Who Is Liable To Pay Professional Tax In Maharashtra Who is liable to pay Profession Tax Every person engaged actively or otherwise in any profession trade callings or employment and falling under one or the other of the

Who pays Professional Tax in Maharashtra It is applicable for both salaried and self employed professionals who earn income working in government and private organizations It is subject Compliance under Maharashtra State Tax on Professions Traders Callings and Employments Act 1975 Every employer not having employees should only pay annual PT

Who Is Liable To Pay Professional Tax In Maharashtra

Who Is Liable To Pay Professional Tax In Maharashtra

https://i.ytimg.com/vi/Qw7sgaKCCPA/maxresdefault.jpg

Professional Tax Maharashtra

https://www.deskera.com/blog/content/images/size/w1000/2022/03/Untitled-design--25-.png

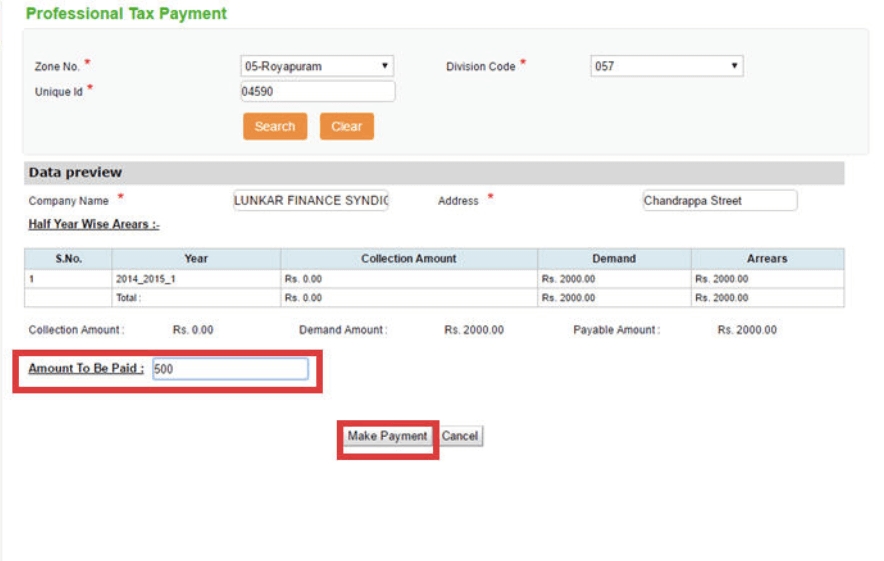

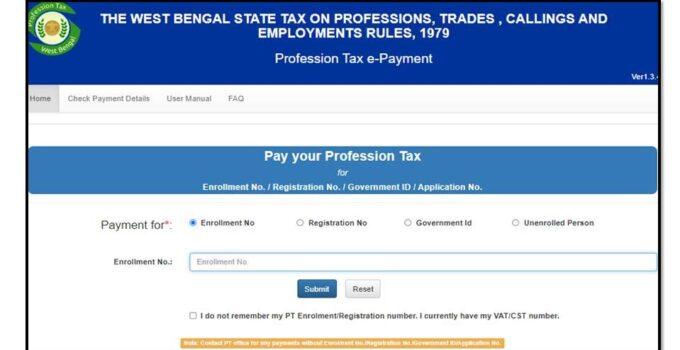

Online Payment Of Profession Tax In Maharashtra

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/07/Online-Payment-Of-Profession-Tax-In-Maharashtra.png

Ques 1 Who is liable to pay Professional Tax in Maharashtra Answer Any individual or entity engaged in a profession trade calling or employment within the state of It is employers liability to pay tax even if it fails to deduct profession tax from the wages or salaries of the employees However if a company does not have any employees then they will only require a PTEC registration and not PTRC

Certain categories of individuals are exempt from paying PT in Maharashtra These include Senior citizens above 60 years of age men and 58 years women Individuals with disabilities exceeding 40 certification Professional tax is imposed by the state government on earning individuals in Maharashtra According to the Article 276 of the Constitution whether an individual is salaried or self

Download Who Is Liable To Pay Professional Tax In Maharashtra

More picture related to Who Is Liable To Pay Professional Tax In Maharashtra

How To Pay Profession Tax In Maharashtra

https://i.ytimg.com/vi/BaPTy5g_mK4/maxresdefault.jpg

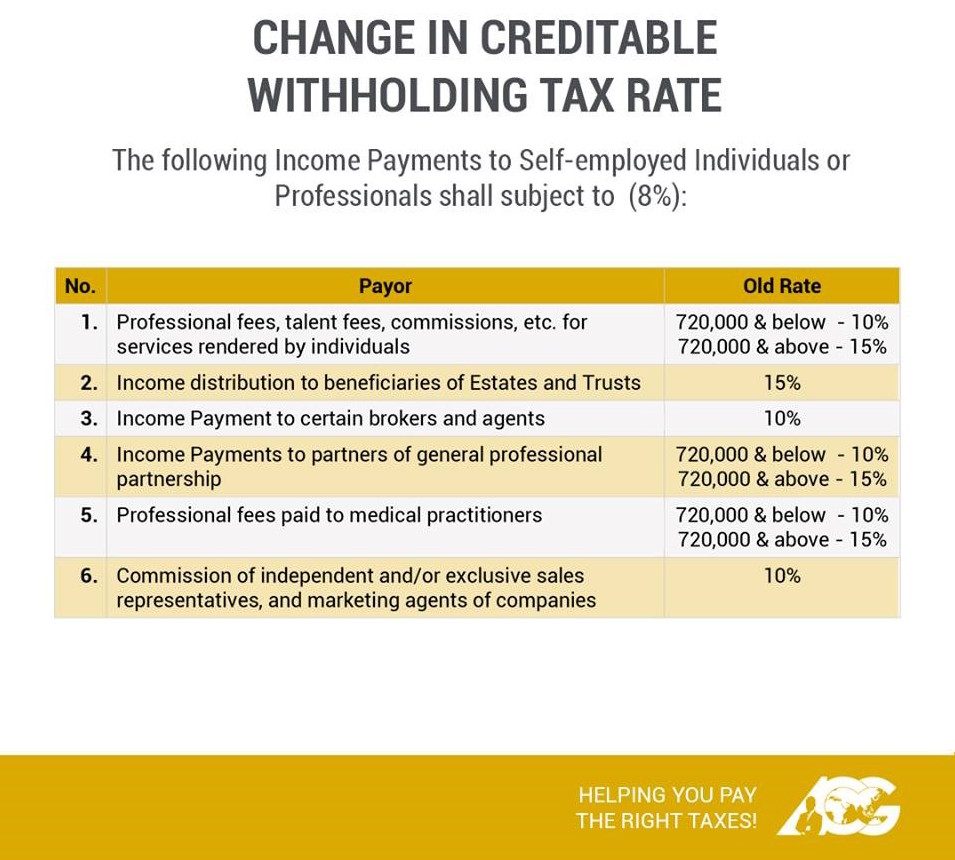

AskTheTaxWhiz Withholding Tax

https://www.rappler.com/tachyon/r3-assets/4ACB916E5A1249EB9CB3D98C3B8013ED/img/A6076DE2D06E4B24A92D8497C1EC3C55/20180222-tax-whiz-1.jpg

Maharashtra Road Tax Calculation Rates Online Payment

https://images.ctfassets.net/uwf0n1j71a7j/2VzrOVh7hr5yrwRZjrrq5X/bdaf5dfb547dfdda1facc25306315603/maharashtra-road-tax.png

They are liable to pay professional tax by 30 th June of the relevant financial year and are not required to file any kind of return with respect to such liability Salaried persons are also liable According to the Maharashtra State Tax on Professions Trades Callings and Employment Act 1976 profession tax is levied on all forms of individuals irrespective of being salaried or non salaried individuals Even corporate

Know Professional tax in Maharashtra including its applicability types documents registration and filing process due date and penalties Bizfoc helps to navigate the complexities of Ans As per the amendments in the Profession Tax Act 1975 a person natural legal registered under MGST Act is liable to enrol for Profession Tax Enrollment Certificate

Person Liable To Pay Tax On Post cessation Receipts Thompson Taraz Rand

https://www.thompsontarazrand.co.uk/wp-content/uploads/2019/03/7d405377-6ef7-42cc-8627-dc468b941afe-1.jpg

A Brief Overview Of Professional Tax In India

https://khatabook-assets.s3.amazonaws.com/media/post/DwHG6qJL8FxFRPTwQ4N69m4nqDpdSSKUbaMXAJEcwSdFqKRU3d-NLuuoIfYaVsm-JixVC9snekdT2hcruNuxKnYyW67f6hk9yz_cCDWbrxVuuysm27xLiJhwOQmZb4pJnb31kHFHW9p9.webp

https://taxguru.in › goods-and-service-tax › ...

Who is liable to pay Profession Tax Every person engaged actively or otherwise in any profession trade callings or employment and falling under one or the other of the

https://www.bankbazaar.com › tax › maharashtra...

Who pays Professional Tax in Maharashtra It is applicable for both salaried and self employed professionals who earn income working in government and private organizations It is subject

Professional Tax Slab Rates Applicability In India

Person Liable To Pay Tax On Post cessation Receipts Thompson Taraz Rand

Collection Of Professional Tax In Tamil Nadu

How To Pay Professional Tax In Online Archives TECHIEQUALITY

Professional Tax In Maharashtra Tax Slab Rates How To Pay Due Dates

What Is A Professional Tax Payment Eligibility To Pay PT

What Is A Professional Tax Payment Eligibility To Pay PT

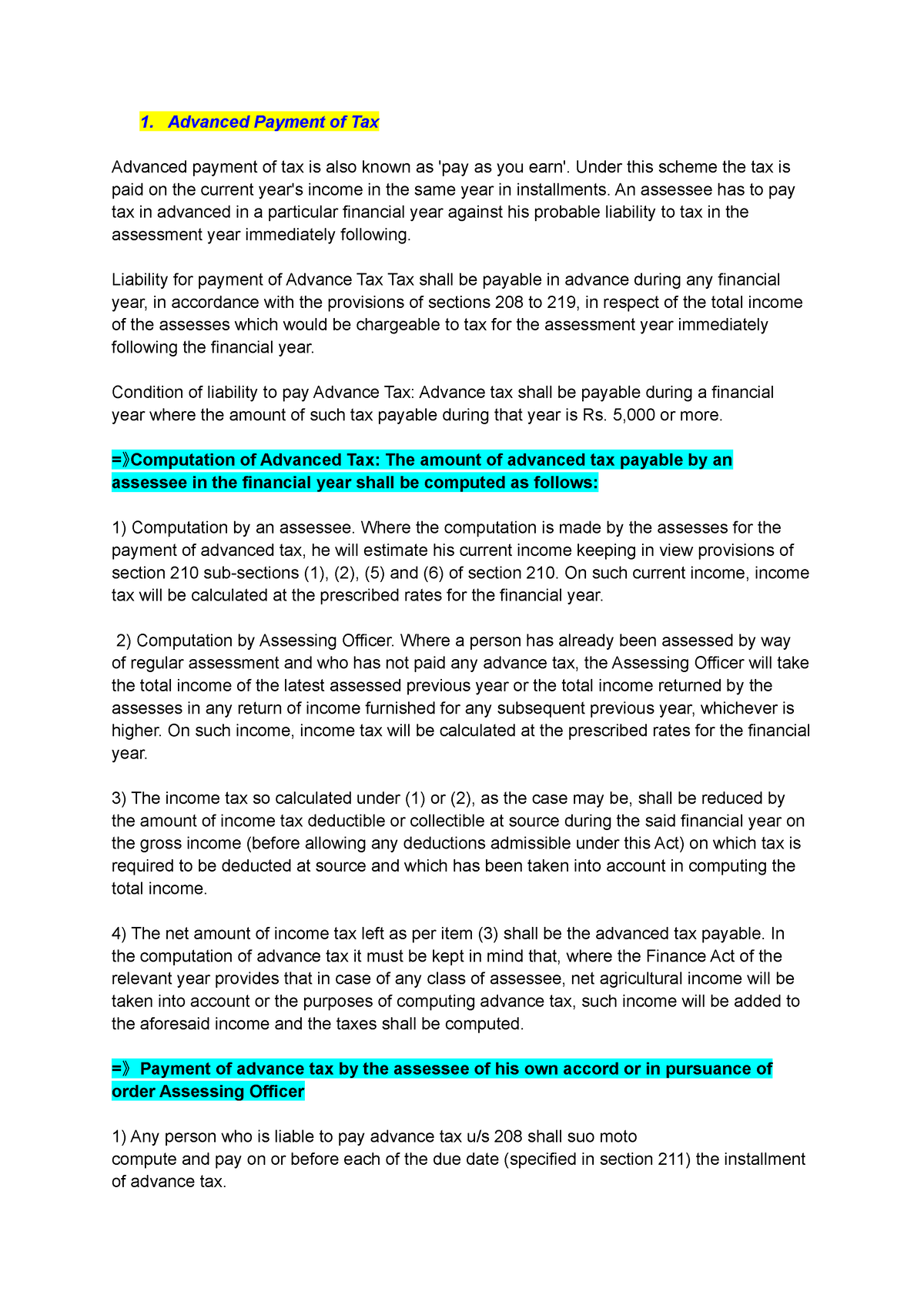

Payment Of Tax 1 Advanced Payment Of Tax Advanced Payment Of Tax Is

Definition Of Person Liable To Pay Service Tax Under Rule 2 1 d

What Is The Professional Tax MME Best Payroll Solutions

Who Is Liable To Pay Professional Tax In Maharashtra - Salaried individuals and companies are liable to pay Professional tax in Maharashtra Employers deduct professional tax from salaried individuals and deposit with the municipal corporation on