Who Is Exempt From Transfer Tax In Pa The transfer to G is excludable because the transfer between C and D and G is an excludable transfer between siblings and between a sibling s spouse and a

See Title 61 PA Code Section 91 154 However a transfer of real estate from a family member to a family farm corporation or family farm Some real estate transfers are exempt from realty transfer tax including Property transfers among family members Changes in ownership

Who Is Exempt From Transfer Tax In Pa

Who Is Exempt From Transfer Tax In Pa

https://imgix.cosmicjs.com/51ba1a10-2547-11ed-b52d-a3f33977cd87-pa-transfer-taxes.png

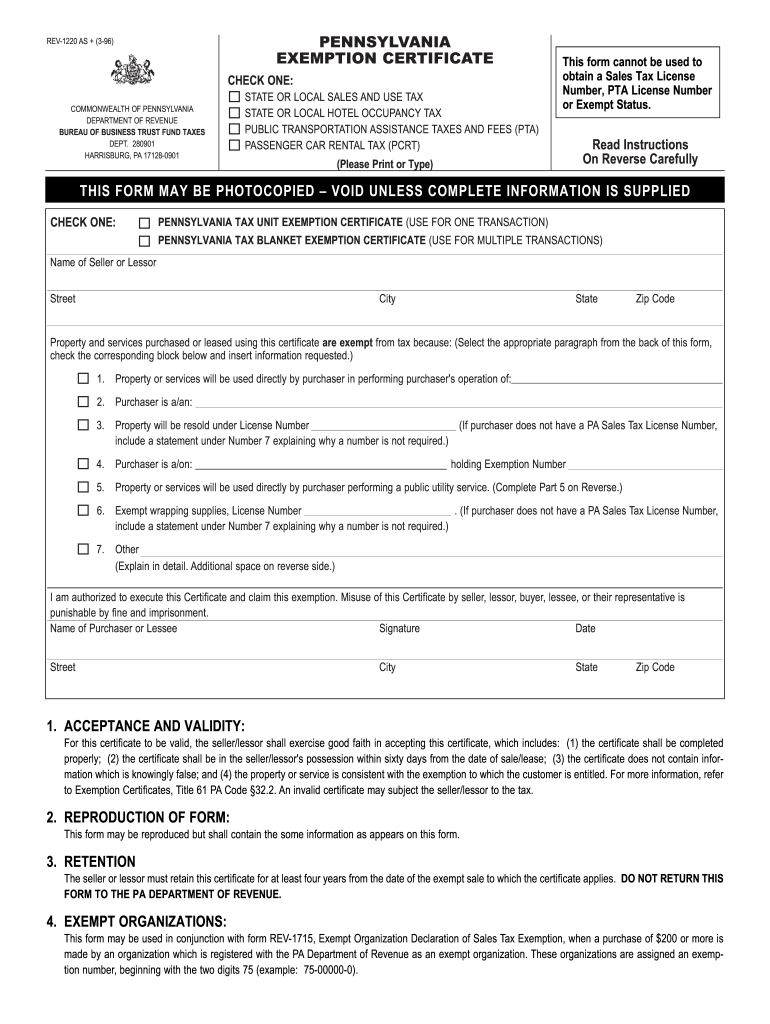

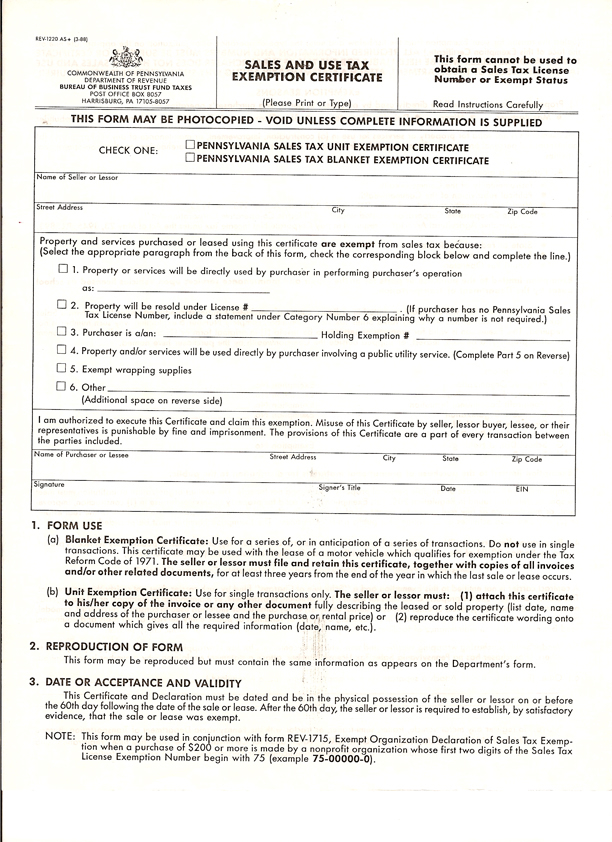

Pa Tax Exempt Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/37/626/37626337/large.png

Hecht Group 1 Property Transfer Tax In Pennsylvania

https://img.hechtgroup.com/1665971593773.jpg

Any conveyance from the sheriff to the mortgagee is exempt from tax However any person who becomes an assignee of the mortgage interest after the bid is The Pennsylvania Department of Revenue Department issued Realty Transfer Tax Bulletin 2022 01 on December 5 2022 The Bulletin

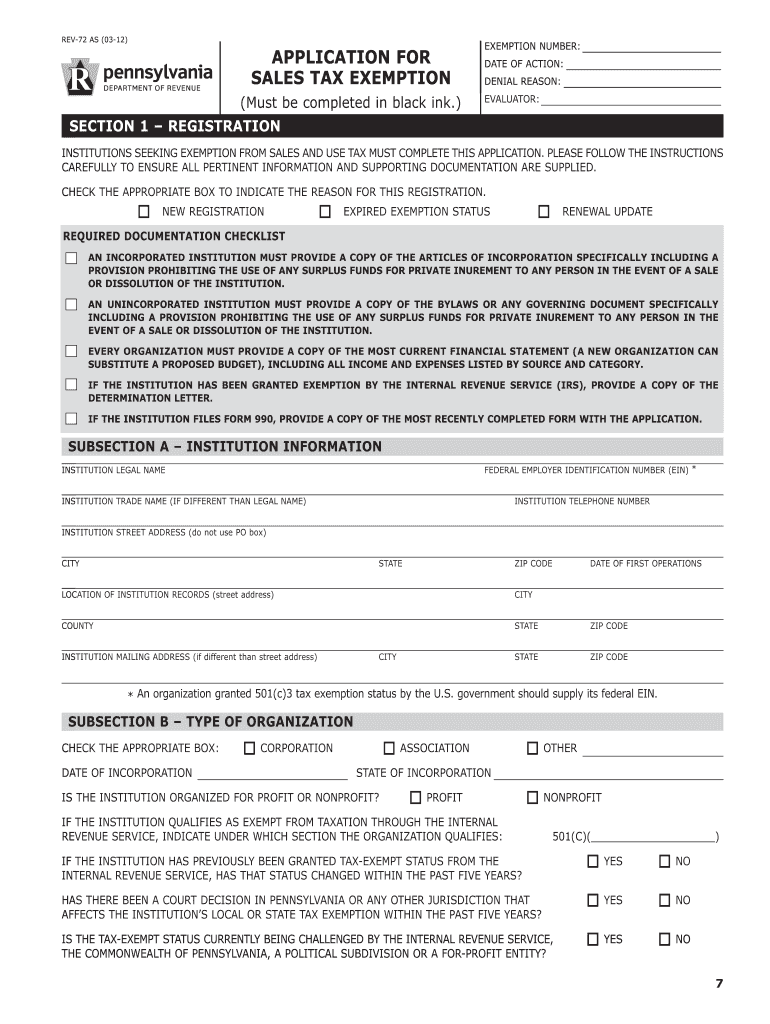

Veterans organizations with a valid tax exemption under 501 c 19 of the Internal Revenue Code of 1986 are now exempt from realty transfer tax This change Certain parties and transactions are exempt from the tax such as transfers between husband and wife lineal family members transfers by testate or intestate succession or

Download Who Is Exempt From Transfer Tax In Pa

More picture related to Who Is Exempt From Transfer Tax In Pa

Pa Tax Exempt Form 2023 ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/pa-exemption-certificate-form-fill-out-and-sign-printable-pdf-1.png

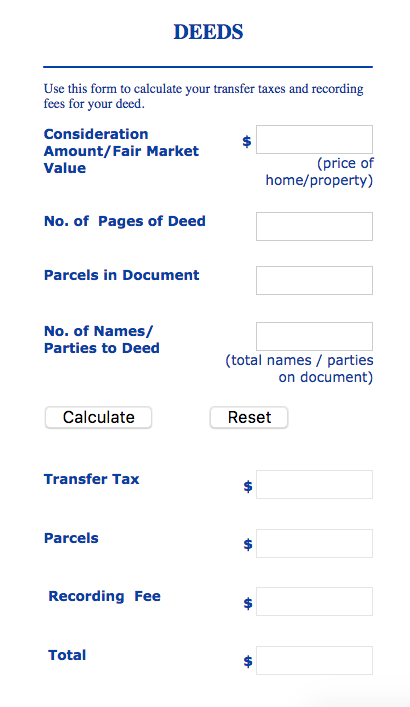

Transfer tax calculator The PA Notary

https://thepanotary.com/wp-content/uploads/2018/08/transfer-tax-calculator.png

Understanding Gifts And Exempt Transfers A Guide To Inheritance Tax

https://axies.accountants/wp-content/uploads/2022/10/20220701_095549-1024x768.jpg

Important dates You should pay Realty Transfer Tax at the time the sale document is presented for recording Payment is required within 30 days The transfer to G is excludable because the transfer between C and D and G is an excludable transfer between siblings and between a sibling s spouse and a

Exempt parties include the federal government the Commonwealth and any of their instrumentalities agencies or political subdivisions xv In the event of a transfer In Pennsylvania both the buyer and sellers are held responsible for paying the state transfer tax It s a norm for both the buyer and seller to evenly

Property Transfer Tax And Ways To Be Exempt YouTube

https://i.ytimg.com/vi/OmFxGXLD8ns/maxresdefault.jpg

Pa Sales Tax Exemption Form 2023 ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/pennsylvania-tax-exempt.jpg

https://www.pacodeandbulletin.gov/Display/pacode?...

The transfer to G is excludable because the transfer between C and D and G is an excludable transfer between siblings and between a sibling s spouse and a

https://revenue-pa.custhelp.com/app/answers/detail/a_id/709

See Title 61 PA Code Section 91 154 However a transfer of real estate from a family member to a family farm corporation or family farm

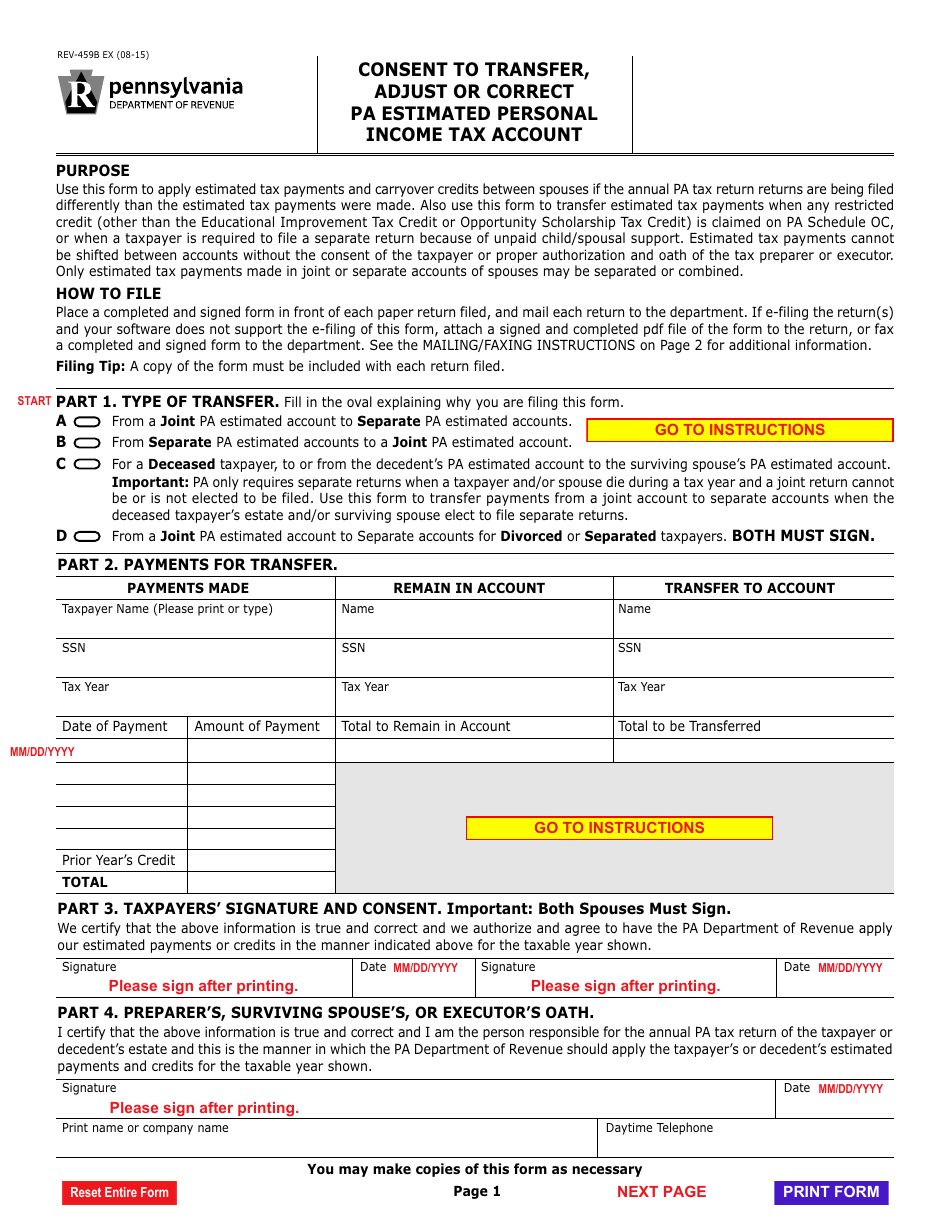

Form REV 459B Fill Out Sign Online And Download Printable PDF

Property Transfer Tax And Ways To Be Exempt YouTube

Potentially Exempt Transfers PETs The 7 year Rule And Taper Relief

A Breakdown Of Transfer Tax In Real Estate UpNest

Pennsylvania Realty Transfer Tax 8 Free Templates In PDF Word Excel

Certificate Of Compliance Template Inspirational Tax Pliance

Certificate Of Compliance Template Inspirational Tax Pliance

Pa Tax Exempt Form Rev 1220 ExemptForm

What Is Potentially Exempt Transfer PET CruseBurke

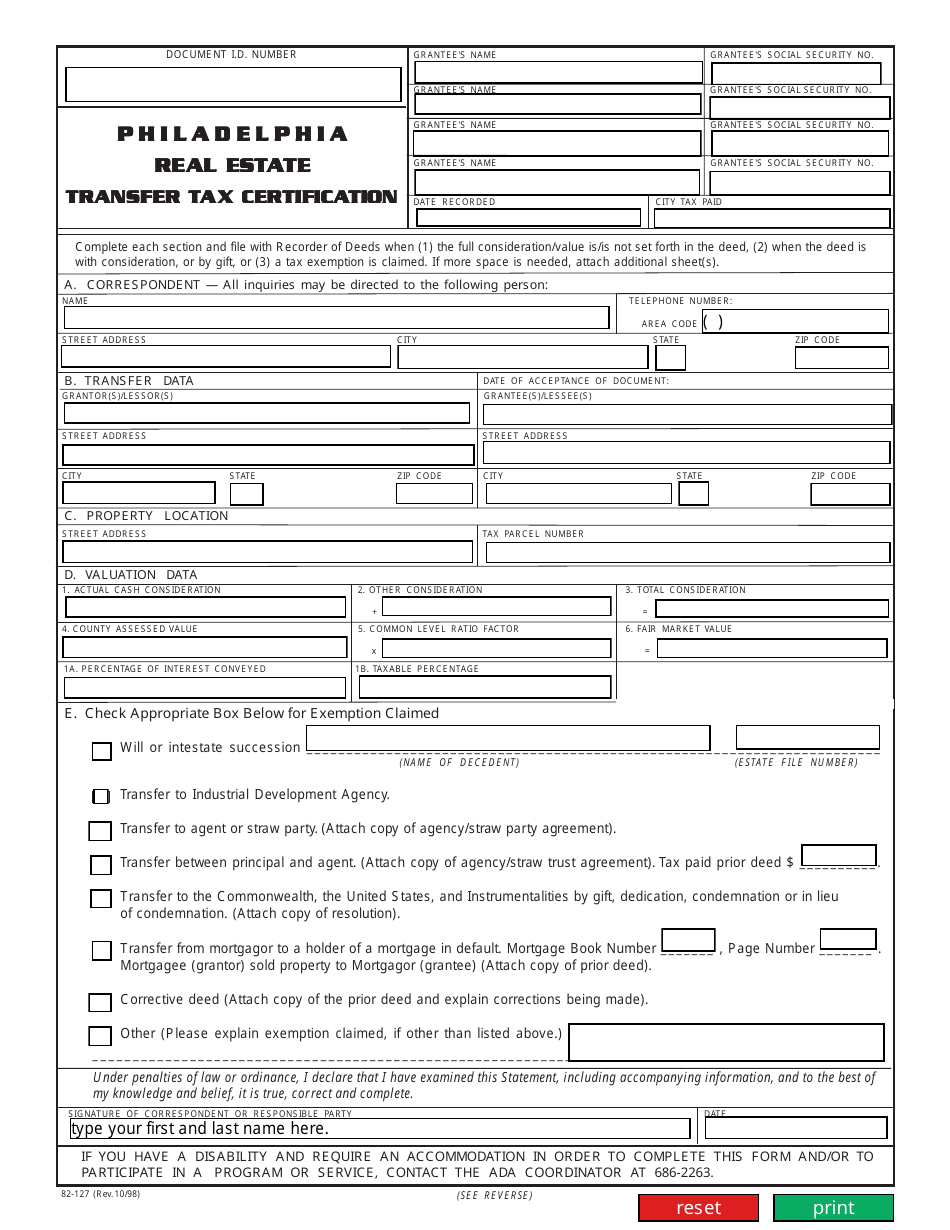

Philadelphia Transfer Tax Exemption

Who Is Exempt From Transfer Tax In Pa - Any conveyance from the sheriff to the mortgagee is exempt from tax However any person who becomes an assignee of the mortgage interest after the bid is