Who Pays Double Taxation If you live in one EU country and work in another the taxation rules applicable to your income will depend on national laws and double tax agreements between these

Double taxation in economics situation in which the same financial assets or earnings are subject to taxation at two different levels e g personal and corporate or in two Double taxation is mainly found in two forms corporate double taxation which is taxation on corporate profits through corporate tax and dividend tax levied on dividend pay outs and international double taxation which

Who Pays Double Taxation

Who Pays Double Taxation

https://assets.paperjam.lu/images/articles/double-taxation-persists-on-se/0.5/0.5/600/400/583278.jpg

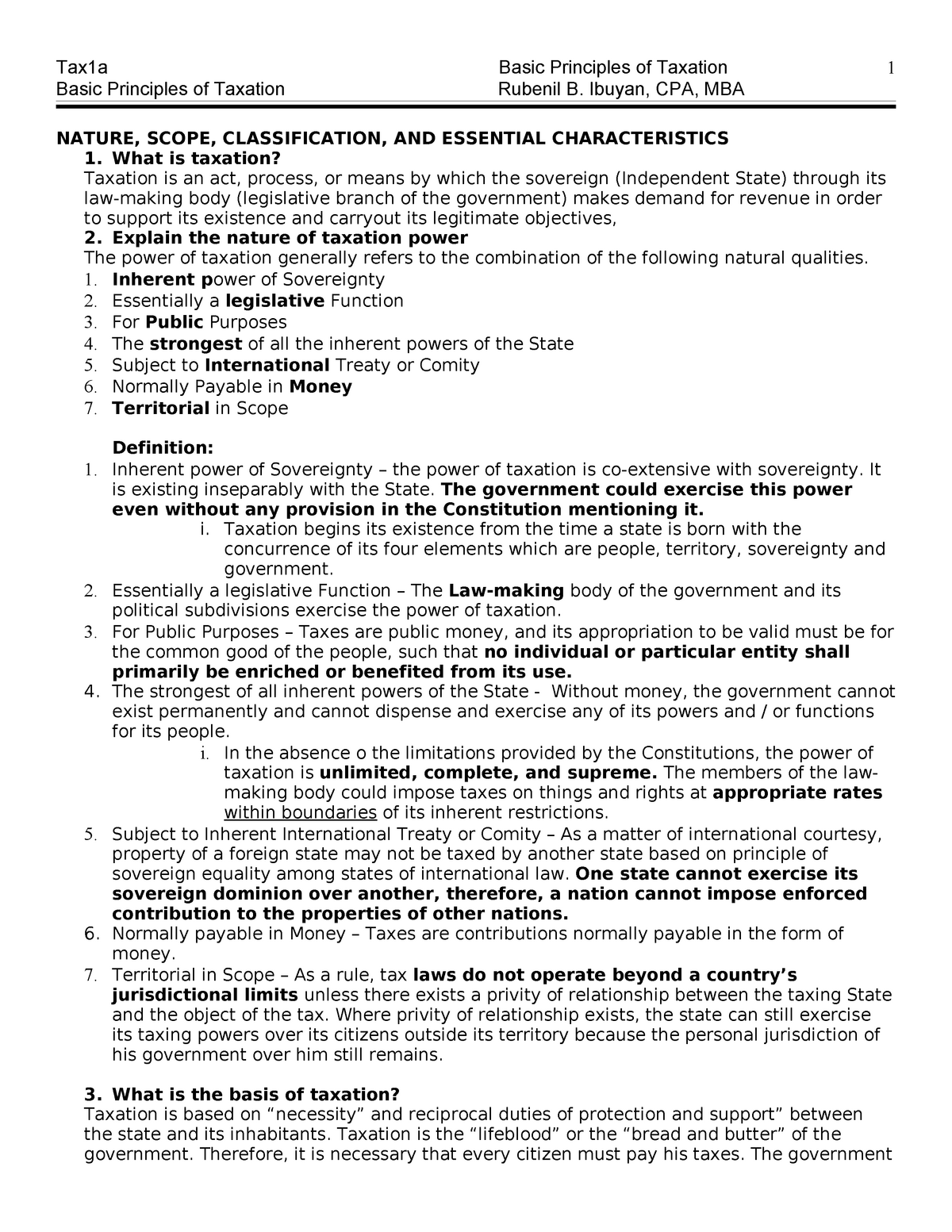

The Evolution Of Taxation Storyboard By Valdezmark

https://sbt.blob.core.windows.net/storyboards/valdezmark/the-evolution-of-taxation.png

Double Taxation Agreement Rates PDF Double Taxation Taxes

https://imgv2-2-f.scribdassets.com/img/document/559242133/original/b74f1ca67b/1709191340?v=1

A tax treaty is a bilateral two party agreement made by two countries to resolve issues involving double taxation of passive and active income of each of their Double taxation is when a corporation or individual is taxed twice on the same income One way this happens is when a corporation pays corporate taxes on

Double taxation isn t avoidable and it applies to other income sources Here s what corporation owners should know about when it comes to double Double taxation refers to an instance in which taxes are levied twice on the same source of income often in situations where incomes may be eligible to be taxed in multiple countries or locations

Download Who Pays Double Taxation

More picture related to Who Pays Double Taxation

:max_bytes(150000):strip_icc()/indirecttax.asp-final-2d0783cf9900460abe8d1e86e39a0cca.png)

Taxes Definition Types Who Pays And Why 58 OFF

https://www.investopedia.com/thmb/JOz2mCJZ6V3ynEV7GITCZkiWbDM=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/indirecttax.asp-final-2d0783cf9900460abe8d1e86e39a0cca.png

The International Double Taxation PDF Taxes Double Taxation

https://imgv2-2-f.scribdassets.com/img/document/567370558/original/42d1f0caf8/1711329655?v=1

International Double Taxation Content Consequences And Avoidance PDF

https://imgv2-1-f.scribdassets.com/img/document/520928070/original/4c06a6a02c/1701461626?v=1

Double taxation is when taxes are paid twice on the same dollar of income regardless of whether that s corporate or individual income Double taxation refers to the imposition of taxes on the same income assets or financial transaction at two different points of time Double taxation can be economic which

Double taxation occurs when a corporation pays taxes on its profits and then its shareholders pay personal taxes on dividends or capital gains received from the Double taxation occurs when income is taxed by two or more countries on the same profits This can happen when there is no agreement between the countries

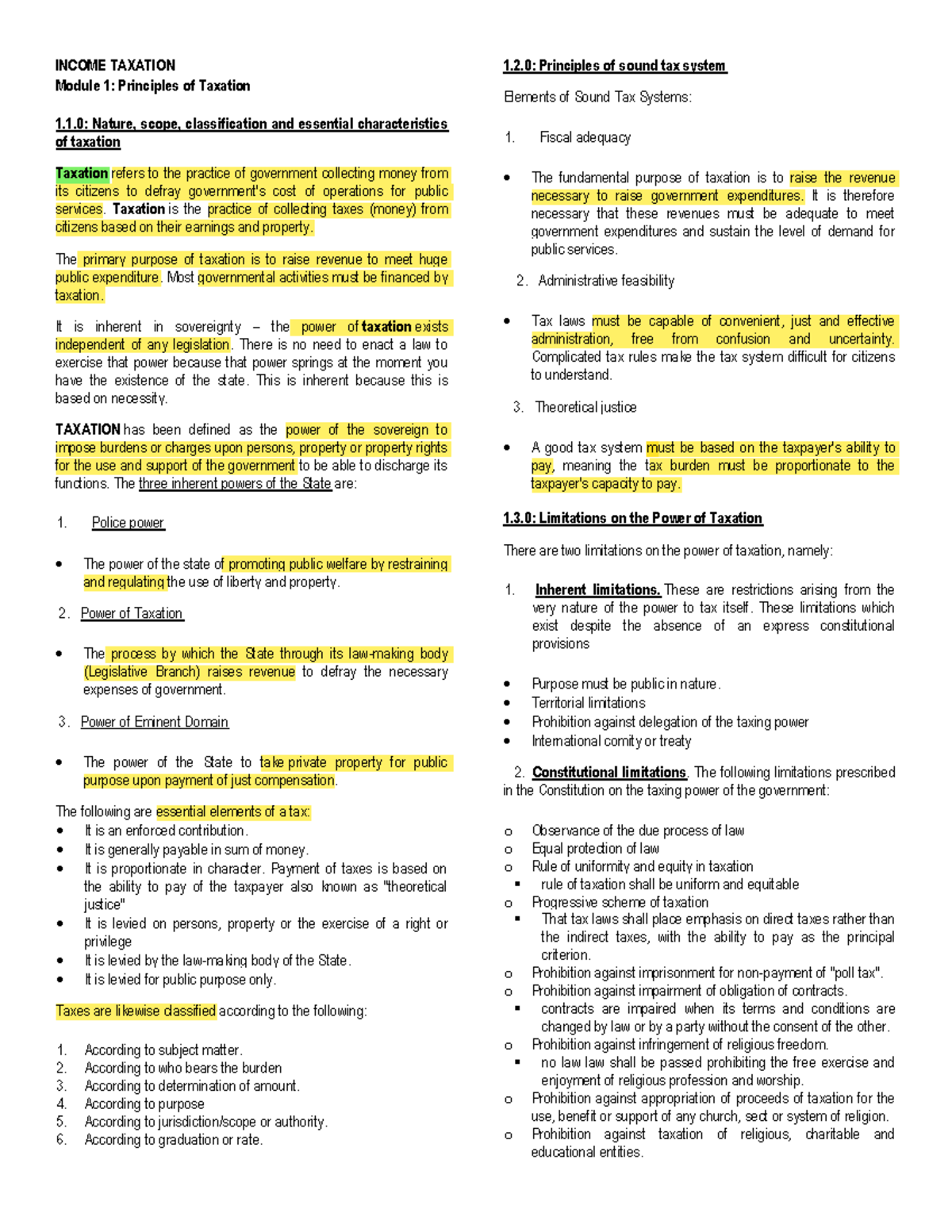

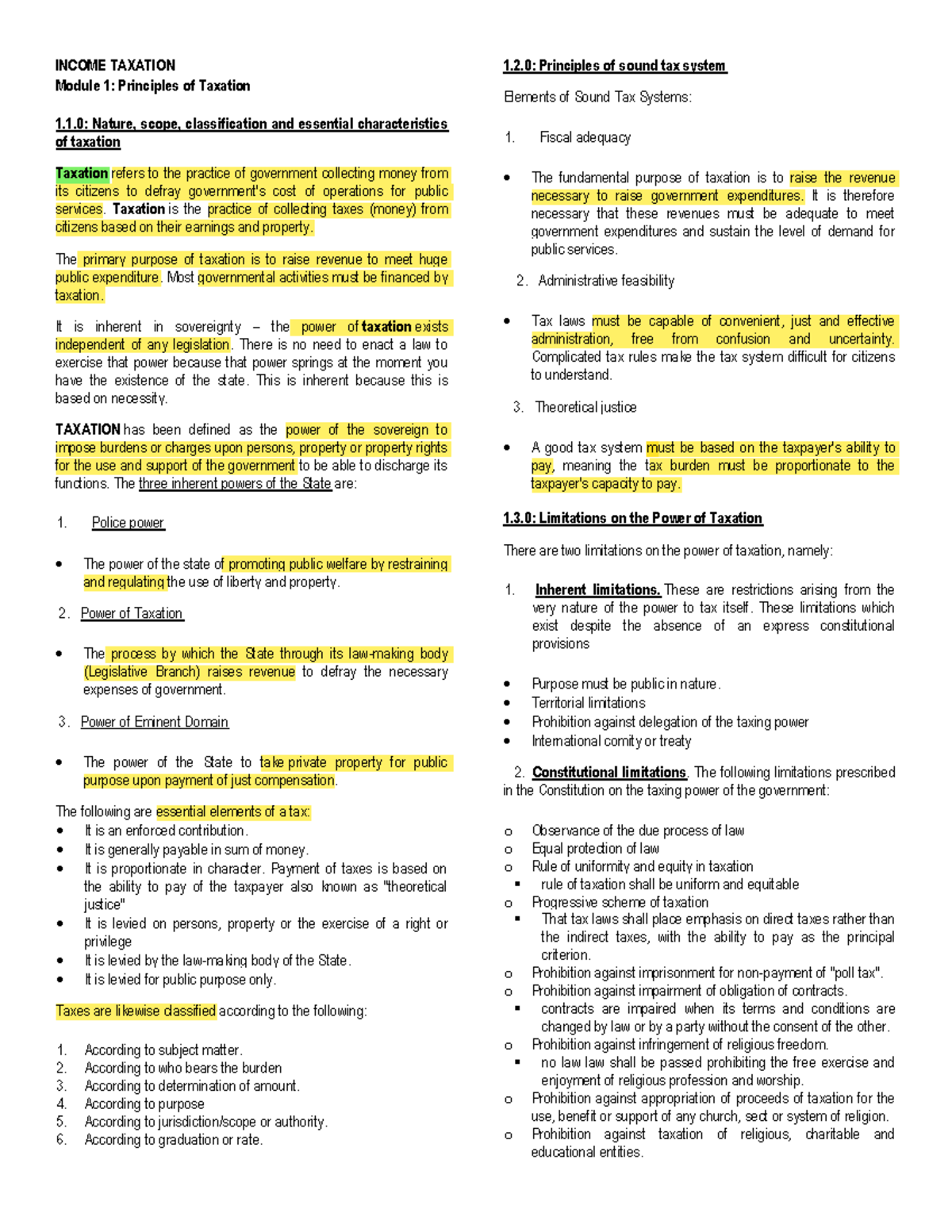

Income Taxation Module 1 INCOME TAXATION Module 1 Principles Of

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/54de4b89c979d853637275713b82db75/thumb_1200_1553.png

What Is Double Taxation Why It Occurs How To Avoid

https://www.financestrategists.com/uploads/featured/Double-Taxation-Examples-scaled.jpg

https://europa.eu/youreurope/citizens/work/taxes/double-taxation

If you live in one EU country and work in another the taxation rules applicable to your income will depend on national laws and double tax agreements between these

https://www.britannica.com/money/double-taxation

Double taxation in economics situation in which the same financial assets or earnings are subject to taxation at two different levels e g personal and corporate or in two

How To Read DTAA A Complete Guide Chartered Tax

Income Taxation Module 1 INCOME TAXATION Module 1 Principles Of

International Taxation Of Income From Services Under Double Taxation

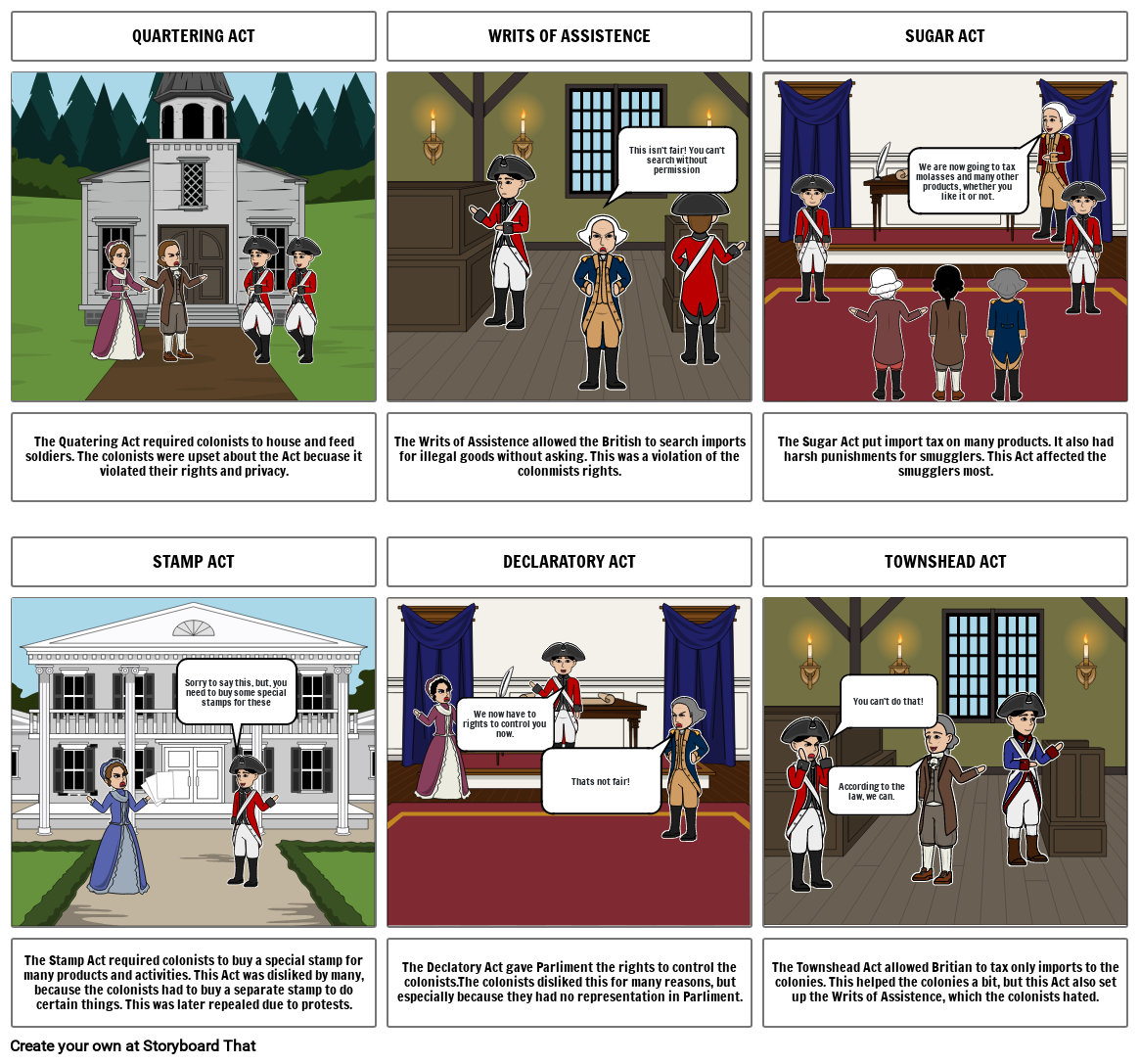

Taxation Controversy Storyboard Por 065a2e24

DTAA Double Taxation Avoidance Agreement 2022 Sorting Tax

Pdfcoffee Basic Principles Of Taxation Basic Principles Of Taxation

Pdfcoffee Basic Principles Of Taxation Basic Principles Of Taxation

Global Taxation Accounting Service Inc Toronto ON

International Double Taxation Agreements PDF Double Taxation

History Of Taxation Storyboard By 87c03591

Who Pays Double Taxation - Double taxation is when a corporation or individual is taxed twice on the same income One way this happens is when a corporation pays corporate taxes on