Who Needs To Submit A Tax Return Uk Verkko 15 elok 2023 nbsp 0183 32 If someone has had a change in circumstances then they might need to complete their first ever Self Assessment tax return for the 2022 to 2023 tax year HM Revenue and Customs HMRC is

Verkko If you file your tax return online you will need to submit it by this date if you want HMRC to collect the tax through your tax code This may be possible where you owe less than 163 3 000 If your income is more than 163 30 000 even more tax Verkko 27 syysk 2022 nbsp 0183 32 HM Revenue and Customs HMRC is reminding customers who need to complete a tax return for the 2021 to 2022 tax year to let HMRC know by 5 October 2022 They can do this by registering for

Who Needs To Submit A Tax Return Uk

Who Needs To Submit A Tax Return Uk

https://www.income-tax.co.uk/wp-content/uploads/2022/08/Who-needs-to-complete-a-Self-Assessment-tax-return_.jpg

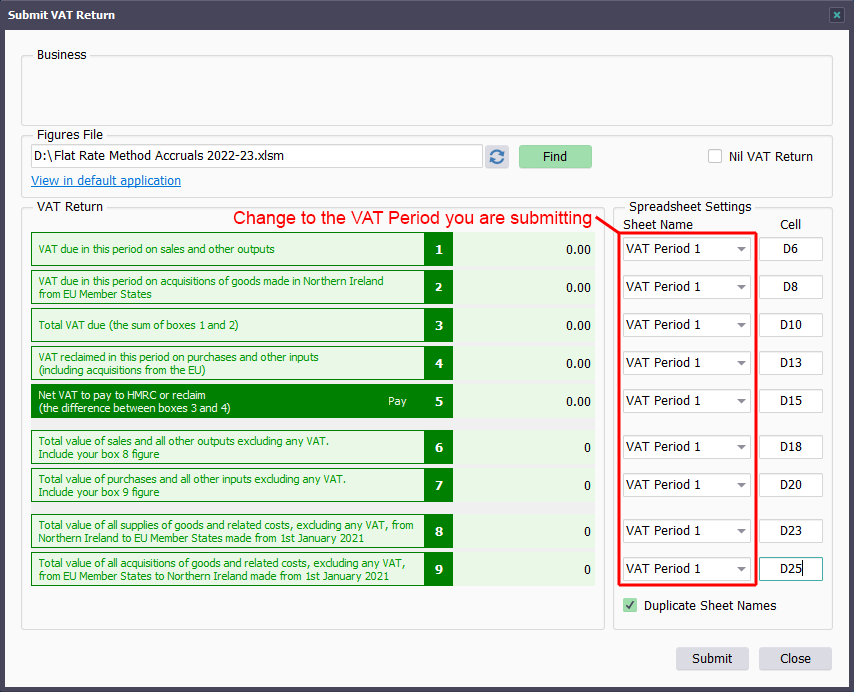

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

https://img.hechtgroup.com/can_i_claim_vat_back_on_a_commercial_property.png

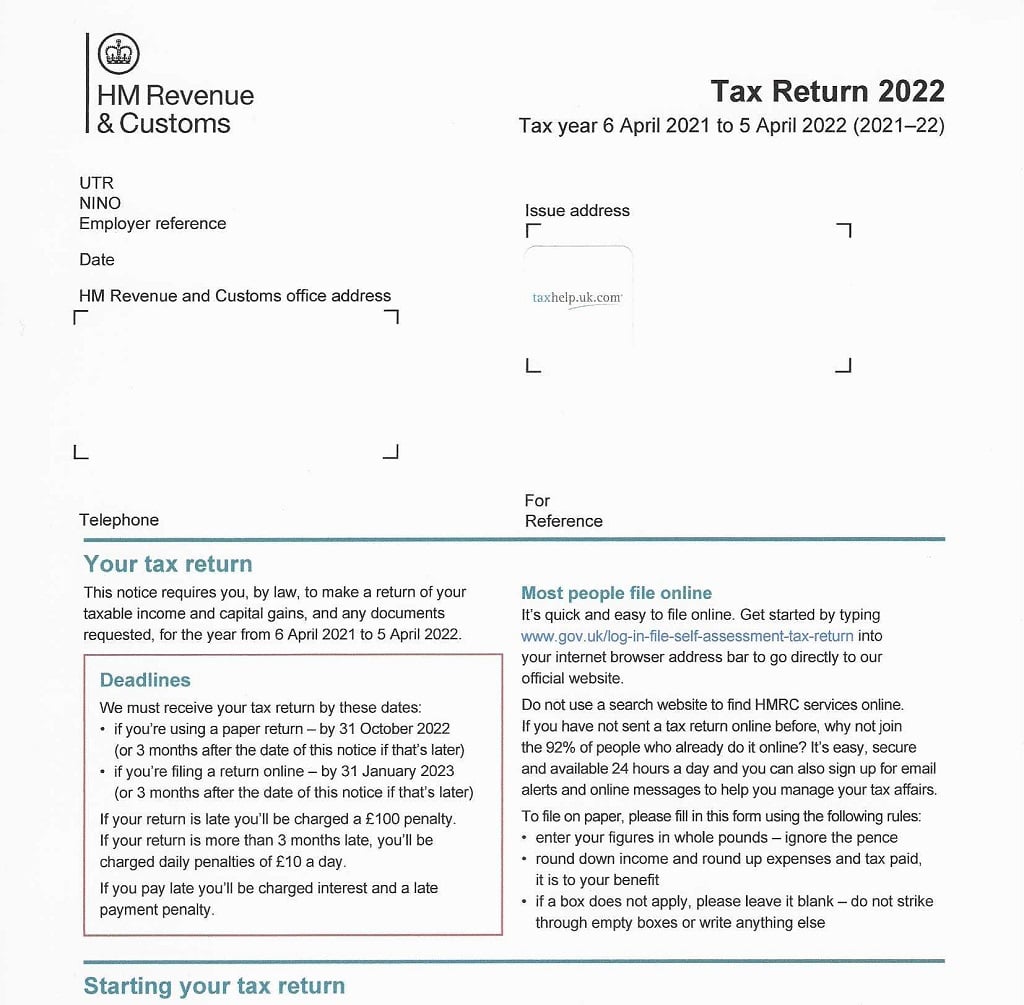

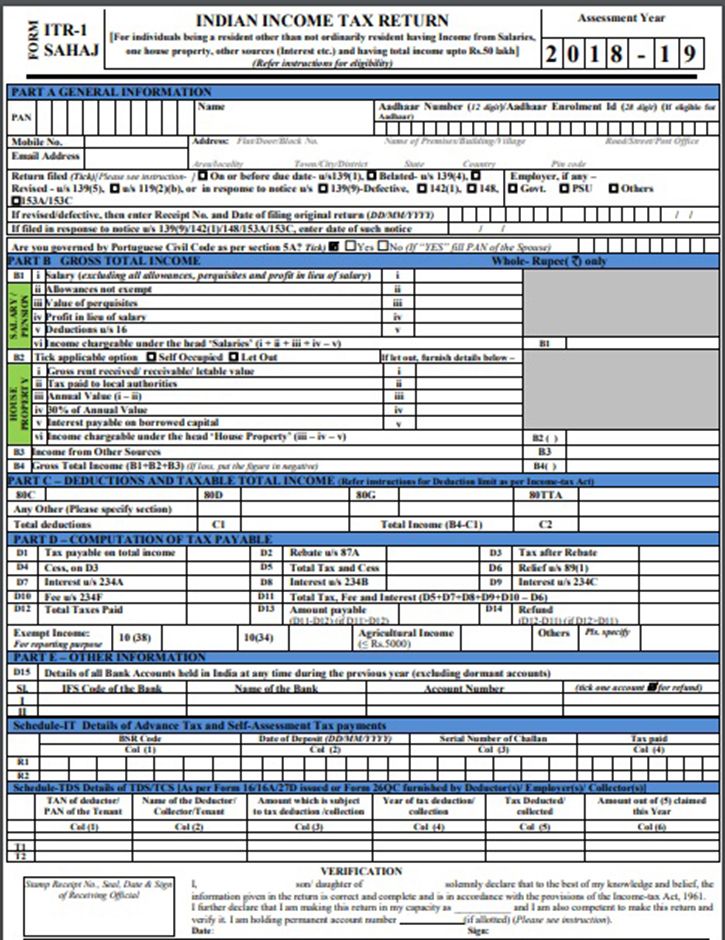

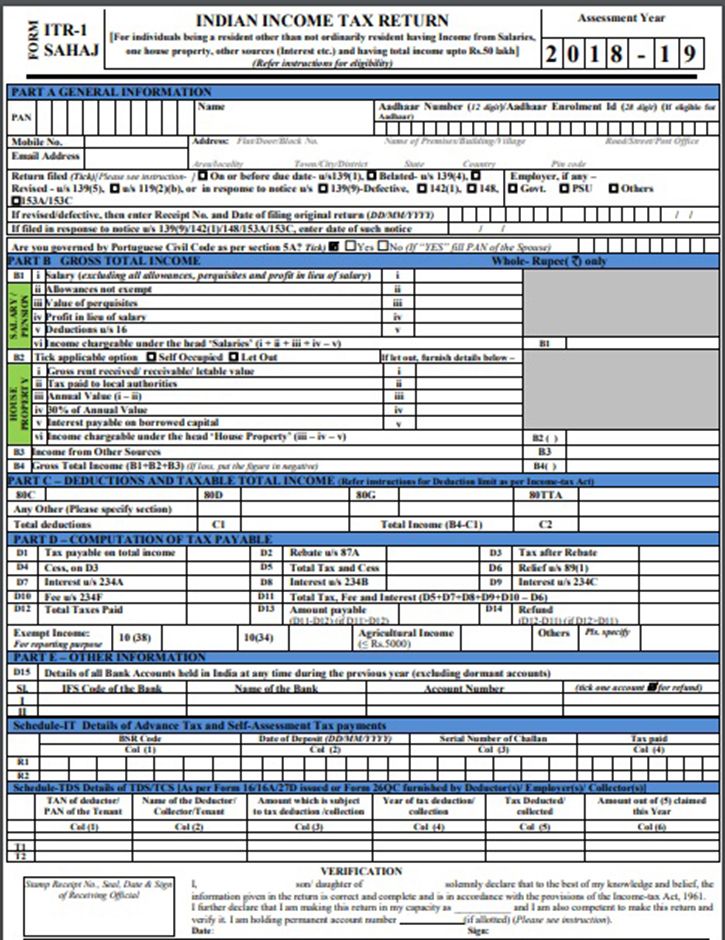

The 2022 Paper Tax Return

https://taxhelp.uk.com/wp-content/uploads/Tax-Return-2022-SA100-Form-m.jpg

Verkko 5 huhtik 2023 nbsp 0183 32 Self assessment tax returns must be submitted each year by anyone who owes tax on income they ve received Find out how to complete a tax return for the 2021 22 tax year and what types of income to include Verkko 19 lokak 2023 nbsp 0183 32 So for the 2022 23 tax year which ended 5 April 2023 you need to file your tax return by 31 January 2024 Also remember that when we talk about tax years we mean 6 April to 5 April

Verkko 4 tammik 2024 nbsp 0183 32 Most people in the UK do not need to file a tax return because any taxable income they have is taxed through a system called PAYE paye as you earn However there are a few situations where you ll be required to complete a Self Assessment also known as a personal tax return Verkko 1 p 228 iv 228 sitten nbsp 0183 32 Customers who need support to complete their return for the 2022 to 2023 tax year ahead of the deadline on 31 January 2024 can access the extensive online support available on Gov uk

Download Who Needs To Submit A Tax Return Uk

More picture related to Who Needs To Submit A Tax Return Uk

Self assessment Tax Returns Peninsula UK

https://www.peninsulagrouplimited.com/wp-content/uploads/2016/01/Tax-Return.jpg

I Worked For Less Than A Year Do I Still Need To Submit A Tax Return

https://www.taxtim.com/za/images/media-za/briefcase-1578138640.jpg

Who Should File An Income Tax Return

https://instafiling.com/wp-content/uploads/2023/02/Topic-33-Who-should-file-income-tax-return-1080x675.png

Verkko 19 lokak 2023 nbsp 0183 32 You can submit your self assessment tax return at any time from the start of a new tax year on 6 April until the deadline on 31 January the following year Filling in your tax return Verkko 2 elok 2023 nbsp 0183 32 Who needs to file a tax return Self Assessment is the system that was created by HM Revenue amp Customs HMRC to ensure the correct amount of tax is collected for a tax year You should therefore check each year whether you need to submit a self assessment tax return By Victoria Morter

Verkko People who need to submit a self assessment tax return can choose whether to submit by posting paper forms or by filling in an online return In general HMRC no longer automatically sends out paper tax returns Verkko 31 lokak 2023 nbsp 0183 32 Generally speaking you ll need to submit your tax return by 31st October after the tax year if filing on paper or by 31st January if you complete a tax return online Some exceptions apply for example you ll need to submit your online return by the 30th December if you want HMRC to automatically collect tax you owe

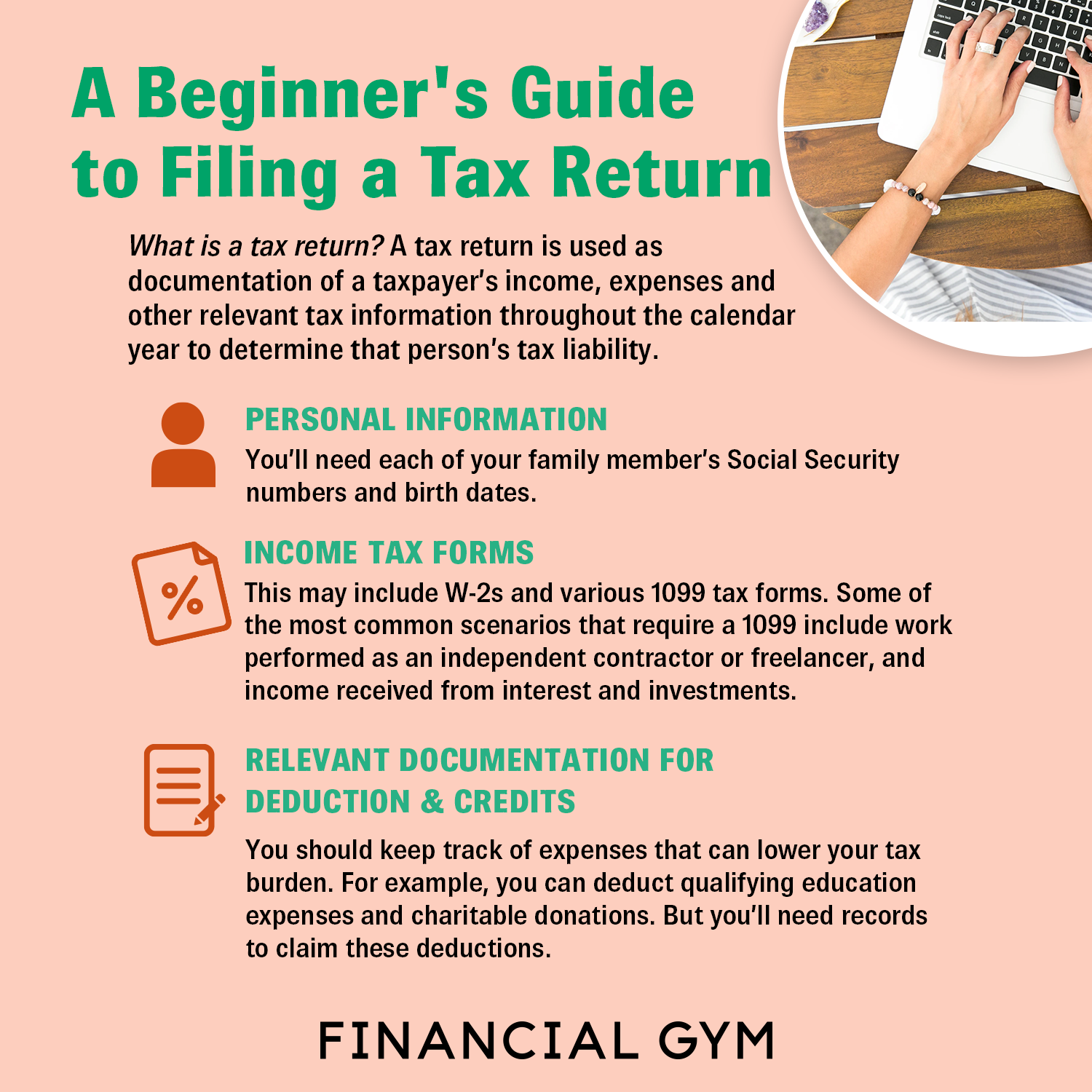

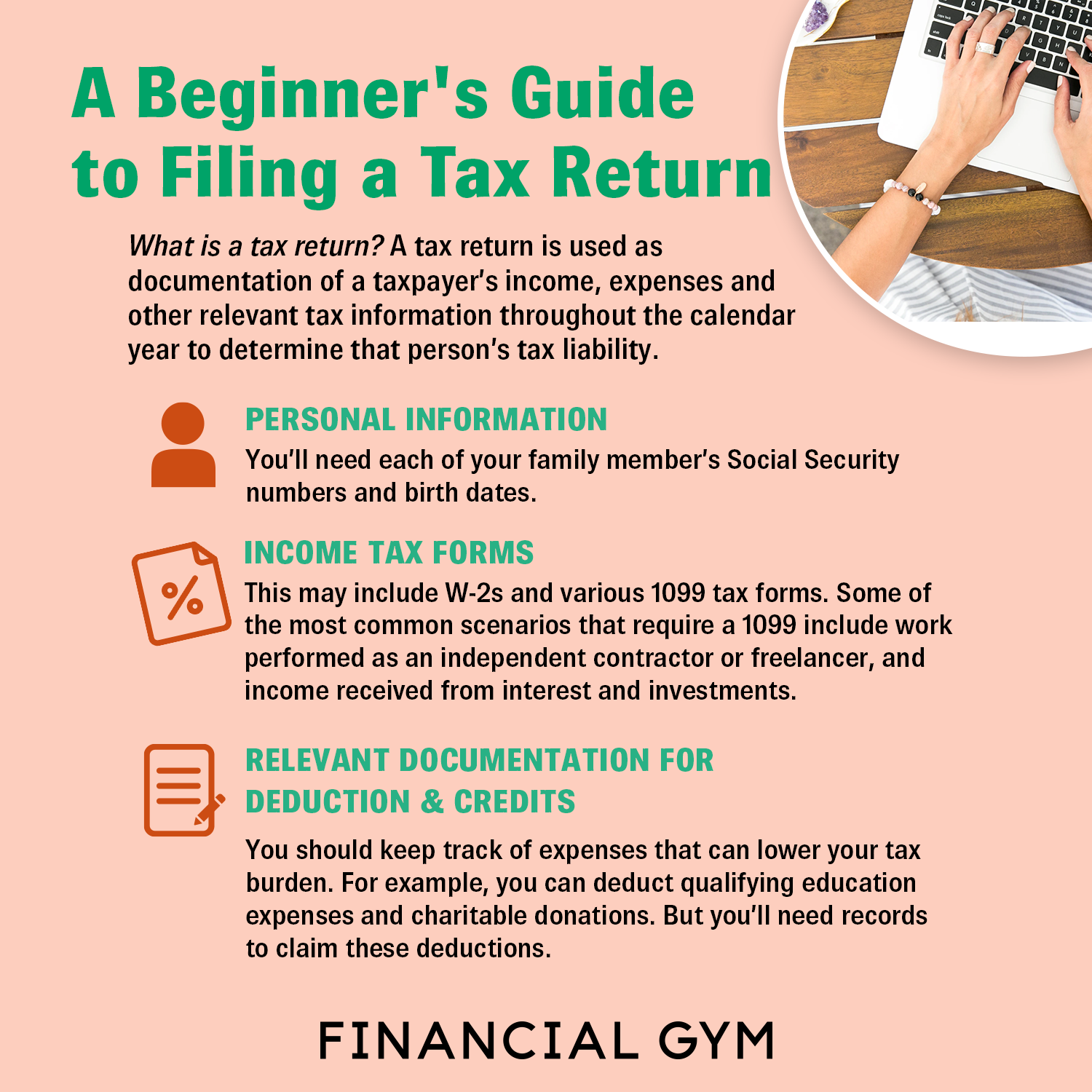

A Beginner s Guide To Filing A Tax Return

https://images.squarespace-cdn.com/content/v1/5a1efe26914e6b83e9456629/1583496520149-15B7KX0KSGFE4JVCHSNQ/ke17ZwdGBToddI8pDm48kJUlZr2Ql5GtSKWrQpjur5t7gQa3H78H3Y0txjaiv_0fDoOvxcdMmMKkDsyUqMSsMWxHk725yiiHCCLfrh8O1z5QPOohDIaIeljMHgDF5CVlOqpeNLcJ80NK65_fV7S1UYapt4KGntwbjD1IFBRUBU6SRwXJogFYPCjZ6mtBiWtU3WUfc_ZsVm9Mi1E6FasEnQ/TFG_A-Beginner's-Guide-to-Filing-a-Tax-Return.png

Example Of Taxable Supplies Jspag

https://bestlettertemplate.com/wp-content/uploads/2020/10/Tax-Clearance-Letter-1086x1536.png

https://www.gov.uk/government/news/do-you-need-to-complete-a-self...

Verkko 15 elok 2023 nbsp 0183 32 If someone has had a change in circumstances then they might need to complete their first ever Self Assessment tax return for the 2022 to 2023 tax year HM Revenue and Customs HMRC is

https://www.litrg.org.uk/.../tax-basics/do-i-need-complete-tax-return

Verkko If you file your tax return online you will need to submit it by this date if you want HMRC to collect the tax through your tax code This may be possible where you owe less than 163 3 000 If your income is more than 163 30 000 even more tax

Do Directors Need To Submit A Tax Return

A Beginner s Guide To Filing A Tax Return

How To Print Your SA302 Or Tax Year Overview From HMRC Love

How To Obtain Your Tax Calculations And Tax Year Overviews

Excel Spreadsheet Templates To Comply With Making Tax Digital For VAT

Income Tax Return

Income Tax Return

10 Mistakes On Your Tax Return That Will Get You In Trouble With The IRS

5 Ways To Make Your Tax Refund Bigger The Motley Fool

Do I Need To Submit A Tax Return 2018 YouTube

Who Needs To Submit A Tax Return Uk - Verkko 1 HM Revenue and Customs sends Tax Returns or a notice to file on line to everyone in the Self Assessment system in April May every year If you receive a tax return or a notice to file on line you must complete a return and submit it to HMRC This is so even if you are an employee and all your income is taxed under PAYE