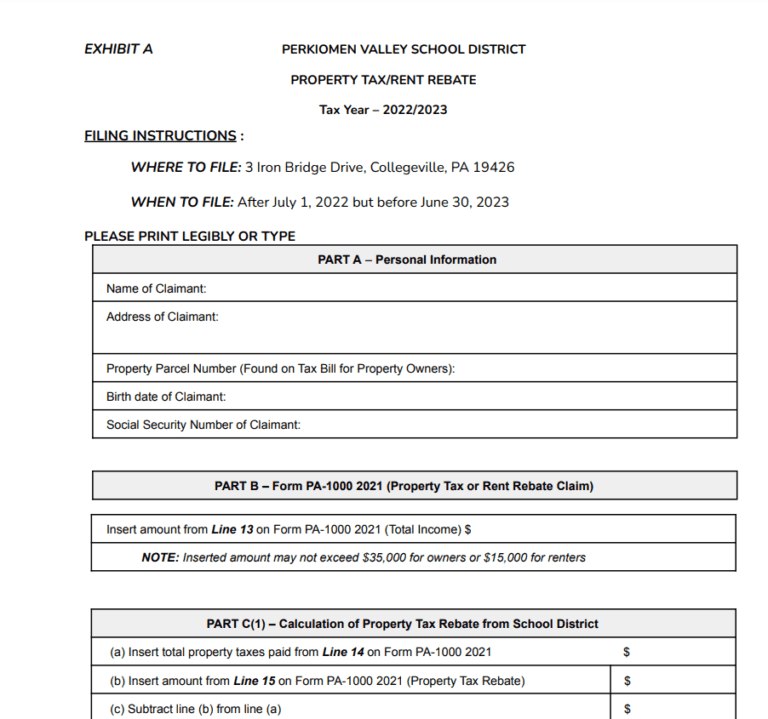

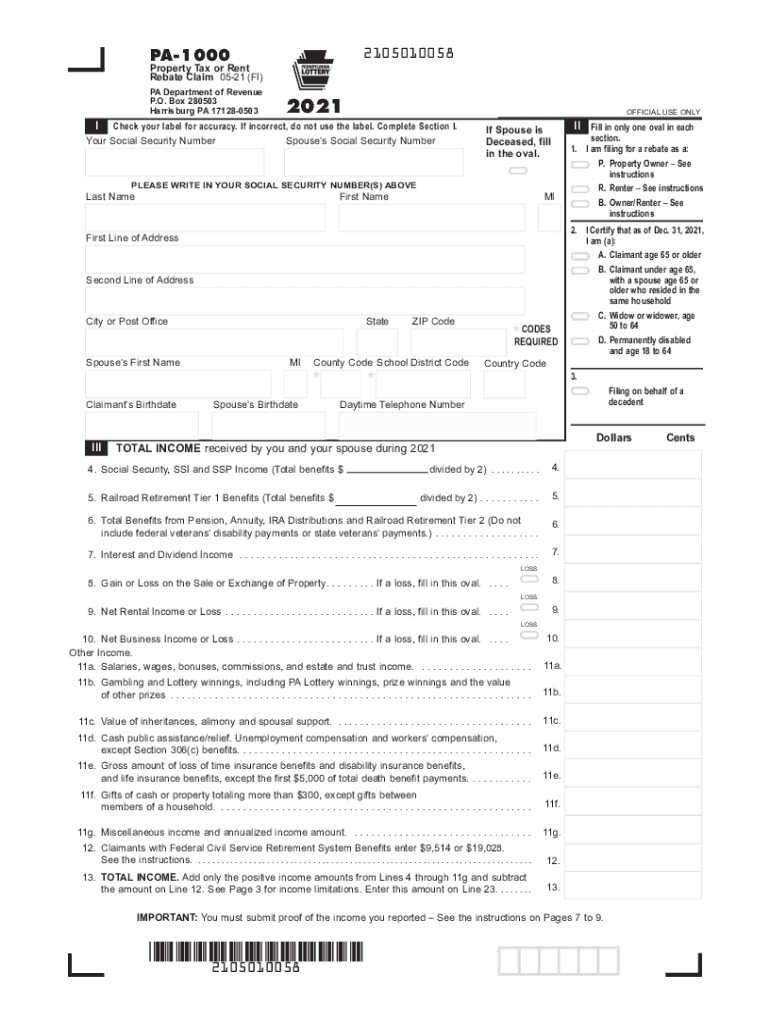

Who Is Eligible For Pa Property Tax Rebate Verkko Eligibility Criteria Applicants of the Property Tax Rent Rebate program must still fall under one of the previous four categories to qualify That means the program will

Verkko 19 tammik 2023 nbsp 0183 32 The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and Verkko 2 elok 2022 nbsp 0183 32 Older and disabled Pennsylvanians who qualify for the state s property tax and rent rebate program have been waiting for word on when they can expect their one time bonus rebate to arrive

Who Is Eligible For Pa Property Tax Rebate

Who Is Eligible For Pa Property Tax Rebate

https://printablerebateform.net/wp-content/uploads/2022/11/PA-Property-Tax-Rebate-Form-768x719.png

Pa 1000 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

Verkko 28 syysk 2022 nbsp 0183 32 If you re 65 or older or receive disability benefits and paid rent or property taxes last year you qualify if you meet the income requirements The income limit is 35 000 per household for Verkko 3 hein 228 k 2023 nbsp 0183 32 The rebates will be distributed to eligible Pennsylvanians who submitted an application through the Property Tax Rent Rebate program for rebates

Verkko 23 kes 228 k 2023 nbsp 0183 32 PA Property Tax Rent Rebate FORMS FLYER 2 page PDF or download below PA Dept of Revenue Frequently asked questions PA online tax hub myPath myPath fact sheet Phone Verkko The Property Tax Rent Rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and

Download Who Is Eligible For Pa Property Tax Rebate

More picture related to Who Is Eligible For Pa Property Tax Rebate

Pennsylvanians Can Now File Property Tax Rent Rebate Program

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pennsylvanians-can-now-file-property-tax-rent-rebate-program-89.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

2022 Pa Property Tax Rebate Forms PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/return-to-claim-notice-4.jpg

Verkko 31 jouluk 2022 nbsp 0183 32 If you are an eligible claimant who has already filed an application for a rebate on property taxes or rent paid in 2021 you do not need to take any further Verkko erty tax rebate To determine if a deceased claimant is eligible for a rebate a deceased claimant s claim form must also include an annualized income amount in

Verkko 3 jouluk 2002 nbsp 0183 32 You are eligible for a Property Tax Rent Rebate if you meet the requirements in each of the three categories below Category 1 Type of Filer You Verkko Property Tax Rent Rebate Program Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on

PA Property Tax Rebate Deadline 2023 Free Rebates

https://i0.wp.com/rebate.cholonautas.edu.pe/wp-content/uploads/2023/09/PA-Property-Tax-Rebate-Deadline-2023.png?fit=611%2C795&ssl=1

Retired In PA Property Tax And Rent Rebate YouTube

https://i.ytimg.com/vi/6mtzAMRaNJk/maxresdefault.jpg

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRent...

Verkko Eligibility Criteria Applicants of the Property Tax Rent Rebate program must still fall under one of the previous four categories to qualify That means the program will

https://www.media.pa.gov/Pages/Revenue-Details.aspx?newsid=388

Verkko 19 tammik 2023 nbsp 0183 32 The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and

PA Property Tax Rent Rebate Apply By 12 31 2022 New 1 time Bonus

PA Property Tax Rebate Deadline 2023 Free Rebates

PA Property Tax Rebate What To Know Credit Karma

Cvs Budweiser Rebate Form Printable Rebate Form

Who Is Eligible For Property Tax Rebate 2023

Minnesota Tax Rebate 2023 Your Comprehensive Guide

Minnesota Tax Rebate 2023 Your Comprehensive Guide

Yellow Tail Printable Rebate Form

Muth Encourages Eligible Residents To Apply For Extended Property Tax

5 Million Lottery Ticket Sold In Dauphin County Pennlive

Who Is Eligible For Pa Property Tax Rebate - Verkko Updated Dec 1 2022 11 53 AM EST WHTM Pennsylvanians who qualify for the Property Tax Rent Rebate Program must apply by December 31 2022 to receive