Who Is Eligible For The Nys Property Tax Relief Credit The property tax relief credit directly reduced your property tax burden if you were a qualifying homeowner The amount of the credit was a percentage of your STAR savings The property tax relief credit has expired However if you were eligible for the credit in 2018 or 2019 but believe you did not receive it

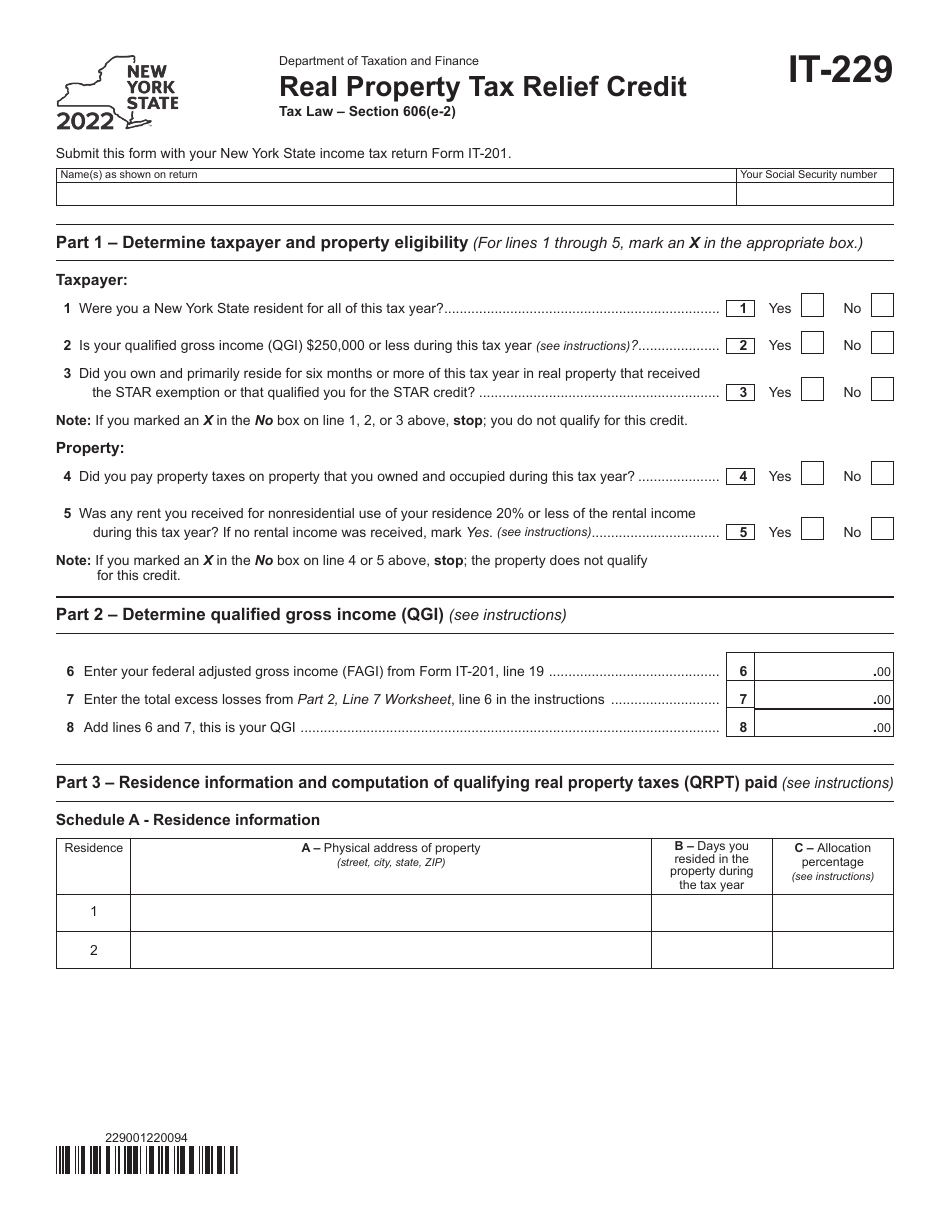

Who is eligible You are entitled to this refundable credit if your household gross income is 18 000 or less you occupied the same New York residence for six months or more you were a New York State resident for the entire tax year you could not be claimed as a dependent on another taxpayer s federal income tax return The Real Property Tax Relief Credit NY IT 229 RPTR was implemented to provide relief to New York State NYS taxpayers who own qualified real property in the state The Credit takes effect for tax years beginning on or after January 1 2021 and is also available for 2022 23 school tax assessments

Who Is Eligible For The Nys Property Tax Relief Credit

Who Is Eligible For The Nys Property Tax Relief Credit

https://www.njspotlightnews.org/wp-content/uploads/sites/123/2020/02/Money-house-1024x576.jpg

Sandra G Johnson CPA P C Check s In The Mail

https://3.bp.blogspot.com/-tLyBq7giphA/WIIomZTYyvI/AAAAAAAAAdM/7I6_zefY8oUBsuqb-5RAC5d0ZYmTlUDFACLcB/s1600/rebate.jpg

LEM MEMO Remember The Property Tax Relief Credit For NYS New York

https://www.nystap.org/wordpress/wp-content/uploads/2022/02/image001.png

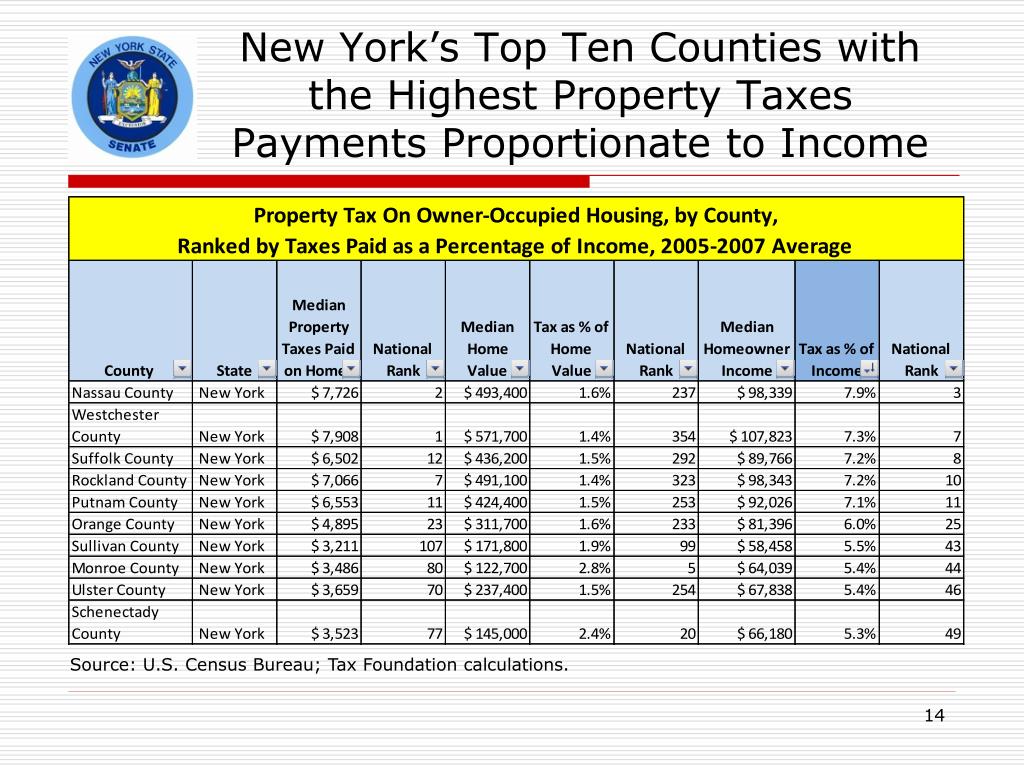

Who qualifies for New York s new property tax credit In general homeowners whose adjusted gross income is less than 250 000 annually with certain restrictions on losses claimed and pay To qualify for the real property tax credit you must meet all of these conditions for tax year 2021 Your household gross income was 18 000 or less You occupied the same New York residence for six months or more You were a New York State resident for all of 2022

To qualify for the rebate the homeowner must have qualified for a 2022 STAR credit or exemption had income less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than the STAR benefit 1 Who will benefit The program will apply to taxpayers who make less than 250 000 based on the proportion of their income spent on property taxes In other words credits are based on the amount of property taxes paid in excess of 6 percent of an eligible taxpayer s federal adjusted gross income

Download Who Is Eligible For The Nys Property Tax Relief Credit

More picture related to Who Is Eligible For The Nys Property Tax Relief Credit

10 Home Design Trends For 2022

https://www.saratogatodaynewspaper.com/media/k2/items/cache/7d122e87f1c6627e9f91988a8e83699c_XL.jpg

In The News

https://assets.website-files.com/5a43cca98192d400018e40cc/5e4d6610fca4737f9959d4de_iStock-1141583737.jpg

Tennessee Property Tax Relief Program Celebrates 50th Anniversary

https://comptroller.tn.gov/content/dam/cot/administration/images/press-release-images/2023/TaxReliefGoldRibbonSeal.jpg

Eligible homeowners must qualify for a 2022 STAR credit or exemption which offers school tax relief to households that make a combined income of 500 000 or less The 2022 tax rebate The STAR program provides tax relief to eligible homeowners in New York How much you receive depends on income level and other factors

The Historic Homeownership Rehabilitation Credit program offers a state income tax credit equal to 20 of qualified rehabilitation expenses associated with repair maintenance and upgrades to historic homes The value of the credit is applied to your NYS tax liability to reduce the amount you owe The program covers 20 of qualified For tax years beginning on or after January 1 2021 if you are eligible you may claim the real property tax relief credit on your residence If you do not use the full amount of the credit for the current tax year you may request a refund or credit the overpayment to the next year s tax liability

Town Officials Screams Prove NY s Property tax Cap Is Working

https://nypost.com/wp-content/uploads/sites/2/2015/01/shutterstock_131022911.jpg?quality=75&strip=all

STAR Program New York Property Tax Relief Credit Karma

https://creditkarma-cms.imgix.net/wp-content/uploads/2020/05/star-program-new-york-property-tax-relief_956461414.jpg

https://www.tax.ny.gov/pit/property/property-tax-relief.htm

The property tax relief credit directly reduced your property tax burden if you were a qualifying homeowner The amount of the credit was a percentage of your STAR savings The property tax relief credit has expired However if you were eligible for the credit in 2018 or 2019 but believe you did not receive it

https://www.tax.ny.gov/pit/credits/real_property_tax_credit.htm

Who is eligible You are entitled to this refundable credit if your household gross income is 18 000 or less you occupied the same New York residence for six months or more you were a New York State resident for the entire tax year you could not be claimed as a dependent on another taxpayer s federal income tax return

NY Unveils New Property tax Credit Here s How You Qualify Property

Town Officials Screams Prove NY s Property tax Cap Is Working

How Do I Pay Nys Estimated Taxes Online TAX

Ny Property Tax Rebate Checks 2023 RebateCheck

NY To Homeowners Your Tax Rebate Check Is Almost In The Mail

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

How Does The 20 Tax Credit Work For Landlords Leia Aqui How Is NYS

Who Is Eligible For E 2 Investor Visa E 2VisaWorld

Form IT 229 Download Fillable PDF Or Fill Online Real Property Tax

Who Is Eligible For The Nys Property Tax Relief Credit - For married couples filing jointly the exemption amount increases to 137 000 and begins to phase out at 1 252 700 Earned income tax credits For qualifying taxpayers who have three or more qualifying children the tax year 2025 maximum Earned Income Tax Credit amount is 8 046 an increase from 7 830 for tax year 2024