Who Is Eligible For Real Property Tax Credit For tax years beginning on or after January 1 2021 if you are eligible you may claim the real property tax relief credit on your residence If you do not use the full amount of

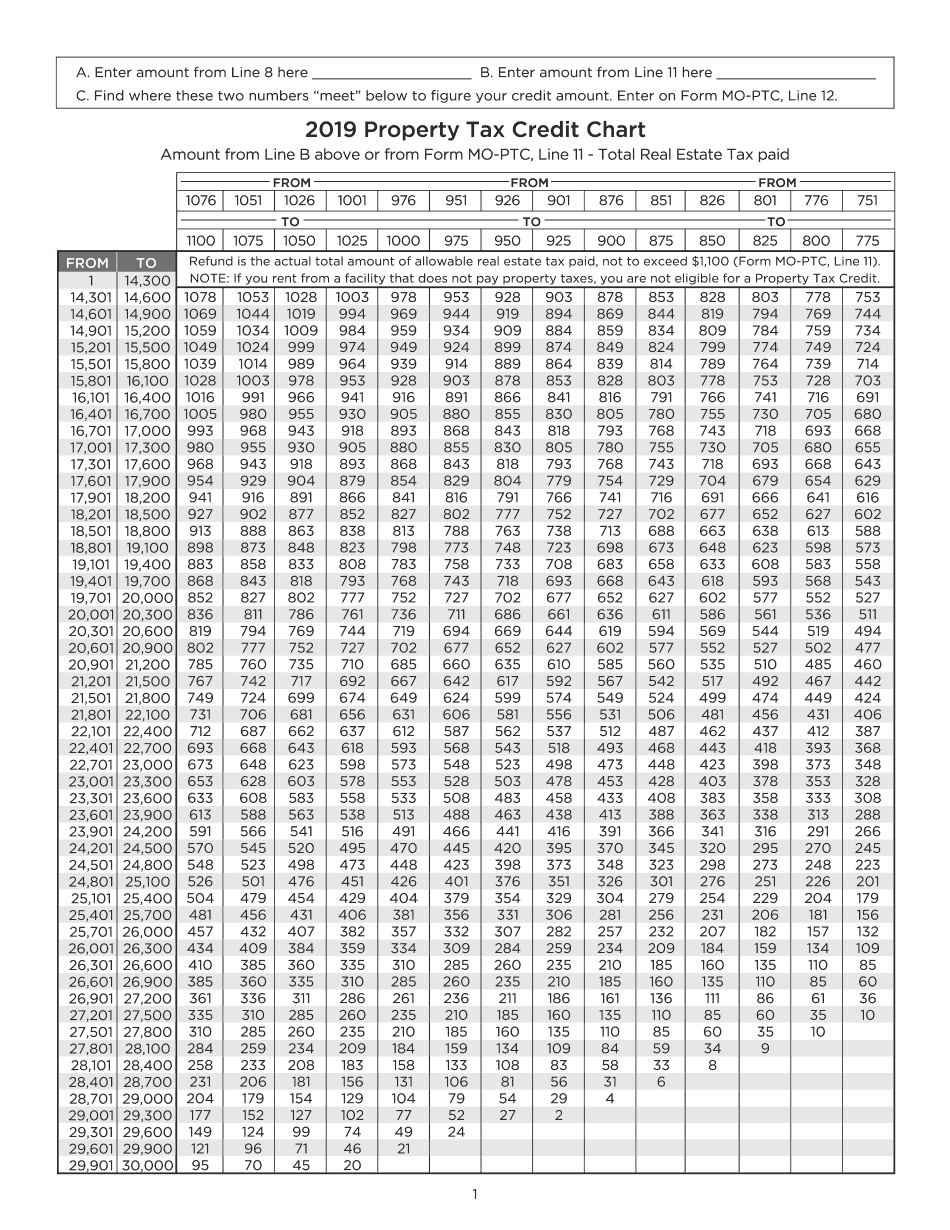

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year The credit is for a maximum of 750 for renters and An individual does not qualify for the real property tax credit if any of the following conditions exist 1 The combined gross income of all members of your household is over 18 000 2 You can

Who Is Eligible For Real Property Tax Credit

Who Is Eligible For Real Property Tax Credit

https://i.ytimg.com/vi/lDYHPHwl45I/maxresdefault.jpg

What You Should Know About Real Property Tax Blog

https://federalland.ph/wp-content/uploads/2018/07/fast-facts-real-property-tax-banner.png

Hecht Group Paying Real Property Taxes In Bulacan A Step By Step Guide

https://img.hechtgroup.com/1662839570804.jpg

The Real Property Tax Relief Credit NY IT 229 RPTR was implemented to provide relief to New York State NYS taxpayers who own qualified real property in the state The Credit takes effect for tax years Am I eligible for a property tax credit You will qualify for the property tax credit if you paid property tax on your principal residence excluding any applicable exemptions late fees and

Applications can be accessed online by downloading our printable Real Property Tax Credit for Seniors application or in person at the Jefferson County Clerk or County Collector s Offices All Property tax credit can be up to 1 250 for married couples and 1 000 for single people Credits are based on a graduated income scale WHO IS ELIGIBLE

Download Who Is Eligible For Real Property Tax Credit

More picture related to Who Is Eligible For Real Property Tax Credit

What You Should Know About Real Property Tax Blog

https://federalland.ph/wp-content/uploads/2018/07/fast-facts-real-property-tax-infographic.png

The 5 Most Common Real Estate Tax Credits

https://info.courthousedirect.com/hs-fs/hubfs/Blog Image Fix/Depositphotos_45934253_original.jpg?width=2800&name=Depositphotos_45934253_original.jpg

Who Is Eligible For The 450 Cost of living Payment In South Australia

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA11kQ7o.img?w=1920&h=1080&m=4&q=91

The new tax credit included in the state s 212 billion budget approved this week by the Legislature and Gov Andrew Cuomo will apply to eligible homeowners whose property tax bill Eligible taxpayers who apply for and qualify for the Jefferson County Real Property Tax Credit for Seniors will receive a credit equal to the difference between an eligible taxpayer s real property

REAL PROPERTY TAX CREDIT The Real Property Tax Credit is a benefit for New York State income tax filers who own or rent property and have a household gross income of 18 000 or Eligible homeowners can now apply for a property tax credit in North Dakota primary residence is eligible There is one credit per household 760 billion in taxes on real

Who Is Eligible For An O 2 Visa In 2024 Shoreline Immigration

https://shorelineimmigration.com/wp-content/uploads/2023/09/who-is-eligible-for-an-o-2-visa.jpg

REAL Property TAX Notes From Books REAL PROPERTY TAX A DEFINITIONS

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/6fb7590a4e91e342764f2f7f63c87d5d/thumb_1200_1553.png

https://www.tax.ny.gov › forms › current-forms › it

For tax years beginning on or after January 1 2021 if you are eligible you may claim the real property tax relief credit on your residence If you do not use the full amount of

https://dor.mo.gov › ... › tax-types › proper…

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year The credit is for a maximum of 750 for renters and

Who Is Eligible For VA Benefits The 2 Critical Factors Revealed

Who Is Eligible For An O 2 Visa In 2024 Shoreline Immigration

Who Is Eligible For The Employee Retention Credit ERC On Vimeo

Stream Who Is Eligible For The Earned Income Tax Credit And What The

Property Taxes Definition And Their Role In Real Estate Investing

Property Tax Rates By State Millionacres

Property Tax Rates By State Millionacres

Manage Documents Using Our Editable Form For Property Tax Credit Chart Form

Who Is Eligible For Help With Energy Bills And Council

Real Property Tax Credit For Homeowners Honolulu PROPERTY HJE

Who Is Eligible For Real Property Tax Credit - Property tax credit can be up to 1 250 for married couples and 1 000 for single people Credits are based on a graduated income scale WHO IS ELIGIBLE