.macpac.gov/wp-content/uploads/2022/05/PIE-CHART-Share-of-Dually-Eligible-Population-by-Medicaid-Eligibility-Pathways.png

You can claim a credit for excise taxes paid on fuels including gasoline diesel fuel kerosene and aviation fuel The credit applies to fuels used for business You can claim a credit for federal excise tax you paid on fuels you used On a farm for farming purposes Ex fuel used to run a tractor while plowing On a boat used for

To claim fuel tax credits with Form 4136 you must Have paid federal excise taxes on fuels Have proof of tax amounts paid Have used fuels for nontaxable This form lists each of the specified fuels and use cases that qualify for a reduction or elimination of federal taxes Common credits you can claim on Form 4136 include

Fuel Tax Credit 2023 2024

https://www.zrivo.com/wp-content/uploads/2023/06/How-to-Claim-the-Fuel-Tax-Credit-1024x576.jpg

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

https://turbotax.intuit.com/tax-tips/small...

In general only the ultimate user of a fuel is eligible for a credit for untaxed use In other words if you weren t the one who burned the fuel then you usually

https://www.irs.gov/pub/irs-pdf/i4136.pdf

A credit for exporting dyed fuels or gasoline blendstocks Substainable aviation fuel SAF credit Attach Form 4136 to your tax return Instead of waiting to claim an annual

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

Fuel Tax Credit 2023 2024

Credit Federal Tax Paid Fuels Tracking Fuel Usage Central PA CPA

What Is Rate Of Social Security Tax And Medicare Tax

What Is A Premium Tax Credit And How Does It Work Commons credit

2022 Tax Refund Calculator Hr Block Very Hot Log Book Photographs

2022 Tax Refund Calculator Hr Block Very Hot Log Book Photographs

Fillable Form 4136 Printable Forms Free Online

Who Is Eligible For The Employee Retention Credit ERC On Vimeo

How Federal Income Tax Rates Work Full Report Tax Policy Center

Who Is Eligible For Credit For Federal Tax Paid On Fuels - However if you operate a business that consumes a significant amount of fuel you may be eligible for a federal fuel tax credit under certain circumstances by filing IRS Form 4136 This article will