Who Is Eligible To Receive Gst Credit Thanks to the GST HST credit low earning taxpayers can get back a portion or all of the federal sales tax they pay Here s everything you need to know about the credit how it

The GST HST credit is a tax free quarterly payment for eligible individuals and families that helps offset the GST or HST that they pay GST HST credit payments Eligible Canadians could get up to 519 over the course of the four payments While those who are married or have a common law

Who Is Eligible To Receive Gst Credit

Who Is Eligible To Receive Gst Credit

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/medicare-eligibility.png

Who Is Eligible Make A Wish India

https://makeawishindia.org/wp-content/uploads/2022/04/eligible.jpg

GST Payment Dates 2021 2022 All You Need To Know Insurdinary 2022

https://www.insurdinary.ca/wp-content/uploads/2021/11/gst-hst-credit-application.jpg

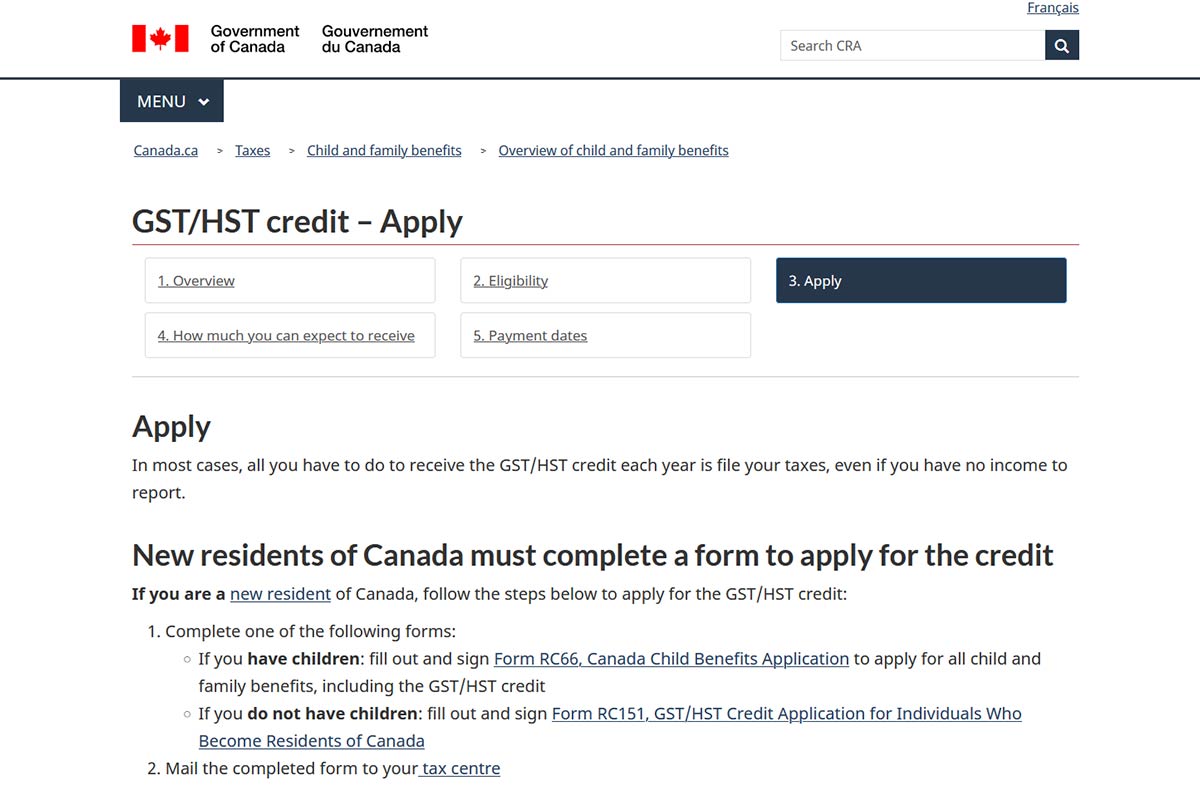

The GST HST credit is a quarterly payment for individuals and families with low to modest incomes meant to help offset the goods and services tax harmonized The GST credit paid to individuals and families with low or modest income is non taxable Who is Eligible for the GST Credit Generally Canadian residents age 19 or older are

Who is eligible Canadian residents aged 19 and older are generally eligible for the GST HST credit Those under 19 can get the credit if they have had a spouse Who is eligible for the GST HST credit The GST HST credit is designed to provide financial assistance to Canadian residents individuals and families who earn

Download Who Is Eligible To Receive Gst Credit

More picture related to Who Is Eligible To Receive Gst Credit

Frequently Asked Questions On The CARES Act Spartan Echo

https://nsuspartanecho.files.wordpress.com/2020/04/rcs_official_photo_2016_optimized-1.jpg

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

Why The Fixed Bond to Income Ratio FOIR Can Affect Your Loan Application

https://www.financialexpress.com/wp-content/uploads/2021/08/Loan-big.jpg

Who is eligible to get the payment If you are already entitled to receive the GST credit in October of this year you will automatically qualify for the one time GST WHO IS ELIGIBLE FOR THE BOOSTED GST CREDIT Anyone who was already eligible for the GST credit will be receiving double the amount they would ve otherwise received

To obtain the GST HST credit you must file your tax return in 2021 even if you haven t received any income during the year Here s how to get your credit depending on your WHO IS ELIGIBLE New residents must have lived in Canada during the month prior to the credit payout and at the beginning of the month

ABLE Eligibility Bangor Savings Bank

https://www.bangor.com/library/img/Maine ABLE Stacked_RGB.png

Earned Income Tax Credit EITC Get Your Payment IL

https://getmypaymentil.org/wp-content/uploads/2022/10/gmpil-website-poll-banner.jpg

https://www.springfinancial.ca/.../who-is-eligible-for-the-gst-hst-credit

Thanks to the GST HST credit low earning taxpayers can get back a portion or all of the federal sales tax they pay Here s everything you need to know about the credit how it

https://www.canada.ca/en/revenue-agency/services...

The GST HST credit is a tax free quarterly payment for eligible individuals and families that helps offset the GST or HST that they pay

:max_bytes(150000):strip_icc()/medicare-part-d-eligibility-4589763-1670217de0f843d5a368218e33b28067.png)

What Is Deductable For Medicare Part B

ABLE Eligibility Bangor Savings Bank

Student Loan Forgiveness Scholarship Application Ohio Credit Union League

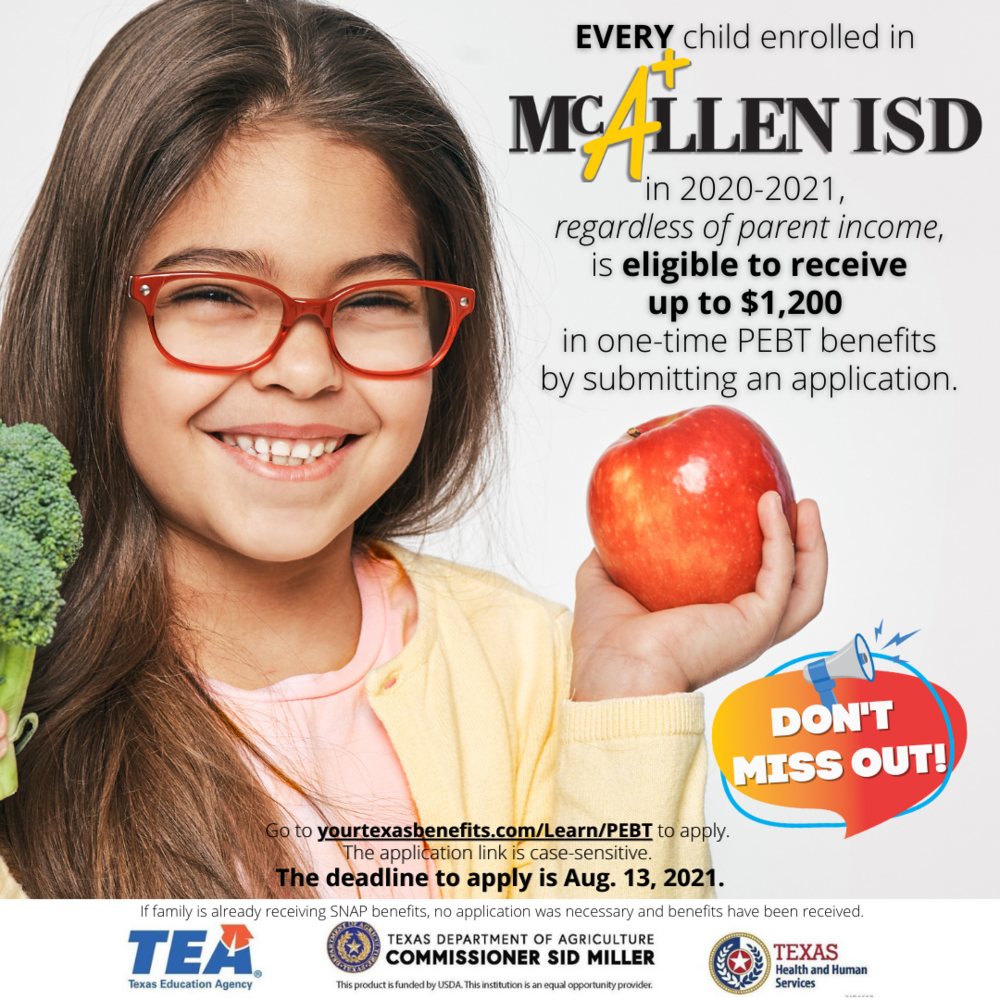

DON T MISS OUT Get Your PEBT Benefits Theodore Roosevelt Elementary

Am I Eligible For Gratuity

Who is eligible Women In Leadership Development

Who is eligible Women In Leadership Development

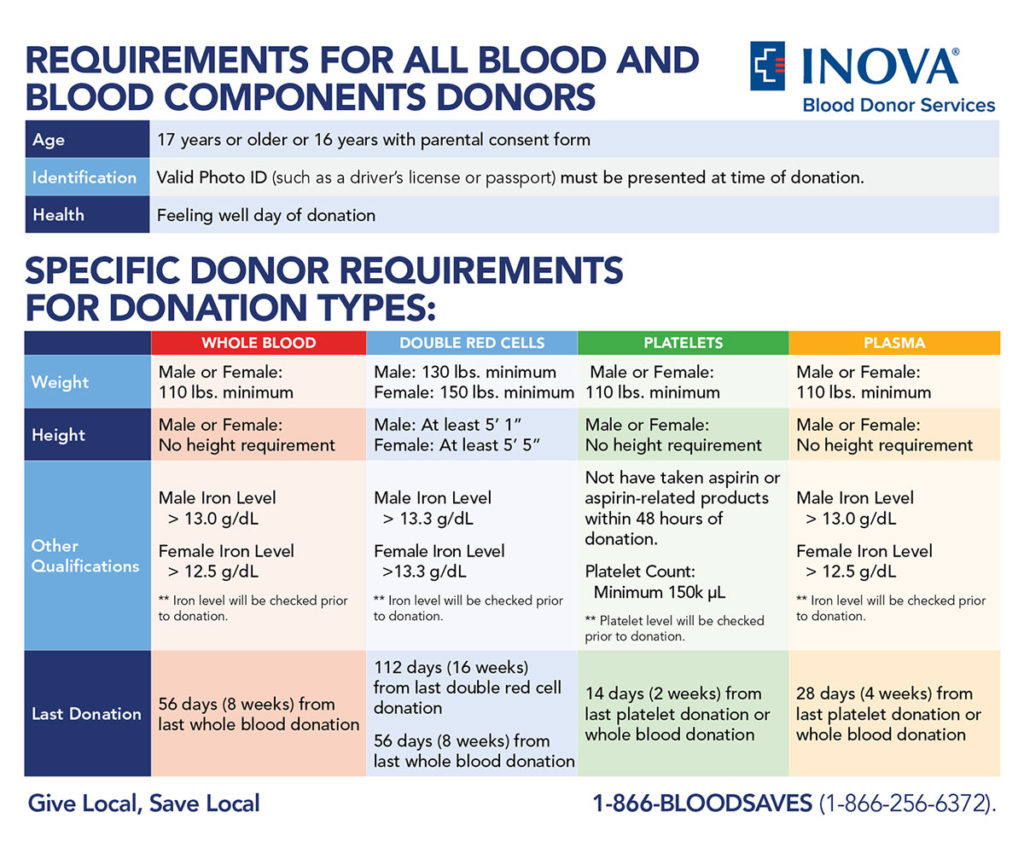

Eligibility Inova Blood Donor Services

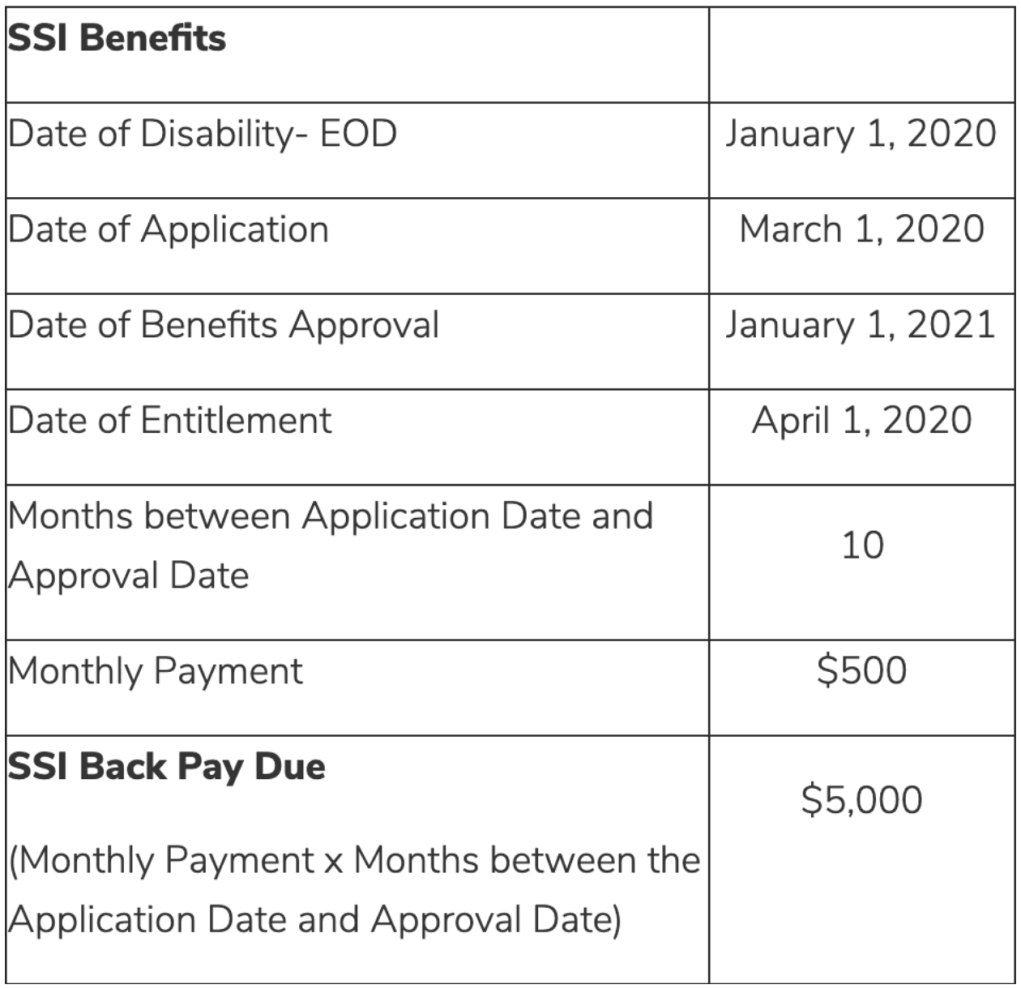

Benefits Back Pay How Much Could You Be Eligible To Receive

Who Is Eligible Google Docs

Who Is Eligible To Receive Gst Credit - Who is eligible for the GST HST credit The GST HST credit is designed to provide financial assistance to Canadian residents individuals and families who earn